CANADIAN FATCA LITIGATION UPDATE December 7, 2019:

You are contributing to raising the money needed to pay the legal costs to litigate with the Government of Canada — to prevent Canada from imposing the U.S. FATCA law directly on Canada and Canadians.

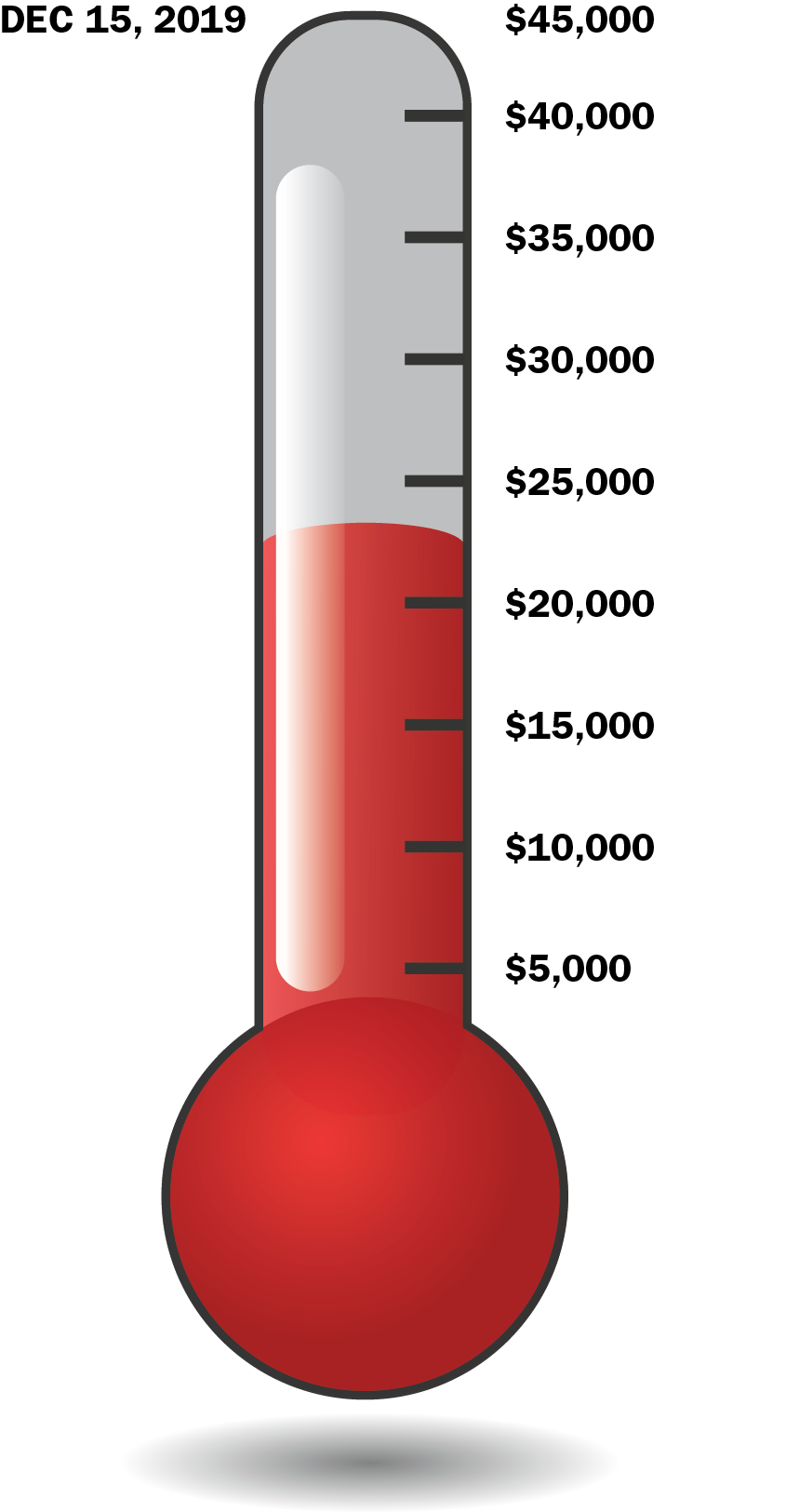

The Alliance for the Defence of Canadian Sovereignty and Gwen and Kazia have raised $24,612 in this funding round. We ask you for $20,388 in EIGHT DAYS to make $45,000 December 15 payment for appeal of FATCA Federal Court decisions.

You can DONATE by cheque, cash, PayPal (easiest) and transfers.

Gwen and Kazia, two brave Canadian citizens having no meaningful relationship with the U.S., are appealing on your behalf two Federal Court decisions to the Canadian Court of Appeal.

The grounds for appeal will include violations against their autonomy (Charter section 7), privacy (8) and equality (15) as well as arguments that the ruling was improperly based on the finding that the Income Tax Act is primarily regulatory in nature, and that factors such as the relationship between Canada and United States were not properly dealt with. Fleshed out details of appeal grounds will be provided in the Factum, likely early next year.

Gwen and Kazia ask for your help in paying for the legal costs of the appeal. If you feel that FATCA IGA laws harm you or someone that you know, PLEASE DONATE.

Appellants need to raise three installments of $45,000 on December 15, February 15, and April 15, and will apply for approximately $50,000 funding from the Canadian Court Challenges Program. Appellants and the Alliance for the Defence of Canadian Sovereignty — SEE OUR WEBSITE FOR MORE DETAILS (ADCS-ADSC).

Justice Mactavish in ruling against us said that it is “important” to avoid consequences threatened by the U.S. But we say not at the expense of our Charter rights.Canadians and International supporters: Please help end one of the FATCA compliance laws that impact on all of our countries.

You can SEND DONATIONS by cheque, cash, PayPal (easiest), and transfers.

For more details see: Alliance for the Defence of Canadian Sovereignty

Our four Board members are John Richardson (co-chair and legal counsel), Patricia Moon (Treasurer), Carol Tapanila, and Stephen Kish (Chair).

EmBee, I am back from snowy Valley City ND and just checked the post office box. There was no money order from you. Other mailed donations have arrived. Sometimes the mail for the post office box gets held up at the central station. I will keep watching and let you know.

@ Stephen Kish

I’ll check at the bank to see if there has been any activity on that order. Hopefully not. Darn should have put a tracker on that thing. Glad you’re back home safe and sound.

@ Stephen Kish

Bank person muttered a lot to herself, did much typing … CONCLUSION … no known activity (I think) … wait awhile longer. (I do tend to get impatient.) The mail could just be 2 times slower than usual.

EmBee, the likelihood is still that your money order is somewhere with Canada Post.

To my knowledge, we have never lost a single donation by mail, but the mail can sometimes be very slow.

During the last funding round Canada Post once kept the donations at its local warehouse (in Mississauga?) for 3-4 weeks until it had accumulated a significant number (one inch thick), and only then sent the package, wrapped with a rubber band, to our ADCS post office box. I did complain but was happy to receive the donations.

The mail is perfect for people who for whatever reason don’t like PayPal or don’t want to disclose their name. Cash in an envelope works easily. I will keep checking every day for your money order.

@ Stephen Kish

Mail delivered by the inch? Can you picture my eyes rolling? 🙂 Anyway, I’m feeling reasurred. Thanks for being such a good minder of the ADCS box.

Yet if you mail a birthday card that’s too thick Canada Post will return to sender. Expect something from me soon. It won’t be too thick, but physical size doesn’t always matter.

EmBee, your money order really arrived this morning — not an unreasonable delay for our Canada Post.

Thanks so much for your support from the very beginning, and thank you for the kind words.

Stephen

@ Stephen

Phew! THAT made my day. Sorry for fussing … next time I’ll use a tracker. I saved screen shots of the trackers I did last campaign and everytime the delivery time was less than 7 days. Maybe the politicians are overloading the system right now with their postage-free campaign pitches. May all other mail donors please be reassured that the mail does get through in Canada … eventually.

One of George Carlin’s most memorable quotes is, “It’s a big club and you aren’t in it.” As if we didn’t know already, the IRS admits it doesn’t audit the “big club” as vigorously as the poor because these audits are just easier and cheaper to execute. Furthermore they won’t change this because (no surprise) Congress has to give them more money first. And to tie this all back to FATCA, we knew all along they weren’t after the whales. It’s the minnows, the easy pickins, they set up the FATCA net to catch. Gwen and Kazia are fighting on our behalf to urge Canada to cast off the odious, US FATCA net because a) it is hurting vulnerable, law-abiding, Canadian citizens/residents of low or moderate means the most; b) it is an assault on the privacy rights of a single sector of our society; and c) it oversteps and degrades the sovereignty of Canada. I feel it’s important to continue to support the appeal process and I hope many others feel the same.

https://www.propublica.org/article/irs-sorry-but-its-just-easier-and-cheaper-to-audit-the-poor?utm_source=pocket-newtab

In another ProPublica article there’s something else we knew all along. The compliance condors do not want tax filing to be easy and free. We also know they are pretty effective at lobbying and masters of customer manipulation. However what caught my eye was a quote, “Do whatever makes your heart beat fastest.” That sounds like tachycardia to me … not so good. Regarding the support of the appeal process therefore I’d say, do whatever makes your heart feel happy.

Point (a) just isn’t true. What has the IRS done to touch Canadians of low to moderate income? Absolutely nothing. (Provided of course those Canadians, presumably with US person status, know enough not to self-harm by voluntarily filing US tax returns.)

Points (b) and (c) are perfectly valid.

Or Canadians of higher income, for that matter.

@ Ron Henderson

Read again please … I said it’s FATCA (not just IRS filing or not filing alone) that has harmed those of low to moderate means. If Gwen and Kazia and many others (myself included) didn’t feel harmed by FATCA there would never have been a lawsuit. It’s not just the execution of a threat to one’s well-being that is harmful, it’s the perception of a threat as well. Turning over what should be private financial information to a foreign government is both outrageous and dangerous, IMHO.

Then (a) is really just (b) isn’t it?

And again, why low to moderate means? Does it not violate privacy equally, regardless of income?

@ Ron Henderson

Those with high incomes can twist and turn and avoid scrutiny in ways which are simply not affordable or imaginable to others. So make whatever you wish of a), b) and c). I’d rather not belabour this anymore.

Those with lower incomes have a much easier time flying under the radar.

The greater the net worth, the stricter the FATCA compliance efforts of banks, investment firms and financial advisers, has been my experience.

Happy to report Minister of Revenue Diane LeBouthillier was defeated in today’s federal election. No clue yet which party is going to form the government.

Update 20.43:

(1) I got the news about Minsiter LeBouthillier from Global TV, but have now noticed that CBC still has that riding up for grabs between her and the Bloc Québecois candidate, with the BQ candidate leading by a slim majority. (And now, at 23.05, I see that Global now has undeclared the winner and has the riding once again up for grabs.)

(2) Finance Minister Bill Morneau has been re-elected.

Update 22 October:

Minister of Revenue Diane LeBouthiillier has been re-elected as has the other defendant Attorney General David Lametti.

Would it be possible to have a donation thermometer installed as there was last time?

I think we’re drifting off topic again….

Thanks, Maz57, for noticing we were getting off topic. I’ve copied my 10:14 comment and moved the comments that arose out of it, since they’re about Andrew Scheer, over to the Election discussion on the Canada: Opposition Leader Andrew Scheer is a US Citizen thread

I wonder what happens to her staff that I’ve been corresponding with…

You mean Diane LeBouthillier? Turns out that she did prevail in the end. Think I’ll add another update to my comment about her.

That poor thermometer … oh dear! I check everyday to see if the amount to be raised is getting lower and many days it’s the same as the day before. Meanwhile the number of days to meet the target are getting fewer (only 3 days to the halfway point). Maybe reading all or part of Laura Snyder’s brilliantly compiled survey report will prove to be motivational.

http://www.citizenshipsolutions.ca/2019/10/27/recently-released-survey-report-dispels-myth-of-the-wealthy-american-abroad-and-demonstrates-why-middle-class-americans-abroad-are-forced-to-renounce-us-citizenship/?fbclid=IwAR1LJifhjJCq_VH1_ocL5AlcYzS5cQWqkiMalrIeeNSW3j0XJaf7nBiGdNs

@Embee

How about provide a legal proposal by the lawyers who want to take this on , to explain what their basis for an appeal is, and what it hopes to accomplish as the best outcome. My understanding is that FATCA is US law so a Canadian court could not reverse it. Perhaps in the best outcome, the Canadian gov would throw out the gov agreement. At that point the banks would then directly deal with the IRS, which would mean perhaps more onerous banking problems for Canadian account holders, in the way that Swiss banks have treated American citizens. Maybe I am wrong, but someone could perhaps provide a legal argument/proposal to that effect, other than how they hate FATCA, because I hate as much all others here.