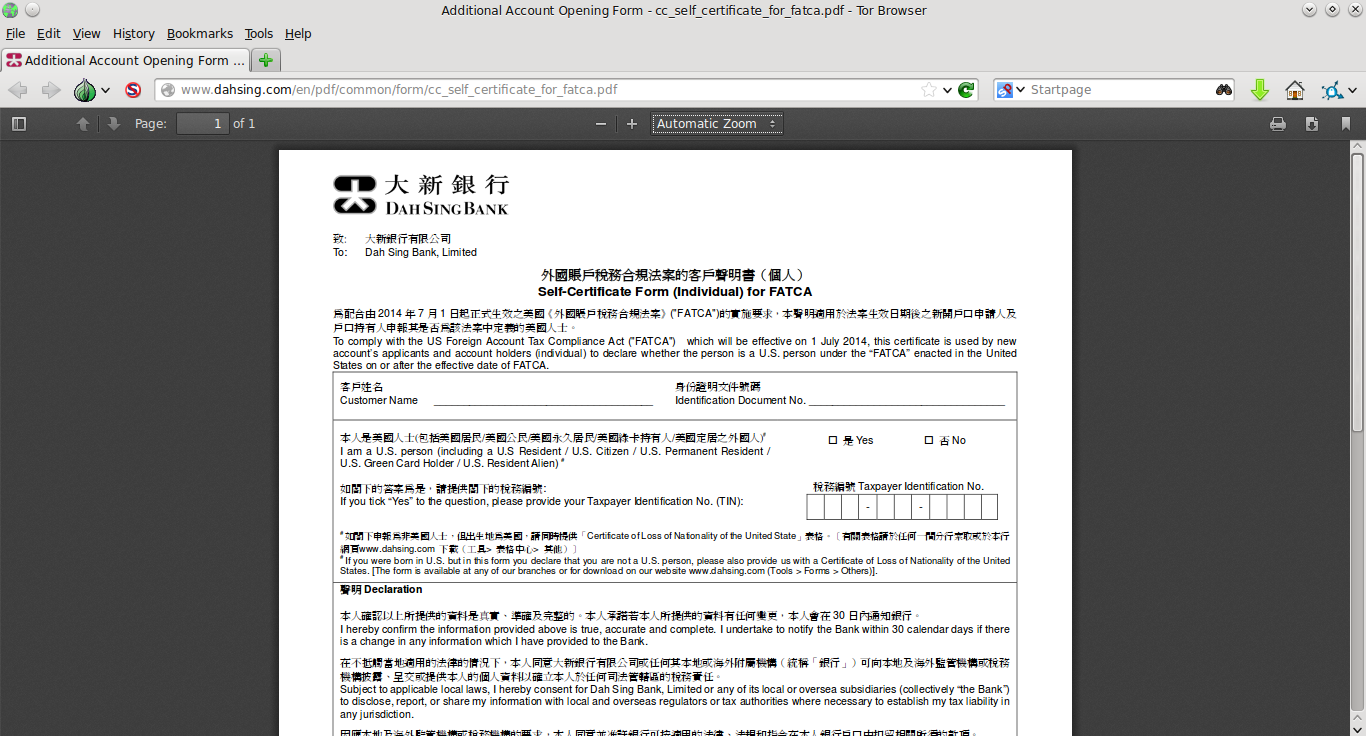

What kind of documentation will your “foreign” financial institution demand from you as a result of FATCA? Here’s one Hong Kong bank’s answer. From Dah Sing Bank’s Self-Certificate Form (Individual) for FATCA, as of lunchtime on 22 November (Internet Archive snapshot, in case they change it later):

如閣下申報為非美國人士,但出生地為美國,請同時提供「Certificate of Loss of Nationality of the United State」表格。[有關表格請於任何一間分行索取或於本行網頁www.dahsing.com下載(工具>表格中心>其他)]

If you were born in U.S. but in this form you declare that you are not a U.S. person, please also provide us with a Certificate of Loss of Nationality of the United States. [The form is available at any of our branches or for download on our website www.dahsing.com (Tools > Forms > Others)].

Dah Sing Bank is the only major licensed bank incorporated in Hong Kong which has neither branches in the U.S. nor substantial U.S. ownership. Oddly enough, the U.S. consulate in Hong Kong has an account with Dah Sing; the consulate used to tell visa applicants to transfer funds directly to that account, but since April 2013 we’ve been told to pay the fees at 7-11 instead. More screenshots after the jump.

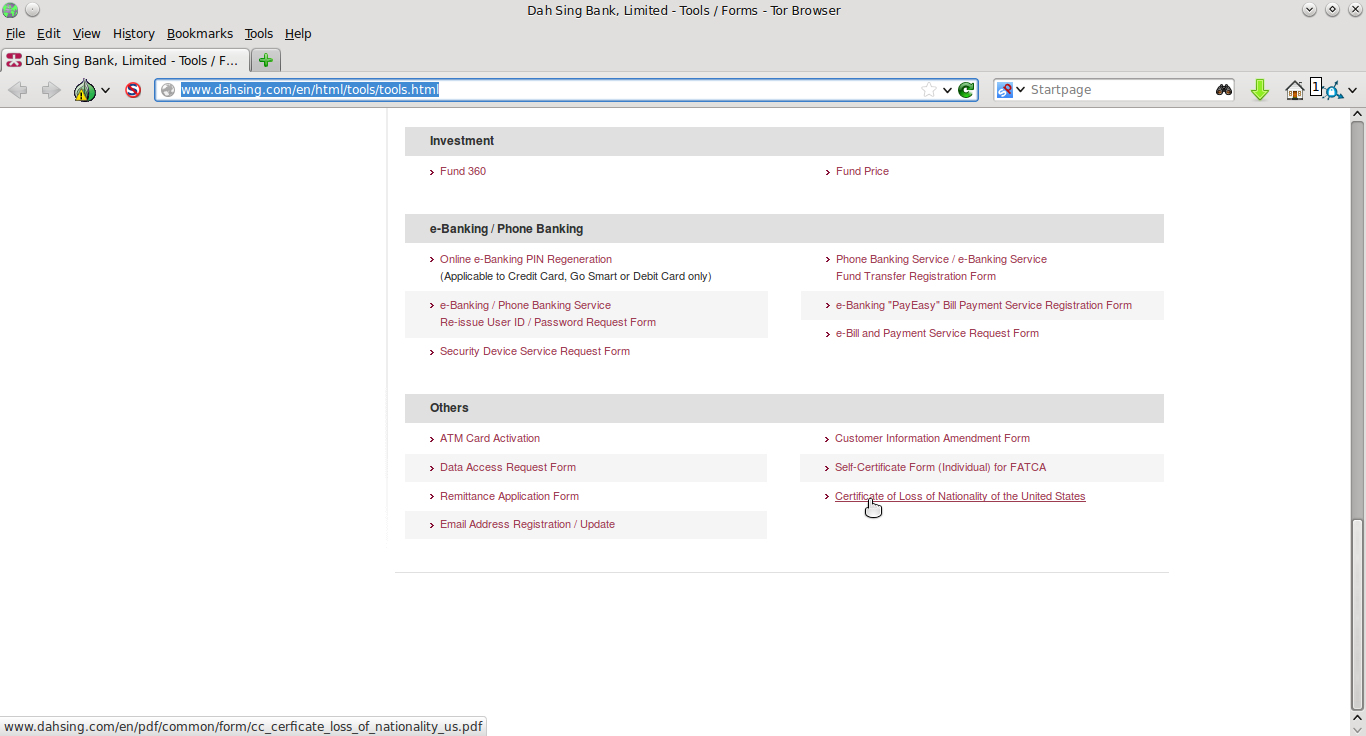

Blank CLN on customer forms webpage

What does the phrase “[t]he form is available at any of our branches or for download on our website” mean? Clearly not the FATCA self-certification form itself — the customer is already looking at that form when he or she sees that comment, and would have no need to download it.

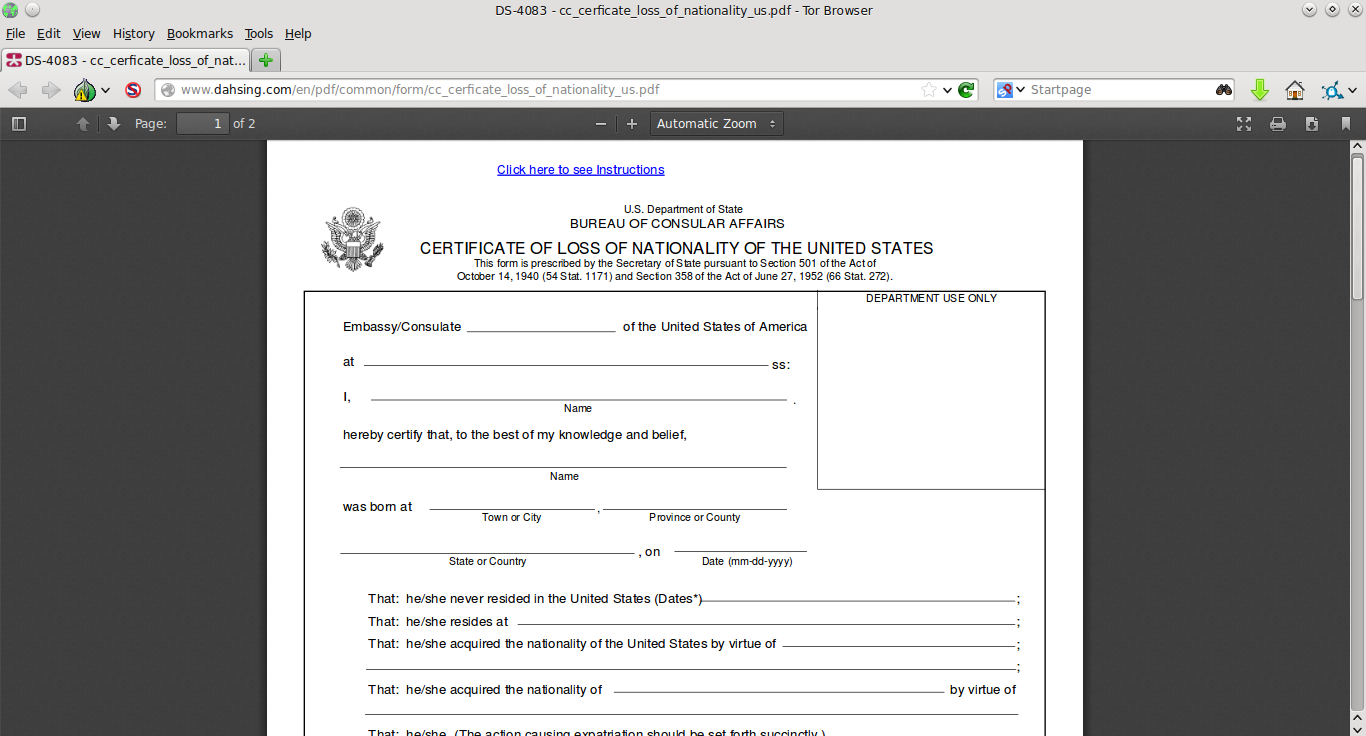

Instead, “[t]he form” appears to mean a CLN. Indeed, the Chinese version of the text calls it a “Certificate of Loss of Nationality form” (表格 rather than 證明書, the latter being normal word for a government-issued certificate used as proof of something). Furthermore, if you go to the specified “tools” section of Dah Sing’s website (screenshot above; see Internet Archive snapshots of the Chinese and English versions of the page), you can download a blank Form DS-4083, Certificate of Loss of Nationality (again, also saved on the Internet Archive).

However, I haven’t actually tried going to a Dah Sing branch and asking the teller for a blank CLN. I’d love to record that conversation, but I don’t think I’d be able to keep a straight face.

“Click here to see instructions”

At the top, the blank downloadable CLN has the strange blue and underlined comment “click here to see instructions”. Dah Sing’s website doesn’t provide any further guidance on what to do with the blank CLN available for download. But think about it: they’re handing out blank CLN forms to customers, at least virtually and maybe even literally at branches, and their FATCA self-certification tells people to give that form to the bank. What exactly do their compliance people expect is going to happen here?

And even if the missing instructions for the CLN would have told the customer to approach a U.S. consulate with the completed form for stamping & certification before submitting it Dah Sing, that’s the wrong way to go about getting an official CLN anyway — you fill out a DS-4079, and State sends back a completed DS-4083.

Conclusion

On a separate topic, it’s disappointing to see that Dah Sing’s FATCA self-certification form does not offer any option for customers to provide a “reasonable explanation” of why they do not have a CLN, as provided for in the Hong Kong–U.S. FATCA IGA — but I guess if you can fill out a CLN yourself, it’s not too big of a problem! And Dah Sing’s FATCA self-certification form does not directly ask for the customer’s place of birth, unlike for example this far more intrusive self-certification form demanded by CITIC Securities. (However, a few other Dah Sing products’ application forms do demand that customers answer whether or not they were born in the United States, such as the mWallet near-field communications credit card Android App.)

And on a serious note: if this is how a bank in a major, semi-Anglophone financial centre is handling FATCA self-certification, how well do you think non-Anglophone developing countries are doing?

If nothing else gets major media attention the eventual physical playing out of how the US torments its citiizens surely will. Imagine if a significant % of those 77,000 US Australians are queued up at the local Centrelink office for a few dollars to live on . . . but with no bank account to put the funds in!

They don’t hand out cash.

@Gordian

You know, a couple years ago I would have scoffed at such a suggestion, but your point is well taken. We are not a country that would tolerate such abuse. But I think the main problem is, as you pointed out, awareness of just what sort of evil is afoot. Sadly it’s going to take some serious personal tragedies and some outrage stories on Today Tonight before anyone takes notice. Even the federal opposition, which has a penchant for criticising everything the government does (except for marching off to an un-winnable war, go figure) was strangely silent on this. I feel that this shakedown is going to have to break itself, but sadly not before it takes a few scalps. I would be surprised if even half of those 77,000 have even had their OMG moment yet.

Someone, somewhere, in a responsible position, has to realise that this is not just money being taken away from persons unknown, but money being lifted from Australia (or Canada, or anywhere) by a Foriegn state. And it will not be coming back

@ ProudAussie,

It’s protection money. Goverments have to see to it that we pay up to keep relationship and negotiations with the US sweet. But if the average, Australian/Canadian took the time to grasp the concept that it lightens their pockets too, they would be majorly pissed off. Unfortunately, it will take some casualties to get their attention.

I can’t figure the opposition on this one either. Were they snoozing?

OMG moments? How would most of them find out about it?? If a friend had not given me the heads up a couple of years ago I expect I would still be oblivious to all this too. Thankfully that gave me time scrabble around and find a few pieces of financial camouflage netting.

I have had discussions with the Aust. Greens over the implications of FATCA. Seems there are quite a few US expats as Green members. However they have been sold on the spin that its all about only catching the big boys hiding millions off shore and the IRS is not really interested in the small minnows. Bullshit! Its really about catching the lot. Green’s Senator Christine Milne’s tax advisor even said there is a good thing in the agreement that it will catch those multinationals who are not paying their proper taxes to Aust. More bullshit. Also interesting that one Greens Senator, Peter Wish Wilson was a former Director of Deutsche Bank! A small conflict of interest there…..

All the political parties here have been served up disinformation and they do not have a clue on what FATCA is all about. The big task is to inform them. Its time Australia wakes up!

Does Jo Hockey thinks it is a great idea for 77,000 people to end up on the government funded Age Pension and not be able to save for their retirement just because they were tainted with being born in the US or have US parents?

@Aussie Dan

You would think that with the big money we pay to people like Senator Milne, that they could afford to take a night school course on economics. Recent cases of multinational tax evasion, like IKEA sending 90% of their profits overseas and writing them off as business expenses, make it pitifully obvious that FATCA won’t effect them at all. They even sent them to IKEA in Belgium, so I guess they’re stiffing the Swedish tax man as well. It really is all about us, the low hanging fruit. It will be business as usual for the big boys. The worst part is the people who will be harmed by this before any notice is taken.

@Gordian

If I had known two years ago, I would have been in much better shape. It seems that I had to step in the dog shit before I actually saw it. At least when I did see it I was able to warn my daughter and the only other ex pat I knew. My daughter is an Aussie. Born here, schooled here ect. She has never lived in the US, never worked there, and yet apparently they own her, or at least a piece of her. Her freedom can be bought for a lot less than mine. But still, is that really OK?

There seems no depth to their depravity

@EllenDownunder

You have every right to be angry at Joe Hockey. His job as treasurer makes him the point man, and the one with the most blood on his hands. But don’t forget to save some of your outrage for the other major parties, because they’ve all thrown us to the dogs. Pretty much the whole world signed up for this crime, and I don’t personally believe that the opposition would have refused to sign it either. I’m not letting the government off the hook, far from it. They have had a spectacular fail in their duty of care. They’re supposed to work for us, how can they just let us be mauled by a Foriegn country?

I have a copy of the agreement between the Aust and US governments and I see no mention at all of children of a US citizen being liable for FATCA. However from what we see happening in Canada and France this may be a possibly further down the track if the IRS decides to move the goal posts.

So, at least for the present our kids may be safe, but…..

@AussieDan

Well thank God for that, at least someone’s safe. It won’t help in my daughters case though. Sadly because she didn’t renouce when she was 18 (who knew) they consider her a chattel. I feel bad because she caught the disease from me.

@ EllenDownunder

I sincerely doubt those sort of implications have crossed the minds of Jo Hockey or anyone else in Canberra. An number of items become law or policy simply because everything is increasingly just too complex to properly challenge . . . or ever read.

@ ProudAussie

My parents brought me here in 1959. I always loved the American connection. I had a 3 year stint back in the Sates after marrying my Australian wife. I arranged US passports for my 3 children, 2 of them born in Oz. I thought I was giving them options. Instead I’ve shakled them.

Ironic: Years ago you could order up all kinds of how-to stuff, free from Uncle Sam. Detailed house plans for example. (Maybe you still can.) Where, oh where, were the detailed plans for surviving as an expat??

@ Gordian

I think they’re somewhere down deep in the stack of plans, but unfortunately under the recent plans on how to prevent someone from surviving as an expat. Which is itself under a huge stack of letters explaining the tax obligations relating to expats, that someone forgot to mail.

Slightly off the main thread of this conversation but an excellent book to put FATCA in a historical perspective is Charles Adam’s latest book: “For Good and Evil The Impact of Taxes on the Course of Civilization”. Heavy title but a very good read. He doesn’t mention FATCA but it certainly fits in the Evil category.

@Gordian

Re: financial camouflage netting.

I opened a small account with Bank of Queensland yesterday to see if they were small enough to fly under the radar. I was asked if I was a “US taxpayer”. Fortunately the wording allowed me to offer up an emphatic “no” without having to lie. Anyhow, this incident confirms that it’s GAME ON. So, OK Barack, close your eyes and count to 100.

@ ProudAussie

“…the wording allowed me to offer up an emphatic “no”…. I could say that too! 🙂 You have to take such escapes as opportunities arise. But not fun in the long run to be constantly wary, a sort of IRS fugitive. I think I’ll test the account application language of a couple of other banks.

@US_Foreign_Person:

In Germany, Nazi-era Aryan Certificates are still sometimes used to establish lineage in probate proceedings. They were notarized when created and so are considered to be official documents.

A German probate attorney mentioned that many of them contain false lineage information, i.e., fake Aryan ancestors were intentionally inserted in place of non-Aryans. But because they are official, they can override other contradictory family information and documents, if any exist. They can be a can of worms if they come to light in probate proceedings.

https://en.wikipedia.org/wiki/Aryan_certificate

@Innocente

From what I heard from family… not only the item u mentioned… but birth certificates & other things were used during the war… I do know of people who used birth certificates of children or adults who passed… who got smuggled out using their birth certificates… people will do anything they can to survive… in my family… there are stories that the elders share with the next generation so we know our history because of the war… we have missing branches in our family tree

@Gordian

I should also mention that there was a form where I had to check 3 boxes and sign. Two of the boxes were just the usual stuff, but the third was fairly odious. It gave them permission to share information with just about anyone, and specifically included extraterritorial entities. I suspect that they’re not the only bank that might require such a waiver to be signed. Welcome to a Brave New World.

@US_Foreign_Person

My partner’s ancestors were German Jews who left in advance of the Holocaust, migrating first to Ireland than to Canada. Their branch of the family survived; the rest remained in Germany and perished.

CERTIFICATES OF LOSS OF JEWISH NATIONALITY ASSISTED GERMAN JEWS IN SURVIVING OR FLEEING THE HOLOCAUST

After the 1935 Nuremberg laws that stripped Jews of German citizenship, a valued document was a “certificate of non-Jewish nationality” obtained through a bureaucratic “reclassification procedure” to “certify” non-Jewishness – according to the pseudo-scientific and racist “bloodlines” criteria that the the Nuremberg laws used to define who was Jewish.

Essentially, this was a certificate of “non-Jewish nationality” or “Deutschblütigkeitserklärung”(German Blood Certificate).

http://www.jewishvirtuallibrary.org/jsource/Holocaust/nurlaws.html

https://en.wikipedia.org/wiki/Mischling#Reclassification_procedure

In all fairness, WW1 and WW2 wiped out many family branches all round. It nipped two off of my Canadian family’s tree. These wars were equal opportunity branch trimmers. Entire German families died in the Dresden fire bombings (and in other Churchill blessed missions) which eerily resemble what happens in Gaza now, every time Israel decides to “mow the lawn”. Escape from Gaza however is impossible, even with the cleverest of forged documents. Lest we forget, war makes victims of the many, not just the chosen few. The history of wars is written by the victors so the other great loss is the truth itself. I hate that we have become diverted out of necessity for our economic survival from a greater task ahead — trying to prevent WW3.

@EmBee

Agree – one of the big costs driving the US deficit is the ongoing global war on terror and the vast web of corporations and individuals profiteering from its limitless budget.

The book I’m getting everyone for the holidays this year is:

“Pay Any Price; Greed, Power and Endless War by James Risen

https://firstlook.org/theintercept/2014/11/25/talking-james-risen-pay-price-war-terror-press-freedoms/

“Risen has published a new book on the War on Terror entitled Pay Any Price: Greed, Power and Endless War. There have been lots of critiques of the War on Terror on its own terms, but Risen’s is one of the first to offer large amounts of original reporting on what is almost certainly the most overlooked aspect of this war: the role corporate profiteering plays in ensuring its endless continuation, and how the beneficiaries use rank fear-mongering to sustain it.”

This extra-territorial taxation situation I share with the rest of you has stressed me no end, robbed me of hundreds of hours and made we give away investments just to be free of complication. If the US were to announce the end of CBT it would feel beyond fantastic. And I worry about my kids in a similar boat. But I think comparisons with the Jewish situation in WW2 is a stretch. Compared with that ugliness this is a walk in the park.

@Gordian

*But I think comparisons with the Jewish situation in WW2 is a stretch*

Not the same situation but a group of people are being hunted… US persons… and we are being punished by having the US try to take our funds… there are some families who hide their funds from the Germans… the money is still hidden away… for safe keeping… they went to the US & as someone put it better then me… I think Petros… what the Germans couldn’t get… the US is trying to get it now…