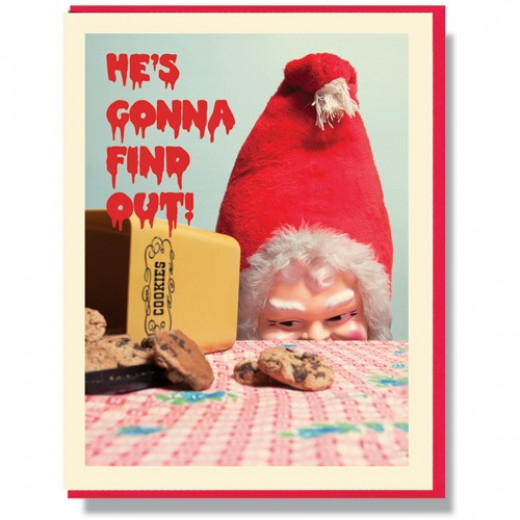

(2) Fear makes the IRS more dangerous than it really is.

He sees you when you’re sleeping,

He sees you when you’re sleeping,

He knows when you’re awake.

He knows when you’ve been bad or good,

So be good for goodness sake!

Commentary: The IRS is not omniscient and omnipresent like Santa Claus. As much as the US government has tried to take away the privacy of expats, it has only very limited powers even with the betrayal of our local governments on FATCA. It is possible in many cases to work around these limited powers.

The first step in protecting oneself from the IRS stripping you of your universal human rights is a sober and realistic assessment of its true power. Many if not most of us who are living outside the USA are relatively safe because the IRS’s powers of seizure, subpoena, and liens are limited outside of USA borders. Moreover, the IRS has an insufficient audit and enforcement personnel to hunt the much bigger and easier game in the Homeland. Even if it could go after us, it would be an inefficient means of increasing revenue.

A better metaphor for the IRS is a roaring but toothless lion and not Santa Claus.

Inordinate fear of the IRS is dangerous because it has caused some people to lay down all of their normal defense mechanisms and like an innocent lamb to stand paralyzed before the toothless lion.

One of the major roles of the cross-border compliance industry has been to frighten their clients and the public about the IRS’s power, and the media has too often created panic by consulting the compliance industry as their principle experts for information on US expat tax issues.

Previous Petros Principles:

(1) What the IRS can’t know unless you tell them can’t hurt you.

About: Petros is the pen-name of the founding administrator of the Isaac Brock Society. He has started this series of Petros Principles as a means of communicating guidelines which he believes have helped him and others deal with the United States’ world-wide tax invasion.

The IRS was not and isn’t about revenue. It is about CENTRAL GOVERNMENT CONTROL and Social engineering.

Read the Communist Manifesto, second chapter and you will see how the world socialist movement got control of the U.S. Government in 1913 when they lied like a rug to get CLASS WARFARE going. They told the Proletariot that they should help destroy the Evil rich and remember Socialism hadn’t yet failed everywhere it was tried, and that only the ”Evil Rich” would ever pay and the 16th Amendment to our beloved constitution had to be passed.

Well, we all know how that turned out. It is an evil Law, too vague for correctness and if it wasn’t all the above thing it couldn’t be enforced. But Alas, they have unlimited funds and unlimited power to confiscate money and property on their say so. Every Federal Judge knows his position and favor with the chief justice depends on dismissing any and all suits related to the 82,000 page tax law…..Bet on it, if it were a law about protecting any minority, race,sexual orientation, they’d have already ruled in their favor, but destruction of the ”middle Class”is the purpose of the law with more rules and more words than the Koran and both testaments of the Holy bible. combined. They purposely keep every line and verse and decide what it means to screw you and me every time.

Conclusion–stay as anonymous as you can. never come to anyone in government’s attention and keep filing the papers that nobody or only about 3% are ever looked at and those have a formula that when entered in the electronic system, are kicked out for audit. The Income Tax industry has a following between IRS agents, tax Lawyers, Tax preparers, friends, dependents relatives, and Socialist’s, that produces nothing, adds nothing to the public well being, scares the pants off everyone, and sucks from all other branches of government,while being a source of income for around 100 million souls……Outside of that it is relatively harmless because of inherit laziness of government ”servants”.

I think you’re right about this Petros. Fear is the enemy…well besides our own government.

These are great posts and comments. While the authorities/government departments are the cause, in my experience the real “threat” is the compliance industry as stated. They will fleece you wherever they can, and fear is our trigger to pay. Not anymore for me. I do it myself now, and I’m not in that “3%” (or less), and I suspect anyone who follows these posts aren’t either.

Btw, I spoke to an IRS agent in Austin (several times) who responds to questions about streamlined submissions and he told me they have guidance that tfsa and resp do not require 3520 and 3520a. Two major fleecing vehicles for the condors/vultures.

Our founders made it very clear, that the government was to be our servants and that Income would never be taxed. The World Socialist movement of the Early Teens in the 20th century, lied to everyone as Socialists are prone to do, because taken to it’s logical conclusion it is a failure that is kept alive by those who despised what the founders wanted.

We would be well of to throw every elected official out and pass the FairTax as described on line and in House Bill HR25, which is always blocked by congressmen who want to be able to extort campaign contributions from those who want a tax break that only they get.

The extorted money gets a congress whose approval rating calls for being fired, re elected 95% of the time when their approval is 9%. What is wrong with this picture?

Fear is dangerous for everyone, a threat to mental and economic health. But Petros’ description of the “roaring but toothless lion” doesn’t address the very real fears of the actions of banks and other FFIs against US-tainted customers or potential customers. Knowing that the IRS can’t grab our assets outside the US isn’t comforting if a bank has closed, or threatened to close, a bank account, deny a mortgage, and other horrors posted here. FATCA itsaelf doesn’t require this; our own governments (non-US) should prohibit these actions by financial institutions against legal citizens or residents of their countries.

Fear is the enemy, including the fear that made our countries bow to US FATCA extra-territorial law in other countries. They chose and continue to choose that over the protection of their own permanent citizens and permanent residents with some US taint.

IsaacBrockSociety.ca is a valuable resource that I wish I had before my many mistakes (reference Petros’ description of *Inordinate fear of the IRS is dangerous because it has caused some people to lay down all of their normal defense mechanisms and like an innocent lamb to stand paralyzed before the toothless lion*).

Ah yes Calgary, we all just do the best we can with what we know. I too made big mistakes before finding IBS…the biggest mistake was being an honest person seeking the truth. I’m learning though. Unfortunately that leads sometimes to a very dark place where I transform into a very angry, bitter old woman, something I never used to be and often don’t recognize in myself. A large number of citizens (or should I say “sort of citizens”) who have no trust or respect for their government will in the end have serious impact on that government as well. A long range perspective is not their strong suit.

Thank you Petros for this.

US Taxation-Based Citizenshup – the gift that keeps on giving!

From the above post by Petros: “The first step in protecting oneself from the IRS stripping you of your universal human rights is a sober and realistic assessment of its true power.”

Fear of the IRS is not unrealistic. It is a very real threat. The danger lies in being paralyzed by that fear. We need to assess what that threat means to our own personal situation. Then have the courage to move out of the path of the oncoming tornado.

Another day another shooting in the USA. This morning seven unfortunate police officers in Baton Rouge, Louisiana were shot. With all the violence on USA soil, it looks like the crumbling of the empire will come from within.

Many threats, among them: from within (another senseless US shooting of police of either race or blacks, mostly African Americans in the continued racism, anger and gun violence seething there) and without (our US-deemed US taxation citizenship!). Loss of trust and further loss of freedom all around. How much longer can the USA call themselves the land of the free?

How WILL the exceptional USA solve the problem of their rights for all to be armed and ready to shoot? Militarization of their police forces doesn’t seem to be the answer.

Yeah agreed to much fear .. When the truth is with the horror these accountants and a lot of web pages say are so the can make a shit load of cash off you.. Which they sure as hell have a will continue to do.. I think if you really sit back and think . why would they really spend the time and money to hunt down people who would owe no tax anyways.. And like stated here I could see you being screwed if you if you crossed the border for not filing but I think that’s along way off.. I am compliant at this point and time but even with fatca and what not I still do not see the point .. Sure the bank this that but . I do think its still important to get the citizenship of where your living .. If you decide to ignore the compliance.. I dunno if I would as a PR or landed imigrant.. But as a citizen yeah.. But I got sucked into few years ago and this may be the last year I even bother..

Petros,

I think of the IRS more like a caged lion– as long as I stay out of the cage (US), I’ll be fine. Climbing back inside the cage with tasty bits of food hanging off of me (the fruits of my 25 years labour working outside of the cage) would be foolhardy– the lion would skin me alive. Unless the expat continues to feed the lion while living outside of the cage, there is no returning “home”– the expat simply becomes fresh meat for the lion.

Petros–this is good stuff. I suggest you also start another topic “Biggest Lies the Compliance Industry Tells You”.

For example, the big lie I hear repeated again and again is that you have to file all your IRS forms before you can renounce. Not true, of course, as long as you pay State their $2450 extortion fee, renunciation is still an absolute right

There has come this day when you and I, Petros have to agree to disagree.

Firstly, I agree it is wise to find a seasoned tax professional and avoid condors at all costs and at your peril if you cannot come into compliance on your own. For many it is too overwhelming on their own.

Secondly, as I recall in your own story, you took steps to not leave yourself stateless. Again good advice, except some countries ( Japan and Germany, correct me if I am wrong) do not permit dual citizenship.

But your latest post, strikes me as written from a very privileged point of view. You write as though the USA is really not as powerful as it appress to roar and people have little to fear. Personally, I agree with that as most readers know.

The difference is you have not only renounced but if I recall this correctly, you were tax compliant with the exception of filing FBARS. So it is easier for you now to say there is little to fear… hindsight and all that.

Again, I will go on record for saying I will never disparage anyone who is compliant or who has renounced. You had your reasons yet now you seem to be speaking to my choir group as though there is nothing to fear, little enforcement rights in Canada etc. Again, I am not saying I disagree with you on that.

The difference however is obvious. I believe all that and haven’t nor will ever renounce. Like Gwen, WhiteKat, Blaze, BC Doc and more. You are the only person I know who has been compliant and renounced who now says hey, nothing to fear about being non compliant. Begs a question, doesn’t it?

I haven’t renounced because I am not nor have ever been afraid and for many other reasons, but so many others are. We are a tad more fortunate in Canada than our overseas counterparts but fear is real and Canadian banks have ferreted out many here already. It’s why Stephen Kish has been seeking witnesses who have experienced various degrees of it.

Fear is still very much in the minds of many of the non compliant. How now, can you tell them, again from your privileged position it ain’t so. Would you have done it any differently?

Like the Doc, I don’t feed lions and I never intend to go into their cages, so they can roar all they want at me.

And it’s entirely possible I read your comments all wrong.

You have afforded us this fantastic site @ Brock and I am grateful. Because of my own circumstances, my group of paisans is the non compliant, to perhaps be their voice as I recognize both the fears of some, and the many who stand with me giving the proverbial finger to the USA. There’s room for all of us who take different paths. But imho, you have to be a member of a choir to know our songs because we surely are not singing from the same hymnal.

Petros –

You left out the third O – omnipotent. Although you did snicker about that aspect with “toothless.” Petros, you wear the brightest of laurels for bravado (almost wrote bavardo there, heh). You get so uppity when you diss the IRS. Such a secure attitude [echo chamber effect here: dude … dude … dude] – when you rely so much on a mere 4000 x 100 mile notion of a nation, noodled along by a servile Justin jerked around on a string. If the IRS ever decides to want you, you will be theirs. And your fearlessness will not be a factor.

Among many thousands of posts here, a few things stand out:

– There is no account of the IRS successfully collecting from a resistant Canadian citizen residing in Canada using the Canadian legal system. (Can anyone advise otherwise?)

– There are no account of any so-called “non-compliant US person” Canadians suddenly receiving unsolicited “demand letters” from the IRS (unless they initially chose to voluntarily engage with the IRS). (Can anyone advise otherwise?)

– There is no account of any Canadian being detained at a US border regarding US tax matters.

In discussing this situation with a friendly Canadian lawyer, he said “Why would anyone voluntarily confess their ‘non-compliance crimes’ to a foreign state, when it has not even made the effort to accuse them?”

Sometimes the best action is … say nothing, do nothing.

@Wondering, nice points. Can I add that last statement to my Petros Points? (with credit)

@USX, Ginny: It seems like USX is saying I am not safe, but Ginny is saying I am in a privileged position of safety.

Here is my initial response to Ginny: https://youtu.be/UneS2Uwc6xw?t=55s

Yes, I relinquished my US citizenship as of February 28, 2011, the day I became a Canadian citizen, and on April 7, 2011, I finally was able to inform the Toronto Consulate that I was no longer a US citizen. So I officially no longer belong to the biggest criminal organization in the world.

I was tax “compliant”. I filed my last 1040 and exit form 8854. I certified that I had been in compliance for the last 5 years. However, I invoked 5th Amendment privilege on the Form 8854 and on my 1040 (2011).

It has been more the 3 years and so I do not expect to be audited. That does not mean that the IRS will not investigate me for criminal behaviour. Apparently fraudulent filings (if they thus accuse me) has no statute of limitations.

The statute of limitations on FBAR is six years and it would appear that means I could still be arrested until June 2018 for not filing FBARs. As a result, I avoid going to the USA. I no longer attend professional conferences, which was my practice before. I no longer go to Hawaii or do other vacations. Last year Cathy went to San Diego for training without me. I might have liked to go. I have only been back to the USA once in July 2013 out of absolute necessity (if I went to prison, well that was better than not showing up in Alaska to search for my missing father who has still never turned up).

There were three main reasons I have been so bold as to endanger myself–i.e., became an activist: (1) to encourage non-compliance by others (esp. Canadians); (2) because I felt very keenly the injustice of the situation and wanted to speak out; (3) I felt that those of us who were out in the open would be a rallying point for a whatever collective action would be taken to fight this injustice.

I admit not being very active lately, and so perhaps the details of my story are not so fresh. But I think because of my very public statement that I have never filed an FBAR–and the fact that I invoked my Fifth Amendment privilege on my 2011 1040 and my 8854, would suggest that rather than being in a privileged position, I actually have skin in the game.

Finally, I must say that I had been filing from circa 1996-2009, before this whole mess began for me and others. So I was already in the system–and that means it was expedient to find closure by filing the necessary forms. Expediency will necessarily be different for each person.

@Wondering

” There are no account of any so-called “non-compliant US person” Canadians suddenly receiving unsolicited “demand letters” from the IRS (unless they initially chose to voluntarily engage with the IRS). (Can anyone advise otherwise?)

Yes, I got a demand letter from the IRS in 2008, before FATCA. It was called “Intent to Levy and Notice of Your Right to a Hearing”. I posted on Brock about this previously in a comment. Don’t recall exactly when or under what. I had arrived in Canada as a Permanent Resident in 2004 and hadn’t filed at al since leaving the USA. The IRS indicated that I owed them about $140,000 US. I still have all the forms and paperwork from this atrocity. It involved extreme stress but I hired a lawyer and eventually ended up owing $00.00 to the IRS.

This is why I think the IRS will send out letters eventually. Best to protect oneself in whatever way is possible.

@PatCanadian, thanks for recounting your story. I wonder how the IRS got your forwarding address.

@Petros

I think it was through TD Waterhouse investments. That is why I dissolved my investments and went to cash in 2008. It’s also why it was an easy decision for me to renounce. Now as a “non US person”, I can invest with more peace of mind but would never go back to TD.

@PatCanadian, yes. You would likely have filled out a W9 with your social security number. Not just Waterhouse but all brokers would require that.

With due respect and appreciation for ALL the comments on this thread, this comment is to remind people of what Petro’s original point is (I think):

Petros is saying that fear can be such a dominant factor that it overwhelms all else and makes it much harder to make a “decision”. When “fear” is the dominant factor, people will “react to the fear” and NOT “decide on the facts”. There is NO way to know for certain what would be the result of any one decision.

Petros is not (I don’t think) saying that people should be “fearless”. He is simply saying that one cannot allow decisions to be made primarily based on fear. On this point, I do agree (for what it’s worth) with him.

My perception of the Fear, The IRS, The Condors and Americans (so called) abroad:

About the fear:

I seriously doubt that long term Americans abroad are on the radar of the IRS. But, I don’t know and nobody really knows. Nevertheless, there is no indication to think that they are.

When people experience fear and the trauma associated with the fear they seek safety which includes certainty. They incorrectly believe they have a “tax problem”. They don’t a tax problem they have a “compliance” (maybe) problem. Suggest you read an old post on this issue:

https://renounceuscitizenship.wordpress.com/2012/01/05/the-taxpayer-the-irs-and-the-professionals-where-to-go-from-here/

About the tax compliance community

If you go to a “tax lawyer/accountant” you will achieve CERTAINTY. But, the CERTAINTY will be at the cost of (possibly) turning over a lot of money to the process (U.S. taxes, compliance fees, etc.). Understand that if you go to a “cross border professional” they will approach the problem in terms of compliance with the Internal Revenue Code. Actually, in most cases they will suggest “heightened compliance” (“we are not really sure if this form is required, so you should file it anyway” – WRONG, WRONG, WRONG and WRONG). Understand that U.S. tax law is NOT enforced by the IRS. It is enforced by the tax compliance community.

About the Internal Revenue Code

Because the Internal Revenue Code is a U.S. law which applies outside the USA, there is no way to know with certainty whether you are ever in compliance anyway. I don’t think (just my opinion) that you respond to this uncertainty with “over compliance”. I think (just my opinion) that you solve it by “defensible compliance”. “Over compliance” means that you have absolutely and completely entered the “prison of citizenship taxation”. Your life is absolutely over unless you renounce. “Defensible compliance” means that you are doing the best can, but when things are ambiguous (“Not even your IRS knows for sure”), you don’t resolve ambiguities in favor of the IRS. One example of this would be the ongoing discussion of whether TFSAs and RESPs are “foreign trusts”. Although this example is “overdone”, it is an example where tax compliance people are likely to say: “Well, we don’t know for sure, so why not fill out these forms!” Well: you are not the one who must live with the consequences of filling out the forms!

About Americans abroad

If the “compliance process” costs you a significant percent of your net worth (and it could depending on your situation), you will no longer have “fear” but you will have extreme (dangerously so) “anger”.

In other words, you will have converted the disabling emotion of “fear” into the disabling emotion of “anger”. As a great and late trial lawyer used to say in his closing remarks to the jury:

“It’s not what you take from them, it’s what you leave them with”

See this older post:

https://renounceuscitizenship.wordpress.com/2012/03/10/collective-psychotherapy-u-s-citizens-outside-u-s-not-what-they-take-from-you-its-what-they-leave-you-with/

My point is largely this:

Whether you are in U.S. tax compliance or not you have a problem. The problem is that you have a U.S. connection. After destroying Americans abroad, the USA will begin destroying the Homelanders (who will think it is just great).

So, you have three options:

1. Take steps to get a CLN (usually renunciation) so that you CANNOT be accused of being American. In most cases this means the 5 years of compliance and renunciation. If you can achieve this for the cost of a used car you are doing well. The difference is that:

– used car is just a depreciating “asset”

– a CLN is simply the best investment that any human being can have in the world. It will grow in value every second of every minute, of every hour, of every day, of every month, of every year for the rest of your life!

2. Take steps to understand why you are NOT American so that you can defend the accusation of being American. (The FATCA IGA specifically allows for this possibility).

3. Live your life and ignore the whole thing.

I am neither discouraging this nor encouraging this. It depends entirely on you. In some cases, the cost of “buying your freedom” is so low that it might we worth doing. In fact there are many Canadian citizens (who with the help of the tax community”) have actually “pretended they are Americans” (even though they know they are NOT) so that they can renounce and get a CLN.

The people who have paid the highest price in emotional and financial terms are the ones who have turned this over to the lawyers and accountants to “do the right thing”. And I am NOT saying that ALL lawyers and accountants are a problem. But, enough are they you should be VERY careful in your choice of adviser. For a recent example, have a look at the following post from Jack Townsend’s blog where he references the story of two women in their 90s and one in her 80’s who tried to do the “right thing”. It was NOT the decision of the three elderly women to enter OVDP. It was the decision of their lawyer. Now, we can’t tall all the factors leading to the lawyer’s decision to enter OVDP, but we can certainly see the consequences of the decision. Returning to the original point, this is what happens when people have so much fear that they cannot think clearly (or at all).

http://federaltaxcrimes.blogspot.ca/2015/10/new-case-filing-challenging-streamlined.html

In conclusion:

Petros is not saying ignore fear. Petros is not saying don’t have fear. What Petros is saying is:

Do NOT allow the fear to overcome everything else – a point that I do agree with!

What would FDR likely say about this crisis and trauma?

It is NOT true that the ONLY thing we have to fear is fear itself!

It IS true that the most dangerous thing we have to fear is fear itself!

I agree USCitizenAbroad. After all this time, I no longer have so much fear. I have moved beyond that but man oh man am I angry! Unfortunately, this anger is also taking a toll. It is also a way of really allowing these idiots to control my life as bad as fear. I’m working every day on it but it is really hard.

@Cheryl

“Let us not look back in anger, nor forward in fear, but around in awareness.”

God bless!

http://tinybuddha.com/wisdom-quotes/let-us-not-look-back-in-anger-nor-forward-in-fear-but-around-in-awareness/