"Residence should be a “necessary condition” for US taxation for ALL people!"https://t.co/4fCxD7DmiJ Jackie Bugnion on importance of RBT

— Patricia Moon (@nobledreamer16) May 3, 2016

This is the first in what I expect will be a series of posts on an issue we have yet to really focus on. Yes we all know what RBT is and so on but what we may not be so aware of, is how the US, while claiming we are “residents” of the U.S., doesn’t even give us equal (if not better) considerations than aliens/immigrants. And if this information doesn’t make you hopping mad, read it until it does.

*******

cross-posted from citizenshipsolutions dot ca

Introduction

Every country in the world with the exceptions of Eritrea and the United States claim tax jurisdiction based on “residence”. Although the tests for “residence” may differ, “residence based taxation” means that it is possible to sever your tax connection to a country by severing residence.

The nations of Eritrea and the United States impose taxation based on citizenship. U.S. citizens (primarily those “Born In The USA”) can NEVER sever their tax connection to the United States as long as they remain citizens. When it comes to U.S. citizenship-based taxation it is possible to NEVER have lived in the United States and still be subject to taxation!

Citizenship-based AKA “Place of Birth” Taxation is NOT based on any kind of physical presence or actual residence …

Q. Why is it that:

(from an email message I received)

“The British are called “subjects” but they are citizens; and the Americans are called “citizens” but they are “subjects”?

A. How about, as a proposed answer? (from an email message I received), because (CBT = “citizenship-based taxation”):

“CBT is a servitude (apparently some minds still can’t accept the abolition of slavery and racial segregation, so they have to reintroduce servitude). You, like any American “citizen” are in truth property of the IRS, and you will remain so unless you give up your citizenship (which means, like all serfs that you wold have to buy back your freedom from your master). If you don’t like the word “serf”, you may say that you are indentured. But that’s basically the same idea; you’re not free.

CBT is a problem of the rest of the world, because it is vile and

despicable: “No one shall be held in slavery or servitude; slavery and the slave trade shall be prohibited in all their forms.Why? CBT means that an American is bound by birth to pay taxes to the US, even if they have never lived there. The truth is, all Americans (including you, including all people in Congress) live in serfdom. Those considering that CBT (i.e. being a serf) is a problem only for expats, are not really concerned by their liberty. They are cattle in a pen, they don’t know what freedom means. CBT has made the word “freedom”

meaningless.”

Strong language indeed! Offensive to some? Yes. But what about the concept itself? Is “citizenship-taxation” morally offensive? It depends on who you ask. Is it better to call U.S. citizens “prisoners”? There have been many references to the “prison of citizenship-based taxation“.

The simple fact of the matter is that:

1. The United States claims the right to impose world-wide taxation on people who do NOT live in the United States and on income earned outside the United States.

2. The United States requires all those who it defines as its citizens to comply with expensive, penalty laden reporting requirements that enforce the principle that: “U.S. citizens abroad are required to live as a U.S. resident lives”. This is the “When In Rome, Live as a Homelander” principle.

What this post is about

This post is NOT about “U.S. citizenship-based taxation” per se. This post is about the connection between “presence” in a country and taxation. U.S. citizens are ALWAYS U.S. tax subjects as long as they are citizens WHETHER THEY HAVE ANY PHYSICAL PRESENCE IN THE UNITED STATES OR NOT!

That said, CBT is a problem ONLY for those U.S. citizens who decide to live outside the United States. From the perspective of U.S. citizens living in the United States (“Homelanders”), the U.S. tax system is based on residence. Let them try to leave the United States of America!

The ONLY advantages to being a U.S. citizen are that you have the right to live, work and carry on business in the United States.

For U.S. citizens, “residence” is not a necessary condition for U.S. taxation.

Rather for those born in the United States, “citizenship” is a “sufficient condition” for U.S. taxation.

But, I have digressed …

This post is about “non-resident aliens” and the circumstances that may cause them to be converted from “non-resident aliens” to “resident aliens”. Once they have been converted from “non-resident aliens” to “resident aliens”, they are subject to the full force of the Internal Revenue Code.

Until they are converted to “residents”, non-resident aliens are subject to their specific and far narrower rules. These rules are found primarily in Internal Revenue Code S. 871. The mode of “taxation of non-resident aliens” combined with FATCA and the refusal of the United States to embrace the OECD Common Reporting Standard, reinforces the role of the United States as a Tax Haven.

Different kinds of visas = Different kinds of “physical presence” to the United States

From a U.S. perspective, if you are NOT a U.S. citizen, you are an alien. Aliens will enter the United States under different kinds of Visas or (in some cases) with NO visa.

The “Green Card” (permanent residence Visa) vs. Other Kinds of Visas (not for permanent residence)

How are “non-U.S. citizens” AKA “aliens” taxed under the Internal Revenue Code? At what point does an “alien” become a “resident” of the United States?

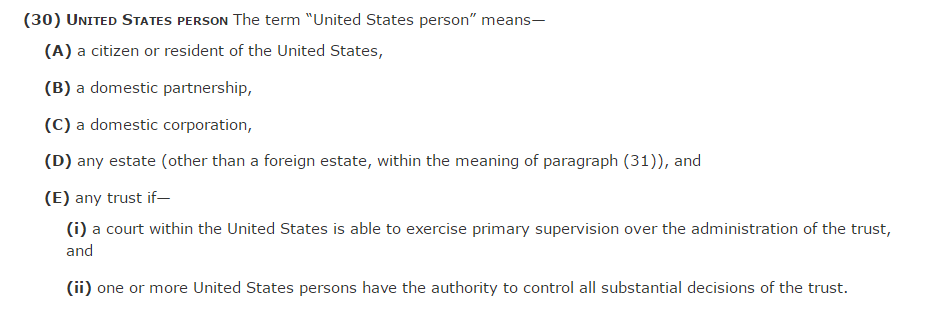

S. 7701(a)(30) tells us that “U.S. Person” includes a “resident”. When does an “alien” become a “resident”?

S. 7701(b)(1)(A) defines when and ONLY when an “alien” becomes a “resident”.

The circumstances INCLUDE:

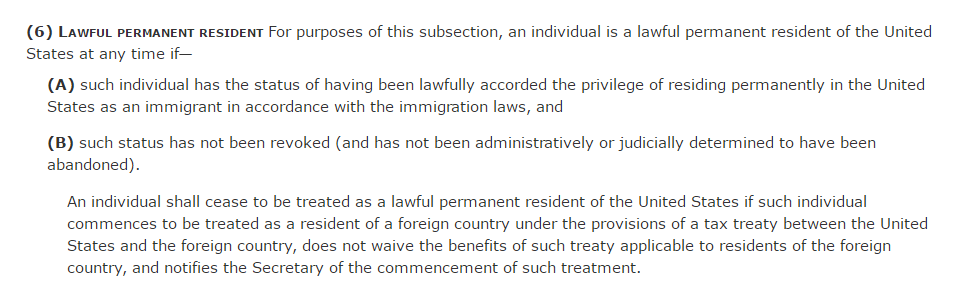

The Green Card Test – lawfully admitted as a “permanent resident”

Note that a Green Card gives the right of “permanent residence”. Therefore the (rebuttable) presumption is that Green Card Holders have an actual physical presence in the United States.

Q. Is it possible for a Green Card Holder to rebutt the presumption that he is a U.S. “resident”?

A. Yes, the Green Card Holder may be able to make use of a “Treaty Election” (normally Article IV) of a Tax Treaty. Does the availability of the Treaty Election presume that one should NOT be at tax resident of more than one country? Does the presume that a person should be subject ONLY to taxation where he actually resides? Does this assume a presumption of “residency based taxation”? It’s interesting to read the criteria to determine “tax residency” under the “Canada U.S. Tax Treaty“.

Article IV of the Canada U.S. Tax Treaty reads:

Article IV

Residence

2. Where by reason of the provisions of paragraph 1 an individual is a resident of both Contracting States, then his status shall be determined as follows:

(a) he shall be deemed to be a resident of the Contracting State in which he has a permanent home available to him; if he has a permanent home available to him in both States or in neither State, he shall be deemed to be a resident of the Contracting State with which his personal and economic relations are closer (centre of vital interests);

(b) if the Contracting State in which he has his centre of vital interests cannot be determined, he shall be deemed to be a resident of the Contracting State in which he has an habitual abode;

(c) if he has an habitual abode in both States or in neither State, he shall be deemed to be a resident of the Contracting State of which he is a citizen; and

(d) if he is a citizen of both States or of neither of them, the competent authorities of the Contracting States shall settle the question by mutual agreement

The “tie breaker” provision of the treaty seems to assume that:

1. People should NOT be tax residents of more than one nation; and

2. They should be treated as “tax residents” of the country where they actually reside.

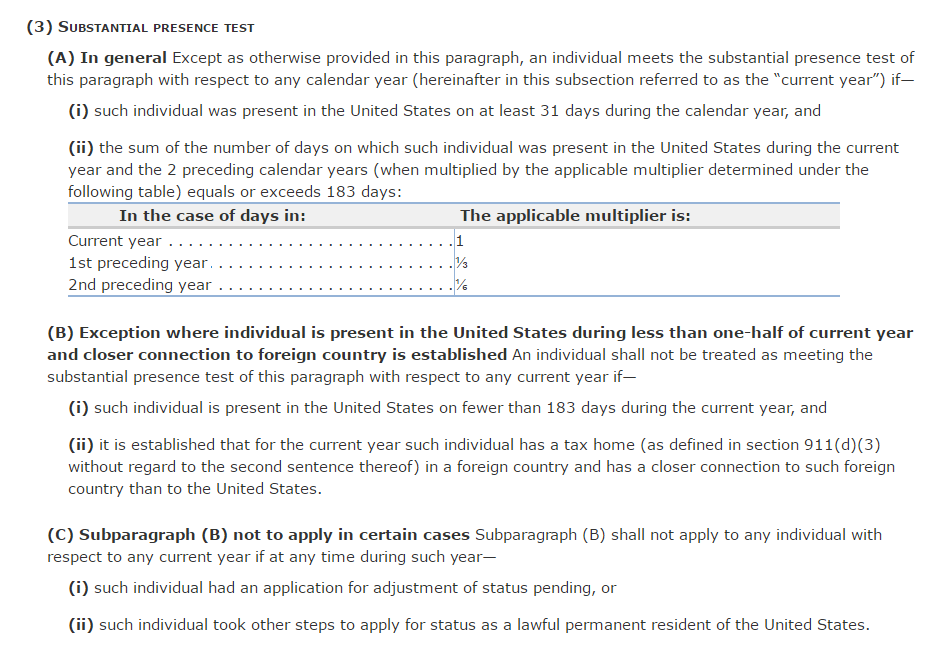

Meets the “substantial presence” test

Note that “substantial presence test” is found in S. 7701(b)(3) and needs to be read very carefully.

A. Defending yourself against having actually met the “substantial presence test”

Note that S. 7701(b)(3)(B) provides a “defense” to meeting the “substantial presence” test. This defense is generally referred to as the “closer connection” exemption. It is NOT available to U.S. citizens (they are not aliens) or to Green Card Holders (they are already “residents”).

It is generally claimed by filing IRS Form 8840.

If you meet the substantial presence test file Form 8840, "Closer Connection Exception Statement for Aliens" https://t.co/rAZCjywXQb

— Citizenship Lawyer (@ExpatriationLaw) May 1, 2016

By filing Form 8840, one is taking the position that:

Yes, I have met the “substantial presence test”. But, I have a closer connection to another country.

The “defense” is based on S. 7701(b)(3)(B) of the Internal Revenue Code. This “defense” is NOT based on Article IV of the Tax Treaty. Notice that the defense is based on being a tax resident of being another nation. Can one infer that the Internal Revenue Code assumes that people should NOT be considered to be “tax residents” of two countries?

The “closer connection test” seems to assume that:

1. People should NOT be tax residents of more than one nation; and

2. They should be treated as “tax residents” of the country where they actually reside.

B. Defending the allegation that you have met the “substantial presence test” in the first place

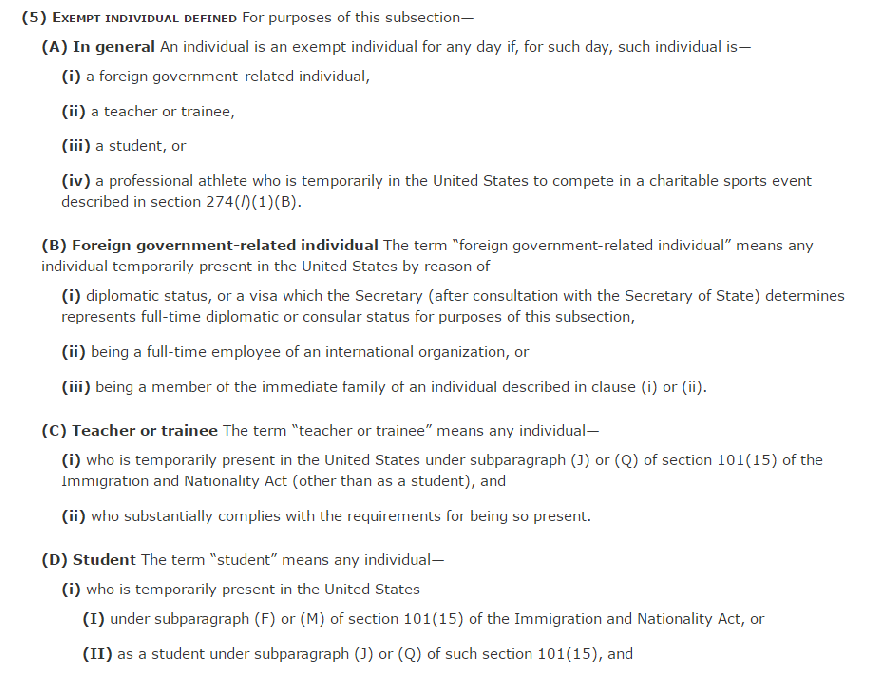

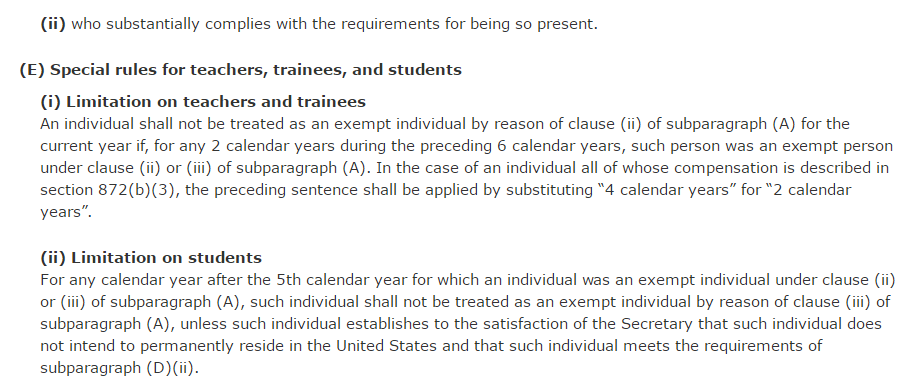

To meet the “substantial presence test” you are required to have spent a certain number of days in the United States. S. 7701(b)(5) specifies days of ACTUAL physical presence in the United States that are NOT to be counted as “physical presence”.

continued

Significantly, this section of the Internal Revenue Code specifically references S. 101(15) of the Immigration and Nationality Act to clarify exactly which kind of visa holder is entitled to this exemption. In other words, the focus is on the specific kind of visa that the person used to enter the United States.

The “exemption” is generally claimed by filing IRS From 8843.

IRS Form 8843: Explaining why you don't meet the substantial presence test – what days are excludable? https://t.co/kd9vwXWO8Z

— Citizenship Lawyer (@ExpatriationLaw) May 1, 2016

By filing Form 8843, one is taking the position that certain days that you were actually present in the United States should NOT be counted as a day toward meeting the “substantial presence” requirement. Notice how the basis for the “exemption” is tied to very specific kinds of visas and specific reasons for actually being present in the United States. A practical description of

- who must file Form 8843

- why Form 8843 must be filed

- how Form 8843 defends one against meeting the “substantial presence” test may be found here.

The “exemption from days toward the “substantial presence test” seems to assume that:

1. People should NOT be tax residents of more than one nation; and

2. They should be treated as “tax residents” of the country where they actually reside.

One might think that the United States has a system of “residence based taxation” …

Notice that the obvious purpose of the S. 7701(b) and Article IV of the Tax Treaty are to ensure that, for non-citizens”, a “physical presence” in the United States is met before one is treated as a “tax resident”?

In the case of “aliens” it appears that “residence” is a necessary but NOT a sufficient condition for U.S. taxation.

What is it about a “U.S. place of birth” that makes U.S. citizens exceptional?

Why should this be different for citizens? Why shouldn’t citizens also be required to have a “physical presence” in the United States before becoming a “resident” for tax purposes? Why should ONLY U.S. citizens be “tax residents” of the United States even if they reside outside the United States?

The usual answer to this question is:

It’s Cook v. Tait! By God in 1924, the Supreme Court of the United States (per Justice McKenna) ruled that the United States could impose taxation on its citizens abroad.

I am not certain that Cook v. Tait can be interpreted to mean that the United States can impose taxation on ALL of its citizens abroad. As I noted in a previous post about “Cook v. Tait”:

“Citizenship taxation” is a relic of the post that probably was NOT justifiable in 1921. If it was justifiable as a general principle, note that even in 1921, the definition of “citizen” in Article 4 of Regulation 62:

4. A citizen is defined as follows: “An individual born in the United States subject to its jurisdiction, of either citizen or alien parents, who has long since moved to a different country and established a domicile there, but who has neither been naturalized in or taken an oath of allegiance to that or any other foreign country, is still a citizen of the United States.”

This appears to mean that if Cook HAD become a naturalized citizen of Mexico OR taken an oath of allegiance to Mexico, that he would NOT have been considered to be a U.S. “citizen” for tax purposes. It also means that all those “so called Americans abroad” who emigrated to other countries and became citizens of those countries would NOT have been considered U.S. citizens for tax purposes! This suggests that “citizenship taxation” does NOT have the rich history that it’s advocates claim. It also means that the new U.S. concept of the “Tax Citizen” which began in 2004 is NOT the entrenchment of an old principle but the establishment of a new principle.

Interesting, assuming that Cook had become a citizen of Mexico and was residing in Mexico, perhaps Justice McKenna should have ruled that:

The definition of “U.S. citizen” for tax purposes seemed to assume that:

1. People should NOT be tax residents of more than one nation; and

2. They should be treated as “tax residents” of the country where they actually reside.

Conclusion …

Those born in the United States are NOT exceptional. In order for the United States to participate in the global world:

As Jackie Bugnion so persuasively argues, Residence should be a “necessary condition” for U.S. taxation for ALL people!

John Richardson

Look at the tax treaty tie breaker rule d.

On the face that muddies CBT

Once it was pretty easy for a mentally-competent to buy their freedom, but the hefty charges lock in the poor and the high exit fees dissuade the rich. I can see the analogy to serfdom (being tied to a specific bit of land, getting taxed ostensibly for protection and freedoms, and also, it is clear, [from the fate of U.S.-born people in Yemen] being cut loose when it is no longer in the master’s economic interest), but analogies to slavery take it too far and will just get people’s backs up.

I have german friends with a condo in London. They go there all the time- just under half of the year for sure. I have never heard them worry about being taxed in England.

re: “analogies to slavery take it too far and will just get people’s backs up. ”

USA cannot physically chain me – a US person living off the plantation – nor make me sweat and toil in the hot sun. But it can take my money away. Money I sweated for to earn. Sounds like a modern day form of slavery to me. And a clever one too. Because people’s backs get up when I say I feel like a slave. I don’t look like I am sweating or toiling or physically stressed. How can I call myself a slave?

Once upon a time, the term ’emotional abuse’ was practically unheard of. Its not like it never existed, but it isn’t clearly visible like physical abuse is. Many pooh-pooh a victim’s claims of emotional abuse, because there are no bumps or bruises to see.

Ditto, physical slavery. Another form of abuse which people can clearly see. They know it is real.

The financial slavery that is CBT is not as in your face. Therefore to some, it is not really slavery. Just like to some, emotional abuse is not really abuse, although more and more, modern society is starting to recognizing it as being just as harmful as physical abuse.

The Canadian government must wake up to the CBT abuse – financial and emotional – that USA is inflicting on those it claims as its own, and STOP BLAMING THE VICTIM.

Besides slavery, this whole FATCA/CBT attack also has parallels with what rape victims go through. People often don’t believe them. Courts don’t believe them. The Canadian government does not believe we are victims of FATCA enforced CBT. Slavery is too harsh a term to use as an analogy. ‘Americans in Canada’ were asking for it – many all happy with their dualness until recently, they should have renounced their US citizenship, it’s their fault what’s happened to them

Polly.

I think prisoner is a better analogy.

US persons can no longer buy a condo in London or a ski apt in Switzerland or a holiday home anywhere but in their homeland.

Movie tales like ‘ under the Tuscan sun’ are now made obsolete.

WhiteKat has it right:

and

We’ve heard it loud and clear: JUST RENOUNCE.

@Calgary, one of the worst things about being a victim imo, is when people don’t see it. It is bad enough to be abused, but doubly worse when you start to question your own sanity because others tell you what you are experiencing is not real.

The government of Canada is not only side-stepping (too nice a word) its responsibilities to treat equally, Canadian citizens who happen to be deemed ‘US persons’ by the USA, but worse is emotionally abusing those it now refers to as ‘Americans living in Canada’ – not only through its invalidation and facilitation of abuse inflicted on ‘US persons’ by the USA, but in its blaming of the victims who should ‘just renounce’ if they don’t like it.

@heidi: US persons can no longer buy a condo in London or a ski apt in Switzerland or a holiday home anywhere but in their homeland.

Yep, yet another poor couple caught by this were asking for help on Reddit the other day

https://www.reddit.com/r/IWantOut/comments/4hdku3/seeking_advice_french_mortgage_for_us_citizens/

It’s easy to see how Canadian banks will now become active participants in the manufacturing of new US taxpayers for the US government when every new account applicant is now being asked to confirm whether they are a US person.

When Canadians don’t believe that any harm exists with being designated a “US person” how many Canadians who don’t whether they are US persons will know NOT to answer with “I don’t know”?

@ Eric

The economic handicaps America has imposed on citizens who want to live or work outside of the US are absolutely terrific news for countries who compete against the US in international markets. Beneficiaries include Germany, GB … and of course China.

The destruction of American exports, influence and good will wrought by FATCA and the US’s off-shore tax-jihad against its own ex-patriots is profound.

The US is already hobbled by unimaginable government debt, the world’s highest incarceration rates, a collapse of manufacturing jobs and the middle class, an epidemic of firearms and its accompanying death toll, and the First World’s world’s most expensive and complicated health care system.

This FATCA folly is just another brick in the wall.

>The ONLY advantages to being a U.S. citizen are that you have the right to live, work and carry on

> business in the United States

What about the unlimited marriable deduction? Pretty much the sole reason GC holders become citizens when they aren’t really that bothered about waving any flags.

@Wondering. Don’t worry…..Donald Trump is going to make America great again.

@ WhiteKat

I think that WhiteKat has described what many of us are currently going through…we have suffered harm and yet no one believes it (exactly like a rape victim…YOU must of done something wrong!!) I feel totally betrayed and bewildered since my OMG moment and I still am not back to normal! I was on my husband’s bank account but now he obviously has taken me off of it since he doesn’t want his personal financial information going to the irs and he doesn’t want to risk his money because of penalties due to mistakes in filing. So now I’m nearly 60 years old and basically vulnerable and potentially penniless if he were to decide to divorce. Even if he were to die (hate to say these things…) I would not have access to our joint account until a judge decided on the right to inheritance.

@Maz57

BWAHAAAAAAA! What a phrase!! What a guy!!!

****

For me, the value of this post is to focus on the efforts of the US to make allowances for obvious unfairness in the case of aliens/immigrants with regard to residence and taxation. And the fact that no such allowances are made for citizens. We have:

treaty/tie-breaker rule

substantial presence test

closer connection test

exemption from days toward“substantial presence test

all demonstrating that US policy allows for situations in which:

1. People should NOT be tax residents of more than one nation; and

2. They should be treated as “tax residents” of the country where they actually reside.

There is simply no such attention to citizens. This is clearly punitive.

AND, the ultimate kicker, Cook v Tait demonstrates that either the judge had a screw loose or else, that people cannot read.

4. A citizen is defined as follows: “An individual born in the United States subject to its jurisdiction, of either citizen or alien parents, who has long since moved to a different country and established a domicile there, but who has neither been naturalized in or taken an oath of allegiance to that or any other foreign country, is still a citizen of the United States.”

They can’t have it both ways.

This could be very important in creating a way to “lead” the US to changing this ridiculous policy.

@WhiteKat calgary411 Publius

With regard to the other govts side of the issue; absolutely:

STOP BLAMING THE VICTIM

They do this only to deflect from their spineless concessions to the banks.

In trauma therapy, the first thing a “victim” must learn is to recogize and accept that the source lies outside oneself. IOW, stop blaming oneself. This is key to unlocking the misunderstood bridge between an event and its subsequent effect on one’s psyche and behaviour.

WhiteKat is right in supporting the parallel between slavery and rape. The psychological position is exactly the same. While some people will be “turned off” by the comparison, how else to get people to understand what is really going on? In a similar vein, think of how shocked people were when USCitizenAbroad’s site was called “renounceuscitizenship.” I remember the psychical sensation even, the shock value and the concern that people would turn away from that phrase. And yet, almost 5 years later, this is common, every-day language, even on the Facebook sites where we have folks who are the “Homelander Abroad types more prevalently than we do here. We are regularly seeing people doing the math and/or coming to terms with their emotional response to this attack by the US and more are like Brockers back in 2011-2012. I think it is absolutely necessary to use the language, as shocking as it may seem.

PS: A victim does not get better without making him/herself say, first in one’s own mind and later, outloud in one’s own voice, “I was shot by somebody”, “I was molested by somebody”, “I was forced to be in solitary confinement for xx amount of time”, “they made me torture people”, etc. In fact, one of the main reasons one has to go for therapy is to get help in validating that it actually happened in the first place. One will avoid believing this until a recognition is made between the intolerable situation produced by the event and one’s mental state and then, going for help where someone else will believe the words, say them, and then help the victim learn to do it his/herself. Until that happenes, no one heals.

It brings up another idea that points to the US’ shameful “exceptionalism’ and of which those of us directly molded/patterned on it, should likely wake up from. And that is that the slavery that occured in that country is by no means, the only slavery that ever existed on the face of this earth. All “primitive” aspects of life lose a certain “rawness” as adaption or “civilization” takes place. The idea that we are not whipped or taken away in ships from our families or made to work on plantations does not, for one minute, change the fact that right now, for a citizen to leave the US one HAS TO PAY FOR IT. I don’t know what percentage of wealth a slave had to pay to be free but for normal, everyday people who live paycheck to paycheck and who have little savings, that $2350 USD is considerable. To me, there is no differece here.

To go back to the trauma analogy, the next step would be learning to find “safety.” In some cases, actually physical safety, for others, emotional safety. Establishing boundaries. So, within our own countries, how on earth can this be done when governments simply re-label us as “Americans abiding in Canada (or wherever)?

This is how some dogs are kept from leaving the plantation.

CBT works similarly on people:

@Bubbles,

Yep. Shock em. Make them feel pain. Take away something of value and match it with something to avoid at all costs.

The endless situation of one in power and one who is not.

US citizenship, the shock collar of all citizenships. Only hurts if you leave the plantation.

Boy those Q1 renunciation numbers are late.

@bb

Those things belong on CBT supporters’ private parts.

@Shovel

eeeeewwwwwww burnnnnnnnn

@ Patricia (at 12:29 p.m.) “Cook v Tait demonstrates that either the judge had a screw loose or else, that people cannot read.”

It’s the loose screw. Justice McKenna had suffered a stroke before Cook v Tait.

“McKenna resigned from the Court in January 1925 at the suggestion of Chief Justice William Howard Taft. McKenna’s ability to perform his duties had been diminished significantly by a stroke suffered ten years earlier, and by the end of his tenure McKenna could not be counted on to write coherent opinions.”

https://en.wikipedia.org/wiki/Joseph_McKenna

And McKenna’s written opinion in Cook v Tait is incoherent. His “opinion” there is actually a faulty, muddled rehash of what he (incorrectly) thought Justice White had said in U.S. v Bennett (1914).

http://isaacbrocksociety.ca/2015/05/22/cook-v-tait-26-help-what-does-this-1924-ussupremecourt-decision-really-say/comment-page-3/#comment-6135583

Rape survivors, domestic abuse victims, slaves, runaway slaves, indentured servants, Apartheid township residents, Warsaw ghetto residents, Berlin Wall escapees – even dogs with shock collars. Arguably varying degrees of hyperbole and political incorrectness, but all increasingly valid analogies for the reality of US Persons and the fundamental goal of our efforts: the restoration of our basic human rights and dignity.