An unusual report from Metro News: MapleMatch.com offers to pair Canadians, Americans fleeing Trump

A new dating website is offering to pair Americans with Canadian singles to save them from a Donald Trump presidency.

MapleMatch.com promises love and a U.S. escape plan if Trump becomes commander-in-chief.

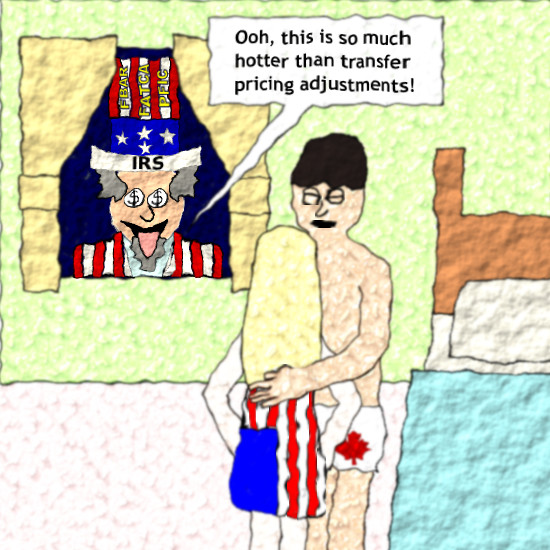

However, nowhere does MapleMatch.com see fit to warn their Canadian users about the severe dangers of becoming intimate with Americans: your new lover has a crazy stalker ex named Sam, who’s coming after you two across international borders to get his voyeuristic jollies. For the rest of your life, you’ll never be alone together: the weirdo will peep into the most private aspects of your relationship, keep trying to break into your house to help himself to money from your wallet, and threaten to drag your children into his perverted games.

The danger of dating American: citizenship-based taxation

Want to have a joint bank account? Both the “Internal” Revenue Service and the Financial “Crimes” Enforcement Network (FinCEN) demand to know all about it and will threaten you with huge fines if you refuse to tell them.

Thinking of buying a house together? Good luck getting a mortgage. Worse yet, “Uncle” Sam will be right there with hand outstretched demanding money when you sell it — even if it was a loss in Canadian dollar terms.

Dreaming of starting a restaurant or a bed-and-breakfast together? That’s a Controlled Foreign Corporation or Foreign Disregarded Entity under US law (unless you make sure the American has less than half — but then it’s in danger of being a PFIC), and you get to keep another set of books under the U.S.’ Generally Accepted Accounting Principles, and spend more than a hundred hours per year filing the same tax forms as U.S. multinational corporations — hope you have fun paying for Google-level accounting on your budget!

Want to save up to help your kids pay for university? That Canadian Registered Educational Savings Plan is an offshore trust just like those folks in the Panama Papers have, and the IRS wants even more paperwork from you to make sure the Canadian government isn’t helping you evade American tax — and it gets even worse if the RESP holds any mutual funds.

And don’t think you can call the cops or your MP and tell them to get this crazy stalker thrown in jail or deported. All they’ll tell you is that “Congress has spoken” — doesn’t matter which party they’re from. The nutter from down South is gonna keep harassing you two unless you pay him $2350 to go away and release your American other half from the “allegiance” they “owe” him — and then even after that, he’ll threaten to block her from going back to visit her friends and relatives (though that appears to be an empty threat for now).

Conclusion

Instead of taxing companies which actually do billions of dollars of business in his country while shifting their profits to tax havens, Sam the Stalker has decided the best way to pay off his ginormous credit card bill is to follow your new American boyfriend or girlfriend to Canada and keep sponging off of him or her. If you’re a Canadian thinking of dating an American, be aware of all the relationship baggage they’ll be bringing north, which people of no other nationality carry — you’ll need protection so you and your future kids don’t get infected.

This piece is a gem and it needs to get published somewhere — Forbes, The Hill, Tax Connections, many others. It has to get beyond Brockers’ eyes only. And all those links … terrific!

You could always just watch the movie. Like I did recently.

Blue State (2007)

And get queasy watching a “Canadian” production go weird with self-hating to try to appeal to a US primary market. Not funny. Except maybe in a gag sense (aka barf humor).

This is both funny and true.

Putting the funny aspect aside. I can’t understand why the U.S. expat and designated U.S. persons community put up with the abuse and violation of their financial well-being by a distant, bullying tyrannical country who believes that it has the right to people’s money and information no matter where they live and make their lives. Have there been big demonstrations in major world capitals to draw attention to this “shakedown and extortion racket”? If they don’t demonstrate publicly and visibly, they won’t get any attention or sympathy. I don’t think that anybody, anywhere, will be surprised by what the US is doing, as it fits their profile of disrespect and violation of human rights on so many levels, most far worse than this.

@Ellen, you said, “I can’t understand why the U.S. expat and designated U.S. persons community put up with the abuse … ”

I think they are like people who have an abusive ex-lover. They still feel they love the abuser and hope, despite clear evidence, that the abuser will change. They may even feel they “deserve” the continuing abuse.

Too bad the Metro News article doesn’t allow for comments.

Would have loved to try to provide link or other material leading to this great post @eric!

I provided a link to this story from CBC yesterday in the Media thread.

I think comments were open.

Have a look at this:

http://maplesandbox.ca/2015/no-crisis-see-you-in-court/comment-page-1/#comment-472672

Why do Americans “put up” with this? In order to “put up” with something, one must feel that one has a choice. In order to feel that they have choice, they must believe that they are people and that they are people who are independent of the U.S. Government. The attitude of the U.S. Government is that U.S. citizens are the property of the USG. On a very deep level, most U.S. citizens believe that too.

It has been 5 years since this thing blew open. Very very few U.S. citizens are fighting back. Most of them are just running around filing forms. They live in terror of the U.S. Government. As long as they feel this way, it will become a self-fulfilling prophecy. The simple fact is this: if they don’t live in the USA, there is little the USA can do to them. Yet, they are willing to accept that they are U.S. citizens and that the symbol of U.S. citizenship is FBAR.

You know what is really scary about the illustration for this post?

If you don’t scroll down far enough to see the whole picture, first impression is that the guy is embracing a giant penis wrapped in the US flag. Is it just me or was that intentional?

@USCitizenAbroad

You have hit the nail on the head. That is exactly what I believe is the case. Not even the Chinese would cooperate with such total and oppressive control and wouldn’t accept being treated like property of the State. I start to agree with a friend’s husband, himself a professor of history, that the US citizens have a lot in common with North Koreans, in that they allow themselves to be controlled, are obsessed with obedience and accept obvious propaganda on a level far higher than in other societies.

I am so grateful that I don’t carry U.S. citizenship, although my husband does and I see firsthand what enormous problems this has caused him directly and our family as well. He is on a five month waiting list to renounce, as are two other friends of ours. What a weird and sad situation. Soon we will be rid of this situation and neither of us have any intention of ever travelling or visiting the United States.

@ Witecat

I saw the same thing.

You mean you saw it one way at first but then realized that was just a phallusy?

@Marie, Good.

@Shovel, yeah, that happens to us girls a lot.

Either a phallus or a nuclear warhead.

Makes for a kinky red white and blue movie. They can’t make any condoms thick enough to protect you from CBT though – better to abstain from any involvement with a USP.

USCAbroad

Let’s just say if the US government saw the need for SCE they would also see the need for FATCA repeal. Until they do, we’re all just scofflaws.

We already have a mass-revolt against CBT – the vast majority US persons living outside the US don’t file US taxes.

I have not gone through what I have to suddenly stop filing. The day I stop filing US taxes is the day I am no longer a US citizen, or the US goes to RBT. I don’t do it to be obedient, I do it to make a clean break when the time comes. I missed the boat in joining any kind of tax-revolt, sorry to say.

Echos of Dr Strangelove?

@Bubbles, “We already have a mass-revolt against CBT – the vast majority US persons living outside the US don’t file US taxes.”

Very true, we need to proclaim that from the hills.

Plus the renunciations themselves.

PLUS the growing wait times……..

Ex/former pats are protesting……as we do.

From a current discussion over on “that other board”:

There were 695,230 tax returns filed from overseas in 2013 (IRS count) versus a total of 6.8 million US citizens overseas in 2013 (State Department estimate). That means in 2013 10.2% of overseas Americans filed a tax return compared to the 46% of US residents who filed. Its likely that State Department’s estimate doesn’t include accidentals or the children of expats (unless their birth was registered) because State wouldn’t even know they existed. That means that the actual non-compliance rate could be even higher than the US government admits in its very own numbers.

Whether you agree or disagree with the idea of CBT, the fact that it is obviously unenforceable is reason enough to get rid of it.

@George @ Bubbles

What, you mean I am not unique? I am heartbroken. Actually I am surprised to read this. Where are those resistors friends I didn’t know about? But wouldn’t those stats justify the witch hunt to track down all of us tax cheats?

@Canadian Ginny

The fact that only you and Gwen would stand up to represent millions like you make you more unique than you give yourself credit for.

The IRS better take a reality pill if they think they’ll get you into the tax-fold, never mind the MILLIONS of others who aren’t even aware of the fact that the US consider them their property.

Heartbreak? No! Give yourself a pat on the back for being an early adopter, ahead of the curve, pioneers, trail blazers, or whatever you want to call it. You and Gwen rock!

Ok, that’s not fair to to the witnesses who participated in the US lawsuit. I apologize to them for my temporary oversight. My thanks to them too.

@ Bubblebustin

Yes there are SO many people to thank in this entire endeavor. Although I don’t say it often enough,I would not even know where to begin to express my gratitude to so many. As always, Gwen is my rock. She is my heroine and someone who provides me with strength every day. Dr. Kish knew exactly what he was doing when he teamed us up. And I am so grateful he did. She works so diligently ( humbly in the background) on so many issues.

And unlike me, manages to keep her cool at all times.

Having said that, I am still surprised to read about the number of people who don’t file, assuming they know. To those who still aren’t aware, maybe that’s a state of innocent bliss until their OMG moment.

Just today, I had a talk with two people who didn’t know. In my own town! The look of fear on their faces was palpable. I hate being the bearer of such bad news, as so many of us have had to be.

maz57 said:

“Whether you agree or disagree with the idea of CBT, the fact that it is obviously unenforceable is reason enough to get rid of it.”

It’s one of those deeming things, isn’t it? The US deems the tax is owed, and deems it’s collectable, ergo it must be so. The same way it deems I have offshore accounts. Reality is not a problem for deemers.

But the US desire to keep control of the OECD and other international bodies might be a problem. CBT can’t easily coexist with plans for a unified global tax system.

Could you imagine having to postpone marriage because of extraterritorial double taxation as well as data invasion? Such a sorry state of affairs…