The Centre for Freedom and Prosperity (CF&P), a US-based organisation which seeks to “promote economic prosperity by advocating competitive markets and limited government” is one of the high-profile critics of America’s soon-to-be implemented Foreign Account Tax Compliance Act (FATCA). This controversial new piece of legislation, say its opponents, will be financially detrimental to the vast majority US citizens living abroad.

Here the President of the CF&P, Andrew F. Quinlan, shares his FATCA concerns in an exclusive interview with iexpats.com.

You, and the Center for Freedom and Prosperity, have been vocal opponents of FATCA. Why do you feel this new piece of legislation, which aims to catch tax evaders, ought to be repealed? Why are you lending your support for the anti-FATCA campaign?

First and foremost, the law simply doesn’t do what it is purported to do. Rather than target actual tax cheats, it burdens all Americans living and working abroad as if that were tantamount to criminality. As a result of FATCA’s sweeping new burdens, American expats are now toxic assets. Unwanted by foreign banks and financial institutions, and hounded by a government that has scapegoated them for problems created by the profligate spending of politicians, it’s not a good time to be making a living as an American abroad.

Overall, FATCA is just an affront to the principles and mission of the Center for Freedom and Prosperity. It violates the fundamental financial privacy of millions of Americans, eviscerates the most basic and long standing concepts of national sovereignty, and seeks to limit tax competition by controlling the free flow of capital. Furthermore, the economic harm to the US in terms of lost investment, and just to the world economy as a whole, may far outstrip the minimal “revenues” expected to be collected by the government.

Simply put, it is not properly the responsibility of the entire world to chase down every last potential dollar for US politicians to waste, all the while footing the bill for the pleasure.

Author Archives: swisspinoy

FATCA: Number of Chinese becoming US citizens declines

The number of Chinese who became US citizens has declined annually over the last five years to 31,868 in 2012 from 40,017 in 2008, according to the US Department of Homeland Security…

…”I don’t really have the urge to apply for full US citizenship,” Duan said. “I like the freedom I have to travel back and forth between China.”

The IT programmer said he also has been deterred from getting citizenship by frustrated friends whose US citizenship makes buying real estate in China more difficult and also requires them to pay taxes on their overseas businesses.

According to Lin, the Foreign Account Tax Compliance Act, which seeks to curtail offshore tax evasion, is also a factor in the decline of Chinese seeking naturalization.

“It’s a law that’s very well known in the Chinese community,” Lin said. “People are really concerned about the implications.”

Under the new law, US taxpayers holding financial assets abroad must report those assets to the Internal Revenue Service if assets exceed $50,000.

Failure to report those assets may result in a $10,000 to $50,000 penalty..

The law also requires foreign banks and financial entities to find any American account holders and disclose their balances, receipts and withdrawals to the IRS or be subject to a 30 percent withholding tax on income from US financial assets held by the banks or financial entities.

Wealthy US dogs abroad don’t bark FBARs

Zhulik, living in Budochka, Belarus, apparently inherited $1 million from his/her US elder, tax-free, with no known US filing obligations and didn’t renounce US citizenship. No FBAR, no FATCA, no nothing. Yet, so far, no Americans have accused the dog of not paying his/her “fair share” or of “evading” US taxation. Must dogs be required to file FBARs too?

Zhulik, living in Budochka, Belarus, apparently inherited $1 million from his/her US elder, tax-free, with no known US filing obligations and didn’t renounce US citizenship. No FBAR, no FATCA, no nothing. Yet, so far, no Americans have accused the dog of not paying his/her “fair share” or of “evading” US taxation. Must dogs be required to file FBARs too?

MINSK, March 31 (RIA Novosti) – A dog from the small village of Budochka in Belarus inherited almost $1 million from a US citizen of the Belarusian origin, local Respublika daily reported.

The ten-year-old dog by the name of Zhulik (Swindler) inherited the fortune from late John Fyodorov, who was born in Budochka, but migrated to the United States after the World War II.

According to Zhulik’s owner Vasily Potapov, Fyodorov visited the small village in Belarus in 2007 and said the dog reminded him of his dog Valet that died in 1950s.

Valet was ill at that time and deciding between an expensive surgery for the dog and buying a ticket to Sacramento, Fyodorov chose the latter. The dog died and since then Fyodorov could not forgive himself for the death of best friend.

Maria Protasenya, a lawyer from Minsk, confirmed that a special bank account was opened for the dog and it currently boasts $993,700.

America still hates citizenship-based taxation!

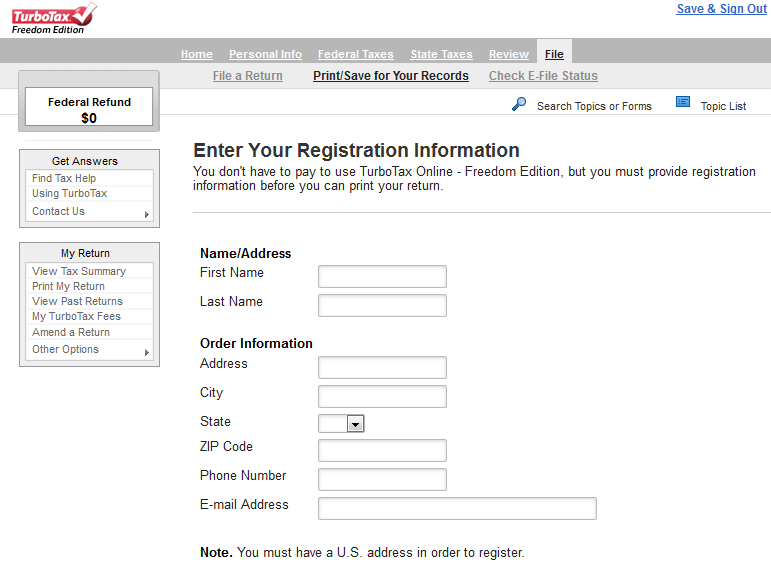

Today, I sat down behind the computer, punched in the requested numbers and ta-dah! It rejected citizenship-based taxation again, just like it did last year and the year before that and before that and that and so on and on.

This shows that nobody hates citizenship-based taxation greater than the American people, the American government, the American Congress. Let’s face it – America hates citizenship-based taxation! If such was not the case, then this problem would have been fixed decades ago.

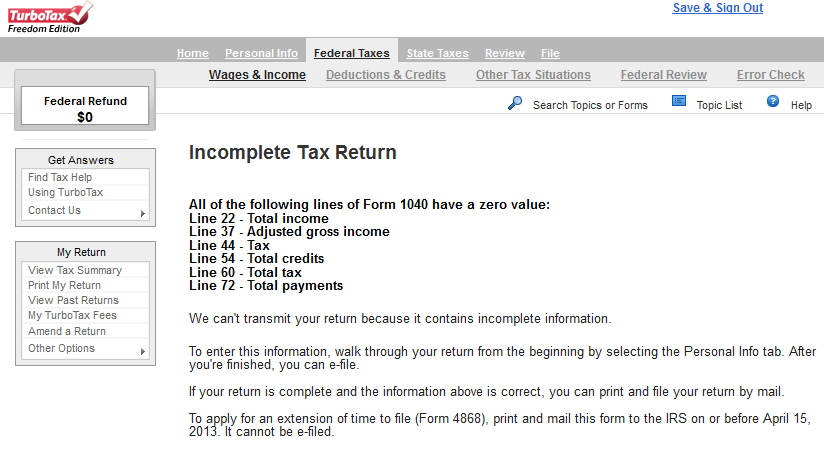

After punching in the numbers, the Error Check reported that Americans abroad cannot free-file US taxes if their income is below the Foreign Earned Income Exclusion, since they then have no “Total income”, no “Adjusted gross income”, “Tax”, etc. In other words, America recognizes that it is utterly stupid to bother people who live and work in other jurisdictions.

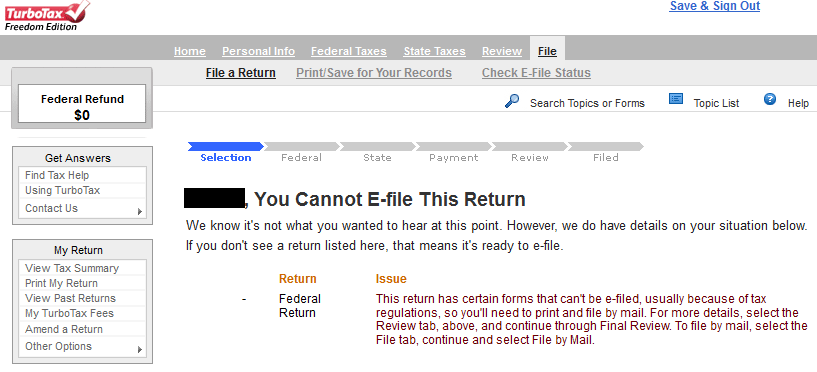

America’s unconditional hatred of citizenship-based taxation is then certified when one clicks to e-file or print the return:

Notice how it specifically states that US taxation is only for people who live in the US:

So, there you have it, folks. America is still the world’s leading hater of citizenship-based taxation, endlessly causing unnecessary trouble for its citizens living abroad to further demonstrate that citizenship-based taxation just cannot work.

American Semites are being thrown out of American banks

FATCA isn’t even being enforced, and yet American Semites are already being reported as getting kicked out of American banks left and right. At the going rate, this is going to become one heck of a lot worse once reciprocity starts to require American banks to export the financial data of Semites based on their national origin, and it certainly won’t be limited to Israel. Unfortunately, American Semites won’t be able to protect themselves with banking secrecy this time.

Arab Americans have been increasingly targeted with account closures… “This is just not an isolated problem. We believe it is happening to hundreds if not thousands of Arab Americans,” Ayad said.

I called the Arab-American Civil Rights League (1-313-633-0890) to ask if they had heard anything about FATCA and the bank account issues it has been causing for Americans living abroad. Yet, sadly, they hadn’t heard anything about it and so tried my best to introduce the topic.

China: the American Dream has become the American Nightmare

An interesting article was posted today in Chinese: http://big5.soundofhope.org/node/320710.

Here is the Google translation:

The richest man in China to avoid heavy taxes acute rejection of U.S. citizenship

2013-03-17 02:28:58

The green card has always been a symbol of the “American Dream”, but in early 2013, the United States resorted to FATCA (Foreign Account Tax Compliance Act) locking overseas income tax inspection, commonly known as “fat cats Act set off a celebrity and rich to abandon green card and U.S. citizenship The wave of the mainland’s richest man, Wahaha Group Chairman Zong recently renounced U.S. citizenship.

These high-income “tax refugee” nationality have moved back to the country, or transferred to countries with lower tax rates; renounce U.S. citizenship, however, still liquidate the property to pay the exit tax, and many of the National People’s Congress of the American dream from the “dream” change ” nightmare. “

The disposable green card predominantly Chinese

French composer in the movie “Green Card”, which, in order to live and work in the United States, at great pains sham marriages in an attempt to fool the immigration officer, only to get a green card. However, with the United States FATCA bill on the road, there are many rich must deliberately with a green card, “said Bai Bai”, which is a continent rich.

“World News” reported that, in the case of “taxing” the wealthy Americans to give up the green card or citizenship case continued to increase, which Chinese majority. IRS statistics show that, to give up the American’s more than 1,500 people annually from 2008 to 2011, according to the quarterly published abandon nationals who found, a very high proportion of Chinese surnames.

Under U.S. law, U.S. citizens and permanent resident green card holder, whether living in the world where to be for overseas income tax. In March 2010, the United States to strengthen tax collection, enacted FATCA aims to crack down on overseas tax evasion, and the rules officially launched in early 2013.

Silently stripped of UK citizenship, assassinated by US, yet no proof of guilt

Friday 15 March 2013 – ‘Where is the evidence my son was a terrorist?’

Mohamed Sakr was stripped of his British citizenship for alleged Islamist activity and killed in a drone strike. His parents tell Chris Woods they have yet to be shown any proof of his guilt.

You get extradited back to the US. Or you get killed abroad in a drone strike. Being stripped of your citizenship was merely a way of absolving your government of your murder. As a man or woman without a country, you don’t exist in the eyes of nation-states, and thus you can be murdered by any government and no other government will raise an eyebrow.

The United Nations has raised another challenge to Obama’s drone policy in Pakistan, saying that it continues to kill innocent civilians because operators have difficulty discerning civilians apart from terrorists.

For drone assassinations lacking a fair trial, America doesn’t even need to silently strip the citizenship of the so-called “tax cheats”, “snot pukes”, “traitors”, “unpatriotic”, “pieces of crap” people who want to live normal lives outside of US jurisdiction. These are all titles rewarded to individuals who choose not to be American citizens for whatever reason. Most of these, I collected from just one single article talking about Saverin. Did I remember to include the “terrorist” label? Notice that in all three articles, none of the accusations are supported with any evidence to justify their careless usage.

It appears that no proof of guilt is needed to justify the assassination of anyone given such a fancy title. They are, after all, “snot pukes”!

If it says anything at all, your once-government lies and says that you were a high profile terrorist.

You are now a confirmed kill.

Swiss Social Democratic Party Demands Reciprocity

Switzerland’s largest political party, SVP, voted against FATCA. The no vote was then followed by the Greens. Together with the Social Democrats (SP), the three parties make up the political majority. The SP, wanting reciprocity through model I, is selling its vote at a high cost, pushing the federal council to make compromises which lead to reciprocity.

Die SP treibt wieder das alte Spielchen

…Die SP versucht, ihre Zustimmung möglichst teuer zu verkaufen, in diesem Fall möglichst viele Zugeständnisse zu erreichen und den Bundesrat auf eine Linie zu zwingen, die zu einem automatischen Informationsaustausch führt. Dies kann sie tun, weil die SVP und die Grünen das Fatca-Abkommen kategorisch ablehnen. Denn die Fraktionen von SVP, SP und den Grünen kommen im Nationalrat zusammen auf 117 Stimmen, was eine komfortable Mehrheit ist…

US may double-tax Canadian resident Canadian earned income when flying directly to UK (no FEIE)

Sound crazy? Not in America.

On Wednesday, the Tax Court held that a flight attendant who was a resident of Hong Kong and a U.S. citizen could not claim 100% of her wages were excludable under the Sec. 911 foreign earned income exclusion (Rogers, T.C. Memo. 2013-77)…

The Tax Court held, therefore, that only her wages earned while in or flying over foreign countries qualify as foreign earned income, and wages earned while in international airspace or over the United States do not qualify.

In other words, a Chinese dual citizen living in Hong Kong, working for a Chinese employer and earning less than $10K per year, may be double-taxed on the same income by America simply because they work above the ground outside of America.

I’m failing to comprehend how one can determine when one worked in international airspace, or even US airspace, and for how long. Will one also be fined $10’000 for not knowing that one flew over a section of American Samoa, thinking that it was Samoa? Flight attendances have to carefully analyze the hours worked over the jurisdictions covered by each flight path throughout the entire year to ensure that their meager incomes will be taxed twice, if they wish to avoid massive fines. How much greater can tax insanity be more hell than that?

How FATCA threatens to derail the American economy

By DOUGLAS GOLDSTEIN 03/14/2013 23:19 – Jpost.com

The US government should also waive FATCA’s reporting requirements for foreign financial institutions.

With the enactment of the 2010 HIRE Act, Congress aimed to increase employment and increase its revenues by going after foreign accounts owned by Americans.

Unfortunately, the legislation doesn’t draw a distinction between honest Americans living and working abroad, and those citizens who are indeed hiding tax revenues from the American government. The legislation, Foreign Account Tax Compliance Act (FATCA), requires that individuals report their accounts held overseas and that foreign financial institutions report to the IRS about their American clients.

FATCA burdens American individuals and businesses overseas, as well as the foreign banks that wish to service them.

The billion dollar question is whether the burden of FATCA will outweigh its benefits.

The potential for losses are great on both the individual and institutional side.