24 Hours Until #FBARs due & Hey! Don't 4get Ur US Person-Kids :Children,Taxes & #FBAR’s –Not Mere Child’s Play! http://t.co/eMwBFs5v91

— U.S. Expat Canada (@USExpatCanada) June 27, 2015

At one minute to midnite, there will be 24 hours left for ALL US Persons to get their affairs in order and get their FBARs filed. And don’t forget, you cannot get an extension for FBAR.

Let’s take a moment to review just exactly what it is that

FinCEN’s mission is to safeguard the financial system from illicit use and combat money laundering and promote national security through the collection, analysis, and dissemination of financial intelligence and strategic use of financial authorities.

“Whaaaat? My chequeing account at Scotiabank is related to possible illicit use of funds, money laundering or other crimes that will affect the financial system and even worse, the national security of the United States? That must make me a criminal.”

Let’s review what is required:

Who Must File an FBAR

United States persons are required to file an FBAR if:

- the United States person had a financial interest in or signature authority over at least one financial account located outside of the United States; and

- the aggregate value of all foreign financial accounts exceeded $10,000 at any time during the calendar year reported.

United States person includes U.S. citizens; U.S. residents; entities, including but not limited to, corporations, partnerships, or limited liability companies, created or organized in the United States or under the laws of the United States; and trusts or estates formed under the laws of the United States.

Checking where to file, I see this on the FinCen site:

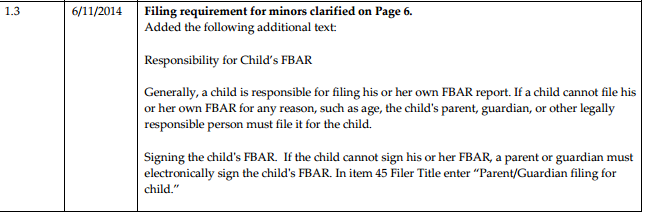

Yes indeed, you read correctly. If any of your children have more than $10,000 total of all their accounts combined then, yes, your US Person children must file an FBAR.Don’t forget your US-born adopted child. Imagine- “alien” parents helping out by filing US tax forms for their children. Now that’s looking out for your kids!

Yes indeed, you read correctly. If any of your children have more than $10,000 total of all their accounts combined then, yes, your US Person children must file an FBAR.Don’t forget your US-born adopted child. Imagine- “alien” parents helping out by filing US tax forms for their children. Now that’s looking out for your kids!

“Well ‘hey now,’ as my grandma would say, any kid can deal with figuring out how to get the pdf file to open up in their browswer – it’s a cinch for them! Oooooo lookey here, now they can do it on an

online fillable form!”

After that, all they have to do is:

- Download, open and complete your FBAR

- Validate FBAR –

- Sign your FBAR

- Save your FBAR

- Upload your saved FBAR

- Monitor your email for an acknowledgement email within 2 business days

And guess what, if your child is unable to put his/her signature on it, you, as their legal guardian, must electronically sign the child’s FBAR. In item 45 Filer Title enter “Parent/Guardian filing for

child.”

“So, let me get this straight… not only is it perfectly acceptable to have a guardian act on behalf of the child, its a requirement. Just like a new immigrant who cannot take the oath on their own, the oath is waived. However, when an adult child (or any other infirm individual) cannot form requisite intent, no one can waive the oath of renunciation for him/her or renounce for them?”

“Oh good gawd, if my kid has to file an FBAR what about…..???” yep, regular taxes too!

What Parents Should Understand

When it comes to filing their children’s income taxes, parents need to know the following:

- Legally, children bear primary responsibility for filing and signing their own income tax returns.

- Children can receive tax deficiency notices and even be audited.

- If children are otherwise required to file a tax return and their only income consists of interest, dividends and capital gains (unearned income), parents may elect to include the child’s income on their own tax returns

- Children who earn net self-employment income above the filing threshold are required to pay self-employment tax for Social Security and Medicare, even if no income tax is owed.

And make sure you know in time for next year; if your child has $2,000 or more of unearned income, they must file file an 8615 form.

Who Must File Form 8615

Any child who meets all of the following conditions:

- 1. The child had more than $2,000 of unearned income.

- 2. The child is required to file a tax return.

- 3. The child either:

- a. Was under age 18 at the end of 2014,

- b. Was age 18 at the end of 2014 and did not have earned income that was more than half of the child’s support, or

- c. Was a full-time student at least age 19 and under age 24 at the end of 2014 and did not have earned income that was more than half of the child’s support. (Earned income is defined later. Support is defined below.)

- 4. At least one of the child’s parents was alive at the end of 2014.

- 5. The child does not file a joint return for 2014

“Whew……is there anymore?” Of course!Alternative Minimum Tax

A child whose tax is figured on Form 8615 may owe the alternative minimum tax.

For details, see Form 6251, Alternative Minimum Tax—Individuals, and its handy instructions.

And here are some reassuring reasons for why your kids should start now:

As children move toward adulthood, parents face several milestone decisions. In each case, part of the decision involves a desire to help children become more independent and responsible. But, there is another milestone that parents might not anticipate, even though it will be part of almost every child’s growing-up experience and (unlike car keys and credit cards) it is legally required. It’s the filing of the first income tax return in a child’s name.

As parents should realize, income tax filing is not taught in schools and it’s not a subject that captivates teens’ attention on TV. Most children have only a dim idea of what income taxes are, let alone the specific rules they are required to meet. Therefore, the parent’s role is to initiate this rite of passage by evaluating tax-filing requirements and/or obtaining guidance from tax professionals. This article is designed as a parent’s “quick guide” to this subject. It covers the basic rules that you should know for determining when your child must (or should) file. It also offers suggestions for helping children take responsibility for their own tax chores in the future.

And just before you put the little darlings to sleep, don’t forget to read them the interactive FinCen Story, sure to warm their little hearts and give them the sweetest dreams ever.

@Shovel,

You’re right, FinCEN failed to include Canada on its strange map of High Intensity Financial Crime Areas, where Obama’s city, Chicago, is the capital and Washington D.C. isn’t even shown to exist.

So is wrong with this picture? Why should FinCEN concern itself with Canadians with a US taint?

@Jan

Why should FinCen bother with any of us… don’t care if homeland or not… if the money is not made in the US… mind your f* business… Do u think that the real criminals… mafia… drug dealers… etc… will spend the time to do any of these forms… better yet… do u think they are stupid enough to just save the money in things we are all doing to ensure our futures? Criminals already have ways in place to move money they get in ways none of us thought of & in ways the gov’t is not bright enough to find… all the US is doing is pissing off countries & people for nothing… money they are getting is for the frigging fines they pile on that make no sense to anyone with a brain. Form after form is put out that no one can keep up with or even knows… make a mistake… u can be ruined easily… Why should I give the US one penny of anything I have that is not made in the US?

@US_Foreign_Person, I agree with you 100%. Make a mistake on some form, and you’re ruined. They try to impose all these forms on honest earners paying taxes in Canada and elsewhere, and the criminals go along their merry way . . .

I’m in the stuff’em camp. I did obtain a CLN almost 2yrs ago and did nothing after that 1) can’t afford to and 2) pure fear of being in the system and targeted. So if I ever have to make a case “why did you not ensure you were complaint”, I’m going with “broke and terrified of what might happen should I do it wrong”. There is literally more fear in repercussions of doing the compliance wrong than not doing it at all!

The proper response is to tell the USA to put their FBARs where the sun doesn’t shine.

Ja, what about FBARs Anonymous? Was there a post? Looked and couldn’t find……….

http://www.urbandictionary.com/define.php?term=fubar

TOP DEFINITION

fubar

short form of “F*%#$d Up Beyond All Recognition”, but also a misunderstandment of the german word “furchtbar”, which means horrible or frightening.

“This situation ist Fubar!”

“Das ist furchtbar!”

“The proper response is to tell the USA to put their FBARs where the sun doesn’t shine.”

AMEN! I’d include a few more expletives and blue language; as well as several ideas of what else long and painful they could stuff up their orifice.

They ain’t getting any cooperation from me.

Neither I nor my wife are US citizens. We do not live in the US. What is the US doing passing laws telling us what to do?

maz57: I agree with your comment. The very name of this agency, the Financial Crimes Enforcement Network, is an idiocy although an extremely accurate one. If read the way most names are read it has the meaning: “The Network for the Enforcement of Financial Crimes”. And since said agency has determined that not filing an FBAR is a financial crime and since many “Americans abroad” find filing an FBAR to be an abuse of their human rights and refuse to file said FBAR, the agency is, indeed, promoting the commission of “financial crimes”.

@US Person Foreigner

The U.S. is anti-emigrant and anti-immigrants who leave. There is the assumption that such people take money out of the U.S. economy.

@Publius

*people take money out of the U.S. economy.*

Depending on their ages… immigrants keep one foot in their home countries & one foot in the US… immigrants who stay in the US for more then a few yrs may have family that settled in the US so they go back & forth… paying taxes on what they have in the US & paying taxes to home country also… separately…

Does the US expect all immigrants to arrive to the US with no past lives? My family is a product of a war… what is happening in Greece… is why my family does not keep all our eggs in one basket… we have funds somewhere else so we don’t starve or have to start fresh… If the US economy takes a dive… they have a road map of all our goodies so they can just take it… don’t bother to tell me a gov’t won’t do that… we have lived through it once… won’t do it again

As one past Brocker wrote:

Fu@ked By American Revenooers

@US-Person-Foreigner

Well, I did say it was an assumption that emigrants and reverse immigrants were taking money out. It’s increasingly not true because of money-making opportunities elsewhere and because there are loads of dual citizens who have lived their entire lives outside the U.S.

I suspect that you are right that FBAR is part of some sort of planned asset grab, maybe inheritances to non-U.S. spouses. Under my circumstances, staying in the system a bit longer makes financial sense, but it’s become like staying in what used to be a great relationship until the kids grow up: the resentment lingers. I do feel like the U.S. government is casing my joint.

Justin Trudeau is on News 1130 right now. Go to Twitter and bombard him with “hate” for his stance on FATCA and Bill C51.

Wildlife Photog @WildlifeFotog70 2m2 minutes ago

@NEWS1130Radio After @JustinTrudeau sold 1M+ CDNS down the river #FATCA + Bill C51, no way in hell I’m going to vote for him.

I just did…

How honored I was to just receive an email from the All-American Financial Crimes Enforcers that our FBAR form has been accepted for self-incrimination processing. Like being told they’re happy to inform me that my photo has been accepted to appear on the Most Wanted poster in the Post Office.

Riddle me this

One of my kids is a teenage and is infected by the Usa condition. I have apologised to teenager who quickly compared us citizenship to a std and that I should have been more carefull

Said teenage would have a fbar requirement because of child saving

s vehicles by my government

I showed this page to teenage and response was f them

What is parents obligation then when a teenage decides to become a non filer

Wh

em.

@George,

“What is parents obligation then when a teenage decides to become a non filer?”

Good question. I know of other young people in a similar situation. They can’t believe this crap applies to them, and it just makes them more cynical about politics and so-called “democracy” than they already are. To me that’s the most dangerous side-effect of US CBT: that it destroys respect for democratic ideals.

Having voluntarily infected my children (thankfully born abroad and with 2 other passports, therefore could 1/ pass as accidentals and 2/ escape US person indicia), my opinion was that we could be pro-active and make their finances easy for when they need to start filing (being in the “comfortable” situation of not having significant wealth). They don’t need to do their FBARs now, being under the threshold.

If they feel it is a burden to have the US passport, I’ll pay for their renunciation fee. Not having a US birthplace, life would then continue normally, with CLN safely tucked away just in case.

What I had not factored in, and is occurring to me as I read previous posts here, is that as teens and young adults, they may very well choose to ignore my advice, and the whole mess entirely, and thus become non-compliant. Were I to lecture them they would not fail to point out my own total non compliance for the past 15 years or so.

@Fred, “Having voluntarily infected my children (thankfully born abroad and with 2 other passports, ”

Bravo, you are the man!!! TWO besides USA USA USA…….the envy…

First year I did not have to fill out this piece of …

Had no desire at all to download this years version but I am curious. Is it pretty much identical to last years?