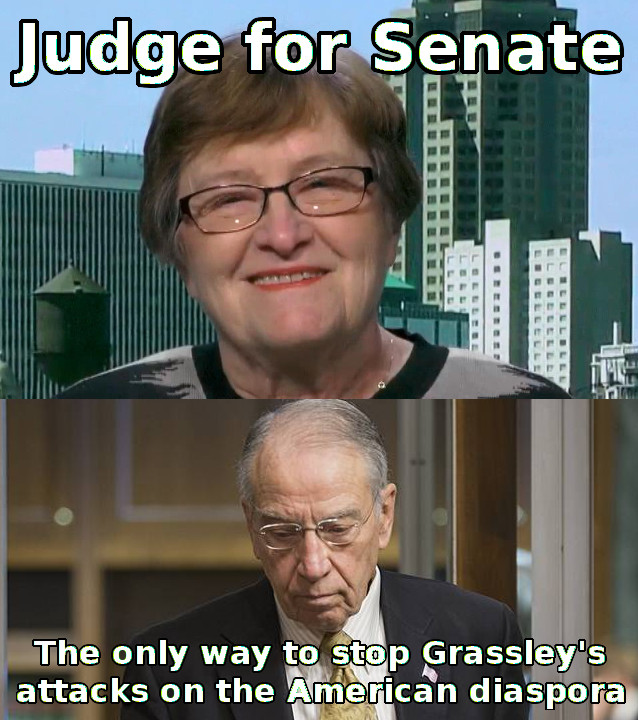

After decades of coasting to reelection, Sen. Chuck Grassley is facing his toughest race yet. Iowa political observers say the 82-year-old Republican senator known for his independent streak could be in danger in a turbulent, no-holds-barred presidential election year. A Loras College poll released Thursday had the Iowa lawmaker in a statistical dead heat against Patty Judge, his Democratic challenger. Grassley led by only one point, 46-45, against the former lieutenant governor. That nominal advantage was well within the poll’s four-point margin or error. (The Hill, 4 July.)

So, the Republicans have made some big promises to the diaspora in their platform. But it’s up to the actual legislators whether they want to implement those promises or not, and any Republican Senator who gets re-elected this November has six years to spend ignoring the platform before he next gets called to account. And as we well know, one prominent Republican member of the Senate Finance Committee is dead set against giving anything to the diaspora: Chuck Grassley, who’s been gunning for us ever since the Ford administration.

In the current election, there’s at least a slim chance of finally putting Grassley out to pasture: Iowa tends to lean more Democratic during presidential election years, and Grassley faces a strong challenger with excellent name recognition. And Democrats Abroad hope to capture the votes of middle-of-the-road emigrants who have been forced by circumstances to become single-minded single-issue voters. So I have to ask: why on Earth have Democrats Abroad been deafeningly silent about Patty Judge?

Do Democrats Abroad know anything about taxes?

The Elephants hardly have a bulletproof record on U.S. diaspora policy. Numerous times, they’ve voted to tax & fine the diaspora in order to pay for goodies for Homeland constituencies they actually care about. Republicans are the party which gave us phantom gains taxation on mortgages and “enhanced” FBAR penalties in the name of fighting terror financing. They keep attacking the Foreign Earned Income Exclusion — TIPRA in 2005 being the prototypical example, 2012 and 2013 tax reform proposals by Dennis Ross (R-FL) being other lesser-known ones. They were fully on board with passport confiscation. In 2002, forty-four House Republicans sponsored legislation to banish every single ex-American who exercised their human right to change their nationality, whether or not they were motivated by taxes. Last year they even voted unanimously to repeal the estate tax on Homeland millionaires and billionaires while explicitly leaving it in place on ex-citizen thousandaires whose inability to comply with the “Internal” Revenue Code’s paperwork demands turned them into covered expatriates.

Not all of these were Chuck Grassley’s fault, but a very large proportion certainly were. I have very little clue about Judge’s proposed tax policies (and apparently neither does she), but while the average Democratic candidate might be worse than the average Republican on this issue, no one short of Schumer and Levin reincarnated in one body could be any worse than Grassley and his blind stereotyping of the diaspora as traitors living the high life in Paris.

This shouldn’t be any big revelation to Brock regulars, but how about the rest of you who came here by following a link your friend sent you? Is this news to you? And if so, why on Earth are you finding out about this for the first time in your life from a blog whose authors have almost all given up on U.S. politics and on U.S. citizenship itself, instead of from the Twitter feed of Democrats Abroad? It’s almost like DA’s sole function is to export stale canned talking points from the Homeland, rather than understand the actual pain points of emigrants in order to generate fresh ideas locally.

Judge and Social Security

Update and correction, 25 July: Judge has at least one concrete tax policy: she supports “increasing the current cap on Social Security wages“. The Des Moines Register also uses the word “wages” when discussing her Social Security proposals. That is to say, Judge is silent about whether or not to extend SECA/FICA to “investment income”, whereas Clinton explicitly supports that. We previously discussed how Clinton’s proposal would massively increase double taxation and paperwork headaches for members of the diaspora in countries with which the U.S. refuses to sign Totalization Agreements.

As the Democrats refuse to admit and we’ve been saying on Brock for years, not just “the wealthy” but everyone living “offshore” ends up having “investment income”, because of the American propensity for inventing income out of thin air.

This is yet another iteration of the Same Old Problem with [citizenship-based taxation]: CBT is a piss-poor way of extracting cash from the diaspora because of the existence of Foreign Tax Credits, and the Homeland wants more cash. Eritrea solves that issue by not signing any tax treaties and thus not being obligated to grant any FTCs. The USA does not have that choice, so they inevitably do one or both of the following:

1. Inventing forms of “investment income” which the local government does not consider to be income and thus does not tax (hello PFIC & phantom gains!), and which are absolutely impossible for any ordinary person to even calculate how much alleged “income” there is thus virtually mandating that you use an accountant

2. Inventing new taxes to which existing FTCs and tax agreements don’t apply (payroll tax, the Obamacare investment tax) and refusing to sign new agreements to plug the gaps (34 out of 36 countries in the Americas, 12 out of 13 in Oceania, 46 out of 48 in Asia do not have a Social Security Totalization Agreement)

To be fair, Democrats Abroad have language in their platform calling for the elimination of Social Security withholding on Americans abroad. However, they didn’t actually ask the Democratic candidates for their opinions on that, nor manage to get it into the Homeland Democratic platform. And none of these thorny issues stop DA from promoting Judge while simply not mentioning Social Security at all. (end update)

To vote, or to stay home?

Many left-leaning members of the diaspora, in particular those with no concrete plans of moving home anytime soon, are rather imperfectly enthusiastic about Hillary, and are thinking of sitting this election out. The Republican promise to repeal citizenship-based taxation isn’t enough to get them to vote for Trump — tax reform involves horse trading, and they suspect that the diaspora will once again be the horse whom Congressional Republicans sell to the glue factory in exchange for quick cash. But equally, they see no reason to believe Clinton’s far weaker promises about ameliorating FATCA’s worst effects, and are not going to swallow their misgivings and cast what’s effectively a vote to continue all of the existing anti-diaspora policies.

In short, they don’t want to vote for a candidate who will make them embarrassed to be American, but they don’t see any reason to vote for a candidate who’s going to force them to stop being American either.

There are Republican emigrants from Iowa who despise Trump and are only planning to vote because they hate Clinton even more — give them a reason to stay home. And there are Democratic emigrants from Iowa who aren’t enthusiastic about Clinton, and don’t see any reason to cast a ballot at all — give them a reason to vote at least in the Senate race. If Democrats Abroad want to do something for the “Abroad” part of their name without betraying the “Democratic” part of it, they should get the word out about how awful Chuck Grassley really is.

About the author: the author of this post is a money-laundering, drug-dealing, job-exporting terrorist who defected to Red China to evade U.S. taxes. Hopefully taking advice from him won’t get the Democrats in worse trouble than that time when the Republicans took actual cash from an ex-American here.

Eric, I worship the ground you walk on, but for the life of me I don’t understand this post.

He wants us to mobilize Iowa registered voters to vote our sworn enemy Grassley out of office. He also questions why Democrats Abroad have not been rallying the troops on this. The perception of DA is that they are an organization that is outward-focused: to promote Homeland Democratic Party issues to expats, when they should be doing the inverse: promoting issues of specific interest to expats back at the Democratic Party.

I slightly disagree with Eric on this latter point. DA has gotten a bit better recently in promoting our views. But it does seem that this Iowa Senate contest is just the sort of issue they should be loudly promoting, especially since the goal would be to replace a Republican who has declared war on expats with a Democrat who will likely, at worst, follow the party line of ignoring us completely.

@Barbara: thank you, that’s exactly what I was getting at, and put far more concisely than I ever manage =)

@Barbara

Thanks, got it!

The man is 82 year sold!!! 82!!! How about retiring? Its HIGH time. If he loses then this might be why.

Jurassic Park incumbents like Grassley represent exactly what is wrong with the US government. He is the poster boy for term limits.

@Polly

I suspect that the age of these dinosaurs is part of the problem. Levin, Rangel, Grassley think that the world works the way it did in the 1970s. Maybe it’s just human nature that everyone thinks of the world the way it was when they were in their forties. Trump is stuck in the 1980s. Clinton in the 1990s. Unfortunately, the taxation committees are very powerful, so they are going to attract the most senior people who then stay on them forever.

@Publius

I agree with your train of thought.

In german there is a word for such people and it is “Scheintod”- which means they have the appearance of death! LOL

I think people like this should be forced to retire! It`s time! These are positions of such responsibility.

He`ll probably die in office. 80 is NOT the new 50.

Actually Trump is more of a ’50’s guy, at least according to Bill Maher:

http://www.thewrap.com/bill-maher-skewers-the-fonz-age-donald-trump-video/

If anyone here from Iowa you know to vote this bsterd Grassley out. He is an ignorant pompous

Knob who cares nothing for the now nearly 9 mill Americans abroad .

Speaking of USA expats, you were abused, used and discarded by the democratic initiative of FATCA. Dems only gave deaf ear to your plees for reform. Have done absolutely NOTHING for diaspora .

Now it’s time to show them your answer.

Vote Trump/Republican in Nov.

We can make a difference! Make the Dems pay

for their ignoring us !

@Brick, a minor correction to your otherwise perfectly reasonable post. My bumper sticker will read:

“Vote Trump/Republican in Nov.” *

*(except Grassley)

I’m not sure where to post this question. But does anyone have any experience with Greenback Expat Tax Services? I found them on the internet. They offer a “Streamlined Filing Package” for $1450 (i assume US $) I never filled any US tax returns. Is this a simple (but expensive) answer to my getting “caught up” so I can renounce?

@Henry – there’s a “renunciation” thread at http://isaacbrocksociety.ca/renunciation/ which would be a good place to ask questions. I would suggest you prioritize the renunciation rather than the filing. (You don’t have to be compliant before renouncing, you can renounce and then do the filing.)

First, be sure you really are a US citizen under US law (might you have relinquished?)

If you are indeed a USC, and need to renounce, the next step (I would suggest) is to get a clear understanding of the procedure, get your documentation ready, and start trying to book an appointment.

Once you’ve got that appointment booked, you can turn your attention to the filing. There’s a lot of good advice available, here and in forums such as http://www.expatforum.com/expats/expat-tax/ – you may find you can do it yourself and save the money.

Good luck.

Henry, Whoa, slow down. Streamlined is meant for those who wish to come back into the system. Read ‘beware of the streamlined system’. -link in the right sidebar.

You might not be a US person. If you are , there is a reasonable chance that doing nothing at all is your best option. Before signing up with a cross border tax condor be sure that’s what you need to do. You have a lot of reading to do. Most of what you need is here under ‘how to renounce’ and we will help with questions as much as possible. You should probably post under ‘Ask your questions about…….’

@ Henry

If you wish to renounce then you will need 5 yrs of streamlined and 6 of FBARS but this can be done after renounciation.

There may be a chance that you have already relinquished by performing a relinquishing act.

If you performed this act before June 2004, IF it was your intention to do so as long as you have done nothing American, since ie vote, use US passport, file taxes, then you may have this relinquishing act recognized and you will not have to back file taxes. It still costs $2350!

Read http://isaacbrocksociety.ca/how-to-renouncerelinquish/

If you have not ‘already’ relinquished and your net worth is over $2,000,000 then you should research how to avoid/mitigate this problem before renouncing. You can read Phil Hodgen’s blog on this site or seek professional help to avoid becoming a covered expatriate if possible.

Someone here did recommend Greenback tax services but I have not had any experience with them.

Don’t rush, read and decide the best course of action first. If there is a long wait at your consulate, you can make an appointment, while you research.,

Thanks for the responses. There is no question I am a “US person”. I applied for and received a US passport in 1990. Interestingly there was no question of tax filing at that time. I also, many years ago, told my bank that I was a dual citizen so now they’re after me for a US form W-9 (who new back then). I will post my question in the appropriate forums. Thanks again.

@Henry– If you decide to file in the US, I’d suggest having a look at Turbo Tax on-line. Turbo Tax was good enough for former Treasury Secretary Tim Geitner to use. I’ve looked at it before– I think it’s good enough (and cheaper) for many expats who want to be “compliant” with the US (not me).

Research by Prof. Amanda Klekowski von Koppenfels suggests that native Iowans may have among the highest rates of residence abroad as a percentage of a state’s population. The last graph at the below link shows native Iowans representing 1.8% of the American diaspora, although, with 3.1 million population, it has the smallest population on her list. These figures suggest that 162,000 native Iowans live abroad, possibly enough to tilt the election against Grassley, if Iowa residents increasingly turn against him:

http://bsmlegal.com/PDFs/vonKoppenfels.pdf

Remarks:

a. 162,000 = 1.8% x 9,000,000 Americans abroad (DOS figure)

b. 162,000 represents 5.2% of Iowa’s current 3.1 million population.

c. From Prof. von Koppenfels’ research, the only state with a higher percentage of its natives abroad appears to be Connecticut at 5.4% (2.1% x 9,000,000/ state’s population of 3.5 million).

d. In 2010 Grassley won election to the US Senate by 347,000 votes, the smallest number since winning by only 101,000 in 1980.

Wild guess: Grassley will be an even bigger pain in the ass in the next six years than he ever has been in the past 35. His long-standing hostility towards the diaspora is unlikely to be attenuated by the platform, least of all now. He will be nearly 90 years old at the end of his term, i.e. he’s not likely to be looking for either re-election or to go on private sector “consulting” and “speaking engagements”.

Off-topic: Grassley is clearly exerting significant influence in the new government

https://www.propublica.org/article/trumps-immigration-pick-attacked-obama-programs-in-ghost-written-senate

Whether you personally support or oppose Grassley’s policies on immigration, we can all agree that Democrats generally oppose his policies. And of course Grassley pushes other policies which have a clear negative effect on Americans abroad. With that in mind, you’d imagine that Democrats Abroad would have said something about Grassley or his Democratic opponent during the election, right? HA!

There were 34 Senators up for election in 2016. Dems Abroad couldn’t be bothered to voice a single complaint about Chuck Grassley or say a single kind word about his opponent Patty Judge.

https://twitter.com/search?f=tweets&q=%40demsabroad%20%22grassley%22&src=typd (people tweeting at @DemsAbroad, no response from them)

https://twitter.com/search?f=tweets&q=%40demsabroad%20%22patty%20judge%22&src=typd (zilch)

Nor did they have anything to say in the two races where Democrats actually did manage to gain Senate seats (Mark Kirk vs. Tammy Duckworth and Kelly Ayotte vs. Maggie Hassan)

https://twitter.com/search?f=tweets&vertical=default&q=%40demsabroad%20%22maggie%20hassan%22 (one tweet after the election)

https://twitter.com/search?f=tweets&q=%40demsabroad%20%22kelly%20ayotte%22&src=typd (one Tweet from three years ago)

https://twitter.com/search?f=tweets&q=%40demsabroad%20%22tammy%20duckworth%22&src=typd (one tweet from a supporter after the election, nothing from @DemsAbroad themselves)

https://twitter.com/search?f=tweets&q=%40demsabroad%20%22mark%20kirk%22&src=typd (nothing)

Meanwhile, Dems Abroad couldn’t stop talking about Elizabeth Warren, who is not up for election until 2018.

https://twitter.com/search?f=tweets&q=%40demsabroad%20%22elizabeth%20warren%22&src=typd

Democrats Abroad: ineffective at supporting Democrats and ineffective at supporting Americans abroad.