NOTE: From Mark Twain’s earlier comment at Brock, re who to contact:

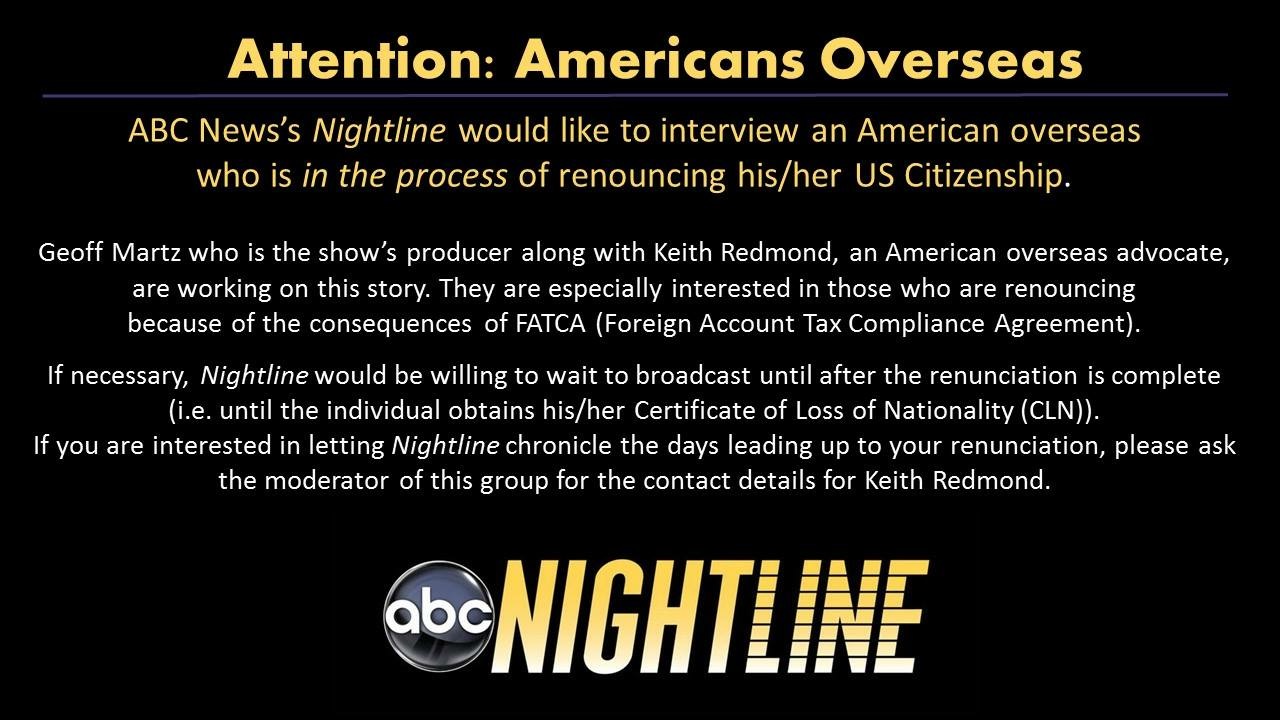

If you are interested in letting Nightline chronicle the days leading up to your renunciation, please contact Geoff Martz at geoff.martz@abc.com or private message Keith to discuss further.

https://www.facebook.com/groups/AmericanExpatriates/523975671101843/?notif_t=group_activity

************

Also passed on to me by email, another notice from Keith Redmond:

FYI from Republicans Overseas: “Ben Carson will host a conference call with Republicans Overseas country chapter leaders worldwide to announce his support for our FATCA lawsuit and FATCA repeal on Oct 30.”

If any person in the process of renunciation is interested in an ABC News Nightline interview opportunity, there is a new post (at which I am commenting).

This could be huge for us….Great exposure. Calgary 411, do I understand correctly that you have already renounced? If so, I wonder if they would still be interested in telling your story even if you already did. I know you may want to respect your privacy, but of all the horrible stories I have heard, yours and your sons is one of the worst. To be trapped with literally nothing your son can do to leave the USA is insane.

OMG. Ben Carson is anti FATCA! ooray ooray ooray ! I wanna watch that tape!!

It’s good Keith’s involved in the evolution of Nighline’s story. He’s very articulate and steadfastly defends Americans abroad, vehemently opposes FATCA and CBT, and to the best of his ability won’t allow for any distortions.

I encourage any one who’s thinking about talking to Geoff Martz to talk to him too.

Yes, Phil, I renounced in November of 2012 and have a CLN to show my *foreign financial institution* that I am indeed only a Canadian (as I only assumed I was from March 25, 1975, when I became a Canadian citizen and was warned I would lose my US citizenship). My renunciation is old news. It appears that Nightline wants current in-progress renunciation stories.

The stories of those like my son who are entrapped into a US-deemed US citizenship (if those who look out for their well-being accept that), unable to renounce due to lack of “requisite mental capacity”, are ongoing as they would be responsible for complex and costly yearly US tax and bank account reporting forever (and beyond). The absurdity of that could be used as an example of the unjust consequences for some of US citizenship-based taxation. Those who would be affected go beyond the developmentally disabled. Lack of capacity to understand* could also apply to those with age-related dementia, Alzheimers, brain damage from an accident or medical event, etc., etc. A parent, a guardian or a trustee cannot act on behalf of such a person even with a court order.

[As stated here often, *the Department of State (DOS) persons have “sympathy” for such cases. However, the developmentally disabled person will have to have FULL understanding of what he’s doing; if any question of lack of comprehension and grasping meaning and importance of ramifications, they could NOT approve such a case. From DOS point of view, US citizenship is precious and they have therefore established fundamental requirements for “compelling reason”. Even though there is the risk that a person’s financial resources could run out before his/her life was over, they will never approve a renunciation for financial / economic reasons. DOS has NEVER had such a renunciation case approved due to “compelling circumstances”. I could sue but persons he talked with at DOS are SURE no one would ever win such a case as the courts view the discretionary action that DOS has would take precedence.]

Good link to whole article (jpg)

https://twitter.com/andygr/status/653439038339334144/photo/1

This is a fantastic opportunity! I hope they find their interviewees quickly! A story like this could be the thing that finally puts us on the map!

Calgary, I think that your son’s story …. IF you are willing to share it with Nightline … is just the sort of horror that might let people understand just how awful this whole thing is.

nervousinvestor, thanks.

As before, my line in the sand all along in interviews with journalists was that it not make the story their story of my son. A few pushed to make it that (about my son); many respected my personal guideline. It is about all such persons as my son — anyone that can be entrapped into a US-deemed US citizenship and all of its consequences. Any law that would entrap someone into US (or any other citizenship) and its consequences, with no way to renounce and escape, among other things, those complex and expensive consequences of yearly compliance,

I am willing to share the story with Nightline as one of the major absurdities of the combination of US CBT and the implementation by IGAs of extra-territorial FATCA law in other countries. It is, for my family and others, a reason we need US RBT over US CBT. It sounds like Nightline’s focus is on those currently in the throes of deciding to and carry out renunciation of their US citizenship. (I don’t even accept that my son has US citizenship.)

How about the Irish girl that was on Phil Hodgen’s website? Someone at the age of 17 renouncing should strike a chord.

That story would be another good one, Don. I am not on Facebook to contact Keith Redmond. Perhaps someone who is could send these suggestions on to him (Facebook link above).

@ nervousinvestor

I think what the Nightline program is looking for is someone who is is about to enter into the process of renouncing, not someone who has already done the deed. My guess is that they want to film the before, during and after events as in “chronicle the days”. If this is the case we need to be reaching out to someone(s) who are not exposed to too much risk (i.e. tax compliant but simply fed up with the complexities and expense of CBT/FBAR/FATCA) and ask them to participate. I know it would be wonderful to see the story of a non-compliant renunciant but that’s asking too much of someone I think. Calgary411 has done more than her share of participating and she really does need to put the safety of her son’s future first.

@ calgary411 says

Messaged Redmond on facebook

https://www.youtube.com/watch?v=8yqLqAlcrrE

http://abcnews.go.com/Entertainment/happened-emily-blunt-us-citizen/story?id=33626044

Who on Earth told Emily Blunt to give up her financial freedom? She claims she did it because of her American born child and husband.

This girl is only 32 years old. What happens if she divorces (not unheard of in Hollywood) and decides she wants to return to the UK?

A picture is worth a thousand words

http://isaacbrocksociety.ca/anti-fatca-publicity-illustrations-clip-art-etc/

Thanks, EmBee. That’s my thinking on what Nightline would want. The absurd entrapment that can also happen would only be an interesting footnote.

I am renouncing in 5 wweks. However, I have been advised against going public and I have a sibling who is still trying to figure out what to do. I do hope Keith does find someone.

It’s a shame the American media is so concentrated on renunciation. I suppose this act is an affront to American exceptionalism and therefore grabs most of the attention. Really! Who would ever toss aside their precious US citizenship? They must be nutters or unloyal or both. So say the homelanders. Meanwhile there are many times more people afflicted with the CBT/FBAR/FATCA scourge who find themselves in an agonizing state of paralysis because it’s too costly to renounce and too costly to not renounce. This is much more than a dollars & cents issue. The unfairness of it all is gut-wrenching. Let’s hope Nightline goes beyond the specific act of renunciation and delves into how the US government created an irrational, overreaching tax system for its diaspora and then doubled down by evoking an unbelievably heavy-handed enforcement mechanism.

You’re right, EmBee, it seems they DO mostly concentrate on just why anyone in their right mind would want to renounce their US citizenship. Several articles that I was interviewed for tended on that slant. Stirs the pot and can get some of the usual ugly comments from those who don’t really read but have their knee-jerk reactions. I’m more than tired of those comments, but I can see how they start. Would be great if the media tried something innovative – like looking at the story through our eyes – COMPLETELY showing the adverse consequences of US CBT for folks who chose to live in other countries. The CBT has to be explained right from the start for many people to be able to recognize the problem.

“(I don’t even accept that my son has US citizenship.)”

Me too, and some US government web pages too. If no one has reported your son’s birth to a US consulate, he isn’t a US citizen yet.

If the IRS reports your son’s birth to the US consulate, your son will be trapped. But he isn’t yet. I don’t know if you can get refunds of your past mistaken payments, but you don’t have to pay more until someone traps him.

“Who would ever toss aside their precious US citizenship? They must be nutters or unloyal or both. So say the homelanders.”

Perhaps someone who has a Facebook account could suggest that the show’s producer read the reasons given by the IRS’s Taxpayer Advocate?

http://www.taxpayeradvocate.irs.gov//userfiles/file/TAS_arc2011_execsummary.pdf

“Analysis

Globalization has driven millions of individual taxpayers and hundreds of thousands of

small and medium-sized businesses to seek economic opportunities abroad. It also has

increased competition among tax administration agencies for tax bases and sources of revenue.

For this reason, 40 economies made it easier to pay taxes last year. However, a recent

World Bank report ranks the United States 66th in the areas of time spent to comply with

tax obligations and 62nd in the ease of paying taxes among 183 countries surveyed. The

complexity of international tax law, combined with the procedural burden on international

taxpayers, creates an environment where honest taxpayers who are trying their best to

comply simply cannot. For some, this means paying more U.S. tax than is legally required,

while others may be subject to steep civil and criminal penalties. Some U.S taxpayers

abroad find the tax requirements so confusing and the burden of complying with them

so great that they give up their U.S. citizenship.”

“Analysis

Many U.S. taxpayers abroad are confused by the complex legal and reporting requirements

they face and are overwhelmed by the prospect of having to comply with them. Some are

even renouncing their U.S. citizenship for that reason; about 4,000 people did so in fiscal

years (FYs) 2005 to 2010. renunciations increased more than tenfold from 146 in FY 2008

to 1,534 in FY 2010, with 1,024 renunciations in the first two quarters of FY 2011 alone.

IRS publication 4732, Federal Tax Information for U.S. Taxpayers Living Abroad, illustrates

the complexity of the filing requirements.”

We get penalized for trying to be honest. We get denied refunds of withholding because we tried to be honest.

When Russian courts issued two verdicts Mikhail Khodorkovsky that contradicted each other, the US president and US secretary of state criticized Russia’s lack of due process. When US courts issued two verdicts against me that contradicted each other, the US government and US courts don’t see anything wrong with their lack of due process.

Russia’s diaspora doesn’t even have to file Russian tax returns; Russia has RBT like all except two countries of the world.

The US is exceptional all right, the US and Eritrea being the two exceptions to the world’s standard.

@EmBee

“This is much more than a dollars & cents issue.”

Renouncing is a dollars and sense issue for the vast majority. It just doesn’t make sense not to if you can.

I think the perfect person would be someone exactly like Marilyn the lawyer who renounced and made the video. They need to find someone like her….very powerful testimony…every time I watch it I cry.

Norman: the amazing thing is how easy it is to simply be dishonest and lie. There are many examples in the US of lying to get tax refunds. Fraud is incredibly easy. But at least criminals give the IRS numbers it wants and likes and can process. What horrifies me is when attempting to comply leads to a nightmare (including your own descriptions).

I have recently advised an aquaintance to stay under the radar. He has a complex financial situation and some wealth. I shudder to think of the field day the compliance condors would have, enrolling him in OVDP or such. Thankfully he has another passport and a non-US birthplace.

@Fred

Only way a person can survive is to do what u are saying… Another good piece of info to give a young person if they are a US person…. get rid of it prior to really making money & saving for the future… having US anything is not an investment… its a noose that can choke u to death… plenty of countries world wide u can make money that will not try to rob u of your worldly goods…. kids in our family…. we no longer gift money for things… we are gifting funds for getting rid of the US person disease…. Never thought I would see the day having a US taint could ruin yrs of hard work and savings…