The Internal Revenue Service agents did not accuse Ms. Hinders of money laundering or cheating on her taxes — in fact, she has not been charged with any crime. Instead, the money was seized solely because she had deposited less than $10,000 at a time, which they viewed as an attempt to avoid triggering a required government report.

“How can this happen?” Ms. Hinders said in a recent interview. “Who takes your money before they prove that you’ve done anything wrong with it?”

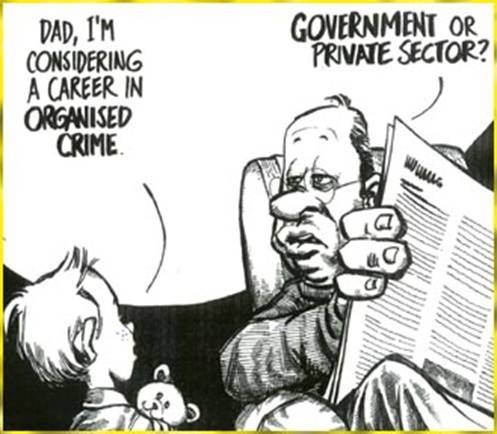

The federal government does.

Law Lets I.R.S. Seize Accounts on Suspicion, No Crime Required

Does anyone except Jack Townsend still doubt that the IRS is a criminal organization?

Hat Tip: Zero Hedge

Sasha and Mettleman.. Depends on whether the account was ‘reportable ‘ or not. I.E. Did the bank have any ‘indicia’ on file when the account was closed. If not, there is no reporting.

Thanks Duke of Devon. That’s what I thought . . . and hoped 🙂

awsome answer. knew there was some catch to it.

thanks

It’s possible that the Zero Hedge article about the Canadian government warning Canadians traveling to the US is slightly misleading. I think this is the original Canadian article that was referenced by Zerohedge.

http://www.cbc.ca/news/world/american-shakedown-police-won-t-charge-you-but-they-ll-grab-your-money-1.2760736

Nonetheless, the Canadian government SHOULD be warning Canadians that there are many elements of the US government which operate like crime syndicates and will steal your money.

Not sure where to post this. This is for anyone here who is unaware of PHISHING e- mails.

Messages such as this or from apple or Microsoft telling you there is something wrong with your account or from Walmart offering you a job and on and on are designed to separate you from your money. Don’t open them-delete them. Report them if you can.

The correct place to post a phishing email is nowhere on our site. Especially the email address. Do it again and your comments will go into moderation to protect the public.

TIGTA just came out with this audit of CI

http://www.treasury.gov/tigta/auditreports/2014reports/201430081fr.html

“I.R.S. Asset Seizure Case Is Dropped by Prosecutors

Federal prosecutors have agreed to dismiss a case against Carole Hinders, an Iowa restaurant owner whose bank account was seized by the I.R.S. based solely on a pattern of cash deposits, Ms. Hinders’ lawyer said Friday.

Ms. Hinders was never accused of any crime. The Mexican restaurant she owned, Mrs. Lady’s, did not accept credit cards, and she regularly deposited earnings in a bank branch a block away.

After doing business this way for nearly four decades, Ms. Hinders was told that the I.R.S. had seized $33,000 from her bank account after agents detected a pattern of deposits under $10,000.

Seizing assets without criminal charges is legal under a controversial body of law that allows law enforcement agents to seize cars, cash and other valuables they believe are tied to criminal activity. The burden of proof falls on owners seeking the return of their property.

The I.R.S. recently announced that it was sharply curtailing seizures in cases like Ms. Hinders’s, where there is no suspicion that the money involved came from an illegal source. But officials said they would not drop cases that were already underway.”

http://www.nytimes.com/2014/12/14/us/irs-asset-forfeiture-case-is-dropped-.html

@Innocente

Do u think criminals are going to waste their time to deposit money under 10k at a bank in their own name all the time? In this day & age… 10k is really not that much… I don’t do internet banking… umm… don’t trust it… If I was a real criminal… I would have a complex system going… I am just an idiot who has crap in my name instead