FYI -01 OCT 2017

I submitted my letter 1 hour late/on Oct 1 and it was accepted. Please keep them coming

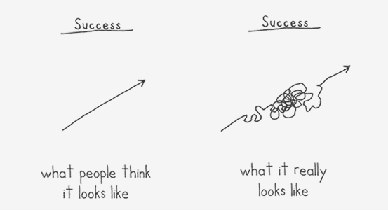

In the last few weeks there has been a plethora of posts, comments and articles about tax reform, and whether or not the issues of non-resident Americans have been addressed. There have also been calls for letter-writing campaigns; the response has been disappointing. Many reasons have been suggested as to why more have not contributed to this effort. The prevailing point of view seems to be that it won’t do any good, it’s pointless, etc. Nobody understands this feeling better than those who have spent countless hours working to promote change. Please think about that for one moment. Would it be acceptable for the visibly active people to just decide, “well, this isn’t doing any good so I will just not bother anymore.” The problem with this way of thinking is that it is based only upon an expected result. Of course anyone who is engaged in an effort wants to see their goals reached. But that is rarely what happens in life; anyone who is married or has children well knows the compromise required, the sacrifices that have to be made to make a household run, for children to thrive, for a family to function well in the world. Life is messy, random and confusing.

I think the value of this post lies in it’s recognition that this process is not perfect. It is not predictable down to the nth degree. It is not instant. It is definitely not easy. But without it, there cannot be a result that achieves change. THAT is why your letters are needed. They will pave the way for the shift to begin. There is no substitute for it no matter how well-written a submission is, how many hours someone puts in presenting meetings, etc. What is needed is your signature on a petition and a letter that Solomon and Michael can deliver to the White House on Tuesday. You can even just sign the pre-made letter-what counts here more than anything, is numbers. Crass? Maybe, but it is what it is. There is still time to sign the dotted line on these two items. Please help by doing these two simple things.

If you need inspiration, please read and digest the post below. If you came to the expat movement just recently, you may be unaware of all that has been done. The post speaks to what HAS been accomplished in the last 5 years and what must continue. Giving up on this hideous, painful and expensive situation is simply not an option. We have built a community, a grassroots movement which is making history. We will likely not see another opportunity like this one for a long time. It is so very important not only for our sakes but for our kids and our adopted countries. Please don’t take a back seat now.

NB-In the expanded list, I wish to point out that there is no intention to demean or minimize the groups that existed long before our entrance- ACA, AARO, FAWCO, DA by leaving them out. I was only vaguely aware of their existence prior to my OMG moment and am not familiar enough to outline all they have done. It also would make the post very long. I do believe it is fair to say that our entrance was a game-changer so am focused on that………

cross posted from the Isaac Brock Society

a comment by USCitizenAbroad

@Embee sums it up very well:

I found a quote from J.R.R. Tolkien today which made me dream a little dream of anarchy. I’m sick to death of control, no matter who or what is the purveyor and/or enforcer of it.

“The most improper job of any man is bossing other men. Not one in a million is fit for it, and least of all those who seek the opportunity.”

We can’t just sit back and wish for freedom though. There may only be a slim chance of anything of significance to us coming out of US tax reform but if we don’t push our particular concerns forward in whatever manner is made available to us, slim becomes zero.

Solomon and Michael need petition signatures and letters. I hope they get enough in time.

The comments in this thread have reflected a diverse collection of views. The RO proposal has been severely criticized for various reasons (mostly revolving around the taxation of nonresident aliens). It’s true that the RO proposal has many flaws.

“That said, I think it’s important to recognize in broad terms, that the RO proposal will change the impact of CBT as it currently stands. The proposal is at least a start and that start is described as “Territorial Taxation For Individuals.”

It is possible (and I think advisable) to support the broad principle of changing CBT without necessarily agreeing with every aspect (or any aspect) of the specific RO proposal. Some of you may have read the most recent ACA proposal which does a good and interesting job of explaining what “territorial taxation” (borrowing from the language of the RO proposal) could mean for individuals. (Interestingly what “territorial taxation” COULD mean for individuals is what most of us think of as “residence-based taxation”.)

The Isaac Brock Society began in 2011. Since that time, the following things have happened or are happening. All this would have seemed to be nothing more than a fantasy in 2011.

– 2012 FATCA Forum in Toronto (transcripts & vidweos at this link) While naysayers wrote this off since it did not draw crowds, this meeting brought together a set of people whose influence has been enormous. It paved the way for the testimonies given at the Canadian FINA hearings-setting an example for others, spreading information in spite of the fact our politicians did not/would not listen.

– 2013 submissions to the House Ways and Means Committee

– 2014 Led by Stephen Kish and Lynne Swanson, the Canadian Charter Challenge collects over $18,500 in one week to fund legal opinion for a Charter Challenge to the IGA

– 2014 ACA Debate with Kirsch/Schneider in Toronto on the University of Toronto campus

Announcement

Video

Play-by-Play Reporting from Seminar to Brock Blog

– 2014 -present ADCS FATCA lawsuit in Canada raised nearly $600,000 and is alive and well

– 2014 Human Rights Complaint to the UN

– 2014 – present RO Bopp FATCA lawsuit in the USA

– 2014 Keith Redmond creates the American Expatriates FB group; leads to development of the Accidental American movement in France. Makes many media appearances and begins lobbying US government agencies

– 2015 submissions to Senate Finance Committee

Also here

– 2015 live meeting with staff of Senate Finance Committee in DC

– 2015 –ADCT formed to explore litigation against CBT in US courts

– 2016 Pushback to FATCA grows to more countries:

– 2016 Israeli Knesset postpones passing FATCA until Supreme Court hears case; case the injunction is denied -many links available

here

Background

– 2016 Trinidad & Tobago resistance to signing of IGA

– 2016 formation of Australian group to

Fix the Australia/US Tax Treaty

– 2016 Nigel Green teams up with James Jatras to form #FATCA lobby Fantastic letter to members of

Congress with 25 signatories including Mr. Green and Mr. Jatras, Andrew Mitchell and Grover Norquist

– 2017 FATCA Hearing in DC (Meadows) Description Video

– 2017 Recent testimony in front of the European Parliament

– Open discussion and support of a general lawsuit against CBT in the USA

– although not always popular ACA has run long fight against CBT and a move to RBT

– Democrats Abroad is now “officially” supporting RBT for individuals

– and now (the subject of this thread) the RO initiative to attempt to get “territorial legislation for individuals” in the actual tax proposals for Tax Reform 2017

(and countless blogs, twitter accounts, Facebook groups, individual meetings, etc.)

All of these achievements (and believe each and every one of these things is a HUGE achievement) involved the tireless efforts OF A VERY SMALL GROUPS OF INDIVIDUALS. But, these SMALL GROUPS OF INDIVIDUALS RECEIVED THE WIND IN THEIR SAILS FROM A LARGER GROUP OF PEOPLE WHO SUPPORTED THESE INDIVIDUALS. This support can from encouragement. This support came from small individuals, who did small things, often by writing small letters (see for example: http://fatca.eu.pn). This support came from the willingness to do the small things that are necessary to make the big things possible!

I am not a fan of the U.S. Government. I am not a fan of their tax policies. I am not a fan of their abuse of Americans abroad. But, (for the most part) I don’t think the U.S. Government has been fully (or in some cases) even partially aware of the effects of the combination of their tax and reporting rules. (They don’t even understand these rules let alone how they impact Americans abroad).

A necessary condition to change these laws is to make those involved in Tax Reform:

1. Aware of what these laws are

2. How these laws actually impact Americans abroad

3. Aware that there is significant awareness and opposition to these laws.

On October 2 two members of RO have made it clear that they will be having direct interaction with those who can make a difference in tax reform. They are asking for your support in doing ONE THING. That ONE THING is to write and “support territorial taxation for individuals”. You don’t have to support their specific proposal to support “territorial taxation for individuals” (which in its most basic terms is a move away from CBT). The purpose of the exercise is to make it clear (awareness point 3) that the current tax policies are a problem. Without this awareness NOTHING is possible.

Even with the awareness, change will be difficult. Change will involved compromises. Change will be time consuming and frustrating. Unfortunately, that’s what the democratic process is about. You/we have lived with the problems of CBT. The lawmakers don’t even know that that CBT exists (let alone the problems). For RO to be able to personally deliver these letters could be a huge step in educating the lawmakers. It’s NOT that the lawmakers are supportive of CBT. The lawmakers don’t even know that CBT exists. On this point, think of Rep Connolly in the FATCA hearings where he said something to the effect that: “All countries tax their citizens” (obviously equating citizens with residents).

I am NOT defending the behavior of U.S. law makers or the administration (few have been more critical than I have been and continue to be). I am simply trying to argue that change will require education. Education will require engagement. Engagement requires personal interaction.

Your sending a letter and/or signing the petition will help RO achieve the personal interaction that they need to engage and educate. If you care about this issue at all, then you must participate.

I don’t believe that the mere fact of sending letters or signing petitions will make a difference. But, I do believe that WITHOUT YOUR EFFORTS and support that NO CHANGE IS POSSIBLE. “Therefore, you are really deciding whether you want to act in a way that makes change possible or to act in a way that makes change impossible.”It’s your choice. This is NOT about supporting a specific proposal. “This is about behaving in a way that opens the door to discussion about change.”

If it matters, I am not a Republican. I am not a Democrat. To the extent that I am political, I would be an independent. I am not primarily a U.S. citizen. So, these comments are not partisan. But, I am deeply committed to the struggle to getting these unjust laws changed. Furthermore, I believe that change can happen ONLY if all those affected create a united front in opposition to CBT. It is the opposition to CBT that unites ALL Americans abroad.

It’s very simple really. Where laws are made through a democratic process: If you don’t make your view known you can’t expect change.

Your participation may or may not make a difference. But, your NONPARTICIPATION will make a difference because it will ensure that no change will happen.

The lack of response to the request for letters makes it clear that Americans abroad are NOT willing to support this important move towards the abolition of CBT. Why not? You don’t have to support every aspect of the RO proposal to support this RO initiative.

This is not a political issue! It is a human rights issue that can be remedied through the political process!

How do they react to FATCA? They do not know and they do not want to know and they get irate when I try to educate them about it.

I have told around twenty, maybe even more, about IBS and as far as I can tell, not a single USC has taken a look. At least one of my British friends has, but I think he is the only one.

They either believe that filing taxes alone is enough as it sounds (in their minds) like it covers the FBAR requirements, or believe that US law stos at th border and if it doesn’t, so what? we are in Japan. Others get angry at the idea that the US could get any info on them from their banks and call me “paranoid” and the like for suggesting it could happen.

I have tried to give copies of the passport renewal application I had to fill out to show what was at that time required. Only one even looked at it. After reading it, it said I had a point but then added, “What’s the worse that’s going to happen?”. He got very angry when I told him our banks will be reporting all data they have on us to the US. He called me paranoid for thinking that US law could be enforced in Japan. He is a USC working at the Embassy here in Tokyo. I’d love to see his reaction to the FATCA letter my bank gave me recently.

They ignore me when I try to tell them about the passport revocation law or say that a $50,000 tax burden while living in Japan is too high to worry about. They, by there own admission, do not know nor care to know that this amount includes fines. Nor do they want to consider how they might lose their passport if someone is running up tax bills in their name via ID theft. They just don’t want to know.

Many believe that they do not need to file if they earn below the FEIE theshold and will not listen to anything about US taxes in the firm belief that they do not owe anything and thus need not file. I was once a member of this group, myself.

As we, my coworkers and myself, are involved in sending students and other employees overseas, I believe it is important that we all know the dangers we are putting these people into by sending them to the US. Yet no one wants to know.

The Japanese are much more open minded on this issue. I have convinced several to not study or take positions in the US. They do not like the idea of their bank sending their financial information to the US, especially after they return.

“On a side note, this is very significant when viewed from the focus of the paper-which discusses the real effects of FATCA not the least of which, has produced “statistically insignificant amounts of annual tax.” Neither the UBS turnover issue nor FATCA has increased by a large margin, the filing of tax returns.”

Not the first time this fact has come up. Yet, people keep saying we are safe because the RoI for persuing us would be so low. I have yet to see any proof that RoI even plays a role in all this and much evidence that it does not.

“Simply put, for US expats there is no reward for tax compliance and no punishment for non-compliance.

I know a long-term expat who doesn’t file, and comes and goes to the US as she pleases without any problems. The only ones who seem to be suffering are those who comply, and complying is a form of acceptance, unfortunately.

I think a case can be made that the comment “those who seem to be suffering the most are those who comply” has a specific context to consider. Suffering refers to contact with the IRS, parting with money etc. But there is still a suffering for those who do not comply because they cannot and that is the never ending worry that this nightmare could get worse, will never end, exposure could financially ruin them etc. Some people cannot put aside such worries even if there are others who do not take action and are comfortable crossing the border, etc.”

Thank you.

Patricia, Yep, there is a lot of denial. We are the buzz killers par excellence. Here they are having THE experience of their lives with its hardship and joys and then someone like me mentions something like CBT or FATCA. Its either a huge ugly unwanted surprise or they’ve actually known for some time and took measures long before FATCA became a reality.

There are reported to be about 50,000 Americans residing in Japan. I think there are more because so many come on short-term teaching contracts or as students (like my daughter).

I am done! (Thanks for asking God, was it tough. I got through the coursework and spent months organizing and doing fieldwork. Writing it up took many more months. I submitted my MA thesis and I got a very good mark (Distinction) and it was accepted. (Happy to share a copy if anyone is interested – it is a study of Anglophone Migrants in Japan (Americans, Canadians, Brits, Irish, Australians and New Zealanders.) I will be formally graduating this November in Canterbury Cathedral in the UK. Cap and gown and whole shebang.

God, was it tough. I got through the coursework and spent months organizing and doing fieldwork. Writing it up took many more months. I submitted my MA thesis and I got a very good mark (Distinction) and it was accepted. (Happy to share a copy if anyone is interested – it is a study of Anglophone Migrants in Japan (Americans, Canadians, Brits, Irish, Australians and New Zealanders.) I will be formally graduating this November in Canterbury Cathedral in the UK. Cap and gown and whole shebang.

Victoria,

Congratulations on completing your thesis!

It is true, unfortunately. The IRS, like any tax agency, needs exact and detailed information about a taxpayer’s finances in order to assess tax owed. It’s difficult to get that information about people living in another country; but if the person complies, whether voluntarily or out of necessity or out of fear, the IRS gets the ammunition it needs to assess. That’s the reason for the threats of terrifying, life-destroying penalties.

“And yet, here many do chide those who do or did comply.”

Some of us chide ourselves because we used to comply. We didn’t know any better. Idiots.

Well, the info I had to supply for my passport is FAR less than my bank is suppling. But by “comply” what are we talking about here? I have not filed a US tax return in over ten years, I am not complying with the IRS. But I had to comply with the State dept and my local bank.

““And yet, here many do chide those who do or did comply.”

Some of us chide ourselves because we used to comply. We didn’t know any better. Idiots.”

I’m not sure if I should chide myself for complying way back when or for not complying now, as with my bank repoerting me via FATCA, I will eventually get hauled in when the net is brought on board.

There is reason to be optimistic as the pushback is slowly spreading, ex. see this from France, where a legal application against FATCA was just filed this week;

http://www.notretemps.com/argent/un-collectif-de-franco-americains-afp-201710,i151862.

….. “Unjust laws exist; shall we be content to obey them, or shall we endeavor to amend them, and obey them until we have succeeded, or shall we transgress them at once? Men generally, under such a government as this, think that they ought to wait until they have persuaded the majority to alter them. They think that, if they should resist, the remedy would be worse than the evil. But it is the fault of the government itself that the remedy is worse than the evil. It makes it worse. Why is it not more apt to anticipate and provide for reform? Why does it not cherish its wise minority? Why does it cry and resist before it is hurt? Why does it not encourage its citizens to be on the alert to point out its faults, and do better than it would have them?…….”

― Henry David Thoreau, Civil Disobedience and Other Essays

https://books.google.ca/books?id=Kk9FDQAAQBAJ&lpg=PP1&dq=Civil%20Disobedience&pg=PA44#v=onepage&q=Unjust%20laws%20exist;%20shall%20we%20be%20content%20to%20obey%20them&f=false

The continued willful recalcitrance and willful blindness of the US government and the actions of two subsequent Canadian governments (the Cons and now the Glibs) in aiding and abetting the injustices imposed extraterritorially by a foreign government makes me question unquestioning respect for laws.

Busy morning here but a quick reply to Pacifica: Thanks for the link to those business cards! I should have known they were available right here but it’s good that the subject’s come up for new readers who might not know about them.

Good to see you here, Japan T! Thanks for commenting about the Japan situation. On just a brief reading it sounds to me like the reaction you’re getting from other Americans in Japan is more similar to Victoria’s than I’d realized. I’ll read in greater detail later when I can sit and concentrate on it properly.

My apologies for sounding dismissive of what other deemed US taxpayers are going thriugh when choosing not to or unable to file. As a matter of fact, one of the reasons why I chose to “come into compliance” was so I didn’t have to spend the rest of my life looking over my shoulder waiting for the IRS to strike and confiscate everything I’ve ever worked for.

There’s always HOPE that one won’t ever get “caught” however – something I had to abandon by filing. Since then there’s a lot more call for optimism for non-filers. The fact that the IRS seems to not be able to handle the data it receives from FATCA, its abandoning substitute tax returns and the distinct possibility that the US may go to RBT. My fate has been determined, and it’s not great. Keep filing or renounce.

“We are the buzz killers par excellence. Here they are having THE experience of their lives with its hardship and joys and then someone like me mentions something like CBT or FATCA.”

Yep, true that.

I no longer try to inform other USCs preferring to focus on non USCs cntrmplating study or work abroad. What ever “solution” that may come out of the swamp, it is likely to be of little benefit to USCs in Japan and most likely too late for us anyway. I believe my time in Japan, with my family is limited, that whatever fix comes it will be after my banks lock me out, my passport is revoked or my employers learn of the risk of employing USCs and let me go.

I wish I knew nothing of this so that I could better enjoy the time I have left with my family instead of putting everything on hold to write to dimwitted congress critters hoing to convine them to learn the US constitution and govern according to it. Having zero success getting other USCs in Japan aboard, I focus on preventing nonUSCs from entering the trap.