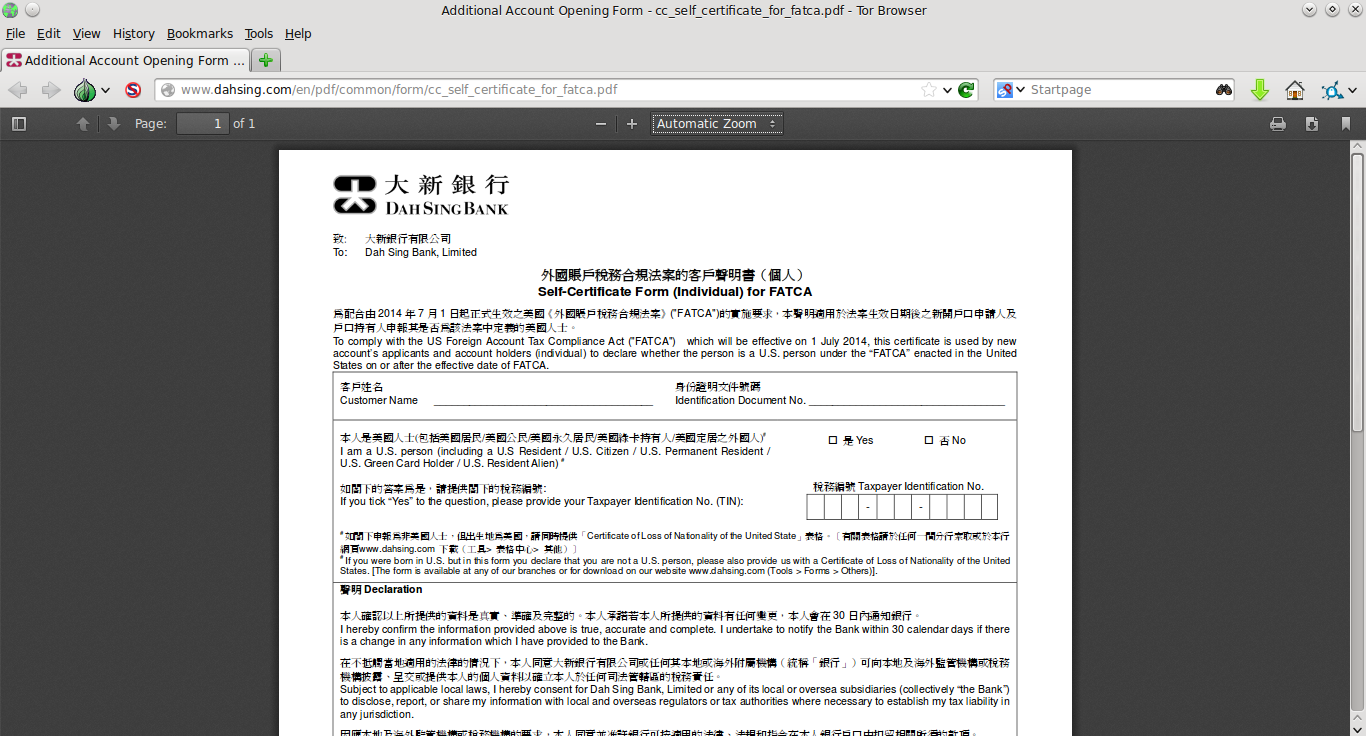

What kind of documentation will your “foreign” financial institution demand from you as a result of FATCA? Here’s one Hong Kong bank’s answer. From Dah Sing Bank’s Self-Certificate Form (Individual) for FATCA, as of lunchtime on 22 November (Internet Archive snapshot, in case they change it later):

如閣下申報為非美國人士,但出生地為美國,請同時提供「Certificate of Loss of Nationality of the United State」表格。[有關表格請於任何一間分行索取或於本行網頁www.dahsing.com下載(工具>表格中心>其他)]

If you were born in U.S. but in this form you declare that you are not a U.S. person, please also provide us with a Certificate of Loss of Nationality of the United States. [The form is available at any of our branches or for download on our website www.dahsing.com (Tools > Forms > Others)].

Dah Sing Bank is the only major licensed bank incorporated in Hong Kong which has neither branches in the U.S. nor substantial U.S. ownership. Oddly enough, the U.S. consulate in Hong Kong has an account with Dah Sing; the consulate used to tell visa applicants to transfer funds directly to that account, but since April 2013 we’ve been told to pay the fees at 7-11 instead. More screenshots after the jump.

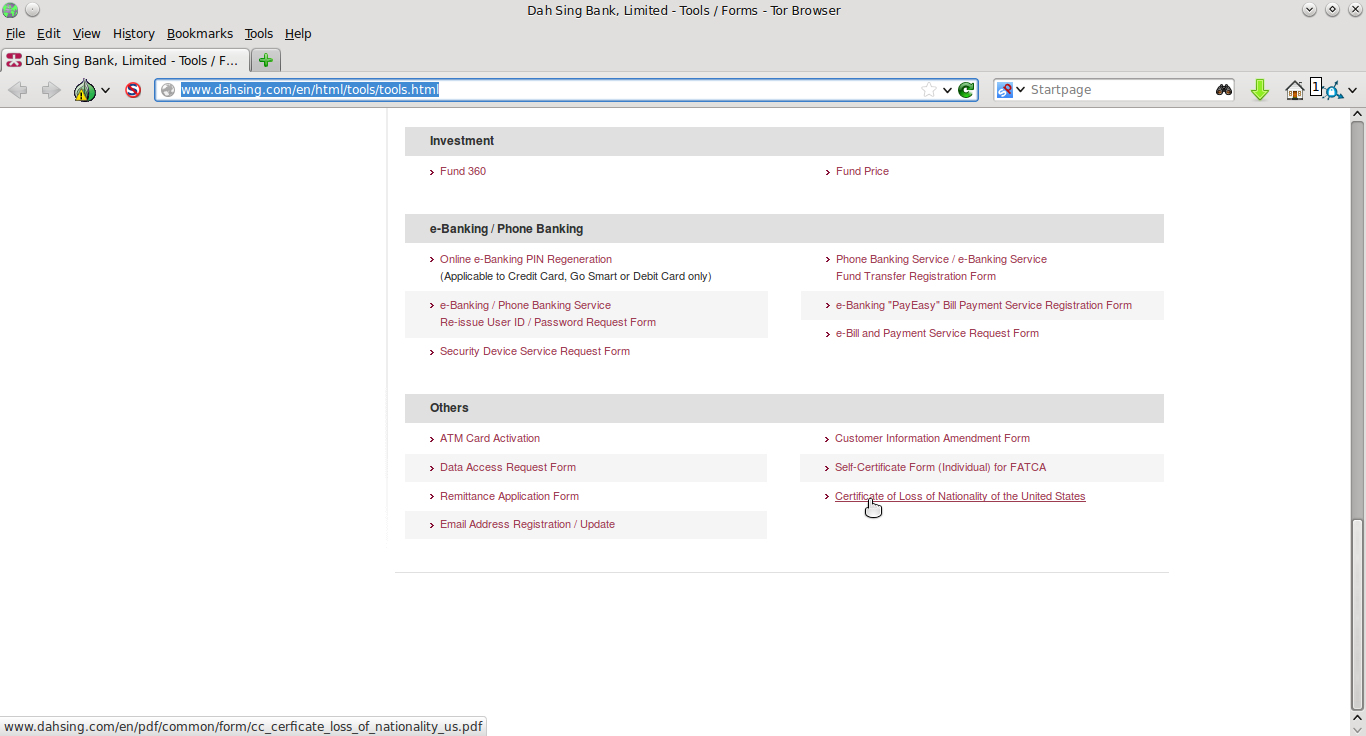

Blank CLN on customer forms webpage

What does the phrase “[t]he form is available at any of our branches or for download on our website” mean? Clearly not the FATCA self-certification form itself — the customer is already looking at that form when he or she sees that comment, and would have no need to download it.

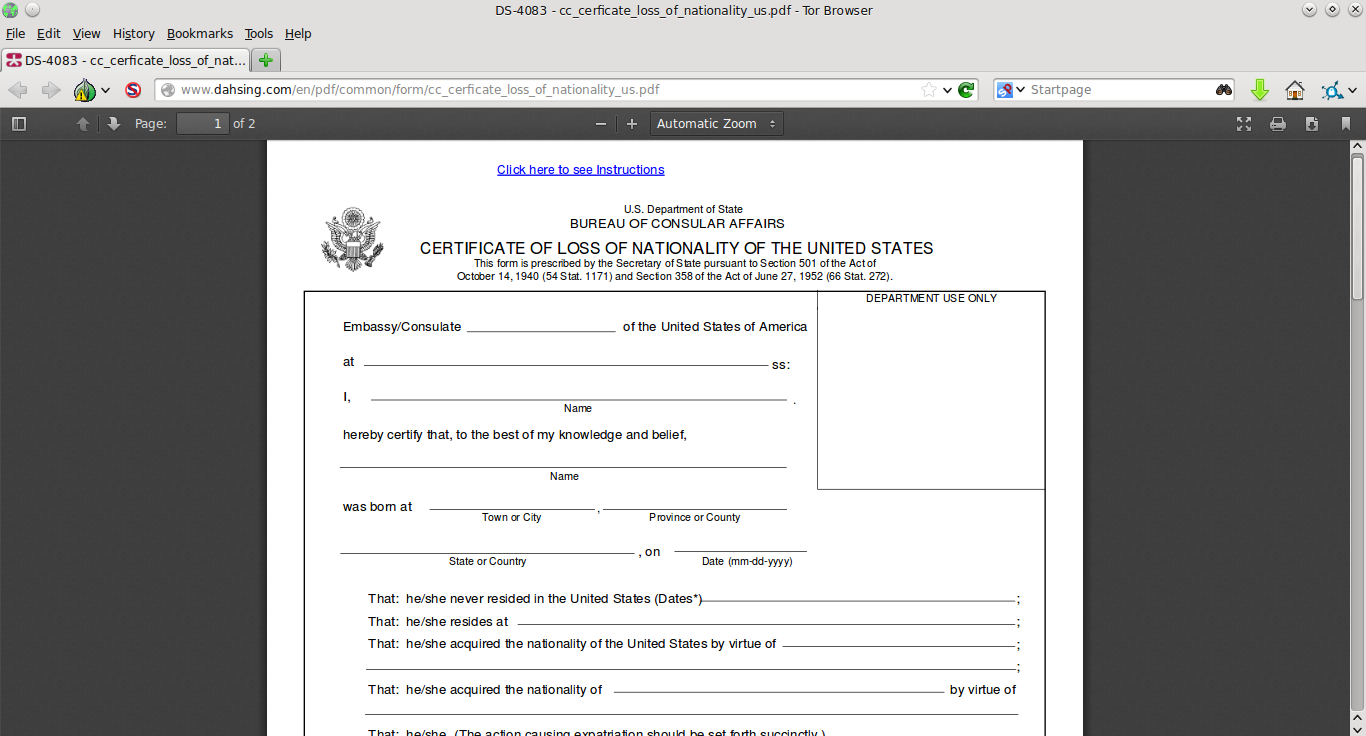

Instead, “[t]he form” appears to mean a CLN. Indeed, the Chinese version of the text calls it a “Certificate of Loss of Nationality form” (表格 rather than 證明書, the latter being normal word for a government-issued certificate used as proof of something). Furthermore, if you go to the specified “tools” section of Dah Sing’s website (screenshot above; see Internet Archive snapshots of the Chinese and English versions of the page), you can download a blank Form DS-4083, Certificate of Loss of Nationality (again, also saved on the Internet Archive).

However, I haven’t actually tried going to a Dah Sing branch and asking the teller for a blank CLN. I’d love to record that conversation, but I don’t think I’d be able to keep a straight face.

“Click here to see instructions”

At the top, the blank downloadable CLN has the strange blue and underlined comment “click here to see instructions”. Dah Sing’s website doesn’t provide any further guidance on what to do with the blank CLN available for download. But think about it: they’re handing out blank CLN forms to customers, at least virtually and maybe even literally at branches, and their FATCA self-certification tells people to give that form to the bank. What exactly do their compliance people expect is going to happen here?

And even if the missing instructions for the CLN would have told the customer to approach a U.S. consulate with the completed form for stamping & certification before submitting it Dah Sing, that’s the wrong way to go about getting an official CLN anyway — you fill out a DS-4079, and State sends back a completed DS-4083.

Conclusion

On a separate topic, it’s disappointing to see that Dah Sing’s FATCA self-certification form does not offer any option for customers to provide a “reasonable explanation” of why they do not have a CLN, as provided for in the Hong Kong–U.S. FATCA IGA — but I guess if you can fill out a CLN yourself, it’s not too big of a problem! And Dah Sing’s FATCA self-certification form does not directly ask for the customer’s place of birth, unlike for example this far more intrusive self-certification form demanded by CITIC Securities. (However, a few other Dah Sing products’ application forms do demand that customers answer whether or not they were born in the United States, such as the mWallet near-field communications credit card Android App.)

And on a serious note: if this is how a bank in a major, semi-Anglophone financial centre is handling FATCA self-certification, how well do you think non-Anglophone developing countries are doing?

Banks that will accept DIY CLNs. What could be better?

I say we all do the same!

About 30 years ago I got a Chinese visa in Hong Kong through an intermediary. They also offered me a Taiwanese student card which allowed me to stay at virtually any hotels, not just the tourist ones, and to use the local currency (there used to be two, RMB and FEC). Their counterfeits are extremely good and the card was never questioned. I doubt that a bank will call Washington to check the authenticity of a CLN. At least not until there are a whole bunch of counterfeits about.

Supposedly it’s against the law for banks to photocopy any pieces of ID to ensure against identity fraud (although I’m pretty sure my bank has illegally photocopied my driver’s licence in the past). I wonder if one can argue that a CLN is a piece of ID and therefore not permitted copying. They’d only be allowed to check off a box saying they “saw” the CLN.

@GwEvil: not sure about CLNs, but here in HK the guidelines on taking photocopies of identity cards are looser; there are restrictions but it is not outright illegal:

https://www.pcpd.org.hk/english/ordinance/code_guide_individual_3.html

https://www.pcpd.org.hk/english/ordinance/code_guide_individual_4.html

@Gwevil

When opening ADCS accounts, pretty sure photocopies were made of our IDs.

I like what you are saying though, makes sense.

http://www.fintrac-canafe.gc.ca/publications/guide/guide6/6G-eng.asp#s3-3

Guideline 6G: Record Keeping and Client Identification for Financial Entities

Identification documents

If you have to ascertain the identity of the individual using an identification document, the record has to include the type of document you used to confirm the individual’s identity, its reference number and its place of issue.

Identification of clients not physically present

If you rely on a photocopy or electronic image of an identification document provided by the individual, you have to keep that photocopy or electronic image; and

If you rely on a deposit account statement for the individual, you have to keep a legible photocopy or electronic image of it.

Notice the first paragraph. If a person opening an account is physically present, the bank is only required to write down what type of ID it is, the reference number and place of issue, but is NOT required (nor have they been encouraged) to take photocopies of the piece of ID. Only if the client “is not physically present” and uses a photocopy or electronic copy of their ID Are they supposed to keep a copy of the copy or a copy of an electronic version. I would venture to say we should all insist that they DO NOT copy our ID when they can see that we are physically present. Insist they don’t photocopy a CLN either, but only write down the particulars (although for some bizarre reason they don’t have issue numbers on them!)

The Netherlands has come up with what I think is the best FATCA guidance.

A nationwide single certification form with a very in depth manual was created so there would be consistency amongst all FIs.

Document is here;

https://www.atbank.nl/Documents/PDF/ENG_FATCA%20Guidance%20Dutch%20self-certification%20form%20natural%20persons.pdf?epslanguage=ru

The key part on self certification is page 9 where they go into reasonable explanation.

“If none of the above reasons or circumstances can be demonstrated by the client (reasonable explanation), this means that the client has not renounced his/her citizenship and the client must be designated as a U.S. Person.”

Essentially you have to demonstrate to the FI that you performed one of the actions in 8 US Code and that is a “reasonable explanation.”

To be honest, that is what most of us want/expect. Nothing more and nothing less.

I think the ADCS team would be well served by sharing this document with legal counsel as a means of showing what good practice actually is.

I have friends in Holland who are former USC and they have not had any FATCA issues, none have CLNs. All have provided reasonable explanations when asked.

This is far different than the feedback we hear from CHF but that is a special case.

There is another lesson that is becoming very clear…..

A former USC (relinquisher) can navigate life post FATCA. It is not ideal, it is not desireable, it is discriminatory but you can navigate.

Life for an accidental has become do I renounce out of the closet or relinquish in the closet but I have to take some kind of action.

However life for the long term American Citizen Abroad carrying a US Passport has collapsed.

I know that ADCS is also fighting for the long term USC migrant to Canada but who knows if they can be saved in Court.

I just reread my last post…….

Amazing the new terms we have developed.

“Relinquish in the closet”

Can you imagine hearing someones accent and then whispering “are you a closet relinquisher?”

The problem is the bank is judge, jury, and executioner when it comes to deciding whether to send your data to the IRS.

The bank makes a mistake – tough luck.

If I was the bank, just send off any suspected US Person’s data because there’s no recourse.

The flowchart on page 6 for me shows pure discrimination also the $50,000 is ‘optional.’

What would be the difference if they substituted Non-US Person for (White People) and made US Person (Black People). This would be called racism.

FATCA is racist in the sense US Person gets treated differently and put into a different pool of people according to the flowchart.

How on earth could a court allow this to go on for citizens of their own country and not call it discrimination?

In Australia one of the local banks has the following statement on its loan application: ‘ You are not a US citizen or US tax resident.” In other words if you are a US person you need not apply.

And for Australia’s largest bank, the Commonwealth Bank in their “Amended Terms and Conditions”, reflecting their new “international obligations”, on page 3 it states: “withhold an amount from a payment to you if required to do so, and if we do, we will not reimburse you for the amount withheld; and/or take such other action as is reasonably required, including, for example, closing your account.”

Too bad in Australia awareness of the gathering FATCA storm is practically nill – until those letters from the IRS arrives….

@Aussie Dan

Best to stay away from the bigger banks. My biggest issue is a brokerage account I have with the Commonwealth which is how I make a crust. Sadly, that was then, this is now, it’s time to scatter the dust to the wind. Even though it will cost me my livelihood, I’ll at least make the bastards earn it. I only ever opened accounts with a QLD or NSW drivers license, and if I used a passport, it would have been my Aussie one. There are at least two of us now who have been woke.

Just in this morning is a Facebook item about a French protest in Sydney over rumors that the French government is considering enacting a FATCA like rule that will affect all French citizens worldwide. The French version is here: https://www.facebook.com/Mouvement.HollandeDemission/photos/a.537279586356066.1073741826.537275039689854/760483210702368/?type=1

Translation: FRENCH PRESIDENT HOLLANDE’s VISIT TO SYDNEY

During his visit to Australia for the G20, Francois Hollande met up with 500 members of the French community at the Opera House on November 18 2014. A group of French residents in Australia -who were not invited- were waiting in front of the Opera house with a sign “Hollande demission” [Hollande resign]. In fact, the president is not really appreciated by French people in Australia who voted 57% against him in the last presidential election. His rating is not set to improve amongst the French community in Sydney with recent rumours of a possible double taxation of French people living abroad. On top that, they are being subjected to the “CSG” and “CRDS”, two taxes which aim to finance social security that (because they pay tax in Australia) they cannot benefit from. The latter is considered as an redundant tax, which is currently being challenged by European authorities.

Welcoming Francois Hollande with demonstration banners asking for his resignation, is occurring more and more frequently in France and also abroad, as his popularity is currently at an all time low, scoring only 15%. The French President was barely visible on the major Australian newspapers this week, as leaders like Xi-jimping for China, Obama, Putin, Shinzo Abe, Angela Merkel, David Cameron and Tony Abbott were making headlines. Even Christine Lagarde (head of the MFI) had more exposure in the press.

After seating on his chair before the Queen of England did, at a ceremonial dinner on May 6, 2014 and before the pope during a visit at the Vatican on January 24, 2014, Mr. Hollande repeated this protocol “faux-pas” and sat down before President Putin during their short encounter at the summit in Brisbane. President Putin did not hesitate to ask Hollande to stand up in order to properly shake his hand in front of the cameras. This new humiliation may add to the discontent of the young French people living in Australia, in front of the Sydney Opera house.

Anyone have any further info on this?

@ Aussie Dan

Who would have thought a significant French community lived in Australia? Anyone know how many US citizens are here?

According to the last census there are approx. 77,000 US citizens in Australia. Add to that God knows how many Green Card holders and then there is the question of all the children of these US citizens. Will the IRS go after then as well?

Australia is a country of immigrants just like Canada and the United States.

http://en.wikipedia.org/wiki/French_Australian

French Australians (French: Franco-Australiens), some refer themselves as Huguenots are Australian citizens who are of French or ancestry or France-born people who reside in Australia. According to the 2011 Census, there were 110,399 people of French descent in Australia and 24,675 France-born people residing in the country at the moment of the census, having an increase of 28.6 per cent compared to the 2006 Census. The largest French Australian community is in the state of New South Wales, with 8,936 France-born people.

http://en.wikipedia.org/wiki/American_Australian

At the 2006 Australian Census, 71,718 Australian residents declared that they were American-born. Concentrations of American-born residents were in Sydney (16,339), Melbourne (11,130), Brisbane (6,057), Perth (5,558), Adelaide (2,862), and Canberra (1,970).[ Also at the census, residents could nominate up to two ancestries; 56,283 respondents declared they had American ancestry with 3,901 who declared Hispanic ancestry, 1,798 declared an African American ancestry, 3,936 declared a native North American Indian ancestry and 224 declared Puerto Rican ancestry.

Americans who were born to a US citizen parent outside the US may wish to attempt to disprove that they are actually US citizens. A few thoughts on this subject:

Parents: if your father was an American but your mother was not, is there a way to demonstrate that you were illegitimate? For purposes of denying that you are a US citizen, could you somehow cast doubt on whether your American father was actually your biological father, even if you were raised by him and your mother.

– If there is any question whether your American father is your actual biological father, a DNA test might also be considered.

Parents’ marriage certificate: Was your parents’ marriage certificate properly completed and signed? Again, with an American father and a non-US citizen mother, could you somehow demonstrate that you were illegitimate with an unsigned/ incomplete marriage license?

Birth certificate: Was your birth certificate abroad properly signed? If not, is it possible to question its validity sufficiently to deny that you are a US citizen? Is it possible to demonstrate that a birth certificate does not exist?

In my life I’ve known people who had incomplete or inaccurate personal documents, e.g.:

1) No birth certificate of any kind. (Born at home on a farm.)

2) An unsigned birth certificate.

3) A partially signed marriage certificate (signed by the couple but not by officiating pastor).

4) A child who was conceived before the couple met but raised as a full member of the family.

5) A niece who was raised by an aunt and uncle as their own but without adoption paperwork.

During the Nazi period some Jews and other persecuted people disproved that they were non-Aryan through missing and incomplete as well as falsified records. An excerpt from Wiki: “genealogical research particularly flourished in Germany during the Third Reich. Opposition clergy helped many racially persecuted individuals by providing them with fake genealogical documents (called “ancestor passports”) as a personal document necessary for survival.”

https://en.wikipedia.org/wiki/Ahnenpass

My grandfather immigrated to the United States through Ellis Island in New York using someone’s else’s name and documents in about 1907.

@Innocente

I suspect there will be an entire market developed for people who need to prove they aren’t American. Call it citizenship cleansing, or something of the like.

77,000 . . . plus greencard holders . . . and offspring! Those sort of numbers could raise a little coin for Obama-schemes. And those 3 catagories . . . I’m all over ’em. Lucky us.

So you think we’ll be lucky enough to get a IRS office in Canberra? There used to be some such in the early 90’s, before they put the regional office in the Phillippines. That way they I suppose they could have feet on the ground and someone knocking at your door.

@EllenDownunder

My grandfather & other family members used fake papers to escape during the war… as told by the elders… they were very lucky… they were always one step ahead of being captured… to this day… we have family we do not know if they died during the war or if they survived… some of the people who used fake paper…. built a new life with that paper work… We tried to do a family tree for our next generation… we had more questions then answers…. But that has always been the case for immigrants of a war….

It seems they do not need an office in Australia. If someone doesn’t jump through their hoops and refuses to pay their extortionate demands they can simply order your bank to close down all your banking facilities: foreclose on mortgages, no business accounts, etc, etc. This is indicated in the new Commonwealth bank terms and conditions and according to a US Tax lawyer who writes on these issues. I consider all this a gross violation of basic human rights. Are there any moves to bring this up in the UN or other international venue?

It seems that another aim for the IRS is to make it virtually impossible for US Citizens to have investments outside of the US.

Aussie Dan,

See the upper right-hand corner of the home page of Isaac Brock for the link to the post regarding our UN Human Rights Complaint. The Committee that addresses Human Rights Complaints next meets in April 2015 as far as we can determine. We have a READ RECEIPT for the UN having received our submission, but no other actual confirmation or any indication of where we might be in the queue.