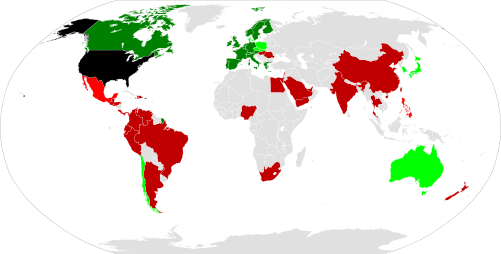

| Sources of data: Social Security Administration, U.S. State Department via American Citizens Abroad | |||

| United States | |||

| Totalization agreement in force by 1978–1999 | No agreement, 100,000+ U.S. citizens in 1999 | ||

| Totalization agreement in force by 2000–2014 | No agreement, 10,000+ U.S. citizens in 1999 | ||

In 1999, among the estimated 4.2 million U.S. citizens residing outside of the U.S., 1.7 million lived in countries which had Totalization Agreements with the U.S. at the time, while 280,000 lived in countries for which Totalization Agreements with the U.S. would come into effect by 2014. The remaining 2.2 million lived in countries where they would have to pay U.S. Social Security taxes on top of any similar local taxes if they worked for U.S. companies or for themselves — without any credits to prevent double taxation.