CANADIAN FATCA LITIGATION UPDATE December 7, 2019:

You are contributing to raising the money needed to pay the legal costs to litigate with the Government of Canada — to prevent Canada from imposing the U.S. FATCA law directly on Canada and Canadians.

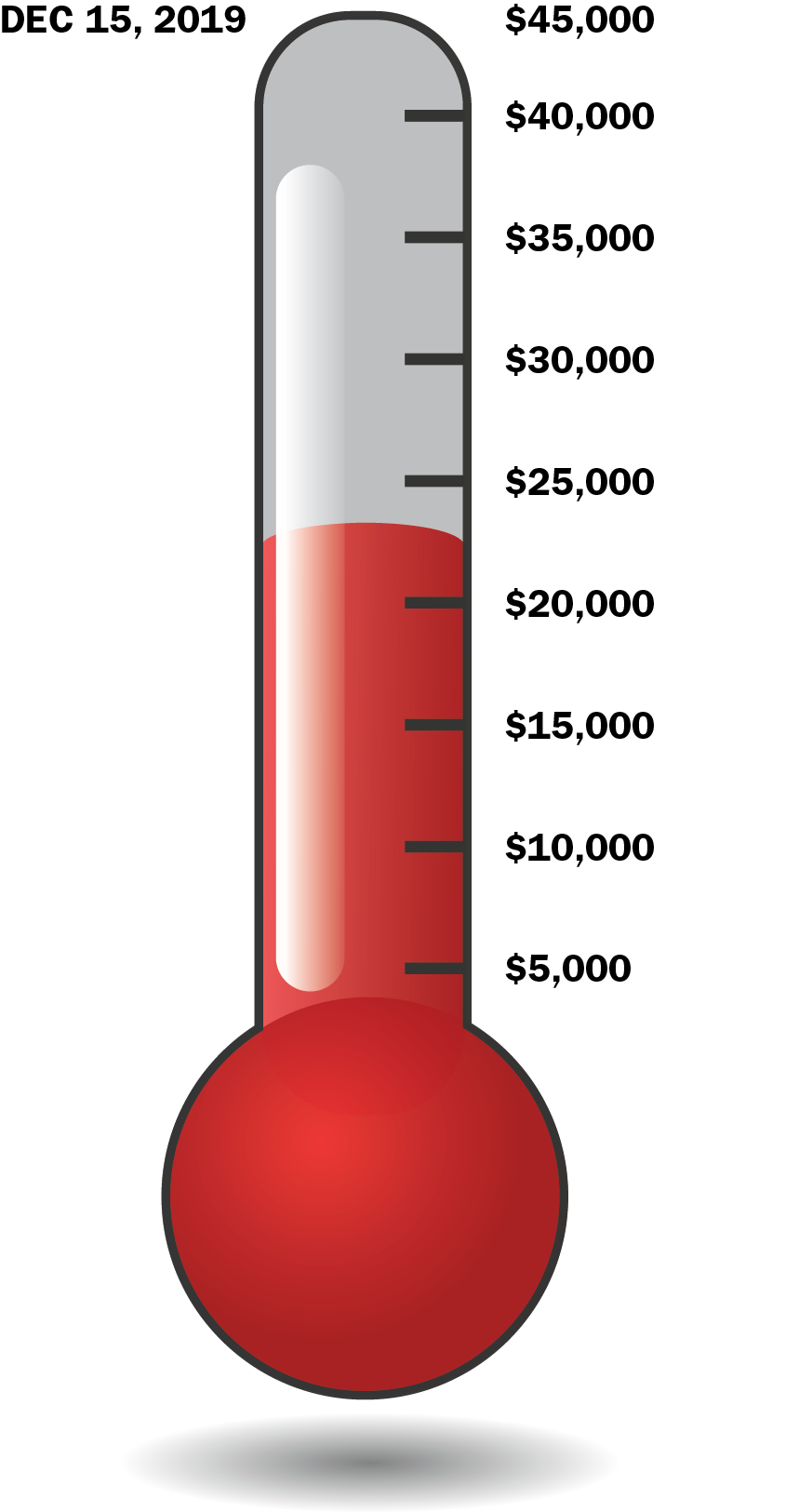

The Alliance for the Defence of Canadian Sovereignty and Gwen and Kazia have raised $24,612 in this funding round. We ask you for $20,388 in EIGHT DAYS to make $45,000 December 15 payment for appeal of FATCA Federal Court decisions.

You can DONATE by cheque, cash, PayPal (easiest) and transfers.

Gwen and Kazia, two brave Canadian citizens having no meaningful relationship with the U.S., are appealing on your behalf two Federal Court decisions to the Canadian Court of Appeal.

The grounds for appeal will include violations against their autonomy (Charter section 7), privacy (8) and equality (15) as well as arguments that the ruling was improperly based on the finding that the Income Tax Act is primarily regulatory in nature, and that factors such as the relationship between Canada and United States were not properly dealt with. Fleshed out details of appeal grounds will be provided in the Factum, likely early next year.

Gwen and Kazia ask for your help in paying for the legal costs of the appeal. If you feel that FATCA IGA laws harm you or someone that you know, PLEASE DONATE.

Appellants need to raise three installments of $45,000 on December 15, February 15, and April 15, and will apply for approximately $50,000 funding from the Canadian Court Challenges Program. Appellants and the Alliance for the Defence of Canadian Sovereignty — SEE OUR WEBSITE FOR MORE DETAILS (ADCS-ADSC).

Justice Mactavish in ruling against us said that it is “important” to avoid consequences threatened by the U.S. But we say not at the expense of our Charter rights.Canadians and International supporters: Please help end one of the FATCA compliance laws that impact on all of our countries.

You can SEND DONATIONS by cheque, cash, PayPal (easiest), and transfers.

For more details see: Alliance for the Defence of Canadian Sovereignty

Our four Board members are John Richardson (co-chair and legal counsel), Patricia Moon (Treasurer), Carol Tapanila, and Stephen Kish (Chair).

I sense donations are stuck in a rut.

There appears to be a “wait and see” problem.

Example: I will “wait and see” if there are larger/more donations before I donate.

I’ve donated, but am affected by this myself.

Lack of donations discourages donations.

I will donate more but as few are donating there does not seem to be much point.

Donations encourage donations.

Perhaps focusing on the submission of Canada (and other countries) to another state under threat of reprisals and resulting discrimination, would be an incentive to donate.

Should we not donate to keep Canada sovereign?

After all, donations are for the ALLIANCE for the DEFENSE of CANADIAN SOVEREIGNTY.

The other thing I feel is that the real focus of the lawsuit is being lost in the details.

Shldn’t we concentrating on the real reason?

I agree with Maple Leaf Forever. Donations beget more donations (also could be called priming the pump, for those of us who are old enough to have actually primed a hand-pumped well.) I gave my designated amount all at once at the beginning. Now I wish I had spread things out. Let’s hope some trickles become the stream we need to get this fund drive topped up by the deadline. Bear in mind that every unchallenged attack on our individual privacy and our nation’s sovereignty begets future attacks when the perpetrators think okay that went well now we can hit them with something even more sinister to take even greater control of their lives and bend their nation’s will to suit our agenda.

Sent cash yesterday. Not a lot towards the goal but a lot for me. First time in a long time that I have had any cash left over after paying my bills. Hope it helps us get over the finish line.

Please notify me when it arrives.

@ Japan T

In reference to the cost of fatca to the irs ,The 2018 tigfa report gives an idea. It might have been posted here at a certain point. The link is here,if interested,

https://www.treasury.gov/tigta/auditreports/2018reports/201830040fr.pdf

What one gathers is that Treasury is intent on filling in the missing parts to the puzzle,such as missing tins,etc. In the long run ,they will come back and with vengeance .

Only two choices here . Either put your head in the sand and get what you deserve.

Or,try to fight it in court ,while lighting a candle in the dire hope that justice will prevail over blackmail.

Also try not to think that our boy-wonder PM is going to help.

@RR

I fully expect the hammer to drop sometime in the future after enough of the pieces are in place and several years of noncompliance are recorded. Them WHAM.

JapanT,

Yes, I will let you know when the cash arrives.

Thank you for continuing to help us get to that finish line.

I just sent another donation via pay pal. It’s small but all I can afford right now. Hope we reach the goal. We need to keep fighting. I believe enforcement of the U.S. FATCA across borders will be happening more if there is no resistance. This will be much worse than the current situation. Renunciation is a blessing for those who are able to go down that path.

Hi PatCanadian,

Your donation has been received. Thank you for your support over many years and for your kind thoughts.

Have you received the money I sent?

Unless it is a further donation, you missed the reply from Stephen Kish, JapanT. Thanks from all of us for your donation!!

https://isaacbrocksociety.ca/2019/12/07/thanks-for-saturday-donations-from-first-and-long-time-supporters-24612-donated-so-far-in-this-funding-round-more-donations-needed-to-pay-legal-costs-of-canadian-fatca-lawsuit-with-your-help/comment-page-1/#comment-8715371

I did miss it then. Thanks.

T

It’s that quadrennial season again, and the candidates are in New Hampshire campaigning for the first Presidential primary. I was able to bring this up to Andrew Yang during a town hall event. Since there are often many voters and not enough time, I don’t always get called on. On Saturday 18 January 2020 I was at a Bernie Sanders event and managed to serve a FATCA letter on him as he shook hands and left. I also served one on Tulsi Gabbard, with enough time to say, “There are two sides to every story and here’s the other side of this one.” and she agreed to read it. That’s the way I also served Andrew Yang, and the letter was worded differently because he mentions his parents paying U.S. tax when they went back to Asia; so I mentioned that he might be one of the victims had his parents not returned to U.S.A.

The FATCA letter reads:

18 January 2020

Senator Sanders:

Imagine getting a birthday card with a check for college, and you like your other grandfather better because he sends toys. Mom and Dad bring you to the place where they have free lollipops and instruct you to write your name on the check and the bank form. Decades later you face criminal charges and devastating financial penalties for failing to report your “foreign” bank account to the U.S. Treasury, when you don’t even live in the U.S.A. This includes border babies born on the U.S.A. side and children of college students returning to their country.

Extraterritorial application of U.S. tax laws and bank account reporting requirements is causing hardships and fury in other countries. Victims now cannot accept employment involving signing the payroll checks because they’d be required to report the employer’s confidential information to a foreign government, the U.S.A. government. Victims infected with United States citizenship are forced to find accountants capable of completing U.S. tax returns that are far more complicated because another currency is involved. Some live in countries with high sales tax rates instead of income tax, and they cannot claim credit for the sales taxes.

U.S. statutes relieved some victims of U.S.A. citizenship when they became naturalized in their country. SCOTUS re-infected them with U.S.A. citizenship without asking if they wanted it.

Under the Foreign Account Tax Compliance Act, banks are forced to report these accounts of “United States persons” to the U.S. Treasury. That data is valuable, especially to hackers.

Some victims are called “accidental Americans,” but they are not Americans at all. Ted Cruz didn’t consider himself a Canadian when he learned in 2013 that he was classified as one of their citizens under their laws. Where the victims live is their country. What could be more infuriating to a proud, loyal, patriotic person than being called a “United States person”?

See: http://www.adcs-adsc.ca, https://isaacbrocksociety.ca

Tom Alciere, PO Box 106, Nashua NH 03061

Thanks for doing this, Tom! I made a separate post for your comment “FATCA and the US election campaign – report by Tom Alciere, New Hampshire” and moved the replies to its thread.

Why is fundraising so slow these days?

@Fred(B)

I have been perplexed by this too. I suspect there won’t be one simple answer. Each reader of this website has their own reasons for contributing today – or not.

But the following probably explains at least part of the problem.

The mess looks too big to fix.

As with so many seemingly overwhelming problems on any scale, from the personal to the global, it is always, always easier to be passive, to just look away, and someone else step up and take responsibility for tackling it. This is true of every issue behind every headline in every news outlet.

Seems to me that the only way a big problem like this gets fixed is by a small group of dedicated, public-spirited and truly decent people putting their heads above the parapet (a deeply grateful nod of thanks here to our plaintiffs and the entire ADCS committee)… and then being supported by many, many people chipping in as often and as much as they can to enable these heroes to do what we individually cannot do for ourselves.

Every month, I send in a contribution, wishing it could be more and wishing it could be more often. Sometimes, I make sure that it is. Whatever happens, something goes in from me every single month – and always has, through every appeal.

Does this make sense to anybody else out there?

Those who are holding back because of disquiet over e.g., normal online bickerings, well I wish you could find it in your hearts to look past that and remember what this should all be about.

Fighting injustice.

History has shown time and time again that all that is needed for evil to triumph is for good people to do nothing. Let’s not fall for that one again!

I was giving to the Jenny court case in the UK, gave up because I realise it’s going nowhere.

It is perfectly clear from my contact with people as high up as the UK secretary to the treasury that they have no intention of tackling the US over this issue, and they will spend as much as it takes for the UK case to eventually fizzle out due to lack of funds.

UK politicians do not understand the issue, they do not realise that the people impacted are UK citizens and permanent residents, do not realise that the system they are expected to live under is a clear breach of their human right to live where they do in peace and security and even those who eventually get a clue will still suggest these people take this up with their own government or renounce when they realise that they are powerless to do anything about FATCA and the US tax code.

The UK also wants to be real friendly with the US government right now.

I believe any action that may ultimate result in serious pushback against the USA is likely to come from the EU where residents have often been unable to forget their US citizenship because it is shoved under the banks nose when they open accounts, particularly from the French and the Dutch.

The EU have of course been doing the same as most national governments, desperately trying to ignore the complaints and pretend there really isn’t a problem here. I suggest US demands to close our residents and citizens bank accounts is a problem.

The EU cannot keep ignoring this, and won’t.

@Mike

“I suggest US demands to close our residents and citizens bank accounts is a problem.”

One of the enduring mysteries, for me, is the enthusiasm for closing accounts when it fact the US is not demanding it, but rather seems to be falling all over itself to provide extensions to the SSN rule so that it won’t happen. I memory serves, some IRS spokesperson even complained last year that accounts should not be closed, and the US government did not require it. (This is all a bit rich, but strictly speaking it’s not untrue: banks in certain countries definitely have gone above and beyond in their fear of FATCA.)

France instructs banks not to close expat accounts.

https://www.internationalinvestment.net/news/4008608/france-tells-banks-close-expats-accounts-fatca

Would it be possible for ADCS to explain how a win or a loss in the lawsuit could change the current situation for non-compliant Canadians who have chosen not to let their banks know they are US citizens?

It’s all well and good to promote the injustice of the FATCA IGA in principle, but Canadians need to understand what the fall out (good and bad) of a lawsuit could entail (win versus loss). I think if you try to present the lawsuit as something that the majority of those directly affected could benefit from and won’t be hurt by — rather than focusing on perceived immorality — it would get more financial support.

In other words, sell it to the majority of Canadian US persons — from a practical and realistic perspective — as being necessary.

My view is…

I agree with the last part of Robert Ross’s comment,

I continue to believe that each person must research and come to their own decisions given their facts and level of risk. If the lawsuit were successful, would it remove the risk (or, as some believe, make it worse as the banks would then step up their due diligence regarding each of their clients)?

All expats COULD step up to support the ADCS litigation, no matter their own personal decisions of compliance or not. Non-compliance will never solve the problem; it’s only a bandaid until further potential steps regarding US CBT.

@Jack

Welcome to Brock.

Your question is important and includes:

Your question is interesting. Your concern is the effect on (if I am reading this correctly) people who are:

To me, this description seems to include (and focus on) Canadians who want to both: remain U.S. citizens and not comply with U.S. citizenship taxation (which is perfectly understandable). Logically, your description also includes accidentals and others who feel they are being unjustly claimed as U.S. citizens (but that doesn’t seem to be your focus). Most of these people don’t agree they are U.S. citizens and might well renounce if they could manage it. But, your question focuses on the group that wants the best of both worlds.

Obviously Canadians who both want to remain U.S. citizens and not comply with FATCA/citizenship-based taxation, are part of the population impacted by FATCA. But, don’t you think the effect/viability of advocacy should include effects on others, including without limitation: Canadians who are compliant (whether or not they want to renounce U.S. citizenship), Canadians who can’t renounce because of exit tax considerations, Canadians who have been destroyed by the recent transition tax, etc.

Do the interests of the compliant (the group that is being harmed by all of this) even matter any more?

What about the effects of FATCA on Canada as a whole? Should Canadian taxpayers as a whole pay for this? Should the CRA be free labour for the IRS?

Should FATCA advocacy be advocacy for and only for protecting the wishes of the noncompliant – and specifically the noncompliant who wish to remain U.S. citizens?

Minor nuance.

There is a difference between: (1) wishing to remain a US citizen so as to take advantage of some potential benefit such as movement rights, job opportunities, or god forbid voting; and (2) refusing to renounce because one doesn’t wish to give the US government $23.50 for the privilege of not having one on its books, let alone $2350, plus the fact that renouncing does in some fashion put one on the IRS radar, if that’s a concern, whereas simple FATCA-evasion keeps one completely off it.

Failing to make this distinction attributes a certain “having their cake and eating it too” attitude to those who want nothing to do with the US government.

@Jack

” I think if you try to present the lawsuit as something that the majority of those directly affected could benefit from and won’t be hurt by — rather than focusing on perceived immorality — it would get more financial support.”

I am curious to know if you can possibly offer some benefits that could be used in such a venture . If not, maybe those US tax lawyers that ET wrote about could come up with some ideas on how to spin it.

Mark , all you are really talking about is ,having your cake and eating it, and in the end, all you are going to get is , burnt.

@Jack

” I think if you try to present the lawsuit as something that the majority of those directly affected could benefit from and won’t be hurt by — rather than focusing on perceived immorality — it would get more financial support.”

I am curious to know if you can possibly offer some benefits that could be used in such a venture . If not, maybe those US tax lawyers that ET wrote about could come up with some ideas on how to spin it.

Jack , all you are really talking about is ,having your cake and eating it, and in the end, all you are going to get is , burnt. There is a price to pay for sovereignity. If Canda sells off its canadians with US taint to stay financial comfortable ,that also means that it is selling off its sovereignity as well.

Where do you drawn the line to stay comfotable?

Interesting feedback, though I don’t feel like my question has been answered.

As a Canadian who does not identify as American, and does not benefit from having US citizenship, I never really thought of myself as “wanting the best of both worlds” and “having my cake and eating it too”.

I would think that if one really wanted the best of both worlds, one would be sure to obey the tax laws of both countries.