FYI -01 OCT 2017

I submitted my letter 1 hour late/on Oct 1 and it was accepted. Please keep them coming

In the last few weeks there has been a plethora of posts, comments and articles about tax reform, and whether or not the issues of non-resident Americans have been addressed. There have also been calls for letter-writing campaigns; the response has been disappointing. Many reasons have been suggested as to why more have not contributed to this effort. The prevailing point of view seems to be that it won’t do any good, it’s pointless, etc. Nobody understands this feeling better than those who have spent countless hours working to promote change. Please think about that for one moment. Would it be acceptable for the visibly active people to just decide, “well, this isn’t doing any good so I will just not bother anymore.” The problem with this way of thinking is that it is based only upon an expected result. Of course anyone who is engaged in an effort wants to see their goals reached. But that is rarely what happens in life; anyone who is married or has children well knows the compromise required, the sacrifices that have to be made to make a household run, for children to thrive, for a family to function well in the world. Life is messy, random and confusing.

I think the value of this post lies in it’s recognition that this process is not perfect. It is not predictable down to the nth degree. It is not instant. It is definitely not easy. But without it, there cannot be a result that achieves change. THAT is why your letters are needed. They will pave the way for the shift to begin. There is no substitute for it no matter how well-written a submission is, how many hours someone puts in presenting meetings, etc. What is needed is your signature on a petition and a letter that Solomon and Michael can deliver to the White House on Tuesday. You can even just sign the pre-made letter-what counts here more than anything, is numbers. Crass? Maybe, but it is what it is. There is still time to sign the dotted line on these two items. Please help by doing these two simple things.

If you need inspiration, please read and digest the post below. If you came to the expat movement just recently, you may be unaware of all that has been done. The post speaks to what HAS been accomplished in the last 5 years and what must continue. Giving up on this hideous, painful and expensive situation is simply not an option. We have built a community, a grassroots movement which is making history. We will likely not see another opportunity like this one for a long time. It is so very important not only for our sakes but for our kids and our adopted countries. Please don’t take a back seat now.

NB-In the expanded list, I wish to point out that there is no intention to demean or minimize the groups that existed long before our entrance- ACA, AARO, FAWCO, DA by leaving them out. I was only vaguely aware of their existence prior to my OMG moment and am not familiar enough to outline all they have done. It also would make the post very long. I do believe it is fair to say that our entrance was a game-changer so am focused on that………

cross posted from the Isaac Brock Society

a comment by USCitizenAbroad

@Embee sums it up very well:

I found a quote from J.R.R. Tolkien today which made me dream a little dream of anarchy. I’m sick to death of control, no matter who or what is the purveyor and/or enforcer of it.

“The most improper job of any man is bossing other men. Not one in a million is fit for it, and least of all those who seek the opportunity.”

We can’t just sit back and wish for freedom though. There may only be a slim chance of anything of significance to us coming out of US tax reform but if we don’t push our particular concerns forward in whatever manner is made available to us, slim becomes zero.

Solomon and Michael need petition signatures and letters. I hope they get enough in time.

The comments in this thread have reflected a diverse collection of views. The RO proposal has been severely criticized for various reasons (mostly revolving around the taxation of nonresident aliens). It’s true that the RO proposal has many flaws.

“That said, I think it’s important to recognize in broad terms, that the RO proposal will change the impact of CBT as it currently stands. The proposal is at least a start and that start is described as “Territorial Taxation For Individuals.”

It is possible (and I think advisable) to support the broad principle of changing CBT without necessarily agreeing with every aspect (or any aspect) of the specific RO proposal. Some of you may have read the most recent ACA proposal which does a good and interesting job of explaining what “territorial taxation” (borrowing from the language of the RO proposal) could mean for individuals. (Interestingly what “territorial taxation” COULD mean for individuals is what most of us think of as “residence-based taxation”.)

The Isaac Brock Society began in 2011. Since that time, the following things have happened or are happening. All this would have seemed to be nothing more than a fantasy in 2011.

– 2012 FATCA Forum in Toronto (transcripts & vidweos at this link) While naysayers wrote this off since it did not draw crowds, this meeting brought together a set of people whose influence has been enormous. It paved the way for the testimonies given at the Canadian FINA hearings-setting an example for others, spreading information in spite of the fact our politicians did not/would not listen.

– 2013 submissions to the House Ways and Means Committee

– 2014 Led by Stephen Kish and Lynne Swanson, the Canadian Charter Challenge collects over $18,500 in one week to fund legal opinion for a Charter Challenge to the IGA

– 2014 ACA Debate with Kirsch/Schneider in Toronto on the University of Toronto campus

Announcement

Video

Play-by-Play Reporting from Seminar to Brock Blog

– 2014 -present ADCS FATCA lawsuit in Canada raised nearly $600,000 and is alive and well

– 2014 Human Rights Complaint to the UN

– 2014 – present RO Bopp FATCA lawsuit in the USA

– 2014 Keith Redmond creates the American Expatriates FB group; leads to development of the Accidental American movement in France. Makes many media appearances and begins lobbying US government agencies

– 2015 submissions to Senate Finance Committee

Also here

– 2015 live meeting with staff of Senate Finance Committee in DC

– 2015 –ADCT formed to explore litigation against CBT in US courts

– 2016 Pushback to FATCA grows to more countries:

– 2016 Israeli Knesset postpones passing FATCA until Supreme Court hears case; case the injunction is denied -many links available

here

Background

– 2016 Trinidad & Tobago resistance to signing of IGA

– 2016 formation of Australian group to

Fix the Australia/US Tax Treaty

– 2016 Nigel Green teams up with James Jatras to form #FATCA lobby Fantastic letter to members of

Congress with 25 signatories including Mr. Green and Mr. Jatras, Andrew Mitchell and Grover Norquist

– 2017 FATCA Hearing in DC (Meadows) Description Video

– 2017 Recent testimony in front of the European Parliament

– Open discussion and support of a general lawsuit against CBT in the USA

– although not always popular ACA has run long fight against CBT and a move to RBT

– Democrats Abroad is now “officially” supporting RBT for individuals

– and now (the subject of this thread) the RO initiative to attempt to get “territorial legislation for individuals” in the actual tax proposals for Tax Reform 2017

(and countless blogs, twitter accounts, Facebook groups, individual meetings, etc.)

All of these achievements (and believe each and every one of these things is a HUGE achievement) involved the tireless efforts OF A VERY SMALL GROUPS OF INDIVIDUALS. But, these SMALL GROUPS OF INDIVIDUALS RECEIVED THE WIND IN THEIR SAILS FROM A LARGER GROUP OF PEOPLE WHO SUPPORTED THESE INDIVIDUALS. This support can from encouragement. This support came from small individuals, who did small things, often by writing small letters (see for example: http://fatca.eu.pn). This support came from the willingness to do the small things that are necessary to make the big things possible!

I am not a fan of the U.S. Government. I am not a fan of their tax policies. I am not a fan of their abuse of Americans abroad. But, (for the most part) I don’t think the U.S. Government has been fully (or in some cases) even partially aware of the effects of the combination of their tax and reporting rules. (They don’t even understand these rules let alone how they impact Americans abroad).

A necessary condition to change these laws is to make those involved in Tax Reform:

1. Aware of what these laws are

2. How these laws actually impact Americans abroad

3. Aware that there is significant awareness and opposition to these laws.

On October 2 two members of RO have made it clear that they will be having direct interaction with those who can make a difference in tax reform. They are asking for your support in doing ONE THING. That ONE THING is to write and “support territorial taxation for individuals”. You don’t have to support their specific proposal to support “territorial taxation for individuals” (which in its most basic terms is a move away from CBT). The purpose of the exercise is to make it clear (awareness point 3) that the current tax policies are a problem. Without this awareness NOTHING is possible.

Even with the awareness, change will be difficult. Change will involved compromises. Change will be time consuming and frustrating. Unfortunately, that’s what the democratic process is about. You/we have lived with the problems of CBT. The lawmakers don’t even know that that CBT exists (let alone the problems). For RO to be able to personally deliver these letters could be a huge step in educating the lawmakers. It’s NOT that the lawmakers are supportive of CBT. The lawmakers don’t even know that CBT exists. On this point, think of Rep Connolly in the FATCA hearings where he said something to the effect that: “All countries tax their citizens” (obviously equating citizens with residents).

I am NOT defending the behavior of U.S. law makers or the administration (few have been more critical than I have been and continue to be). I am simply trying to argue that change will require education. Education will require engagement. Engagement requires personal interaction.

Your sending a letter and/or signing the petition will help RO achieve the personal interaction that they need to engage and educate. If you care about this issue at all, then you must participate.

I don’t believe that the mere fact of sending letters or signing petitions will make a difference. But, I do believe that WITHOUT YOUR EFFORTS and support that NO CHANGE IS POSSIBLE. “Therefore, you are really deciding whether you want to act in a way that makes change possible or to act in a way that makes change impossible.”It’s your choice. This is NOT about supporting a specific proposal. “This is about behaving in a way that opens the door to discussion about change.”

If it matters, I am not a Republican. I am not a Democrat. To the extent that I am political, I would be an independent. I am not primarily a U.S. citizen. So, these comments are not partisan. But, I am deeply committed to the struggle to getting these unjust laws changed. Furthermore, I believe that change can happen ONLY if all those affected create a united front in opposition to CBT. It is the opposition to CBT that unites ALL Americans abroad.

It’s very simple really. Where laws are made through a democratic process: If you don’t make your view known you can’t expect change.

Your participation may or may not make a difference. But, your NONPARTICIPATION will make a difference because it will ensure that no change will happen.

The lack of response to the request for letters makes it clear that Americans abroad are NOT willing to support this important move towards the abolition of CBT. Why not? You don’t have to support every aspect of the RO proposal to support this RO initiative.

This is not a political issue! It is a human rights issue that can be remedied through the political process!

Me personally I have given up. I just need to get my money out of the UK in a couple of years when I hit 55. Nothing else seems to have any hope of working.

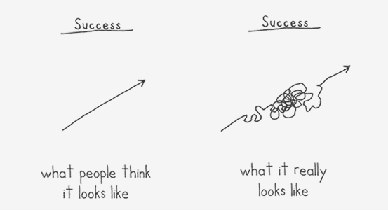

I like the illustration and the reminder. Life isn’t usually lived in a straight line. We often have to find our way around and over and under a myriad of obstacles.

As USCitizenAbroad reminded us from the beginning, (and I paraphrase) it’s a “marathon, not a sprint…..”.

Well said Patricia. Maybe those who feel hopeless about this insanity ever changing can find some inspiration from these Howard Zinn quotes:

“TO BE HOPEFUL in bad times is not just foolishly romantic. It is based on the fact that human history is a history not only of cruelty, but also of compassion, sacrifice, courage, kindness.

What we choose to emphasize in this complex history will determine our lives. If we see only the worst, it destroys our capacity to do something. If we remember those times and places—and there are so many—where people have behaved magnificently, this gives us the energy to act, and at least the possibility of sending this spinning top of a world in a different direction.

And if we do act, in however small a way, we don’t have to wait for some grand utopian future. The future is an infinite succession of presents, and to live now as we think human beings should live, in defiance of all that is bad around us, is itself a marvelous victory.”

“We don’t have to engage in grand, heroic actions to participate in the process of change. Small acts, when multiplied by millions of people, can transform the world.”

“The challenge remains. On the other side are formidable forces: money, political power, the major media. On our side are the people of the world and a power greater than money or weapons: the truth.

Truth has a power of its own. Art has a power of its own. That age-old lesson – that everything we do matters – is the meaning of the people’s struggle here in the United States and everywhere. A poem can inspire a movement. A pamphlet can spark a revolution. Civil disobedience can arouse people and provoke us to think, when we organize with one another, when we get involved, when we stand up and speak out together, we can create a power no government can suppress. We live in a beautiful country. But people who have no respect for human life, freedom, or justice have taken it over. It is now up to all of us to take it back.”

“Pessimism becomes a self-fulfilling prophecy; it reproduces itself by crippling our willingness to act.”

“There is a power that can be created out of pent-up indignation, courage, and the inspiration of a common cause, and that if enough people put their minds and bodies into that cause, they can win. It is a phenomenon recorded again and against in the history of popular movements against injustice all over the world.”

“Surely, if it is the right of the people to “alter or abolish,” it is their right to criticize, even severely, policies they believe destructive of the ends for which government has been established. This principle, in the Declaration of Independence, suggests that true patriotism lies in supporting the values the country is supposed to cherish: equality, life, liberty, the pursuit of happiness. When our government compromises, undermines, or attacks those values, it is being unpatriotic.”

“Very important thing to keep in mind, that when justice comes and when injustices are remedied, they’re not remedied by the initiative of the national government or the politicians. They only respond to the power of social movements.”

“There is no act too small, no act too bold. The history of social change is the history of millions of actions, small and large, coming together at critical points to create a power that governments cannot suppress.”

“Civil disobedience is not our problem. Our problem is civil obedience.”

“We’ve never had our injustices rectified from the top, from the president or Congress, or the Supreme Court, no matter what we learned in junior high school about how we have three branches of government, and we have checks and balances, and what a lovely system. No. The changes, important changes that we’ve had in history, have not come from those three branches of government. They have reacted to social movements.”

“The struggle for justice should never be abandoned because of the apparent overwhelming power of those who seem invincible in their determination to hold on to it. That apparent power has, again and again, proved vulnerable to human qualities less measurable than bombs and dollars: moral fervor, determination, unity, organization, sacrifice, wit, ingenuity, courage, patience.”

Patricia: Beautifully said and I LOVE the diagram of the road to success! How true it is!

Mr. A, thank you for those marvelous quotes. They will encourage and sustain us.

If “naysayers” had prevailed over the course of history we’d all still be back in the cave. They didn’t and we’re not! Sooner or later, the victory is ours.

I’m pleased to see USCA’s comment featured in a post and I love the success doodle, Tricia. Amazing what a few lines on a piece of paper can convey. And Mr. A., those quotes are so helpful … thank you. My favourite is this:

Never, never forget that our cause is just. Sir Isaac Brock still inspires me with his call to “Surgite!” because “Press on!” is the ONLY option after all the effort that has been put into advancing our cause to date.

Thank you all, for your kind comments. They are much appreciated!

I love the Quotes Mr. A. Keith suggested I read the Peoples’ History which I have only managed to get through a few chapters. My sense is that Howard Zinn has the right balance between expectation of what the US should be while being aware of things that need changing. Very inspiring!

Yes, EmBee Surgite!

That’s a very good post, Patricia, and you ask the questions I’ve been asking in my time here in Japan. All of the things you mentioned are true here: people are either unaware or they don’t see how it effects them. I would add another one to the list: individual strategies for getting around CBT and FATCA. People who have been successful at staying out of the net sure aren’t going to call attention to themselves and join the movement against CBT.

Back to the lack of awareness. Several things make it difficult to address the problem. After 3 years I am unable to point to an “American” organization here through which any program of education and awareness could be successfully implemented. And (a pet peeve of mine) as far as I can tell there are no ACA or AARO membership drives here and I’ve have yet to meet one American in Japan who even knew that those organizations existed. Reaching people means finding organizations – ones that have some Americans as members – that have other purposes, such as groups that organize English teachers or writers here. Another issue is that your message is going to compete with other concerns and priorities that may be more immediately relevant to them like housing or employment discrimination. And last issue is that I find a strong aversion to anything that smacks of American politics. They don’t want to hear about Repubs or Dem or anything that has to do with the American government.

That’s a synopsis of what I see here. That said, it’s doable but it needs a lot of effort. I have consistently brought this up with AARO: Why am I paying dues when I get newsletters about events I can’t attend and I see zero attention paid to the lives and interests of members who don’t live in Europe or North America?

Maybe the larger problem is one of legitimacy and trust. Until there is an effort to reach and persuade them, we can’t just expect them to trust us and agree to be part of a collective movement.

That’s my .02. I would be interested in hearing if the same issues I see in Japan apply in other countries.

Simply put, for US expats there is no reward for tax compliance and no punishment for non-compliance.

I know a long-term expat who doesn’t file, and comes and goes to the US as she pleases without any problems. The only ones who seem to be suffering are those who comply, and complying is a form of acceptance, unfortunately.

“Simply put, for US expats there is no reward for tax compliance and no punishment for non-compliance.”

There’s no punishment for non-compliance when pursuing the non-complier is not cost-effective for the IRS; which is usually the case for taxpayers living beyond the US borders. If they could punish us all, they surely would.

“The only ones who seem to be suffering are those who comply”

Yes – because the way a US expat taxpayer complies is by giving the IRS the information that makes it cheap and easy to punish him if he doesn’t comply. Sending them the bullets, as Phil Hodgen once said.

“complying is a form of acceptance, unfortunately.”

Complying with unfair laws may simply signify a desire to respect the rule of law.

There is a difference between “rule of law” and “rule by law”.

The phrase “rule of law” suggests a basic fairness in the system of laws – a way of ordering society that is not fundamentally (although far from perfect) unfair.

The phrase “rule by law” suggests a system where law is a system of control, unfairness, etc. This is where the USA stands today.

“The phrase “rule of law” suggests a basic fairness in the system of laws – a way of ordering society that is not fundamentally (although far from perfect) unfair.”

That may be how you see it, but others may have different views. Compliance does not necessarily imply acceptance or approval or a view that CBT is fair.

My husband and I have been compliant for 30+ years living outside the USA, including filing our FBARs since day 1. We felt no sense of threat when we started. We simply wanted to be law abiding. We didn’t have meaningless, semantic arguments over “rule of law” versus “rule by law”. It was simply the law. We never used an accountant. The whole system was annoying and time consuming, and we resented having to do it. But it didn’t wreck our lives.

Then came the OMG moment, and FATCA, and being shut out of investments and business opportunities, and the newly-found nightmares and sleepless months, worrying about ruinous penalties over minor form crimes. And now, as everyone at this forum agrees, people like us are the ones most likely to be screwed. And there’s no good way out.

Though we are making moves toward obtaining another citizenship, it is not the citizenship of our country of residence, and frankly, it’s not a citizenship that would ever attract us under other circumstances. And doing so will cost us our life savings–invested in property, so the money isn’t lost, but still, it’s tied up for at least five years in an investment we would not have otherwise made. Which makes us stop and wonder if we are being fools. Wouldn’t it be easier to just stop filing at all, or is it way too late to drop off the radar?

Rule of law or rule by law, our compliance until now sure isn’t about acceptance. Semantic arguments about these things truly irritate me. As though I should feel apologetic for having been compliant all these years.

Barbara: “…is it way too late to drop off the radar?”

If the proposal to double the standard deduction goes through, that might be a good time to stop filing. It might be hard to distinguish between those who have stopped filing because they’re below the new threshold, and those who have just decided enough is enough. And the IRS has discontinued (for the time being) the Automatic Substitute Return thing.

https://www.taxanalysts.org/content/irs-pauses-automated-substitute-return-case-selection

Victoria: Good to see you here! I’m curious about your analysis of the American situation in Japan because we’ve been hearing quite a different take on it from Japan T. His comments seem to indicate that banking and just plain living under FATCA is truly a disaster for Americans in Japan and I’m very surprised to learn that there seems to be very little concern about it in the community as a whole. Anything we can do here to help?

My reason for complying in the first place was to be able to cleanly extricate myself from the system when I renounce US citizenship.

That was six years ago. All this talk of getting rid of CBT has ruined my escape plans.

Hope is a double edge sword.

@MuzzledNoMore, Good to be here! I always read Brock but haven’t had much to add to the conversation. But then I read the post by the lovely and eloquent Patricia and thought I would throw in my .02. And vent a little because I’ve found the situation in Japan to be frustrating. Are there banking issues and the like due to FATCA? Have people suffered under CBT here. Yes. But for all the reasons I mentioned I’m not seeing mass outrage or any sort of solidarity or a desire to get out there and do something about it. It’s every individual for himself. That’s what I see. I’d love to hear Japan T’s take on it.

Victoria: I can’t imagine how anyone can manage their situations, purely from the sanity standpoint, without getting involved in a community like this one. The day I found Brock with all its links to the resources that were out there (including your blog!) was the day I began my long road away from the brink of despair. It didn’t change my situation but the “society” has enriched me with knowledge and the courage to stand my ground. There were some IBS business cards and hand-out materials put together some years ago. I wonder if the keeper of those (Patricia?) might be able to send you some.

Japan T has commented on many other threads. I hope he’s reading this and will be in touch here. Thanks again for adding your “0.02”! It’s always worth much more than that!

@ MuzzledNoMore, Victoria, all,

Here’s the Brock business cards.

http://isaacbrocksociety.ca/wp-content/uploads/2013/06/Brock-business-card.-2.jpg

You can also get to them through the Sidebar under Take Action, Anti-FATCA/CBT Publicity and Protest Materials.

I keep a couple in my wallet to hand someone in case the situation arises, and sometimes leave a few at coffee shops and stick them in library books on US tax.

@Victoria,

I wrote a comment in response on Sunday but it appears to be floating in the cyber ether.

I enjoyed and appreciate your delightful comments. You have added a dimension which I think is important to address. USCA’s comment & my additions were directed toward the US government; i.e., we need to make them aware, to educate them and not assume the process is pointless.

That said, it is obviously true that there are still many who either don’t know at all or don’t know much and/or are badly informed. A new paper by Prof Wm Byrnes indicates some interesting figures. For 2014, there were 8.5 million tax returns that included either FEIE or FTC.Of course this includes Homelanders with foreign income. In contrast to that, there were 1.1 million FBARS filed and only 300,000 8938s. So it appears a large majority of expats are still not filing but it is unknown whether they are aware or not. On a side note, this is very significant when viewed from the focus of the paper-which discusses the real effects of FATCA not the least of which, has produced “statistically insignificant amounts of annual tax.” Neither the UBS turnover issue nor FATCA has increased by a large margin, the filing of tax returns.

I think your point about legitimacy and trust is 100% on the mark. People seem to be, in my experience, one of two extremes. They either completely freak out if you tell them OR they totally reject what is communicated, often to the point of “Well that is simply NOT true.” (I know a few people who have decided it is immoral to bring such anxiety into their lives when they are likely better off not filing). It is easy to understand why as resistance tends to emphasize non-compliance and renunciation as definite choices and people think that the first is illegal and the second, unthinkable.We really have to work on challenging the notion that U.S. law can take precedence when one is living and/or an actual citizen of another country. This is difficult. .

As far as any organizations functioning here locally, I am only aware of one chapter of Republicans Overseas and one for Democrats Abroad. I know there are none for ACA, and presume none for AARO or FAWCO (by now, I would assume we would have heard something if they were). The only resources available that I am aware of are Brock, the FB pages etc. And I suspect a lot of the Americans resident in Toronto and Canada in general, are likely different from us-i.e., higher earners and less likely to come forward to resist or comply. Dewees would be a good example. There are many university professors in Canada that are from the U.S. There has been off-again/on-again newspaper coverage-(more would be better) but it was how I (and many others) came to know of this situation.When I made contact with the large U.S Expat Meetup Group here, I realized they were not receptive to our message. A lot of them either were already compliant or they did not question the need to become so. They certainly reacted as if “renunciation” were a dirty word. I also had an extremely unpleasant exchange with a DA member from out West who had asked me to promote the election. I tried to diffuse the expectation by pointing out the majority of us were either already not US citizens or were but would not vote for a variety of reasons. I pointed out that Canada was quite different from the US etc and I got quite an earful about how Canada was basically controlled by the US and so on. This person had been in Canada for 8 years and was active in promoting Canadian issues yet had that exceptionalist axis intact. The crowning “tell” was her exasperated judgement, “All you have to do is give the tiniest s**t.” I would be hesitant to approach another “US oriented” group for those reasons. We tried doing posters and such and cheap advertising for meetings but there are not enough of us here willing to do that so it is not a real resource. And your point about the political turn-off-absolutely the same here (even on Brock and Sandbox). Especially now, with Trump, who I think it would be fair to say, appears to many Canadians (not all mind you) to be a buffoon and dangerous. The Canadian psyche is simply not geared toward accepting him or even how it came to be that he would even be a candidate.

I am curious if you can estimate how many U.S. expats are in Japan? And how is your degree going? Are you still back and forth between Japan & Brussels?

@Bubbles and All

I think a case can be made that the comment “those who seem to be suffering the most are those who comply” has a specific context to consider. Suffering refers to contact with the IRS, parting with money etc. But there is still a suffering for those who do not comply because they cannot and that is the never ending worry that this nightmare could get worse, will never end, exposure could financially ruin them etc. Some people cannot put aside such worries even if there are others who do not take action and are comfortable crossing the border, etc.

I agree. I was able to renounce, and did. If I had had to stay under the radar I think it would have made me permanently sick with rage – another kind of suffering.

““Simply put, for US expats there is no reward for tax compliance and no punishment for non-compliance.”

There’s no punishment for non-compliance when pursuing the non-complier is not cost-effective for the IRS; which is usually the case for taxpayers living beyond the US borders. If they could punish us all, they surely would.

“The only ones who seem to be suffering are those who comply”

Yes – because the way a US expat taxpayer complies is by giving the IRS the information that makes it cheap and easy to punish him if he doesn’t comply. Sending them the bullets, as Phil Hodgen once said.”

Not true. To renew my passport and remain with my family, I was coerced into giving this information. Further, my banks are providing the IRS with the information.

Not complying with the requirements of my passport renewal application would mean losing my family. Not complying with my bank’s “requests” means dying in the street. And NO, that is NOT hyperboyle.

“Semantic arguments about these things truly irritate me. As though I should feel apologetic for having been compliant all these years.”

We are damned if we do, damned if we don’t. Though I have never been made to feel as if I should be apologetic for complying back when I did, I can asure you I get no sympathy for no longer complying. Indeed, I get the “you do the crime, you do the time” lecture.

And yet, here many do chide those who do or did comply.

Each of us is on the wrong side of one or the other.

First, I should be grading tests now and then homework and then…

Boy, Victoria, I wish I could change coworkers. My esteemed collegues can not stop talking about US poilitics regardles of nationality! Be for the latest presidentil election greeting went as follows; Me: “Good morning.”

Any non JN coworker: “Did you here what F’n Obama did!?” or “Did you here what those F’n Repubtards are trying to do!?”.

After the election they reply to my morning greeting with “Did you hear what F’n Trump did!?” or the same comment about the republicans sans Trump.