CANADIAN FATCA LITIGATION UPDATE December 7, 2019:

You are contributing to raising the money needed to pay the legal costs to litigate with the Government of Canada — to prevent Canada from imposing the U.S. FATCA law directly on Canada and Canadians.

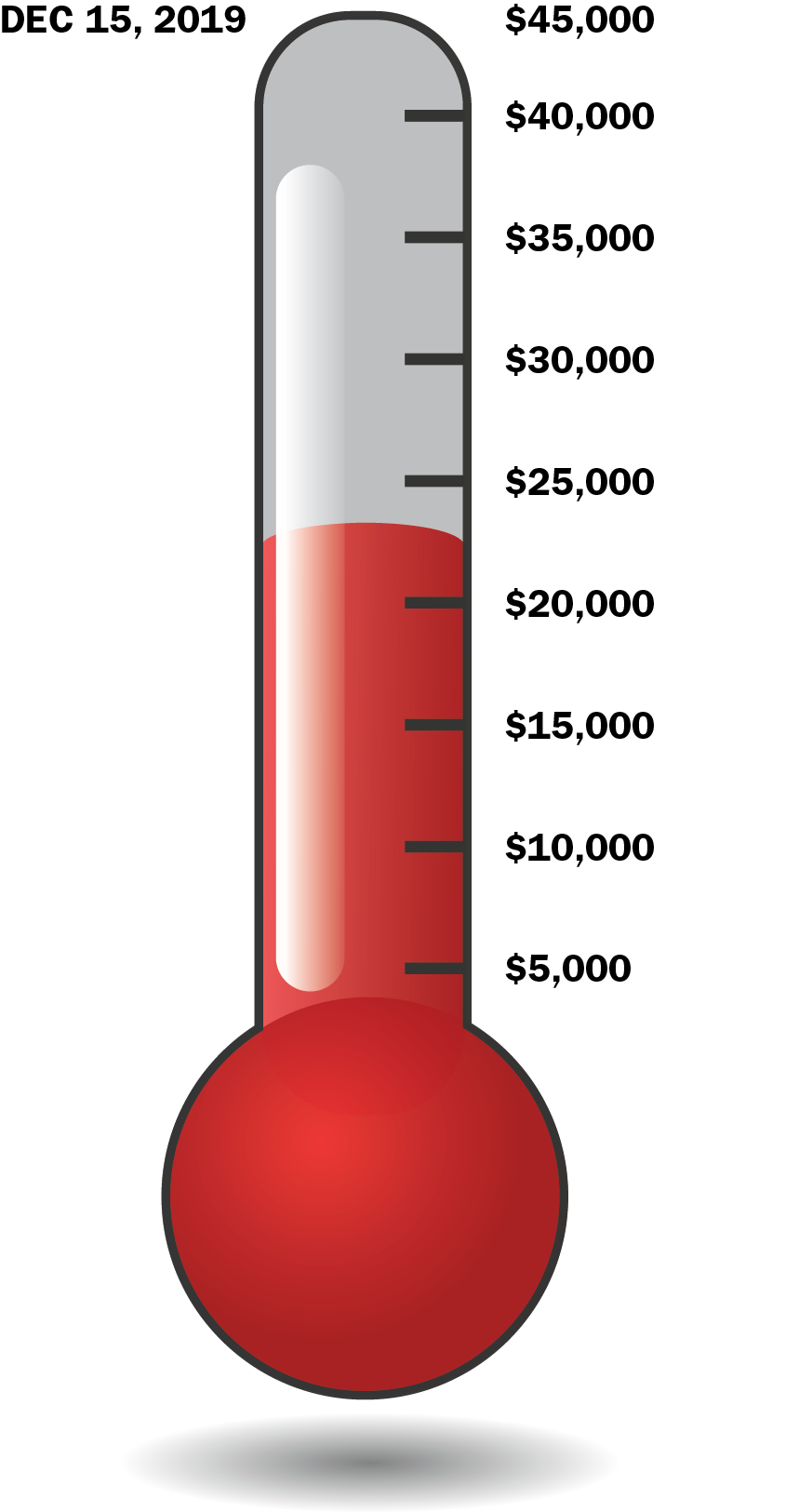

The Alliance for the Defence of Canadian Sovereignty and Gwen and Kazia have raised $24,612 in this funding round. We ask you for $20,388 in EIGHT DAYS to make $45,000 December 15 payment for appeal of FATCA Federal Court decisions.

You can DONATE by cheque, cash, PayPal (easiest) and transfers.

Gwen and Kazia, two brave Canadian citizens having no meaningful relationship with the U.S., are appealing on your behalf two Federal Court decisions to the Canadian Court of Appeal.

The grounds for appeal will include violations against their autonomy (Charter section 7), privacy (8) and equality (15) as well as arguments that the ruling was improperly based on the finding that the Income Tax Act is primarily regulatory in nature, and that factors such as the relationship between Canada and United States were not properly dealt with. Fleshed out details of appeal grounds will be provided in the Factum, likely early next year.

Gwen and Kazia ask for your help in paying for the legal costs of the appeal. If you feel that FATCA IGA laws harm you or someone that you know, PLEASE DONATE.

Appellants need to raise three installments of $45,000 on December 15, February 15, and April 15, and will apply for approximately $50,000 funding from the Canadian Court Challenges Program. Appellants and the Alliance for the Defence of Canadian Sovereignty — SEE OUR WEBSITE FOR MORE DETAILS (ADCS-ADSC).

Justice Mactavish in ruling against us said that it is “important” to avoid consequences threatened by the U.S. But we say not at the expense of our Charter rights.Canadians and International supporters: Please help end one of the FATCA compliance laws that impact on all of our countries.

You can SEND DONATIONS by cheque, cash, PayPal (easiest), and transfers.

For more details see: Alliance for the Defence of Canadian Sovereignty

Our four Board members are John Richardson (co-chair and legal counsel), Patricia Moon (Treasurer), Carol Tapanila, and Stephen Kish (Chair).

Where is the PR outreach around this decision?

American Expat Finance is good, but not widely read in Canada. Where is the reach out to: Elizabeth Thompson · CBC News ? Or maybe in the works. ?

I look up “FATCA” and “Canada” and click News, and the first 4 are about compliance.

https://americanexpatfinance.com/tax/item/271-gwen-and-kazia-launch-appeal-to-july-fatca-ruling?fbclid=IwAR32Ypp5L395_BZzYKSTH1ulvnSwDDau6nF_exNY3mBBXgztbSBBbj0qKLQ

Why not create a GoFundMe ?

It will make it much easier to donate and increase SEO

Sam, we tried GoFundMe, or something similar, previously, and it was a fail.

Firstly, we had to compete with cute animals and sympathetic kids with illnesses and I hate to tell you this, but everyone hates us “tax evaders” and they don’t think we deserve anything.

Secondly, we have to pay the funding sites an additional fee over and above the fees we already have to pay for our PayPal donations, which obviously takes a bigger bite out of our donations.

Our website IS a funding website just like GoFundMe and the rest, but its homemade and dedicated to just our cause, so there’s no distraction. People who come to our site know exactly why they are there, and want to support us, AND we pay less in fees.

So, please promote THIS site by posting it everywhere. The others are of no real value to our progress.

@ GwEvil

So nice to see your icon after a long absence. I hope you and Kazia are doing okay. Anyway you’re right. I remember that attempt … sadly. I’m going to use my previous method of contribution — mail a cheque or money order to Dr. Kish, that is as soon as our car is freed from its snow birth and I can get to the bank (we got twenty inches but it’s melting fast now). The December 15th deadline will be here in a blink of an eye so I hope everyone donates sooner rather than later. Best of luck with this fund drive and SURGITE!

Donation made! All the best in your fight for justice, Gwen and Kazia.

Embee – snow would be nice (though 20″ is excessive). They’re forecasting highs above 35C next week in our neck of the woods.

I can’t say I’m glad to be back, EmBee, but this decision just can’t be allowed to go unchallenged, as far as I’m concerned.

Kazia and I (and Ginny at the start of all this, of course), are doing this on behalf of all affected so-called “US Persons”.

Thanks for the support, everyone!

Car freed from its snow berth (spelled correctly this time) so money order is on its way. Thanks to Gwen, Kazia and the entire ADCS team for continuing this fight for what I believe to be a noble cause.

Canadian duo takes Fatca fight to court of appeals

By Cristian Angeloni, 3 Oct 19

https://international-adviser.com/canadian-duo-takes-fatca-fight-to-court-of-appeals/?fbclid=IwAR3WM-KUdLy6mioURU9epwPKnE4Lp9fL65DfjT35-xk85yNomh5JZeKV6-I

There is a comment section there although no comments yet.

https://www.thestar.com/politics/federal/2019/10/03/conservative-leader-andrew-scheer-acknowledges-holding-us-citizenship.html

I plan to donate and I wonder if our friend Andrew plans to donate as well.

Marie just noticed this as well. I had a good laugh this morning while watching the news. Andrew Scheer is a dual citizen, Canada/U.S. He is saying, “It’s not a big deal”. I wonder if his Canadian financial details have been sent to the IRS via the CRA? We should ask him for a donation. Maybe down the road he’ll realize what a big deal U.S. tax citizenship really is!

So let me get this straight: if Andrew Scheer becomes PM before his CLN is finalized, he’ll be a US citizen with official authority over Canada’s Treasury Board. Does that mean he has to file an FBAR for the entire balance of the Canadian Treasury? And when his CLN comes through, will he have to pay an exit tax on that amount?

Sorry to have gone off-topic. I will be donating to the new lawsuit. Feeling drained by this whole thing, but not giving up.

@Barbara

Were Scheer still a US citizen if elected PM, the answers would still be no and no. Government accounts are excluded from FATCA, and you don’t pay an exit tax on account balances.

Well done Gwen and Kazia and ADCS for refusing to back down in the face of our governments’ shameful hypocrisy and cowardice. I have donated. Fingers crossed for your appeal.

A donation will be sent to support the ADCS challenge.

As Brockers reading here from the inception of this site might remember, I am no longer a US citizen, and have not been now for years – I reluctantly relinquished my birthright – because of the shameful (and unique in the world) US practice of extraterritorial CBT, FBAR and FATCA, but this site and the ADCS challenge is still very important to me.

IBS was a priceless life and sanity saver, but it should never have had to exist. The intransigence of the US, and the shameful ceding of Canadian sovereignty by the previous CONs and the current ongoing active GLIB defense of a foreign government’s extraterritorial attempt to control Canadians residing on Canadian sovereign soil via FATCA cannot be forgotten.

Once again, I send a grateful and heartfelt thank you to all that have made, and continue to make this possible – for continuing to give so generously and altruistically of your energy, skills, dedication, work, and countless hours, days, months – and now the mounting years you’ve donated as volunteers and complainants to make this legal challenge possible.

Surgite!

Is any Canadian beside myself worried about what may happen if we lose appeals? It could make the situation worse, no.

@ Debbie

I don’t think it’s a good idea to be out of sight, out of mind. That could be their ticket to make things worse because they perceive (wrongly) that nobody cares. I’m in favour of keeping this injustice out in the open, in the courts and making it obvious that WE care and we’re still fighting.

I second that @Embee re staying visibly engaged.

I think a favourite government (and corporate) strategy is to assume that they can usually just outlast the outrage, attention spans and funds of the little people – who don’t have dedicated staff, legal departments and unlimited taxpayer funds on tap. I suspect that the Cons and the Glibs were banking that ordinary citizen’s awareness of and objection to FATCA would be minimal (ex. that obscure initial webpage notice https://web.archive.org/web/20190903142755/https://www.fin.gc.ca/treaties-conventions/notices/unitedstates-etatsunis-eng.asp which was a token ‘public’ gesture by Finance which I feel certain they thought no-one would notice, much less respond to). They also did their best not to share those submissions they did get with the Canadian public and the MPs and Senate that would be voting to enable the IGA and thus enshrine the enforcement of a foreign law via Canadian law.

I note that the Canada Revenue Agency Ministerial Transition Documents – November 2015 ‘Section 6 – CRA Litigation Forecast*+ ‘ that included FATCA https://web.archive.org/web/20190925003257/https://www.canada.ca/en/revenue-agency/corporate/about-canada-revenue-agency-cra/canada-revenue-agency-ministerial-transition-documents-november-2015.html were not publicly accessible, but marked “*Documents under review” and ” *+ Documents protected pursuant to the Access to Information Act”.

As we face a federal election, I find it useful to visit a reminder of who voted to pass the bill that enabled the FATCA IGA legislation;

https://www.parl.ca/LegisInfo/BillDetails.aspx?Language=e&Mode=1&billId=6483626&View=5

House Government Bill

41st Parliament, 2nd Session

October 16, 2013 – August 2, 2015

C-31

An Act to implement certain provisions of the budget tabled in Parliament on February 11, 2014 and other measures

Short Title

Economic Action Plan 2014 Act, No. 1

Sponsor

Minister of Finance

Statute of Canada

2014, c. 20

Last Stage Completed

Royal Assent (2014-06-19)

As we move to fund the next stage of the fight against FATCA in Canada, the words of

Hon. Pierrette Ringuette from 2014 are still relevant in my opinion;

“Hon. Pierrette Ringuette: Honourable senators, at second reading of the bill, we debated trade marks and demutualization. However, today, I want to talk about clause 5 of the bill, which concerns the Canada-U.S. tax information exchange agreement.

On Monday, we discussed the very important matter of people’s privacy. Unfortunately, a few days later, the new Privacy Commissioner said the following which, I believe, is at the heart of what I will share with you later.

[English]

In an interview before MacKay’s comments, privacy commissioner Daniel Therrien said the government treated basic customer data as relatively benign, which may have been reasonable at the time.

But now that the Supreme Court has ruled that this information deserves a high level of privacy, the government needs to take C-13 and S-4 back to the drawing board, he said.

“The premise under which this legislation was constructed has been held to be invalid,” said Therrien.

Privacy is a very important issue. Colleagues, for three years now I’ve taken a very keen interest in the issue of taxation for dual citizens in Canada. Living in a border community with the U.S., as many of us do, I know that many Canadian citizens were born in the U.S. and vice versa. We have a major issue all along border communities, and I have been working on this for three years now. I have my file here. I’ve been in discussion with the U.S. embassy here that seems to have quite a revolving door in regard to this issue and getting answers for Canadians.

I think one of the things that is kind of funny in this situation is that the U.S. is a country that bases personal income tax on citizenship and not residency like the rest of the world. Their tax policy has always been that way. It’s funny that a country that had a revolution started by the Boston Tea Party based on taxation without services would have legislation to tax citizen non-residents who are not getting services from their government, but I guess that’s it.

The issue is that their income tax law has always been that way. However, a few years back they noticed that a lot of Canadian citizens and residents were not complying with their income tax act. Therefore, they said that what they will do is say to all foreign banks with a banking institution within their territory that they will have to comply in their home country subsidiary to the taxation information and law in the U.S. with regard to information for citizens — not residents, citizens.

That has sparked a lot of discussion throughout the country, and I’ve had a lot of discussions with the U.S. embassy here on the issue. Honestly, how can a Canadian government enforce, directly or indirectly, foreign legislation?

Second, how can this country sign an agreement to give private Canadian citizens’ information via Canada Revenue Agency to the U.S.? From my perspective, that’s a clear breach of our Canadian citizen, whether they are dual or not.

(1800)

Some Hon. Senators: Hear, hear.

Senator Ringuette: That is a clear breach of their privacy.

I also believe it is a clear breach of our Canadian Charter of Rights of Freedoms, section 8, which says, “Everyone has the right to be secure against unreasonable search or seizure” and section 15(1), which says, “Every individual is equal before and under the law and has the right to the equal protection and equal benefit of the law without discrimination” —”

……….

“Senator Ringuette: I will repeat section 15(1) of the Charter of Rights and Freedoms:

Every individual is equal before and under the law and has the right to the equal protection and equal benefit of the law without discrimination and, in particular, without discrimination based on race, national or ethnic origin, colour, religion, sex, age or mental or physical disability.

In my opinion, Part 5 of Bill C-31 is a clear violation of the Canadian Charter of Rights and Freedoms. It is also, from my perspective, a clear violation of our Canadian citizens’ right to privacy.

Senator Moore: Sure it is.

Senator Ringuette: The Canadian government has not signed such an agreement with the Chinese government, the Russian government, with France or with the U.K. This is done particularly for Canadian citizens who also are U.S. citizens, and this has all been done in order to help the Canadian banks that have branches in the U.S. That is the basis of this agreement. It’s to save Canadian banks from this U.S. legislation.

By the way, the way the act is written, it removes any kind of court challenge for that information within the Canadian banks. It puts all the onus on the Canada Revenue Agency. That’s phenomenal. As a government, you say that you pride yourselves with regard to private business and competition and so forth, and you would remove that onus of responsibility from these banking institutions.

I will tell you again that many of the citizens from my area of the country are very upset with the U.S. legislation, and they are doubly upset with the fact that the Canadian government is acting against the fact that they reside in Canada. They are Canadian citizens, just like anyone else, and they are being targeted by this agreement and the current bill we have in front of us, and it is not right. If the Americans want to collect personal income tax, that is their responsibility. They are not given facts that someone might be corrupt or there must be money laundering or something else. There’s no criminal intent here, none whatsoever. It’s not like talking about the FINTRAC issue. That is not the purpose. The purpose of this bill is to give personal financial information about Canadian citizens to a foreign country. I have been through that issue before in the case of Tepper in New Brunswick. I know what can happen when that kind of misleading information is provided to a foreign nation.”

https://sencanada.ca/en/Content/Sen/chamber/412/debates/074db_2014-06-18-e#56

I’d like to add a reminder that the current Glibs reversed course after they came to power, said they supported the FATCA IGA, and took up the Con mantle by choosing to continue to defend against the ADCS challenge https://ipolitics.ca/2016/03/17/trudeau-liberals-reverse-position-on-controversial-irs-information-sharing-deal/ https://ipolitics.ca/2016/03/22/brison-garneau-endorse-deal-to-share-canadian-banking-records-with-irs/ . This is despite the comments of Canadian professor and constitutional law expert Peter Hogg which was shared with Canadians by MP Elizabeth May http://elizabethmaymp.ca/wp-content/uploads/peter_hogg_fatca.pdf

Luckily there are still some MPs around who were willing to ask the government tough questions on our behalf ex.

https://www.maplesandbox.ca/2016/bravo-mp-dusseault-for-keeping-the-pressure-up-on-fatca/ , https://youtu.be/fT2nnMFgUFk https://www.greenparty.ca/en/media-release/2014-03-05/fatca-threat-canadian-rights-and-sovereignty .

I personally will remember this as I vote in the upcoming Canadian federal election.

Donation question: Since the PayPal links on the donation page do not work for me (my own issue with PayPal, not a problem with the link itself), may I confirm that if I manually send through PayPal, the ADCS account is registered to information@adcs-adsc.ca?

Barbara, thanks for the donation question. Your suggestion makes sense, but we have never tried donating via PayPal without going through the donation post. To be safe, you might want to try another way to donate.

@ Stephen Kish

I mailed a money order on October 3rd. Any sign of it yet? (Sure hope I didn’t make a mistake on the address.)

EmBee, normally I check the ADCS post office box once or twice a day, but I have been on a long road trip to visit my many cousins in North Dakota. Will be back day after Canadian thanksgiving and I will confirm on Brock that your donation arrived safely. Thanks for sending a donation!

Thanks Stephen. Enjoy your road trip and family visits. The weather looks a bit dicey in North Dakota today. Take care.

Happy Thanksgiving to everyone and especially to Gwen, Kazia and the entire ADCS team.

And I hope that Stephen isn’t stuck in a snow drift somewhere and that he has a safe journey back to Ontario.