Anti-FATCA/CBT Publicity and Protest Materials for use On-Line and Hard Copy

Some items have a direct link in the Table of Contents.

Some items don’t have a link in the Table of Contents because that item has several links — scroll down this page to get to those links.

And some items don’t have links in the Table of Contents because the item is on this page, just scroll.

(1) Business Cards

(2) Spreading the Word with Kijiji, Twitter, Facebook, Etc. Thread

(3) Links for Posting On-line

(4) Social Media Tool-Kit Thread

(5) Talking Points

(7) Practical Suggestions for Protesters

(8) Links to On-Line Petitions

(9) Contact Info for Government Representatives

(10) Introduction to FATCA for Canadians

(11) Brochures and Hand-Outs (General Matters/Issues)

(12) Brochures and Hand-Outs (ADCS)

(13) FATCA Fact Sheets.

(14) Illustrations

(1) Business Cards

Isaac Brock Society Business Cards (printable sheet of 10)

(2) Check this thread for ongoing discussion and ideas:

Spreading the Word with Kijiji, Twitter, Facebook, Etc thread

(3) Links for Posting On-line

Links to Facebook, Meetups,Twitter

Links to Classified Ad Sites and Newspapers

(4) Social Media Toolkit Thread

(5) Talking Points

It’s NOT the taxes, It’s the Effect on Real Lives, Stupid. A concise list of the serious and destructive effects this is having on people’s lives. Compiled by Patricia Moon.

(5) Slogans

Anti-FATCA slogans for Protest Signs

(6) Practical Suggestions for Protesters

Practical Suggestions for Protesters

(7) Links to On-Line Petitions

(8) Contact Info for Government Representatives

Contact Info for Government Representatives

(9) Introduction to FATCA for Canadians

Introduction to FATCA for Canadians

(10) Brochures and Hand-Outs (General Matters)

Sheet of Links re Citizenship/FATCA/ACDS/etc, March 2015

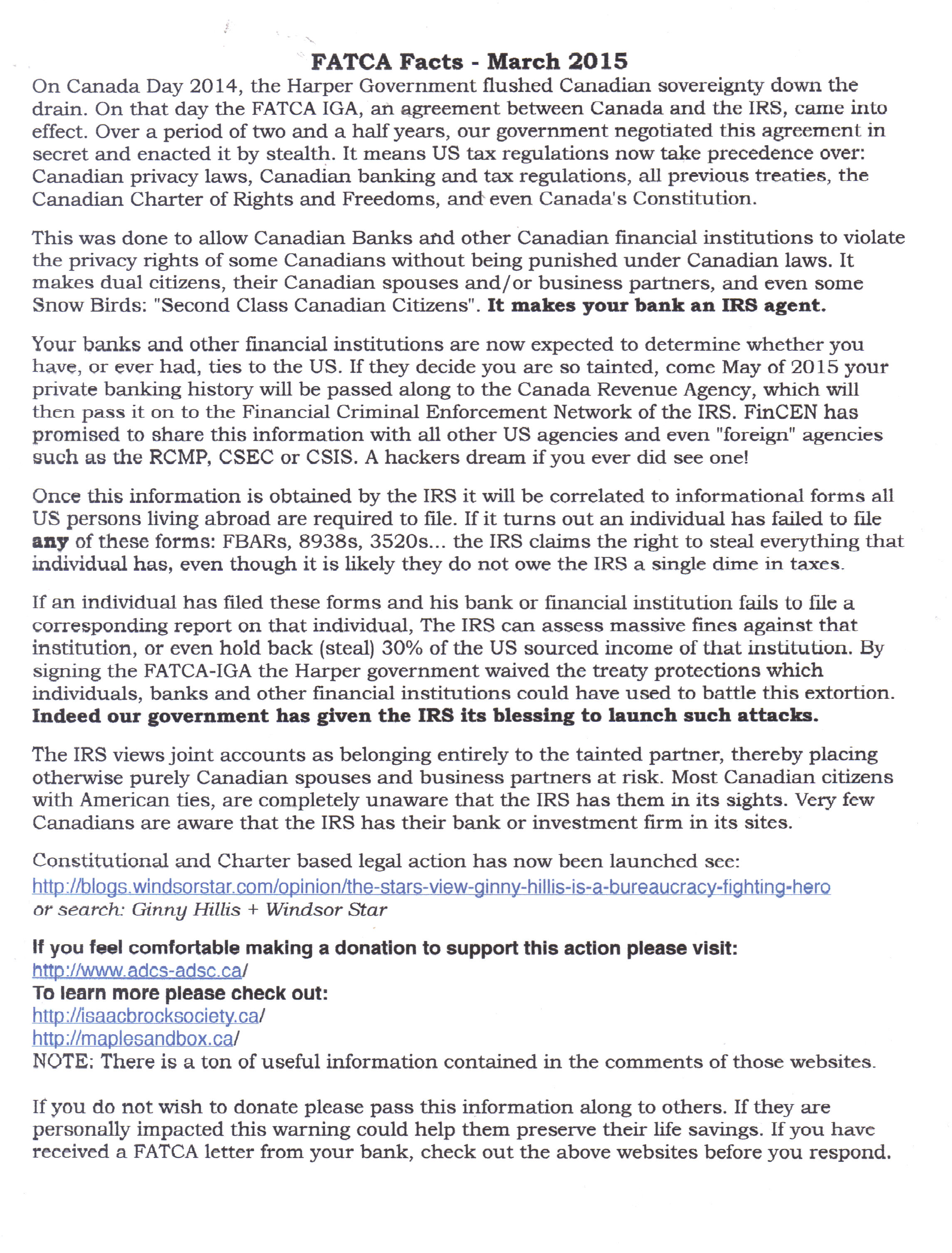

FATCA info sheet, March 2015, Canada

SEEKING US PERSONS IN CANADA — you need to learn about FATCA!!! flyer

Personnes des États-Unis recherchées-Arrêtons la FATCA

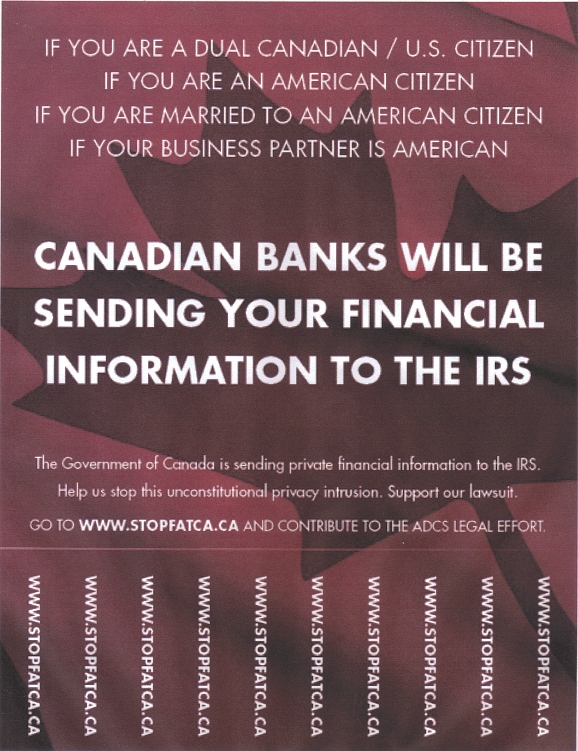

Stop FATCA flyer with pull-tabs

FATCA: We Are Not Myths Brochure

FATCA: We Are Not Tax Cheats Brochure

Help Stop the FATCA Monster (Sheet of 4 on 8-1/2 x 11 paper)

Thanks to:

eh freeman for FATCA sheet February 2015 Canada handout.

LM for Seeking US Persons in Canada handout and the Links list handouts.

Gwen for creating and designing the Stop FATCA with pull-tabs handout.

EmBee for creating and designing Stop the FATCA Monster handout.

Lynne Swanson, author of the We Are Not a Myth and the We Are Not Tax Cheats brochures, and to Gwen for their graphic design.

(11) Brochures and Hand-Outs (ADCS)

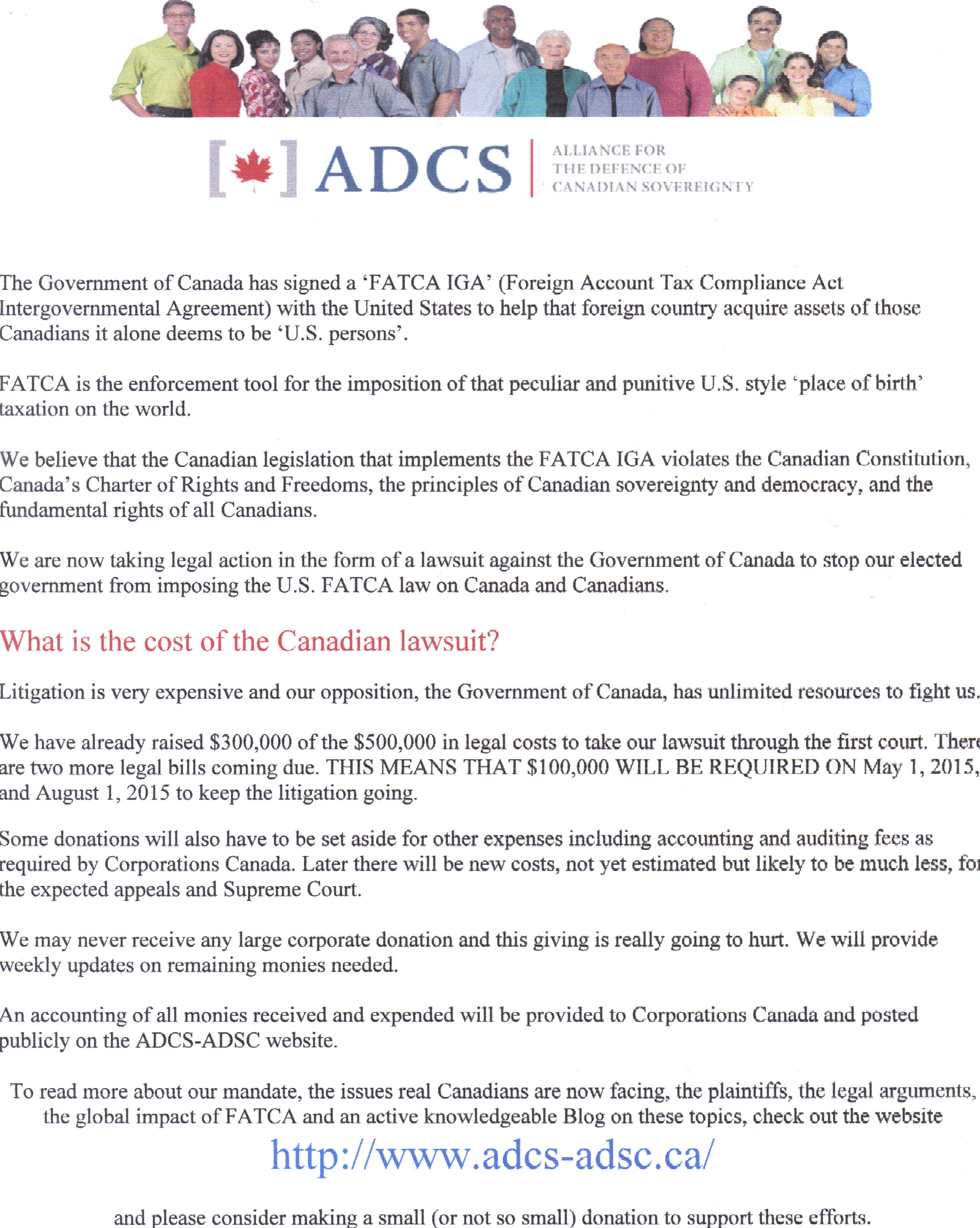

Request for donations/support to ADCS

Thanks to LM for creating these.

(12) FACTA Fact Sheet

The FATCA Fact Sheet is an 8-1/2 x 11 handbill (For other publicity materials (business cards, protest sign slogan suggestsions) see links at bottom of page)

Fact Sheet for all countries.

This edition (PDF) has keywords in bold

This edition (Word) has keywords in bold

This edition (PDF) has headers in bold, text in plain

This edition (Word) has headers in bold, text in plain

CANADA Fact Sheet (available in a graphic layout as well as a plain document).

Canada FATCA Fact Sheet (JPEG)

Canada FATCA Fact Sheet (PDF) This PDF is a plain document.

Canada FACT Fact Sheet (Word) is a plain document.

Note: If you have individualised the FATCA Fact Sheet for your country, it can be posted here too.

Thanks to everyone who worked on creating the FATCA Fact Sheet – a large team effort coordinated by WhiteKat – and to Gwen for its graphic design.

(13) Illustrations, Clip Art, etc.

Illustrations, Clip Art, etc., are at this link

@ calgary411

It isn’t copyrighted. The earth part is free, uncopyrighted, clip art and the rest is my attempt to draw a FATCA monster. Anyone can use it as far as I’m concerned … except the IRS.

@Em, and it is a great play on the NSA spy satellite logo..

http://onforb.es/1gOnzDg

Well done.

So you are more than a musical poet, are you?

@ Just Me

Yes I saw that dreadful NSA logo and it gave me the idea. You wouldn’t believe how many erasings I went through to do what an artist would have done in a few easy strokes. Thank goodness I found a clip art for that earth.

@all

Has anyone investigated having the flyers inserted into local papers? This is usually not terribly expensive and works really well in smaller towns and/or targeted neighborhoods in larger cities. It is also more likely to be pulled out/saved if it has any relevance to the reader.

Does anyone know of a standard FATCA letter that folks like me who aren’t great writers could use to send to their MP? Something short and sweet and easily understood by me and my MP?

our fight has evolved from advocating for USP’s abroad to protecting Canadian tax sovereignty

would it be possible to add a second line to the business card to read something like

“defending all Canadians from FACTA”

“defending all Canadians from US tax invasion”

also a the back side of the card could be used to promote the charter challenge

!@Patrica

very good suggestions.

I have a question.

I have read the documents about FATCA in Canada above, but I don’t live in Canada. I live in another country with an equally stupid government that wants to sign the FATCA legislation. The problem I am having is how to relay how bad FATCA is to the local people? Without the local people understanding and fighting back, there is no chance of stopping FATCA from being signed where I am. Those with US citizenship are considered privileged and somewhat hated, as they often have more money than normal locals, and only accounts for less than 1% of the total population. If I target this group to go against the government the other 99% will tell the government to sign it and chant anti-rich people slogans.. The only thing I can come up with is that US companies operating where I am may pack up and leave causing a huge job loss to normal citizens which might have some effect, but it’s just not enough…

@Taxconfuzaled,

You could use the sovereignty issue, and the fact that it will raise ALL your fellow residents taxes and fellow accountholder’s fees in order to put FATCA into place and maintain it FOREVER by your home country government. Use the lack of US reciprocity. The US will NEVER give as much information to your country as it is demanding. Also, FATCA is a Made-in-the-US law – not one negotiated between equal powers. FATCA disrespects all other countries because it is a US law which is being forced on every other country by threat – not by mutual agreement. The US retains the sole power to change the FATCA ‘agreement’ at any time – without notice or consent by your country of residence. That is an affront to the dignity and sovereignty of every other nation on the planet.

Appeal to your fellow’s patriotism – underscore the aggressive and disrespectful nerve of the US – ask how dare a ‘foreign’ country – the US – dictate to your country and government what it must and should do on its own sovereign autonomous soil – with its own financial and tax system – via US extortionate threats of 30% withholding and to be shut out of access to the US financial market. Even more egregious if your country has very few US persons. Basically the US is threatening your country and its financial (and many non-financial) institutions – but with NO return or gain for your country. And if it works this time and your country caves, the US will just come back with more demands whenever it feels like it.

Point out US hypocrisy – that even the OECD Common reporting structure that they are discussing – (to be finalized in September?) makes a specific point that RESIDENCE not national origin/status is the ‘global norm’ for taxation.

@badger thank you for this, it is useful, I can use some of it, but it is very hard to get people to understand and bring it down to the local level. Any suggestions for a catchy title to an article or newspaper article?

Will banks send non-US citizen data to the IRS? I believe they will if they don’t with to spend the money to separate the data or pay for expensive software to do it for them.

Could someone put the English version of the ADCS logo on this page? Right now there are two French versions. Thanks.

Done. Thanks.

I have put together the following as a one page hand-out I can give away to anyone I might encounter who could be impacted by FATCA. I know I have missed a great deal but my goal was to get enough across that potential victims would know why they need to look for more information, and where they can look for it. Our biggest challenge at the moment is reaching the 90% who stopped reading or listening when they encountered the phrase; “US tax cheats.” A little one on one can’t hurt!

Keeping the stated goals in mind, please feel free to offer any suggestions.

••••

On Canada Day 2014, the Harper Government flushed Canadian sovereignty down the drain. On that day the FATCA-IGA, an agreement between Canada and the IRS, came into effect. This agreement/treaty, which the Harper Government negotiated in secret and enacted by stealth, means that US tax regulations now take precedence over: Canadian privacy laws, Canadian banking regulations, Canadian tax regulations, all previous treaties and the Canadian Charter of Rights.

This was done to allow Canadian Banks and other Canadian financial institutions to violate the privacy rights of some Canadians without being punished under Canadian laws. It makes snowbirds, dual citizens, their Canadian spouses and business partners: “Second Class Canadians”

Your banks and other financial institutions are now expected to determine whether you have, or ever had, ties to the US. If they decide you are so tainted, come May of 2015 your private banking history will be passed along to the Canada Revenue Agency, which will then pass it on to the Financial Criminal Enforcement Network of the IRS. FinCEN has promised to share this information with all other US agencies and even foreign agencies such as the RCMP, CSEC or CSIS. A hackers dream if you ever did see one!

Once this information is obtained by the IRS it will be correlated to informational forms all US persons living abroad are required to file. If it turns out an individual has failed to file any of these forms; FBARs, 8938s, 3520s…..; The IRS claims the right to steal everything that individual has, even though it is likely they do not owe the IRS a single dime in taxes.

If an individual has filed these forms and his bank or investment manager fails to file a corresponding report on that individual, The IRS can assess massive fines against that institution, or even steal 30% of the US sourced income of that institution. By signing the FATCA-IGA the Harper government waived the treaty protections which individuals, banks and other Financial Institutions could have used to battle this extortion. Indeed they have given the IRS their blessing to launch such an attack.

The vast majority of Canadian citizens with American ties are completely unaware that the IRS has them in its sights. The vast majority of Canadians are unaware that the IRS has their bank or investment firm in its sites. In the case of joint accounts, the IRS considers the entire account a legitimate target, thus putting spouses and business partners at risk.

Constitutional and Charter based legal action has now been launched:

http://blogs.windsorstar.com/opinion/the-stars-view-ginny-hillis-is-a-bureaucracy-fighting-hero

If you feel comfortable making a donation to support this action please visit:

http://www.adcs-adsc.ca/

To learn more please check out:

http://isaacbrocksociety.ca/

http://maplesandbox.ca/

NOTE: There is a ton of useful information contained in the comments of those websites.

If you do not wish to donate please pass this information along to others. If they are personally impacted this warning could help them preserve their life savings. If you have received a FATCA letter from your bank, check out the websites before you respond.

@ eh freeman

Generally a spot-on presentation; do update after you receive/consider comments so others can copy/print and share around!!! My few suggestions are shown here in ALL CAPS; feel free to use or not, they are just suggestions.

IN JUNE, 2014, the Harper Government flushed….. On CANADA DAY, 2014, the FATCA-IGA……… This agreement [DO NOT MENTION THE WORD “TREATY”, AS WE KNOW THIS IS NOT A TREATY]], which the Harper Government……….means that FATCA. (a US tax regulation) now take precedence over: Canadian ………..

This was done to allow…….. It makes SOME snowbirds, dual …… “Second Class Canadian CITIZENs”

Your banks and other financial institutions ……….. ***no suggestions for change***

Once this information is obtained……… to file ANY (***put this word in caps) of these forms ( FBARs, 8938s, 3520s…..) the IRS claims the right to CLAIM everything that individual has, ………

If an individual ….or investment INSTITUTION fails to file ……….., or even steal (HOLD BACK) 30% of the US sourced income….. to battle this ECONOMIC SANCTION extortion. Indeed they have given……..

The vast majority of …….. The vast majority of THESE Canadians are…… In the case of joint accounts………..

CANADIAN Constitutional and Charter based legal action has now been launched. SEE: http://blogs.windsorstar………..

If you feel comfortable making a donation…….. ***no suggestions for change***

To learn more please check out THE FOLLOWING (There is a ton of useful information contained in the comments of thEse websites):

http://isaacbrocksociety.ca/

http://maplesandbox.ca/

EVEN if you do not wish to donate, ………. If they are …… If you have ……, check out the ABOVE websites before you respond.

Thanks for the comments, even when I did not incorporate them they did let me know whether what I was trying to say was what you were reading. Nothing is cast in stone so any further suggestions are of course welcome.

I have revised it a bit and placed a pdf version here:

https://www.dropbox.com/sh/e4s502lxtmgbune/AAAbtM_xhDA_aIjbqSsNuCDta?dl=0

NOTE: DropBox has a very annoying tendency to ask you to sign in or sign up before viewing. You do not have to do this, simply click the x in the upper right corner and that box will go away. I suspect this attempt at self-promotion costs them more potential users than it attracts. Not only that but I find it quite irritating to have to include this disclaimer.

@ eh freeman,

Thanks very much for creating this hand-out! I uploaded it to the site here, so it can be directly accessed from the list under “(10) Brochures and Hand-outs” in the main post above. I take it that’s okay with you — if not, let me know. I’ll make a thumbnail jpeg of it later today, so it will show up better on the list.

@Pacifica777

That’s fine with me.

I have added a newer revision titled FATCAdRevB.pdf version here:

https://www.dropbox.com/sh/e4s502lxtmgbune/AAAbtM_xhDA_aIjbqSsNuCDta?dl=0

NOTE: DropBox has a very annoying tendency to ask you to sign in or sign up before viewing. You do not have to do this, simply click the x in the upper right corner and that box will go away. I suspect this attempt at self-promotion costs them more potential users than it attracts. Not only that but I find it quite irritating to have to include this disclaimer.

@Pacifica777

Please feel free to replace the earlier version with Revision B.

I hope I am finished tinkering and can go on to trying to distribute it.

OOPS make that Revision C.

I am done tinkering. I really am!

Thank you very much, eh freeman! I’ve uploaded the new revision here under ” Brochures and Hand-Outs” in the main post above. Sorry for the delay.

“https://www.dropbox.com/sh/e4s502lxtmgbune/AAAbtM_xhDA_aIjbqSsNuCDta?dl=0

NOTE: DropBox has a very annoying tendency to ask you to sign in or sign up before viewing. You do not have to do this, simply click the x in the upper right corner and that box will go away. I suspect this attempt at self-promotion costs them more potential users than it attracts. Not only that but I find it quite irritating to have to include this disclaimer.”

Started to hand some of these out. If you can hit accountants when they are not overwhelmed I have found them to be quite receptive. I talked to one who was a dual citizen and even though he makes good money doing returns for duals, he absolutely hates the entire CBT routine. Hopefully he will make an anonymous donation. I think he believes the IRS would not approve of his making his feelings public knowledge and he is probably correct.

Canadian accountants like being able to hand this information off as well. One said point blank that he would not even do Canadian taxes for anyone with US ties, but still appreciated having the handout to give them.

LM has, once again, created some great publicity material for our use. Thanks very much!

These are:

*Sheet of Links re Citizenship/FATCA/ADCS/etc., March 2015

*Sheet of Links – similar to above, prepared for Hamilton, Ontario, Info Session on Solving the Problems of US Citizenship, March 2015

*ADCS Information Sheet, March 2015

*Request for Donations/Support of ACDS, March 2015

These four documents are available on the above list under (9) Brochures and Hand-Outs (General Matters/Issues) and (10) Brochures and Hand-Outs (ADCS)

Vote for switch to resident based taxation and repeal of FATCA in the 30 top discussions during the presidential election :

https://presidentialopenquestions.com/questions/6739/vote/

ABC and CNN moderators agreed to consider the Top 30 questions voted up on this site!

@ JakDak

Do you know if a non-US postal code will work on that Open Questions site? With over 600,000 total votes, less than a hundred votes for our question doesn’t stand a chance, I’m afraid. It’s times like this I wish we had a better network for organizing online action.

Definitely wrote that comment too fast. Sorry JakDac for misspelling your name.