The Internal Revenue Service agents did not accuse Ms. Hinders of money laundering or cheating on her taxes — in fact, she has not been charged with any crime. Instead, the money was seized solely because she had deposited less than $10,000 at a time, which they viewed as an attempt to avoid triggering a required government report.

“How can this happen?” Ms. Hinders said in a recent interview. “Who takes your money before they prove that you’ve done anything wrong with it?”

The federal government does.

Law Lets I.R.S. Seize Accounts on Suspicion, No Crime Required

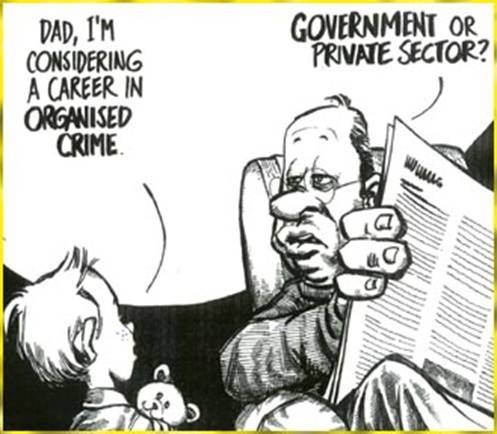

Does anyone except Jack Townsend still doubt that the IRS is a criminal organization?

Hat Tip: Zero Hedge

I have been tweeting a lot about this recently, and glad you are making a post of it.

One of the best comic/serious discussions of civil forfeiture laws is this by John Oliver. I recommend it…

http://youtu.be/3kEpZWGgJks?list=UU3XTzVzaHQEd30rQbuvCtTQ

Then there was this by the Economist…

The Ham Sandwich standard

http://www.economist.com/blogs/democracyinamerica/2014/02/civil-liberties-and-supreme-court

Note this quote…

and today, Dan Mitchell at CATO just put up a blog post on the subject…

http://danieljmitchell.wordpress.com/2014/10/26/another-example-of-government-thuggery-and-another-reason-why-decent-and-moral-people-are-libertarians/

and finally, this from a recent discussion with @Judgenap on Huckabees program..

http://youtu.be/gU-tiGU6SiA

I think I might have put up the wrong link for John Oliver’s program… it might be linked to a list of his programs, which are worth watching, but here is the more specific one…

Try this one.

http://youtu.be/3kEpZWGgJks

AS soon as I saw the NYT article this morning, I sent it to the Isaac Brock Society,

I think it is a disgrace that this denial of due process is unfair under law. It is a crime to take away someone’s business without due consideration of the owner’s rights.

AS soon as I saw the NYT article this morning, I sent it to the Isaac Brock Society,

I think it is a disgrace that this denial of due process is xxXxxxxxxxxxxxxxxxxxxxxx allowable under law. It is a crime to take away someone’s business without due consideration of the owner’s rights.

Let’s not overreact! There are only two kinds of cash deposits subject to seizure in the U.S. only two:

http://renounceuscitizenship.wordpress.com/2014/10/26/the-two-kinds-of-cash-deposits-that-can-lead-to-account-seizures-in-the-usa/

So highway robbery is now legal, eh?

This is why FATCA must be ruled illegal. The US in future will try to invoke MLATs, and MCARs to get payment from ex-pats. The US will say you’ve signed the treaty and must assist the US without any proof or evidence.

What would an ex-pat pensioner do if the US freezes an overseas bank account on simply a hunch she may have evaded taxes?

The US must be made to realise its tax border ends at its border.

Many countries have anti -structuring laws but the key difference is that the US does not require the intent to commit a crime, the other countries require a criminal intent element. Effectively, the US, once again is over the top. The fact that the banks cannot even warn or proactively advise the customer makes it even more onerous. Forms, reporting and penalties is the US mindset.

@Don – this is precisely the issue we will be faced with. Many bank consent forms for FATCA include the provision that on the order of the IRS they can deduct fines/penalties and taxes owed and of course the account can be frozen. Imagine the absurdity and horrible. There is no choice but to renounce as terrible a choice as that is for me.

A blatant disregard for the 4th Amendment of the Constitution:

“The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated, and no Warrants shall issue, but upon probable cause, supported by Oath or affirmation, and particularly describing the place to be searched, and the persons or things to be seized.”

How are they getting away with such tyrannical BS?

More people need to just come out and call a spade a spade… When one pieces together different pieces of information to try and intuit a bigger picture, it appears the US government is trying to seize more and money through whatever means as long as they can get away with it. It seems to me that FATCA (along with other new recent trends) is not about catching tax cheats, it’s about being able to seize larger sums of money… The US Government will always claim it is doing something for a moral reason to make it difficult to fight against.

But we should know better… What happens when you make an honest mistake and didn’t pay a minor amount like $100 on your taxes? Will they be using this as an excuse to seize all of your bank accounts? This line of conjecture sounds silly now. But what happens when this trend of unchecked power continues to its logical ends? The first olive left the jar long ago… And already the courts in the US do not offer an adequate counterbalance to the executive and legislative branches…

@ Just Me says Thanks for the links.

This is of course one worst case scenario:

http://www.forbes.com/sites/steveforbes/2013/03/18/for-whom-does-the-cyprus-bell-toll-alas-all-of-us/

Sorry, here is the link I meant to post: http://www.forbes.com/sites/steveforbes/2013/03/25/can-a-cyprus-like-seizure-of-your-money-happen-here/

@ Petros Thanks for posting! Please excuse my past comments which may have unintentionally sounded “brusque”.

It is not new. The IRS writes regulations that are based loosely upon the law, but not exactly. Congress lets them get away with it because most of the congressmen and senators know how vague the tax code is and if one of them takes the citizens part he will find himself in violation of some part of the 80,000 page stack of laws.

There is a movie that showed in 900 screens Oct 14,2014, called Unfair. The producers and writers will become the object of the IRS affection soon. They concluded, as did the packed houses who saw it, that the IRS cannot be reformed and the Income Tax Law cannot ever be made fair. Even Cicero in 33 BC said an honest man will pay more taxes than a dishonest man, on the same income, if taxes are based on income.

Some years ago I had a few employees and filed a quarterly tax for employers to transmit witheld taxes to the treasury. I got notice I had not paid with the report, when the check was in the same envelope. I photoed the ft and back of the cashed ck and sent it with a letter to the IRS. They ignored my letter and proof and within a week took $2600.00 from my account. I wrote the commissioner and sent copies of everything to my dist. Rep. About 3 months later I got a letter from the IRS saying I had overpaid for one quarter. The same quarter they took the money. However there was no refund of the money I had ”overpaid”. About 3 more months I got a check that said ”refund for overpayment” and an interest payment of 44 cents. That is how they operate so don’t ever be surprised when they do something that seems illegal. It’s not illegal and if you try to prove it, you’ll loose.

@JohnSmith

“How are they getting away with such tyrannical BS?”

In part because no one is standing up to this kind of nonsense stateside–even the people who profess to oppose it. I’ve gotten far better value for my money when it comes to my donations to ADCS-ADSC than when it comes to a similarly sized donation to the U.S. counterpart effort, FATCA Legal Action.

warning do not take cash to US

http://www.zerohedge.com/news/2014-09-24/canada-warns-its-citizens-not-take-cash-usa

@patricia

Thank u… that was the article I was looking for. I also found a few months ago a web site… can’t remember now… with stories of people who had their money taken at the airport even though they followed the supposed rules… majority of them were immigrants who had no clue what to do & seeking info how to get their money back. A few yrs ago… it use to be that u didn’t have to declare anything under 10k to the US per person… now they changed that to 10K per family… of course… I didn’t see signs that say anything like that at customs… did anyone? I usually just see u must declare 10K & over… but I assumed it was per person… guess I was wrong… not a first time… not the last time

@John Smith…

That 4th Amendment is just a quaint little statement, that most Americans have long ago forgotten or never knew in the first place. I think you forget how ignorant the average person is about our form of government, or even who the current leaders are. When most Americans on the street, don’t know who Joe Biden is, how can they remember an amendment?

http://youtu.be/tTCXR8uaCHg

It appears that Ms Hinders’ restaurant is called “Mrs. Lady’s Mexican Restaurant”. This is a picture of it:

http://www.yelp.com/biz_photos/mrs-ladys-arnolds-park#thoBrTNHO_E6txyMealjWA

This is a burrito – or something like that – that this restaurant serves:

http://www.yelp.com/biz_photos/mrs-ladys-arnolds-park#yJ0DXwU0SM4wWv14jYnV_w

Did an IRS agent eat a burrito and get heartburn there and so decided to seize the proceeds? Or was the serving not big enough?

A few years ago a US state seized a few grand from a bank account I had there. They said that they tried to contact me – probably sending notices to decades old address. If they could extract the money from the account they might have extracted my current address from them. Seize first, ask questions later. Anyway the basis for their seizure was they thought I owed tax for a year – 10 or more years after I could no longer be considered a resident of that state. I got the money back after their investigations and it all took about a year. They could not put the money back in the account but had to send a check.

The time is coming that it will be unwise to keep your savings in US banks.

There should be no anxiety about a US citizen keeping hard earned money in their account.

The US government is increasingly disrespecting its own citizens. I am hearing more and more

of innocent people getting roughed up by local law enforcement, IRS, etc. over small amounts of money.

even the $10,000 limit now at international airports is small. Families coming for summer holiday for a couple months? $10 grand can be gone through very quickly and lets no assume CCs work all the time.

Cash is necessary. Still hard to believe this $10000 limit was instituted in the 70’s and NEVER HAS BEEN RAISED A SINGLE PENNY. And when confronted by customs or enforcement they make such a big deal that even $1000 is ALOT OF MONEY. WHAT ARE YOU DOING WITH THIS MONEY SIR!?

Tell them you want to stick it up their a_ ss.

@Just Me–Who is Joe Biden?

@patricia, I missed that post (http://www.zerohedge.com/news/2014-09-24/canada-warns-its-citizens-not-take-cash-usa) at Zero Hedge. Thanks for sharing that. I’ve been telling Canadian to stay out of the USA. But my warnings have been seen as idiosyncratic (i.e., weird, obnoxious and nutter). So don’t take cash because authorities have stolen 2.5 billion from Canadians visiting the USA. The US is a kleptocracy. That’s becoming clear.

I say stop going to the US because they don’t have to take your cash. You can also be detained and that will provide further stimulation to their economy as you will have to post bail or pay fancy expensive lawyers to obtain your freedom.

@ mettleman

“can someone enlighten my memory….i thought i had read somewhere on here that any bank accounts that are closed after july 1st are reportable to the CRA and then to the IRS. i am attempting to clean up an issue and don’t want to create another one by closing a bank account.”

I recall reading that as well and am hopeful someone can advise. TIA