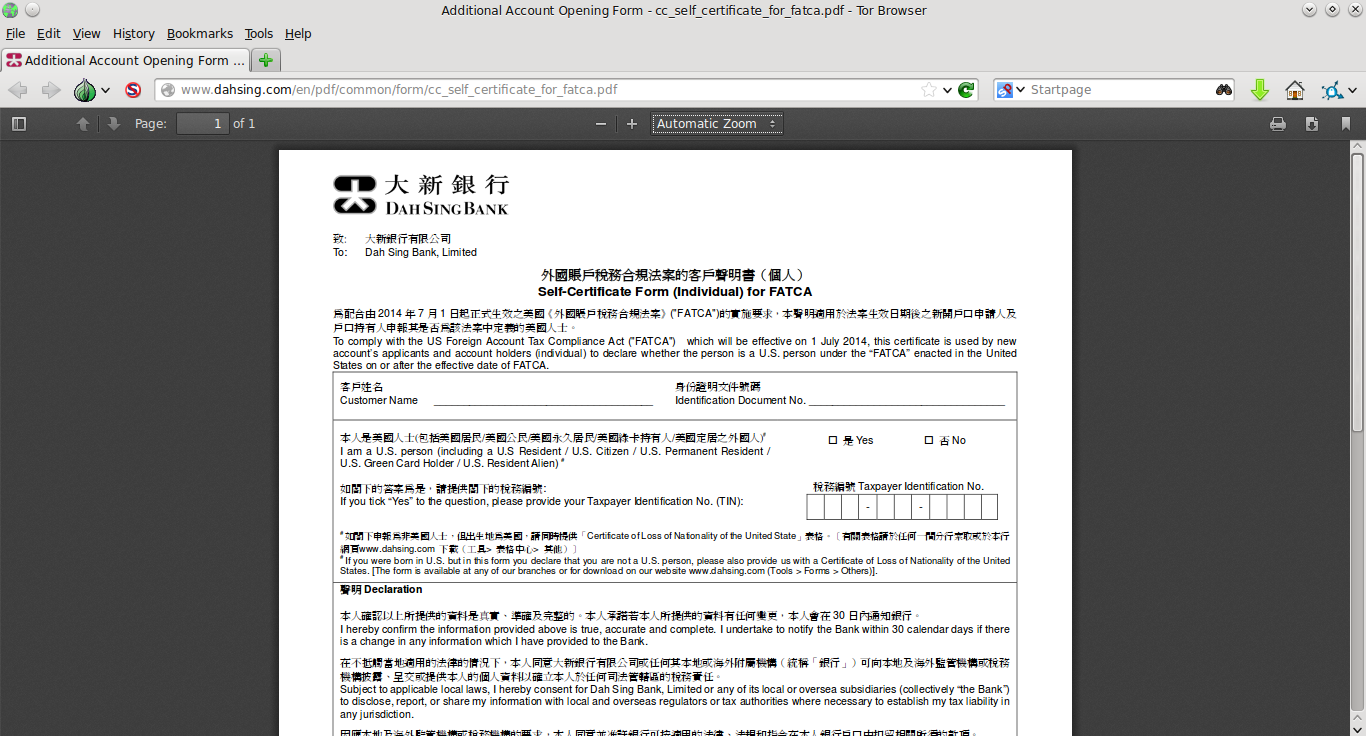

What kind of documentation will your “foreign” financial institution demand from you as a result of FATCA? Here’s one Hong Kong bank’s answer. From Dah Sing Bank’s Self-Certificate Form (Individual) for FATCA, as of lunchtime on 22 November (Internet Archive snapshot, in case they change it later):

如閣下申報為非美國人士,但出生地為美國,請同時提供「Certificate of Loss of Nationality of the United State」表格。[有關表格請於任何一間分行索取或於本行網頁www.dahsing.com下載(工具>表格中心>其他)]

If you were born in U.S. but in this form you declare that you are not a U.S. person, please also provide us with a Certificate of Loss of Nationality of the United States. [The form is available at any of our branches or for download on our website www.dahsing.com (Tools > Forms > Others)].

Dah Sing Bank is the only major licensed bank incorporated in Hong Kong which has neither branches in the U.S. nor substantial U.S. ownership. Oddly enough, the U.S. consulate in Hong Kong has an account with Dah Sing; the consulate used to tell visa applicants to transfer funds directly to that account, but since April 2013 we’ve been told to pay the fees at 7-11 instead. More screenshots after the jump.

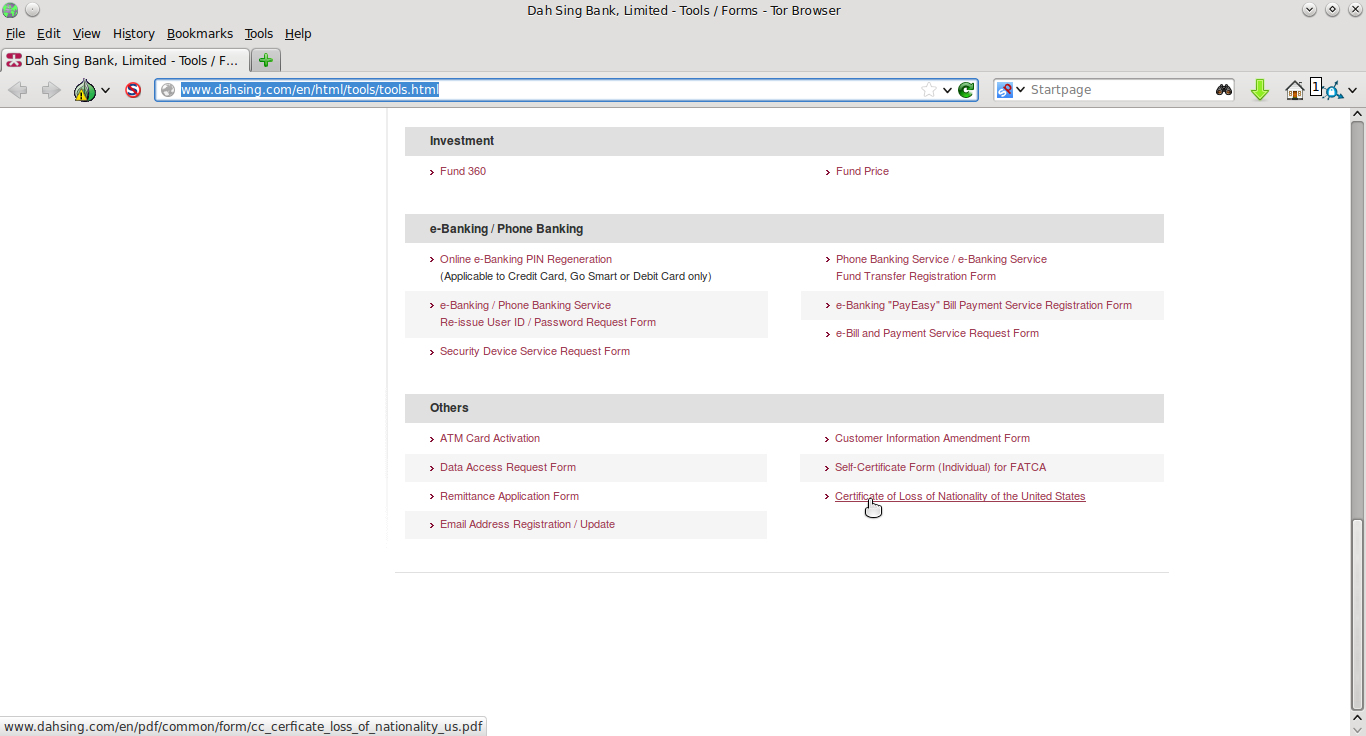

Blank CLN on customer forms webpage

What does the phrase “[t]he form is available at any of our branches or for download on our website” mean? Clearly not the FATCA self-certification form itself — the customer is already looking at that form when he or she sees that comment, and would have no need to download it.

Instead, “[t]he form” appears to mean a CLN. Indeed, the Chinese version of the text calls it a “Certificate of Loss of Nationality form” (表格 rather than 證明書, the latter being normal word for a government-issued certificate used as proof of something). Furthermore, if you go to the specified “tools” section of Dah Sing’s website (screenshot above; see Internet Archive snapshots of the Chinese and English versions of the page), you can download a blank Form DS-4083, Certificate of Loss of Nationality (again, also saved on the Internet Archive).

However, I haven’t actually tried going to a Dah Sing branch and asking the teller for a blank CLN. I’d love to record that conversation, but I don’t think I’d be able to keep a straight face.

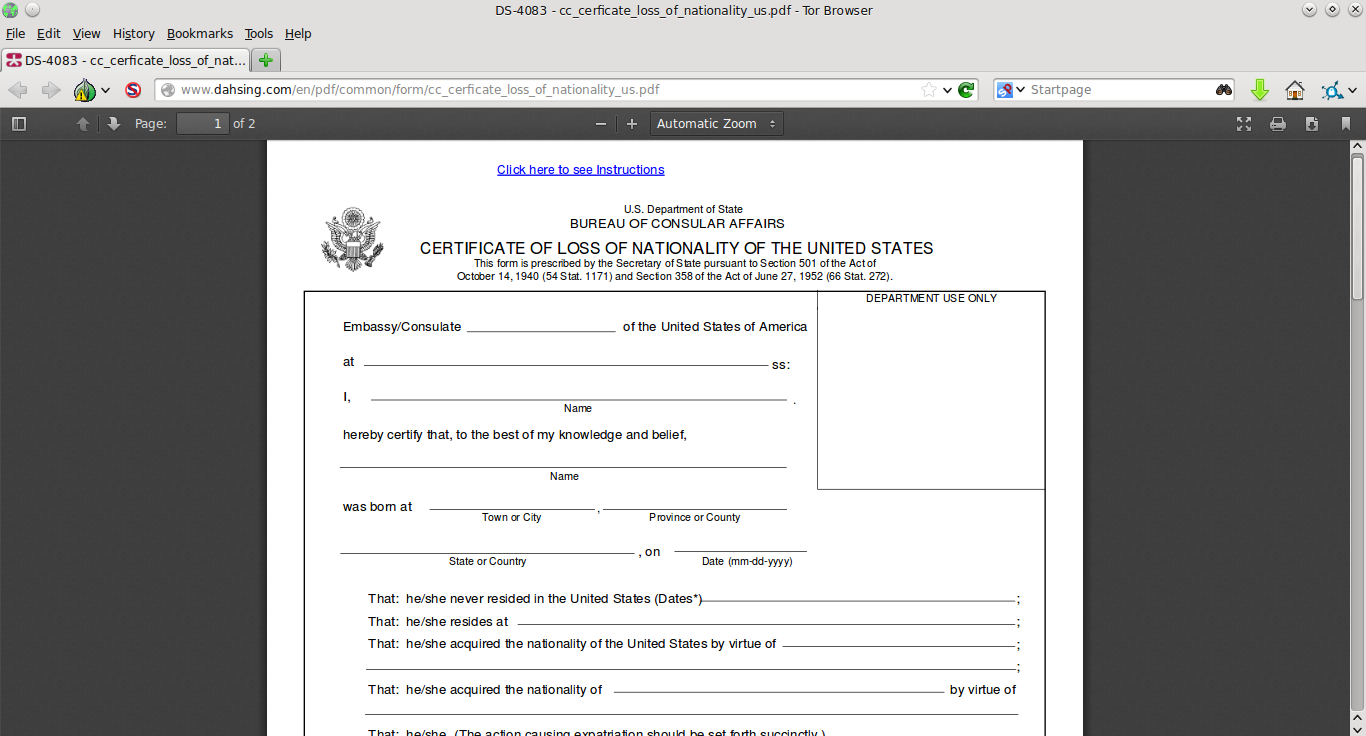

“Click here to see instructions”

At the top, the blank downloadable CLN has the strange blue and underlined comment “click here to see instructions”. Dah Sing’s website doesn’t provide any further guidance on what to do with the blank CLN available for download. But think about it: they’re handing out blank CLN forms to customers, at least virtually and maybe even literally at branches, and their FATCA self-certification tells people to give that form to the bank. What exactly do their compliance people expect is going to happen here?

And even if the missing instructions for the CLN would have told the customer to approach a U.S. consulate with the completed form for stamping & certification before submitting it Dah Sing, that’s the wrong way to go about getting an official CLN anyway — you fill out a DS-4079, and State sends back a completed DS-4083.

Conclusion

On a separate topic, it’s disappointing to see that Dah Sing’s FATCA self-certification form does not offer any option for customers to provide a “reasonable explanation” of why they do not have a CLN, as provided for in the Hong Kong–U.S. FATCA IGA — but I guess if you can fill out a CLN yourself, it’s not too big of a problem! And Dah Sing’s FATCA self-certification form does not directly ask for the customer’s place of birth, unlike for example this far more intrusive self-certification form demanded by CITIC Securities. (However, a few other Dah Sing products’ application forms do demand that customers answer whether or not they were born in the United States, such as the mWallet near-field communications credit card Android App.)

And on a serious note: if this is how a bank in a major, semi-Anglophone financial centre is handling FATCA self-certification, how well do you think non-Anglophone developing countries are doing?

@ US_Foreign_Person

Fair call.

Looks like the story is now Hong Kong banks tell U.S.-born customers to get lost if the don’t have $3 million!

http://www.china-briefing.com/news/2014/12/18/hong-kong-banks-shut-us-accounts-rather-deal-fatca.html

The FATCA blowback would be funny if it wasn’t so tragic for Americans and American companies abroad, Publius.

Dah Sing updated their FATCA self-certification form.

https://web.archive.org/web/20150731155438/http://www.dahsing.com/en/pdf/common/form/cc_self_certificate_for_fatca.pdf

1. They fixed a spelling error (they misspelled “United States” as “United State”)

2. They changed it to refer to FATCA’s effective date as a past rather than future event

3. They now require you to certify that the Taxpayer Identification Number you provide is your correct U.S. Taxpayer Identification Number (i.e. they added “U.S.”, to outwit all the sneaky or easily-confused folks who planned to give them other countries’ Taxpayer Identification Numbers)

However they have not fixed the biggest error of all: they are still telling people to download and fill out a CLN from their website. The blank CLN remains available for download on their customer forms page

https://web.archive.org/web/20150731160041/http://www.dahsing.com/en/html/tools/tools.html

https://web.archive.org/web/20150731160211/http://www.dahsing.com/en/pdf/common/form/cc_cerficate_loss_of_nationality_us.pdf

How handy!

Here’s another amusing one: OCBC in Singapore is telling U.S.-born customers that they can submit either a CLN or a Form I-407 to prove that they’re no longer U.S. tax residents

https://web.archive.org/web/20150618102020/http://www.ocbc.com/assets/pdf/Cards/T30318-304265-Supp-Card-Form-Internet.pdf

Dah Sing updated their FATCA certification form in January 2017 to include CRS certification as well

https://web.archive.org/web/20170417025958/http://www.dahsing.com/en/pdf/common/form/cc_self_certificate_for_fatca.pdf

The new form still tells you to download a Certificate of Loss of Nationality from their website

Dah Sing also have a form for customers to providin a “reasonable explanation” for CRS if they are not tax resident in some country but have a mailing address there. Four standardised reasons (student, teacher/exchange visitor, diplomat, train/ship crew) and one “fill in the blank” for other explanations.

https://web.archive.org/web/20170417030536/https://www.dahsing.com/tc/pdf/common/form/cc_reasonable_explanation_form_crs_ind.pdf

However they do not seem to have any standardised form for a US-born customer to give a “reasonable explanation” of not having a CLN.