(2) Fear makes the IRS more dangerous than it really is.

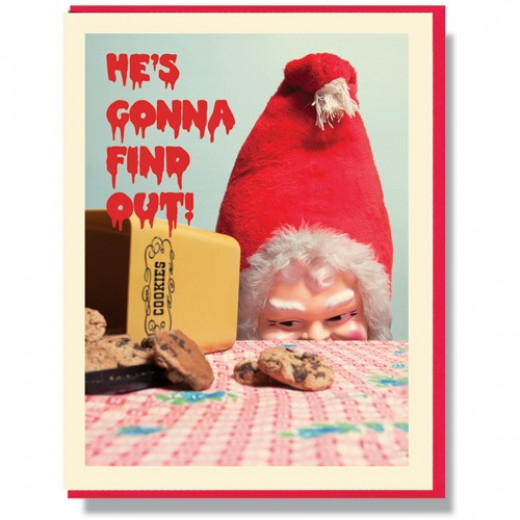

He sees you when you’re sleeping,

He sees you when you’re sleeping,

He knows when you’re awake.

He knows when you’ve been bad or good,

So be good for goodness sake!

Commentary: The IRS is not omniscient and omnipresent like Santa Claus. As much as the US government has tried to take away the privacy of expats, it has only very limited powers even with the betrayal of our local governments on FATCA. It is possible in many cases to work around these limited powers.

The first step in protecting oneself from the IRS stripping you of your universal human rights is a sober and realistic assessment of its true power. Many if not most of us who are living outside the USA are relatively safe because the IRS’s powers of seizure, subpoena, and liens are limited outside of USA borders. Moreover, the IRS has an insufficient audit and enforcement personnel to hunt the much bigger and easier game in the Homeland. Even if it could go after us, it would be an inefficient means of increasing revenue.

A better metaphor for the IRS is a roaring but toothless lion and not Santa Claus.

Inordinate fear of the IRS is dangerous because it has caused some people to lay down all of their normal defense mechanisms and like an innocent lamb to stand paralyzed before the toothless lion.

One of the major roles of the cross-border compliance industry has been to frighten their clients and the public about the IRS’s power, and the media has too often created panic by consulting the compliance industry as their principle experts for information on US expat tax issues.

Previous Petros Principles:

(1) What the IRS can’t know unless you tell them can’t hurt you.

About: Petros is the pen-name of the founding administrator of the Isaac Brock Society. He has started this series of Petros Principles as a means of communicating guidelines which he believes have helped him and others deal with the United States’ world-wide tax invasion.

@USCitizenAbroad:

Excellent commentary. Thanks.

@Renaud

Absolutely correct there is NO requirement to file IRS forms as a condition of renouncing. What they mean (probably) is that the failure to have met the requirements of the Internal Revenue Code for 5 year prior makes you a “covered expatriate”. This may or may not matter – depending on your circumstances.

@Petros

Thank you very much for bringing this important issue into the discussion! Welcome back by the way!

Thanks for your kindness. A little humanity makes a huge difference.

I agree that the fear and the anger are not helpful. Best to be aware and move on, if possible. After taking necessary steps for one’s unique situation with regard to the FATCA mess. Brock has helped me with the awareness part. This is not a situation where “head in the sand” works.

USCitizen

Thanks for mansplaining this. I am in agreement with what you said until the part about people pretending to be American in order to get a CLN? Odd. That’s a new one for me.

I believe that people who are seriously contemplating becoming compliant to renounce, would benefit from having information about and access to ethical tax professionals, as none of us wants to hear anymore incredible stories of more people ripped off by condors.

No one yet knows how this is all going to play out. Some are afraid the USG will change the rules again or that Canada may etc. Living in fear is an awful state to be in, on that we agree. But it is a common emotion for many, with some cause. I hear from them frequently, a lot of us do. Would it help them if I said be like me, I am not afraid. No it wouldn’t, and in my opinion would be rather arrogant and dismissive.

I am here to stand up for all our rights; and many of our best supporters have been those who have their CLNs. The work continues, which is why we really are on the same page.

-30-

do you think its possible for those who have gotten sucked into compliance at the time of fear and not knowing.. .. that now know it may have been a mistake to doit to just QUIT and and stop being compliant ???

and not bother with the renouncing circus?

@USCA @Cheryl

“If the “compliance process” costs you a significant percent of your net worth (and it could depending on your situation), you will no longer have “fear” but you will have extreme (dangerously so) “anger”.

In other words, you will have converted the disabling emotion of “fear” into the disabling emotion of “anger”…”

I would be a poster child for this statement, but would venture to disagree that my fear has been “converted” to anger, as anger is “never a primary emotion”. All compliance did was convert some perceived fears into others that only exist with compliance, such as now being in the IRS’ gun sights (Monty Python’s “How Not to be Seen” video comes to mind).

“Anger—How We Transfer Feelings of Guilt, Hurt, and Fear”:

“It’s by now generally agreed upon that anger, as prevalent as it is in our species, is almost never a primary emotion. For underlying it (as fellow blogger Steven Stosny pointed out two decades ago) are such core hurts as feeling disregarded, unimportant, accused, guilty, untrustworthy, devalued, rejected, powerless, and unlovable. And these feelings are capable of engendering considerable emotional pain. It’s therefore understandable that so many of us might go to great lengths to find ways of distancing ourselves from them.”

https://www.psychologytoday.com/blog/evolution-the-self/201306/anger-how-we-transfer-feelings-guilt-hurt-and-fear

@Ginny, I for one have difficulty with reconciling the terms “ethical” and “tax professional” when it comes to cross border issues. If we consider CBT to be a violation of universal human rights, then what is ethical about helping someone to have her rights violated?

“feeling disregarded, unimportant, accused, guilty, untrustworthy, devalued, rejected, powerless.” Well I would agree as all of those now apply to me. I agree with you BB. Sometimes I just go into denial.

@ Petros

Thanks and feel free to add any of my “points” to your “Petros points”

This site is an important public service and anything I post here can be freely shared.

I was glad that Maplesandbox.ca choose to quote and expand upon some points I’d made regarding the rights and protections so-called “US persons” in Canada have – this is right on topic:

http://maplesandbox.ca/2015/questions-to-ask-cross-border-lawyers-and-accountants/

@ Petros as to my above question is it possible ?

@Canadian Ginny

I am referring to people who relinquished U.S. citizenship many years ago under the nationality laws, have lived life only as Canadians, completely believe that they are not U.S. citizens, but back filed U.S. taxes and renounced U.S. citizenship because they believed (1) that a CLN is absolutely required and (2) that the only way to get a CLN was through renunciation (a position advocated by some compliance people).

“The only way to be sure that you are not American is to formally renounce and get a CLN.”

Also, there were people who entered OVDI in 2011 who were not U.S. citizens.

Bruno.. Yes it is possible. Unless you are particularly wealthy nothing much will happen. If you have no US income there will be no ‘ information slips’ for the IRS computers to match. If you don’t intend to emigrate southward, go for it.

@Bruno, I know too little about your specifics to understand the question much less hazard an answer.

But why go to the bother of complance and not renounce? It seems that one is just short of the goal.

@Cheryl

I’m no shrink, but it would seem that anger is just a ‘catch all’ for the feelings of being “disregarded, unimportant, accused, guilty, untrustworthy, devalued, rejected, powerless, and unlovable.”

Let’s add “exiled” to that list, just for Americans abroad. My greatest fear is that those feelings might actually be reinforced by renouncing.

@ petros and duke …. specifics i have no US income no nothing just some siblings there now,,,

moved here 17 years ago born a dual went to get canadian taxes done by a accountant… then got slammed with YOUR SUPPOSED to this that your gonna get put in the slammer if you cross the border … so a few grand in back filing 5 years . it was done …. and i didnt even know what renouncing was or heard of it then… and i sure as hell dont have the funds to pay the renounce fee now that i know whats what.. so thats the bother of compliance… so in a nutshell that my specifics Petro .. so im all open to advice,,,,

Those symptoms didn’t happen to me when I intentionally relinquished U.S. citizenship in 1977. I felt confident and happy that I was in control of my citizenship and had moved to a better, more equitable society but I was young, hopeful and naive. Fast forward to now, well perhaps it’s all just an illusion and always was. Things are either definitely different now or I’ve just come to understand the reality better now.

Bruno. Another example of being screwed by a tax professional. Too bad you didn’t have the benefit of Peter’s Principles 5 years ago.

@ USC

Thanks, now I see who you mean. Sadly, I think there may be many of those. Which is why John Richardson and others ( yes including that terrible group of lawyers) who advise people to ascertain their citizenship before taking any drastic measures.

On another note, and perhaps I am biased based on my location and vocation but there are many lawyers and tax specialists here who have a wealth of experience dealing with the USG in many areas, particularly NAFTA matters, cross border immigration and now FATCA. All the major Canadian accounting firms HQ in Toronto and other Canadian areas have full office firms here. I have referred locals to them because I do find them ethical and trustworthy and they act in their clients’ best interests. I know for a fact that they have told people ‘ there is nothing you are required to do at this time, but you should know what choices you have’. They explained renouncing and relinquishing, exit taxes etc. They are not tax condors. I have known many of them from my years of practice and over the years have referred many clients to them ( pre FATCA) on matters beyond my expertise. Most of the FATCA initial interviews were free or a low nominal fee. I have received feed back from the people who attended and to a one, all were happy with the service. I think that’s what people who are in the initial information stage are seeking and should receive. Obviously I get no kickback from those referrals nor would I accept any in case anyone needs to know.

We each try to do our part here and I haven’t run across too many condors on board lately, which is nice. I tend to exit stage left whenever they arrive.

I agree with you, Cheryl. I felt the same as you when I chose to become a Canadian citizen in 1975 and went forward as a Canadian. Anything I did from that point, I did as a Canadian, the reason many of us feel betrayal from both the US and from Canada. Too late, but my eyes are now wide open to the reality of consequences I give my children born and raised in Canada because of my birth and being raised in the USA.

With hindsight, can see that can see that I panicked and lost a lot of money. But back in the dark ages of 2011 before Brock, I really felt lime a deer frozen in the headlights. To be fair, I had already been filing so was already in the system so probably had to resolve things officially, as was overwhelmed. My accountant avoided unessesary forms and sensibly kept me out of OVDI.

“If you have no US income there will be no ‘ information slips’ for the IRS computers to match.”

Not true. For tax year 2002 TD Waterhouse in Canada deducted both 10% Canadian withholding (correctly because I live in Japan) and 30% US withholding from Canadian sourced interest income in my TD Waterhouse account in Canada. TD Waterhouse in Canada issued US Form 1099 showing around US$17 in US withholding from my Canadian sourced income. So there SHOULD have been an information slip for IRS computers to match.

The reason there wasn’t an information slip for IRS computers to match is that IRS data entry clerk Monica Hernandez and cohorts were embezzling the withholding reported on Forms 1099.

I am greatly indebted to IBS and the posts of Just Me http://isaacbrocksociety.ca/2012/02/04/letters-to-shulman-or-a-case-study-of-ovdp-communication-attempts-with-the-irs/, ij http://isaacbrocksociety.ca/2012/09/16/a-minnow-opts-out-of-the-irss-ovdi-and-gets-the-correct-result-a-simple-warning-letter/ Moby http://isaacbrocksociety.ca/2012/03/10/moby-opt-out-update/, and Not That Lisa, which were very instructive for me ex. http://isaacbrocksociety.ca/wp-content/uploads/2013/06/Not-that-Lisa-FINAL-My-OVDI-Odyssey.pdf . It was also from Just Me, and IBS that I learned about the potential to obtain help from the IRS Taxpayer Advocate’s office.

Thank you Petros for returning with this series of posts. And for your support when I needed it.

Bless you and the others at IBS and Maple Sandbox and ADCS. You all and others posting here kept me going in the darkest of days (I miss some of those from those days, who no longer post and hope they are well). I will always be thankful for the creation of IBS, (and that first invaluable info session at U of T), and those putting in countless volunteer hours behind the scenes now and then, that keep this and the lawsuit running. Though I have my CLN, I stick around because I believe in the lawsuit and the Brocker community, and because I want to help to keep as many as possible out of the quicksand that US citizenship has come to represent.

Norman. That horse has been flogged to death.