(2) Fear makes the IRS more dangerous than it really is.

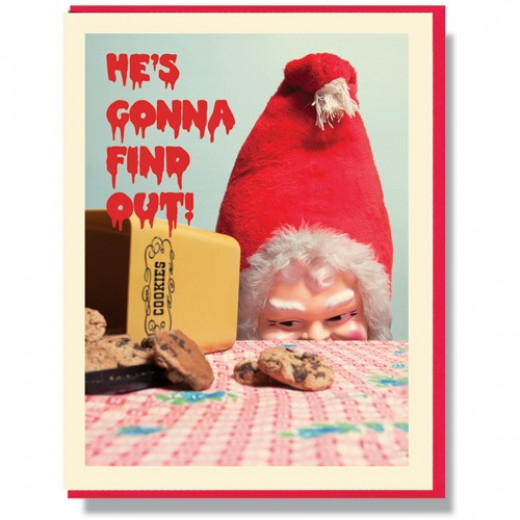

He sees you when you’re sleeping,

He sees you when you’re sleeping,

He knows when you’re awake.

He knows when you’ve been bad or good,

So be good for goodness sake!

Commentary: The IRS is not omniscient and omnipresent like Santa Claus. As much as the US government has tried to take away the privacy of expats, it has only very limited powers even with the betrayal of our local governments on FATCA. It is possible in many cases to work around these limited powers.

The first step in protecting oneself from the IRS stripping you of your universal human rights is a sober and realistic assessment of its true power. Many if not most of us who are living outside the USA are relatively safe because the IRS’s powers of seizure, subpoena, and liens are limited outside of USA borders. Moreover, the IRS has an insufficient audit and enforcement personnel to hunt the much bigger and easier game in the Homeland. Even if it could go after us, it would be an inefficient means of increasing revenue.

A better metaphor for the IRS is a roaring but toothless lion and not Santa Claus.

Inordinate fear of the IRS is dangerous because it has caused some people to lay down all of their normal defense mechanisms and like an innocent lamb to stand paralyzed before the toothless lion.

One of the major roles of the cross-border compliance industry has been to frighten their clients and the public about the IRS’s power, and the media has too often created panic by consulting the compliance industry as their principle experts for information on US expat tax issues.

Previous Petros Principles:

(1) What the IRS can’t know unless you tell them can’t hurt you.

About: Petros is the pen-name of the founding administrator of the Isaac Brock Society. He has started this series of Petros Principles as a means of communicating guidelines which he believes have helped him and others deal with the United States’ world-wide tax invasion.

“That horse has been flogged to death.”

Yes, but we still see repetitions of nonsense like this: “If you have no US income there will be no ‘ information slips’ for the IRS computers to match.”

What should I do, just call the person a liar without explaining why?

Norman. You are partly correct. I apologize. I should have said ‘ if your bank doesn’t know you are a US person, there will be no US information slips for the IRS computers to match’

Embezzlement of U.S. funds by the IRS own report exceeds 100 billion dollars every year. The Marxist Income that Marx called for to destroy the middle class was never about revenue . It was and is a tool to destroy the middle class. There were 700 tax returns all with no income and 7 to 10 kids somewhere South of the Border, file from one address in Atlanta. All got large amounts from the Earned Income Tax credit, @3000 per child. No audit and discovery when there was no trail produces no results except a Gov’T employee got a salary, The FairTax would solve the Expat’s problem, the earned income tax credit problem and without the expat taxes, unles they came home and bought something, but we would pick up all the illegal non filers who live in fine homes and drive fine cars and own a large yatch. Pimps, and all the businesses that take in cash and never file on it. The FairTax would solve a million problems and will never happen because the politicians haven’t yet figured how to get a cut of it without anyone knowing.

An example of the effect of deliberate IRS threats and IRSgenerated duress creating a climate of fear as it deliberately herded as many as possible into their ‘one size fits all” OVD programs in 2009, 2011, and later, before the Streamlined programs were created. The IRS made no effort to make distinctions between US residents deliberately hiding money to evade US taxes, and minnows and people ‘abroad’ with legal local non-US accounts and assets who owed minimal or no US tax:

“,,,,,,,,a number of taxpayers that participated in an offshore voluntary disclosure program can conceivably argue that IRS’ threatened severe criminal and civil penalties forced them to accept the terms of an offshore voluntary disclosure program. Given the IRS’ position regarding quiet disclosures, some participants may have believed that they had no viable alternatives outside the program and these taxpayers were forced into a choice between forfeiting to the IRS an OVDP miscellaneous civil penalty or risk paying enormous civil penalties along with possible criminal prosecution with lengthy periods of incarceration.

In deciding whether the IRS’ threats of criminal prosecution and severe civil penalties amount to duress, the Court of Claims will not inquire whether these threats are indeed actions that the IRS could pursue. Instead, the court must measure, from an objective standpoint, whether the IRS’ overt or subtle threats would be enough to “defeat…the will of the party coerced.” It is important to note that threats made against individuals who willfully or recklessly failed to disclose foreign financial accounts are justified. In these cases, “[i]t is not duress for a party to do or threaten to do what it has a legal right to do.” However, IRS threats of criminal prosecution and severe civil penalties were likely exaggerated to individuals who mistakenly or innocently failed to disclose a foreign financial account on an FBAR. ”

http://san-francisco-california-tax-attorney.com/post/2014/07/14/Can-an-OVDP-Participant-Set-Aside-a-Closing-Agreement-on-the-Theory-of-Duress.aspx

FBAR should be renamed FUBAR–All you with any military knows what this means.

“I should have said ‘ if your bank doesn’t know you are a US person, there will be no US information slips for the IRS computers to match’”

That’s also wrong but in a different case. If you’re not a US person but do have US income, there’s an IRS form called 1042-S. Before 2002 we didn’t know about Form 1042-S because brokers issued T-5 or equivalent forms in other countries, and I think US payers issued 1042-S to brokers but brokers had no use for it because they weren’t the beneficial owners and weren’t filing US returns to get refunds. I learned about 1042-S when I had an account with a US broker and the broker issued the wrong form.

Subsequently I discovered evidence that IRS employees embezzle withholding from 1042-S the same way they do from 1099. They just haven’t been caught yet. Otherwise, there would be forms for IRS computers to match.

“Embezzlement of U.S. funds by the IRS own report exceeds 100 billion dollars every year.”

TIGTA told Congress it’s 6.5 billion per year. That includes some amount of theft by non-IRS employees such as preparers and accountants, but I think theft on that scale usually depends on participation by insiders.

The filers who get the earned income tax credit is where the 100 billion goes. Every scammer in the country knows to make up fictitious children by a woman in Mexico and other countries where he says she lives with their children. It may even be higher since more criminals have learned from the IRS reports how it is done.

We simply cannot go on as a nation unless we get this under control. Borrowing endlessly is not a plan. Republican and democrats alike have had a majority and won’t tackle the problem by voiding the income tax, passing the fairtax—No tax return to be filed hence no fraud– the campaign contributions to Ways and means members keeps the Marxist Progressive Income tax going.. They are simply too short sighted to understand that when the boat sinks all passengers drown.

Petros Principles work better if you are not already in the IRS cage.