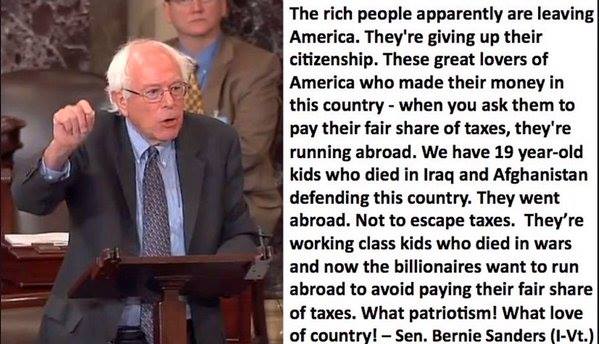

I’ve noticed that some of the people on Facebook really like Bernie Sanders. But let’s make one thing clear: this senator is a demagogue:

I’ve noticed that some of the people on Facebook really like Bernie Sanders. But let’s make one thing clear: this senator is a demagogue:

“a leader who makes use of popular prejudices and false claims and promises in order to gain power” Merriam-Webster’s Collegiate Dictionary., Eleventh ed. (Springfield, MA: Merriam-Webster, Inc., 2003).

I have myself given up US citizenship. I know lots of people personally who have given up US citizenship. I do not know a single billionaire. I am not a billionaire. I did not leave the United States to avoid paying taxes. For crying out loud, I live in Canada where taxes are much higher than they are in the United States. This man has vilified me and others like me who have become targets of the Obama administration of exorbitant fines, destroying our rights of due process and presumption of innocence.

We should remember that the colonists felt that it was unfair that Britain tax them and that is why they led a revolution and gained the independence of the colonies, thus creating the United States of America. Bernie Sanders may not realize it, but the current policy of the United States towards expats is ten times the son of the Devil what British taxation policies were against the colonists. Most of us who have relinquished US citizenship are victims not villains.

The wierd world of non-doms:

http://www.theguardian.com/money/2015/apr/07/non-dom-tax-status-living-working-paying-tax-uk

The first instance of Homelander Abroad is in comment: http://isaacbrocksociety.ca/2014/05/23/controversial-us-tax-law-affects-many-american-expats-and-how-it-may-compromise-canadian-sovereignty-this-sunday-on-contact/comment-page-2/#comment-1853014

The first post to use the term, I believe, was by yours truly: http://isaacbrocksociety.ca/2015/06/17/homelanders-abroad-at-american-expatriates-facebook-group/ My specific reference was to the Democrats Abroad and Republicans Overseas activists who run the American Expatriates Facebook group.

The pattern which comes out in this are people who are acting first and foremost to the benefit of the United States, and this inevitably brings them into conflict with the interests of their home country. The term is thus disparaging and pejorative.

Examples of Homelanders Abroad are compliance condors, activists for the Democrat or Republican party. Military personnel or diplomats are not really Homelanders Abroad, as they are not really Abroad in the true sense of the term: they are Homelanders pure and simple.

The term Homelander Abroad is really an evolution of the term “Homelander” which also became vogue at the Isaac Brock Society: it refers essentially to the parochial American that is unable to see how CBT/FATCA, etc. is a very bad policy and why a person would have to renounce their US citizenship in order to protect themselves from what has become the greatest threat to their happiness, the United States federal government. I shared the following comment at the Facebook group, Citizenship Taxation, on Sept 15, 2015:

Obviously these people are not informed . The colateral damage done by FACTA is also affecting US persons who have lived all their lives abroad ,have not worked in tne US,have no investements in the US and are bonna fide residents of another country where they are tax compliant. The bureaucratic nightmare that

FACTA has created for aprox, 6/7 million such persons is apalling and the only solution is taxes only in your country of residence.

This is a different situation from a US person living in the US and avoiding taxes.

@Daniel Alfaro

*This is a different situation from a US person living in the US and avoiding taxes*

Many immigrants in the US have no clue about this… why do people assume that we had no lives prior to going to the US… I pay whatever I owe to the country where my savings and investments are held… My family owns property that has been in the family for many generations… why should the US get a piece of that? Don’t say I am hiding my money there… don’t u think I have expenses to pay… immigrants also send money home to support other family members… Recently I learned… some even send money home because they do not trust the US to keep their money safe… why do people all assume that immigrants live tax free & on hand outs of the gov’t…

@Polly, Other countries didn’t give up CBT, they never had it in the first place. With very few exceptions, countries always used RBT or territorial taxation, since the UK created the income tax in 1799. They just never thought that it made any sense to tax people based on citizenship. The few countries that adopted CBT were dictatorships (Soviet Union, Bulgaria, Vietnam, Myanmar, Eritrea), and abolished it when they became democratic or opened their economy (except Eritrea, which is still a dictatorship), or they inadvertently copied the US income tax (Mexico, Philippines) and later abolished CBT when they realized that it was unfair or impractical. The case of the Philippines is well documented in this book.

I just tweeted this article out. See tweet at link:

https://twitter.com/JimJatras/status/657730602704195585

#Obama & #Bernie ALREADY driving Americans out of US! They’ll build a border wall – 2 keep us IN! http://isaacbrocksociety.ca/2015/10/21/bernie-sanders-demagogue-of-the-senate/ … #JimJatrasVeep

Sanders is My Homeboy

The demagogue T shirt.

Deckard tweaks the image on it a face hair or two, and it’s perfect for fans of Bernie.

http://tshirtroyalty.com/view/80690/colonel-sanders-is-my-homeboy-kfc-t-shirt

http://isaacbrocksociety.ca/2015/10/21/bernie-sanders-demagogue-of-the-senate/comment-page-1/#comment-6736240

But, bingo, here’s something you can do…

Americans Abroad: IRS to Crack Down on Improper Claims of Exemption from Social Security & Medicare Taxes — Virginia La Torre Jeker J.D., November 8, 2015

A recent report by the Treasury Inspector General for Tax Administration (TIGTA) has shown significant noncompliance with payment of Social Security and Medicare Taxes by Americans working abroad. The report, more fully discussed below, has prompted the IRS to agree to coordinate very closely with the Social Security Administration to halt the noncompliance and recoup millions of dollars in unpaid Social Security and Medicare Taxes. Everyone knows that the Social Security system is in dire need of funds and so, this measure may help rake in the much-needed cash.

“But, bingo, here’s something you can do…

Americans Abroad: IRS to Crack Down on Improper Claims of Exemption from Social Security & Medicare Taxes – Virginia La Torre Jeker J.D., November 8, 2015”

I’m confused. Thank you for reporting on something that is bad news for a lot of people (i.e. I understand quite well the difference between the messenger and the message) but what is the something that we can do other than the usual somethings:

1. If a non-resident US citizen, choose (a) renunciation or relinquishment or (b) move to the US; and

2. If a non-US affiliate of a US company, take care not to hire a non-resident US citizen.

Not the something we can do but the more of the somethings the US will do. How many living and working abroad will this affect? Small businesses?

It affects big businesses too. I worked for US companies in Canada for 3 years and Japan for 10 years.

Part of the time that I was essentially working for a US company in Canada, I was self employed under laws of both Canada and the US at the time, so I had to pay quadruple social insurance taxes (employee + employer portion to Canada and employee + employer portion to the US). Luckily a totalization agreement came in part way through that and the US refunded its double portion, though later I figured out that they shouldn’t have refunded it.

Part of the time that I was working for a US company in Japan, the US came up with a policy that the company could decide on its own whether to subject me to double social insurance taxes (employee portion to Japan and employee portion to the US), I would have no say and governments would have no say over the company’s choice.. Luckily the company didn’t do it because they’d have to pay employer portion to both too. That was a very big company at the time, not a small business.

@US Foreign Person.

People assume the all immagrants live tax free and only want handouts because we are no longer allowed to differentiate between illegal immigrants and legal immigrants. To do so would be discriminatory, and we can’t have that, now can we?

Myself, I feel very sorry for legal immagrants and even fury on their behalf. Talk about a bill of sale differing from the goods delivered!