The latest NICS report shows a new total of 31,525 records in the “Renounced U.S. citizenship” category. That’s an increase of 552 since last month, and 4,285 since the beginning of the year. (Using the old ratio of four or five non-renunciant relinquishers for every six 8 USC § 1481(a)(5) renunciants, that suggests a total of around 800 to 900 people giving up U.S. citizenship by any means last month, and 7,000 to 8,000 since the beginning of the year).

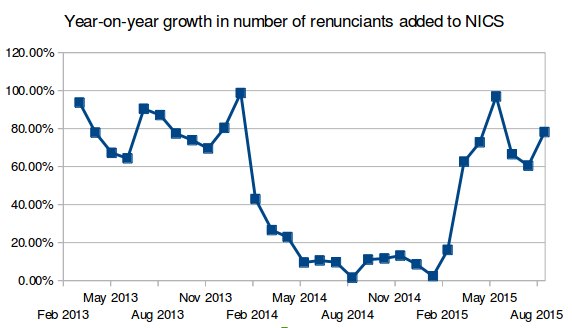

The above chart depicts the year-on-year growth in the number of renunciants added to NICS (i.e. the number of renunciants for the most recent twelve months, compared to the number of renunciants from two years ago). As you can see, growth has been picking up again in a big way after a relatively flat period last year.

It’s now been nearly one full year since the State Department started charging American emigrants twenty times the fee in any other developed country in order to exercise the human right to change their nationality. In a recent Federal Register notice (discussed by the Wall Street Journal, and also in comments here at Brock), State finally deigned to respond to all the objections to the cash grab: they claimed that this sudden change was necessary to comply fully with the laws on renunciation, despite the fact that the relevant statutes haven’t changed in over a quarter of a century and the most recent development in case law consisted of a rebuke to the State Department for arbitrary and capricious refusal to recognise a relinquishment. They also further asserted that the fee hike demonstrated their commitment to protecting human rights.

Fee hike stimulating renunciations?

Four comments asserted that the renunciation should be made more efficient rather than more costly. A few asked if there were ways to reduce bureaucracy and paperwork to lower the cost of the service. Specifically, one commenter pointed to the German renunciation process, which involves an online application, mailed certified copies of certain documents, and no in-person interviews. As described above, certain legal requirements exist in the U.S. system, unique to our laws and jurisprudence, to protect both the integrity of the process and the rights of those renouncing. The renunciation process involves significant safeguards to ensure that the renunciant is a U.S. national, fully understands the serious consequences of renunciation, and seeks to renounce voluntarily and intentionally. In short, the comprehensive process of expatriation under U.S. law does not impinge, but rather protects, the right of expatriation.

Most Brockers were dismissive of these claims, seeing them in the same light as the suggestion that a poll tax protects the right to vote. But all snark aside, the number of renunciants added to NICS in the twelve months since the fee hike is 78% greater than the number of renunciants added in the twelve months preceding it. That’s more than US$12.5 million in renunciation fee revenue, assuming that all renunciants added to NICS in September 2014 and afterwards were charged the new, higher fee.

In contrast, as you can see from the chart above, in the months preceding the fee hike, growth in the number of renunciants had leveled off. Clearly, someone in the State Department saw those flagging numbers and decided to take decisive action to ensure continued growth. And it worked: American emigrants are so enthusiastic about Washington’s newfound respect for protecting human rights that they have decided to start exercising those rights in greater numbers, before Washington starts to get any more “protective” — a successful marketing campaign for Articles 13 and 15 of the Universal Declaration of Human Rights, rebutting earlier claims that they didn’t respect it!

Other possible reasons for recent growth

On the other hand, growth didn’t really start picking up until a few months after the fee hike. That might just be due to State’s delay in forwarding CLNs to the FBI for inclusion in NICS. But that was also roughly when most banks started sending out FATCA letters threatening dire consequences if customers with U.S. indicia failed to fill out a W-9. Those recipients no doubt included “practicing” dual citizens who were unaware of their tax obligations and decided to end their dual citizenship in response to their newfound knowledge.

Many others, however, no longer even had U.S. citizenship in the first place, as they’d relinquished it long ago. Among the latter group, some were scared into approaching a U.S. consulate to clarify the situation, where they learned that the U.S. government had tightened up its standards (e.g. in this February 2015 Foreign Affairs Manual update), and so they no longer met the burden of proof for the U.S. government to issue them CLNs for those earlier relinquishments. Some were thus misled into voiding their relinquishments and declaring that they’d remained U.S. persons in order that they could renounce and get a CLN.

So what’s your take? Which had a greater stimulus effect on the number of renunciations: the September 2014 fee hike, the February 2015 FAM update on relinquishments, or the FATCA letters?

The numbers are even higher than that.

There were 1100 renunciations during the first 10 months of 2014 at only one consulate post.

http://blogs.wsj.com/law/2015/08/24/why-it-now-costs-so-much-to-renounce-your-citizenship/

Huh, that’s interesting. State previously said they don’t compile renunciation statistics either at the level of individual posts or overall

http://static.globalnews.ca/content/interactives/documents/general_news_bucket/130812_ly_citizenship.pdf

http://andysundberg.weebly.com/1/post/2012/08/more-on-the-state-department-foi-follies.html

And now they say, in writing in the Federal Register, that they have such statistics. Logically, one of the below must be true:

1. State just started compiling these statistics in 2013 or later (except that Andy Sundberg was told in 2012 by an FSO that such statistics already existed)

2. State was lying to earlier FOIA requesters

3. State is lying about the 1,100 and just made up that number to justify the fee hike

(My money’s on #2)

Wish I could sell my citizenship to buy my freedom for less.

Next year I will have that money…

When demand increases, you can hike the price. Normal business practice. Maybe when they get rid of CBT the price of renunciation will be slashed. SALE! 50% off! Renounce now!! Bring a friend, get an additional 20% off!

Seriously, for me it’s the FATCA letters. Getting kicked out of a bank. Wake-up call. I did not renounce, but it’s made me think about it seriously. And I have met 2 people who renounced, and paid the new fee. Something happened maybe 6 months before the fee hike, I guess.

Most non-compliant US persons never hear or worry about FATCA until they got good and scared by the banks. Then they do their homework, then part of them ends up renouncing.

As for me I’m a bit cheap and optimistic. So I’m waiting things out a bit. And if things get worse I plan to get a third passport, where I now reside, along the way carefully documenting my relinquishment, which, I guess, remains free. My boys remain dual citizens, and they’ll be able to renounce later if they want. I’ll foot their bill (least I could do, right?) unless it escalates some more.

My money is on the FATCA letters. But I enjoyed Fred’s “When demand increases, you can hike the price. Normal business practice. Maybe when they get rid of CBT the price of renunciation will be slashed. SALE! 50% off! Renounce now!! Bring a friend, get an additional 20% off!” Wouldn’t surprise me at all if “normal business practice” with a dose of avarice is at the bottom of the fee-hike.

Thanks for this great post, Eric!

All of the above and more?

…American emigrants are so enthusiastic about Washington’s newfound respect for protecting human rights that they have decided to start exercising those rights in greater numbers, before Washington starts to get any more “protective”…

Thanks for the chuckle, Eric. And thanks for your ongoing investigation into this subject, something the media in general has been delinquent in doing.

http://www.theguardian.com/us-news/2015/sep/02/microsoft-us-government-cloud-computing-ireland

The US Government is fighting Microsoft, the Government of Ireland, and others for the right to seize a US citizen’s email and other data held on server’s outside of the US.

Yet another ‘condition’ of holding US citizenship being played out before our eyes. FATCA allows the US Government to seize financial data of US citizens abroad and now the USG wants to extend this to other types of data such as emails.

The terms and conditions of holding US citizenship becomes more and more daunting.

The cost to renounce is the roadblock created by the USA. All of their actions show how desperate and how incredibly inhumane the current USA government has become. The hatred for the USA is spreading fast around the world. this is their own fault. Imagine, a person in the 20th century having to BUY their freedom…. inhumane!

Their own fault / our own fault, collectively, though we are trying to stand up against what is happening in our respective countries.

Where would George Carlin, SMART MAN, would put us in the freak show (born in America – front row seat), loss of rights, reduction of our liberties?

Look at how badly you’re doing — why did you do this to yourselves?

“Social Hysteria and freedom of choice” ~ George Carlin

Be a little ‘Crazy’ https://www.youtube.com/watch?v=E7GtnWWBlNU

I wonder if we could get an online poll going for people to answer one question. That question would be “If the USA dropped the renunciation fee and the tax and fbar filings, would you renounce immediately?”

NativeCanadian,

Me first — though I renounced officially in 2012 and now have a CLN to show to my local Canadian *foreign financial institution* (as I thought my expatriation had occurred in 1975 when I became a Canadian citizen and was *warned* that I would thereby lose my US citizenship), I would once again do it all over again. Fool me once, shame on you. Fool me twice, shame on me.

Those common-sense terms still would not release my son and others like him (with some *mental incapacity*) from *US-deemed US citizenship*. Even though my son would not, according to those parameters, have to file US tax and FBAR reports, I would PREFER his release from US citizenship — officially Canadian-only as I believe he is and should only be.

NativeCanadian, don’t forget the exit tax. For many of us who have lived their entire adult lives “abroad”, the exit tax is the ultimate killer.

Native Canadian: I like where you’re going with this, but can I suggest that this be done with a punchier question, such as “Are you being forced to keep your US citizenship as a result of the high cost and difficulty in ridding yourself of it?” or something to that effect.

I feel this could have better effect in highlighting our cause since I still believe that too many unaffected (or who believe they are unaffected) still think that you’re lucky to have US citizenship, and just want all the benefits without paying the price, ie you actually WANT US citizenship (they may even be jealous a bit).

Pre-Obama, there might have been some degree of truth to US citizenship having some advantages, and most are still ignorant of the huge downside.

(Disclaimer; I AM NOT a US citizen….just someone unfortunate enough to have a 15-year expired green card in my briefcase, and a US born spouse, living in Canada).

Very good ideas. Asking the question would likely show a 98% increase in renunciations if the US government was not going to gouge and punish those who want to rid themselves of this unwanted citizenship. The poll question would need to be distributed around the world and the results sent to Congress who likely would not care. If they did, they would not do this to people born in the US in the first place. When I met my wife over 10 years ago, she told me where she was born. She also told me she is Canadian and Canadian only. She would renounce today if it was not for the disgraceful US government’s tactics and methods of holding her for “ransom” The payments of all tax, fees etc. Should be renamed “US Ransom”!

While watch BBC TV tonight, I came across another US born celeb living in the UK.

Jerry Hall (ex model, actress and wife of Mick Jagger) was born in Texas.

https://en.wikipedia.org/wiki/Jerry_Hall

I wonder what she thinks about FATCA?

@Don

I think she took Mick to the cleaners. He didn’t get no satisfaction from that, and had to find another honky tonk woman. Anyway, she probably has a gaggle of attorneys to sort it all out.

It is highly ironic, having come of age in the 70s (I’m 48) with all the talk on how much freer and better we were than the USSR (and we were), that the West, led by the USA, is now so obsessed with reducing freedom, including that of putting your money where you want. And of course the barriers to escaping the US are more subtle than an Iron Curtain, but perhaps in some ways more effective. For if you got over the Iron Curtain you were able to open a bank account in the West.

Information technology and border controls will effectively make it possible to keep people in the US if there is any suspicion they might not be compliant in any way.

As for an earlier comment, about accessing US citizen emails on foreign servers, my first thought was that cannot happen. My second thought is they have the NSA to do it, it’s already done. And my third thought is they could easily use the same threat as for FATCA, but vis à vis a country, i.e. withholding tax until that country complied. I really can see that going easily through Congress and any President. Easy enough to package it as going after tax frauds and “terrists”. And you could put it in Budget projections, say it will bring in billions of dollars, which you can then proceed to redistribute in the homeland.

Another site publishes the final rule on consular fees;

http://diplopundit.net/tag/fatca/

‘With Final Rule on Consular Fees, State Dept Addresses Comments on Renunciation of U.S. Citizenship’

The speech below isn’t about FATCA, but as I read it, I thought it contained something that State and the Treasury Dept. should think about in terms of whether continuing to further alienate and anger those the US deems US citizens outside the US is good ‘foreign policy’. Does forcing some to renounce and fleecing them on the way out by raising the renunciation fee from 100 to 450 to 2350. best serve the future interests of the US abroad? Is it good diplomacy? Is keeping people citizens against their will, or raising revenues by extorting it from those pushed by the US to renounce in order to have a normal life without the US Treasury on their backs for life, and raising the ire of those ‘abroad’ and their families and business partners the best way to achieve the goals of the US?

Is using FATCA as an economic threat against ALL of the rest of the world indiscriminately, including major allies and economic trading partners and neighbours (ex. Canada, UK, etc.) good foreign policy? And since those subjected to the abuses of US extraterritorial CBT, FBAR and FATCA are primarily those the US deems citizens, does it make good ‘domestic’ policy?

“………..Since the fall of the Soviet Union liberated Americans from our fear of nuclear Armageddon, the foreign policy of the United States has come to rely almost exclusively on economic sanctions, military deterrence, and the use of force. Such measures are far from the only arrows in the traditional quiver of statecraft. Yet Americans no longer aim at leadership by example or polite persuasion backed by national prestige, patronage, institution building, or incentives for desirable behavior. In Washington, the threat to use force has become the first rather than the last resort in foreign policy. We Americans have embraced coercive measures as our default means of influencing other nations, whether they be allies, friends, adversaries, or enemies.

For most in our political elite, the overwhelming military and economic leverage of the United States justifies abandoning the effort to persuade rather than muscle recalcitrant foreigners into line. We habitually respond to challenges of every kind with military posturing rather than with diplomatic initiatives directed at solving the problems that generate these challenges. This approach has made us less – not more – secure, while burdening future generations of Americans with ruinous debt. It has unsettled our allies without deterring our adversaries. It has destabilized entire regions, multiplied our enemies, and estranged us from our friends…….”

from;

speech he delivered at the Academy of Philosophy and Letters on June 13, 2015.

Too Quick on the Draw: Militarism and the Malpractice of Diplomacy in America

by Chas W. Freeman, Jr.

http://diplopundit.net/2015/06/17/amb-chas-w-freeman-jr-militarism-and-the-malpractice-of-diplomacy-in-america/

The administrations’ FOIA claims that they don’t maintain detailed renunciation info is again confirmed to be complete bullshirt

https://foia.state.gov/_docs/PIA/AmericanCitizenServices_ACS.pdf

Time for another FOIA request, perhaps?

Badger: Charles W. Freeman, Jr. certainly got it right in his assessment of what U.S. “diplomatic” practice has become. We can only hope that someone in power learns to heed his words.Thanks for sharing them with us.

@ badger

Sadly and frighteningly the words of Mr. Freeman ring true. What he describes is the U.S. policy of “Full Spectrum Dominance”.

http://www.globalresearch.ca/full-spectrum-dominance-totalitarian-democracy-in-the-new-world-order/14046

Any guess at why there is an increase in acknowledged renunciations needs to take into account the time it takes to get an appointment at a consulate and the time it take the State Department to process the “applications” and issue CLNs. For example: I made the decision to renounce in June, 2014 but gave myself the summer for sober second thought before requesting an appointment in September. First the consulate sent me some forms to fill out before they would issue and appointment. When I sent those in, they said they weren’t issuing any new appointments so I should send my docs in again in another month. I ended up with an appointment to renounce in early March 2015 and I don’t have my CLN yet. So it’s quite doubtful I am included in any government stats yet but I started the process before I knew of the increase in the fee and before any 2015 FATCA letters were issued.