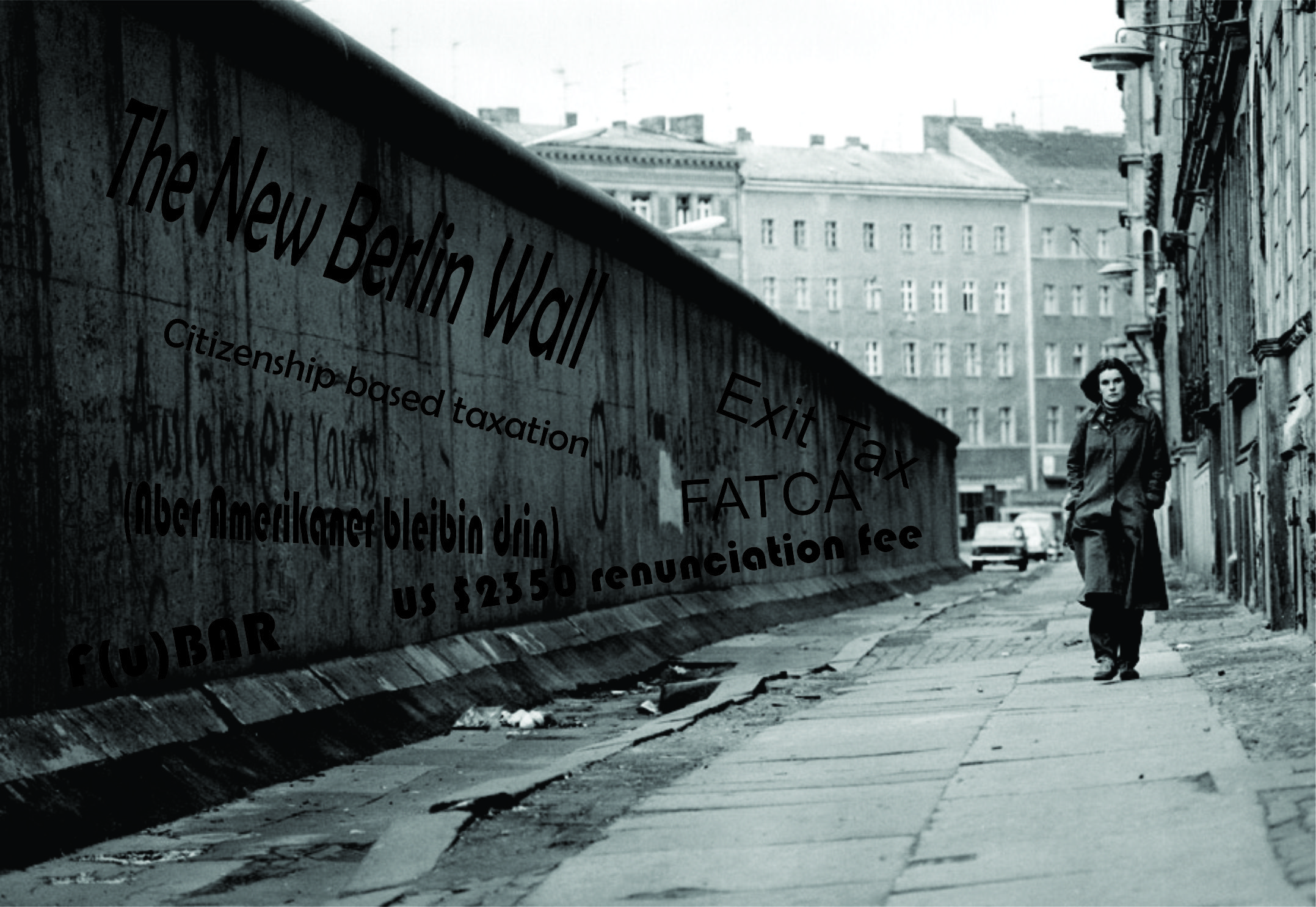

“I think this fence business is designed and may well be used against us and keep us in. In economic turmoil, the people want to leave with their capital and there’s capital controls and there’s people controls. Every time you think about the fence, think about the fences being used against us, keeping us in.” Ron Paul

If you ever get over the wall, and you return to Amerika, this is what happens to you: https://isaacbrocksociety.ca/2012/09/29/the-parable-of-the-prodigal-uncle/

The worst kinds of fences are the ones in your mind.

Now that I have recently become rather a FATCA “troll” out there in the universe I am finding this argument actually has resonance with those living in the US. (I think it is starting to get into…oh, her AGAIN). But anyhow, we have all been searching for ways to present this in a way it will have impact within the US as they don’t give a fig about us. The prognostications of losing reserve currency status, flight of capital etc are all rather esoteric and have no real immediate “bite”. The financial Berlin Wall argument seems to actually scare them. (Funny this human nature thing…most Americans have never left its borders but the thought of not being allowed to ruffles their feathers. Great issue for us to capitalize on.)

Some of the comments from resident-Americans are just plain sickening. They think this all about taxes. What about JUST being able to have a bank account? Has anyone tried to reason with (argue with) their bank about the limits of the FATCA?

Let’s suppose someone needs an account to receive payment, but their account balance is never to go above $5-10k. The “trigger” is $50,000, right? Well, why don’t they leave you be with your small account?

Back to the nasty comments, when I read stuff like that, it makes me wonder if these people are just envious, due to their dillusions about overseas life? At least in my case, it’s much much harder than living in the US. And there are plenty of headaches to go along with it. But what else can I do– go back to the US and start collecting public assistance?

@Petros, this is actually much bigger than us little guys. Google – “US Persons” derivative markets -. It’s almost as if we are being used as little pawns to seize control world markets. I really wish I could be exaggerating by saying this, but I’m afraid that I’m not.

I’m starting to tell homelanders that I’m not against being taxed by the US, just one that’s based on residency, not citizenship – like the rest of the civilized world enjoys!

I had a wire transfer go missing on its way to Cameroon. My bank says the “intermediary” bank has not responded to their inquiries. I wonder if US banks, in control of international wire transfers, has started randomly seizing funds.

I’ve seen the real Berlin Wall and this virtual wall is no different.

During some sort of economic crisis, another chilling aspect of FATCA is if the US Government knows who has offshore bank accounts, what is stopping the US Government ordering all US Person bank accounts to be frozen abroad?

Then we enter the world of pleading with our ‘other’ governments not to enforce the US’ will upon us.

We’re now getting a taste of this from the FATCA fight.

BTW Bleibin should be Bleiben on the wall – the German for to stay.

Die FATCAmauer.

My first reference to the New Berlin Wall was February 25, 2010:

http://righteousinvestor.com/2010/02/25/the-new-berlin-wall-heroes-earnings-assistance-and-relief-tax-act-2008/

Don, graffetie is often mispelt. But thanks for the correction.

Excellent visual — and it was as interesting this time to read The Parable of the Prodigal Uncle once again. Thanks, Petros.

In 1979 the UK Conservative Party launched a campaign ‘Labour Isn’t Working’ with long queues of people going into the unemployment office.

http://en.wikipedia.org/wiki/Labour_Isn't_Working

Imagine the scene of long queues of people going into the US Embassy ‘US citizens in’ and another exit door ‘Former US citizens out.’ with perhaps something like ‘FATCA Isn’t Working.’ and a sign show $2350 today’s renunciation fee.

Perhaps a more controversial idea I had was somehow subtlety tie FATCA and racism together. Imagine a queue in a bank with people only some are darken in with a small tag above their heads ‘US Person.’ with a tagline ‘The black sheep – US persons.’

It would be nice if a professional cartoonist could be found.

@ Charl

Whenever I come across your comments I say, “Yay, she’s on it. Thank goodness.” And then I up arrow, thumbs up or recommend. You are doing a fine job. Brock on!

@ Petros

I hope our future isn’t as bleak as that photo — makes me shudder. Couldn’t you at least add an ADCS drill attacking the base of the wall? Anyway the Berlin Wall graphic and concept does have potential for reaching the minds of they who do not even want to try to “get it”. Opening up a closed mind is sometimes just a matter of finding a key image.

@geeez

I found that article really, really frightening, but read it completely differently. What I got out of it is that the head of the U.S. Commodities Futures Trading Commission is concerned that the world economy might break up into blocs, which was what happened when the world economy broke down before in the 1930s, because of various incompatibilities between the EU and US rules, including U.S. restrictions regarding trading and U.S. persons. This is not good because trade depends on financing and he says that the financial markets are splitting. This is a concern that I have had (about the world economy generally, not about swaps and futures), but it is a bit alarming to hear the head of the U.S. Commodities Futures Trading Commission say such things.

@Petros

JFK in his ‘Ich bin ein Berliner’ speech in 1963 said ‘Freedom has many difficulties and democracy is not perfect, but we have never had to put up a wall to keep our people in, to prevent them from leaving us.’ How things change.

@Embee, You guys are on the good side of the wall 🙂

@ noone

There is no good side of a wall which keeps people trapped or excluded. Whether a wall is virtual or real it is a blight on humanity. None of us are truly free when some of us are enslaved. I feel the same way about the wall which imprisons Palestinians.

Publius, it is frightening but I think that those of us standing outside the wall will be better off in the long run than those trapped behind it in.

The Bank of Scotland pic has incorporated passing on tax information (trying to be non-discriminatory) by using language as ‘such as the US.’

http://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&cad=rja&uact=8&ved=0CCYQFjAB&url=http%3A%2F%2Fwww.bankofscotland.co.uk%2Fbankaccounts%2Fpdf%2Fbank-account-conditions.pdf&ei=58MlVJTiBM6rPOmugNAO&usg=AFQjCNEBFVvWrGTuZJCP79tjRXuGhT3lag&sig2=lLUGvFkTu4EgjdJovlbzWw

UK banks seems to be going to lengths to making this legalised discrimination. They must have been advised to do so.

However it’s heartening the banks face another bank fee payout in the UK.

http://www.mirror.co.uk/news/uk-news/excessive-bank-charges-court-victory-4329713

So if someone mounts a legal challenge in the UK, a FATCA carve out for resident citizens may happen?

Further to the Bank of Scotland’s terms and conditions:

22. Tax reporting and withholding for customers who are subject to the tax regime of certain other countries (including the US). 22.1 We (or other companies in the Lloyds Banking Group) may be required by legislation or by agreement with tax authorities to report certain information about you and your relationship with us, including information about your accounts: a) t o the tax authorities in the UK, which may then pass that information to the tax authorities in another country where you may be subject to tax; or b) d irectly to the tax authorities in other countries (such as the US) where we reasonably think or are required to presume you are subject to tax. 22.2 Where we are required to report information about you and/or your relationship with us, including information about your accounts, this information includes (but is not limited to) the account number, the amount of interest paid or credited to the account, the account balance or value, your name, address, country of residence and social security number or taxpayer identification number. In addition, we may need you to provide us with further information, documents or certifications about your identity, tax residence, nationality and status. 22.3 If we are required to report information about your accounts, you agree that: a) y ou will provide additional information or documents we need from you and confidentiality rights under applicable data protection, bank secrecy or similar laws will not apply to this information we report or obtain from you to comply with our obligations; b) i f you do not provide us with information or documents we need, we may (i) apply a withholding tax to amounts, including interest, we pay to you; or (ii) close your account; or (iii) transfer the account to an affiliate in another jurisdiction; and c) w e will not be liable to you for any loss you may suffer as a result of our complying with legislation or agreements with tax authorities in accordance with this condition 22, unless that loss is caused by our gross negligence, wilful default or fraud

If you don’t provide the information, they’re going to do withholdings, close your account, or transfer it to another jurisdiction (i.e. the US).

And to top all that you’re waiving all your data protection rights along with going after them in the event you lose any money.

Talk about outrages.

A legal challenge needs to be made in the UK for dual citizens.

Again all done in very neutral language so the discrimination bug doesn’t bite.

^^ this is what I was saying, has anyone tried to say “The FATCA states that anything above 50k is reportable.” — just to see the response.

Don. Do you mean a visual such as the picture of TD bank here?https://isaacbrocksociety.ca/2014/06/26/please-provide-in-this-post-questions-big-canadian-banks-will-ask-new-account-holders-on-july-2-2014/

@Duke of Devon – Absolutely but try to tie it with a more emotive subject like racism.

Canada is ahead of the game. In the EU there needs to be a website to start getting dual citizens together and start using the skills between us to knock some legs out of these IGAs.

The politicians only offer silence on this issue in the hope it goes away.

FATCA may not disappear, but we can influence the ‘rules of the road’ on this. At present it’s just a free for all.

@Don, you have to stop using the term “dual citizen” as that term does NOT exist in law except that a citizen of a member country in the EU is a national of the EU and their main nationality.

We/you/all should be saying, “A lawsuit needs to be started by a EU Citizen who the US claims as a citizen.”

@Don, also if you consider yourself to be “dual” then you defacto agree to the US imposing obligations on you.

To be honest, I have less pity to US Citizens living abroad that are complaining about their government. If you want to carry the little blue book then you need to dance.

What I object to are those that carry the little maroon book and only the maroon book whom the US thinks they have their talons into.

@George – You’re right. My blue book lays in the draw collecting dust only to cross the US border. My EU passport is used for everything else.

The lawsuit I’ve always advocated was an EU citizen mounting a legal challenge to enforce their EU citizenship rights.

That questions remains unanswered.

@Don, I did not mean to needle you, rather we ALL need to be constantly reminded as to the terms being used.

When we call ourselves dual, we are agreeing to the piper.

I have always said this is not a tax problem rather it is a citizenship problem.

A Canadian Citizen living in Canada with clinging US Nationality is solely and absolutely a Citizen of Canada whilst in Canada. The US has no claim to that person unless that person voluntarily agrees.

A French Citizen living anywhere in the EU with clinging US Nationality is solely and absolutely a French/EU dual citizen whilst in the EU. The US Has no claim to that person unless that person voluntarily agrees.

And again, I have less sympathy for the US expat living in the EU with a permanent residency visa.

Post FATCA, how many EU Persons do you think will renew any dusty blue books? Me thinks they will simply decide to never return to the USofA.