The National Monitor reports that 39 Americans are vying for the opportunity to expand the reach of the Interstellar “Internal” Revenue Service to Mars, producing an unwelcome drain on the scant resources of the planned human colony there:

The Mars One foundation, a Dutch based non-profit group that plans to send humans on a one-way trip to Mars, has narrowed down 200,000 applications to 100. Americans make up 39 of the shortlisted candidates from 35 countries. These candidates will go on into further testing later this year where they can expect team-building exercises and tests in isolation. … The American candidates include middle-aged engineers, Ph.D. candidates in their 30s and several contenders in their 20s. The ages of all the candidates range from 19 to 60. The United States has the most amateur astronauts in the running.

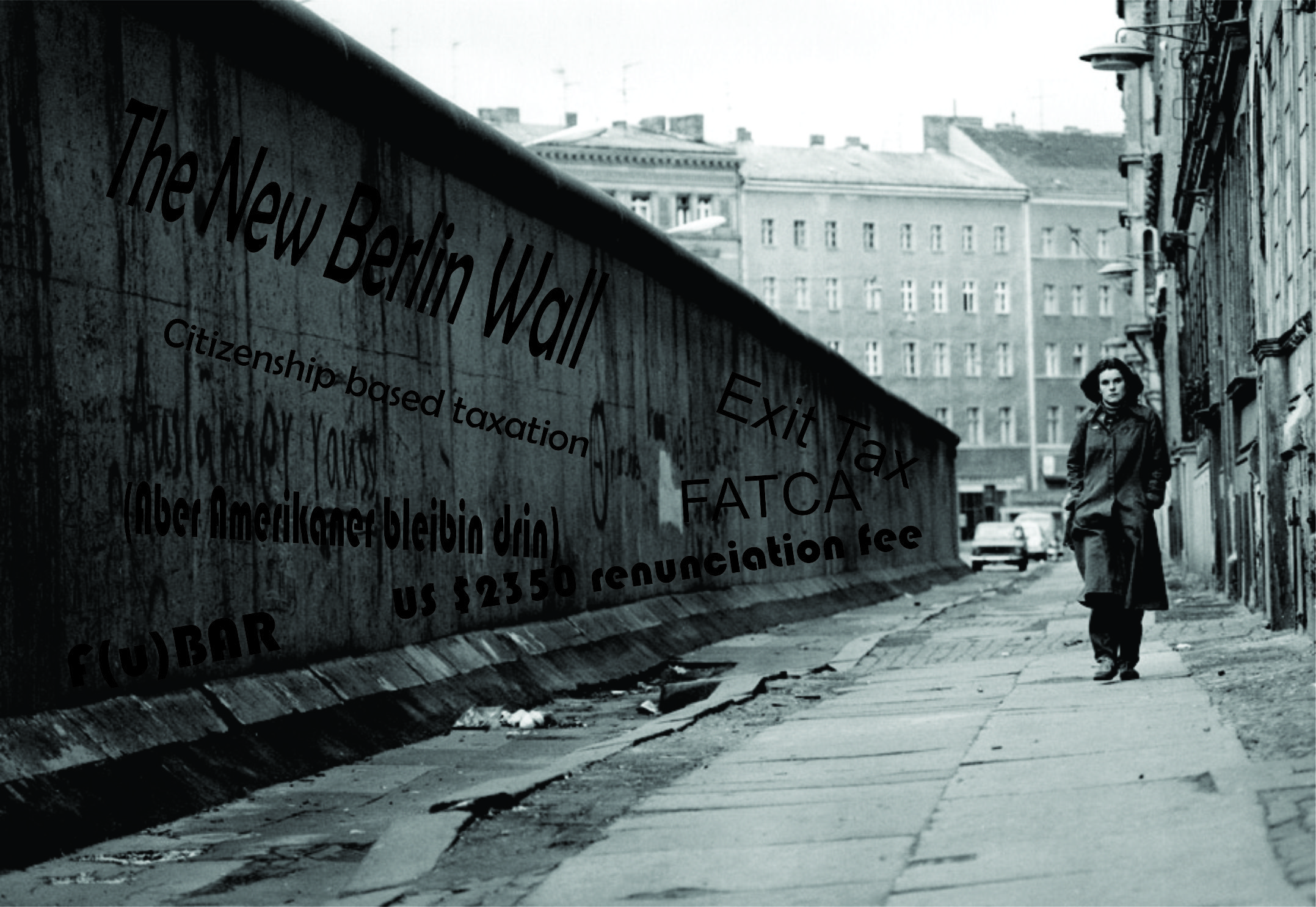

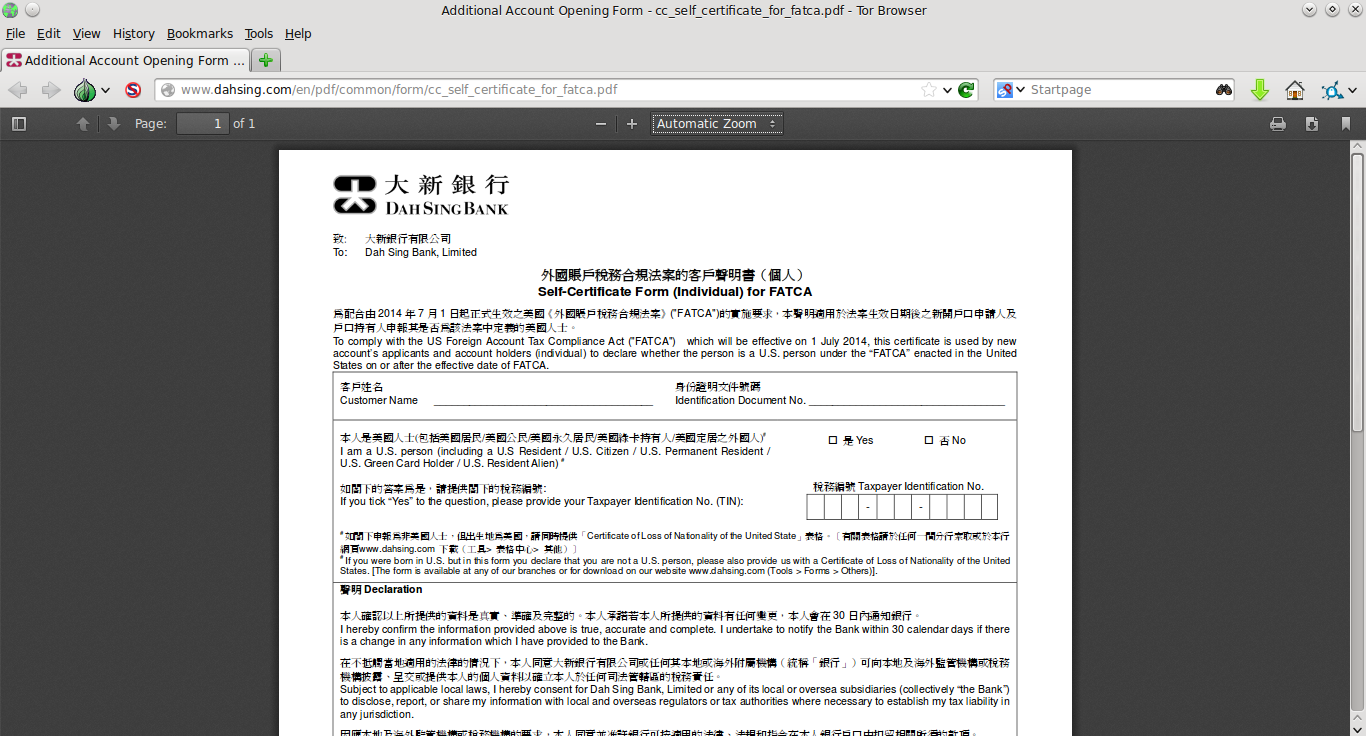

As previously mentioned here at the Isaac Brock Society, all of these traitorous ingrates fleeing the planet with their intellectual & physical capital will continue to owe U.S. taxes, in recognition of the enormous benefits they will derive from U.S. citizenship during their temporary stay off-world, such as the ability to come back at any time and work in the United States and the ability to pass their citizenship on to their children — even if they don’t want to. Furthermore, Chuck Grassley will no doubt be delighted to learn that the Americans near Deimos won’t be getting any special “tax breaks” that Americans near Des Moines can’t enjoy: Martian income of Americans on Mars is defined as “U.S.-source” under 26 USC § 863(d), and Mars is not a foreign country anyway — meaning that the Foreign Earned Income Exclusion is inapplicable.

Mohnish Pabrai recently made a similar point in an interview with Forbes‘ Lauren Gensler about the massive federal & local tax breaks for people who move from the fifty states to Puerto Rico — another tiresome example of Washington’s tax discrimination based on where you move:

“The way the U.S. tax code is written, I could be on Mars and be taxed on intergalactic income but not if I’m sitting on this island in the Caribbean. It’s kind of in a twilight zone.”

On the other hand, perhaps this suggests a “thin end of the wedge” strategy for people seeking to amend the tax code to eliminate citizenship-based taxation: first exclude people off-planet from the definition of “U.S. Person”, and then work your way down from the sky to the ground.

A Canadian dies and arrives at the Pearly Gates. St. Peter greets him and says, “Hey, would you like me to show you around before I take you to your eternal mansion?”

A Canadian dies and arrives at the Pearly Gates. St. Peter greets him and says, “Hey, would you like me to show you around before I take you to your eternal mansion?”