Are US Refugee statistics correct?

Hmmm. What’s up here? Does 2+2 = 32? Why are the US Federal Register published statistics off by a factor of 8? Is this “truth”? Is this “competence”? Is this “leadership”? Is this “‘information’ for ‘formulating an opinion’?” What kind of opinion is meant to be formulated with this kind of “information”?

The President turns to his staff mathematician and asks: “Quick, what’s 2 = 2 ?” The mathematician answers, “The answer is straightforward: 2 + 2 is exactly 4.” The President turns to his staff statistician, and asks the same question. The statistician replies: ” The probability that 2 + 2 lies within the region 3.5 and 4.5 is 98% “. The President turns to his appointed first report at the Federal Register, and asks the same question. The administrator responds “What would you like it to be, Mr. President?”

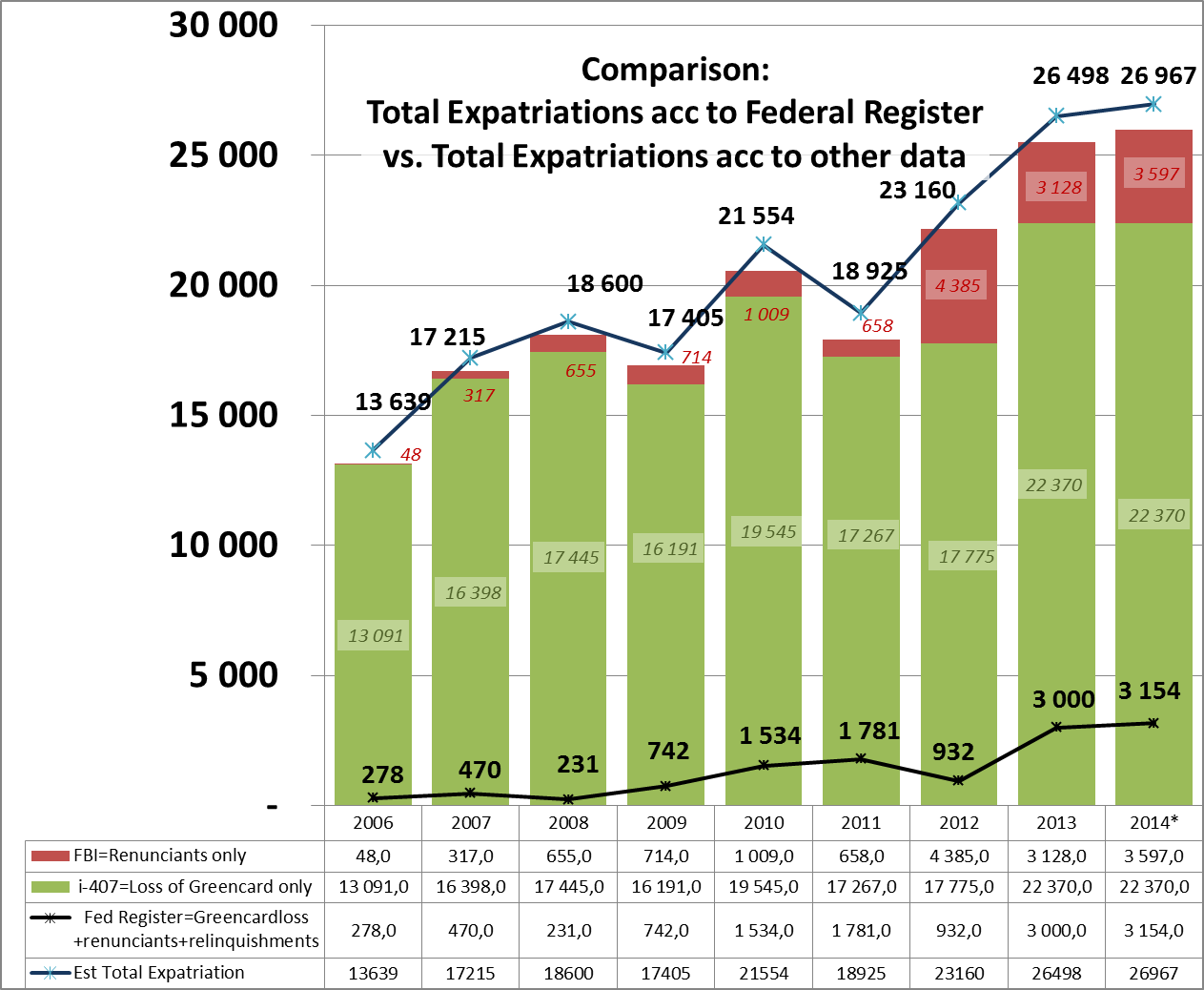

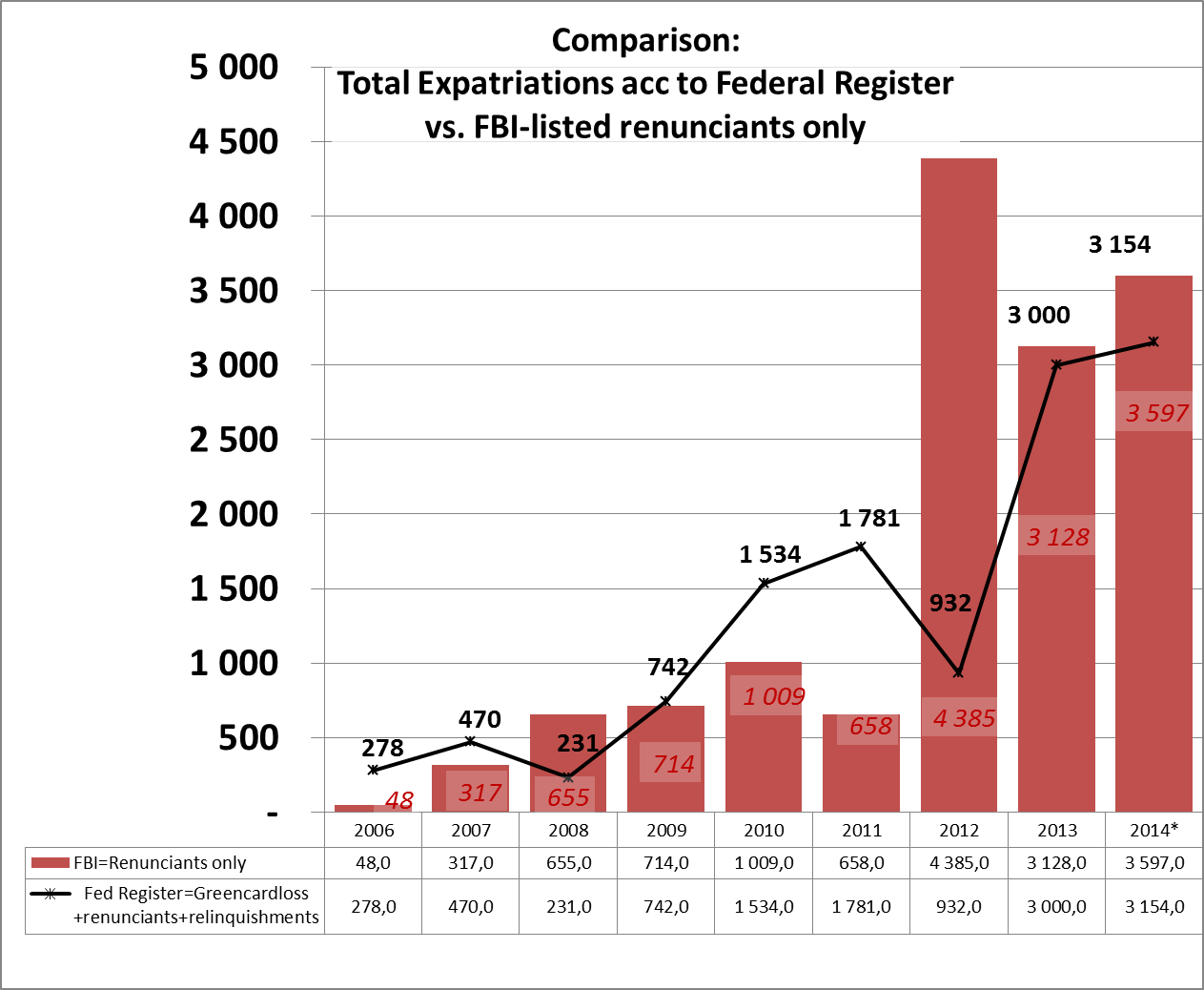

Federal Register Statistics (the ones published all the time, shown as the black line in the graph):

Let’s look at what the Federal Register has reported, as acquired from Wikipedia’s “The Federal Register Quarterly Publication of Individuals Who Have Chosen to Expatriate” (source referenced “A” below). This is a list which supposedly reports the quantity of Expatriating individuals from USA–the number is supposed to include 1) renunciants, 2) relinquishers, and 3) those long-term residents who have terminated their visa’s (“this listing, long-term residents, as defined in section 877(e)(2), are treated as if they were citizens of the United States who lost citizenship.” (“A” & “B“))

FBI statistics of renunciants only (red bar on the graph)

A renunciant is one who has gone to the embassy and directly stated to the embassy that has traveled to the embassy and stated a consulate-standard oath of renunciation of US citizenship. For this privilege, (s)he must also now pay $2350 to the consulate. A relinquisher is one who has performed a particular act with the specific intention of losing his citizenship. Such an act could be such as working within a foreign government, or taking upon a foreign citizenship with the specific intent of simultaneously relinquishing US citizenship.

A database of those who have renounced their US citizenship exists at the FBI. This is a result of the Brady Bill which disallows renunciants from purchasing firearms. To meet the intent of that act, the list only holds the category of renunciants. Let’s make the assumption that the FBI is both correct and honest, and use it’s renunciation data with other newly data. (See references “D“, especially the first)

Loss of Long-term visa status, I-407 (shown by green bars on the graph)

The final category of expatriation is those who have held green cards. In order to be completely final of US personhood, a green card holder must file the I-407 IRS form which states that he is terminating his visa status.Only recently has a list of those terminating their greencard status with form I-407 been released. (see reference “C“)

Adding (Renunciants) + ( I-407 visa turner-inners) makes the stacked bar graphs

Therefore, with correct statistics, it should be able to add the FBI list of renunciants (the red bar) to the FOIA list of I-407 greencard turner-in-ers (the green bar, acquired from the FOIA referenced “B” below.) to make a sum. This is done by stacking the two bar graphs.

Adding relinquishers to the stacked bars: not available

The quantity of relinquishers is needed to complete the analysis. However, this is not available., hence it is not shown as a stacked bar. It was assumed that 500 relinquishments occurred per year in the first half of the period of analysis. 1000 per year were assumed for the second half of the period of the analysis. The assumed numbers are an insignificant portion of the total, and therefore would not negate any conclusions.

Blue line: What the Federal Register SHOULD read (I-407 visa turner-inners), Red bar (Renunciants), + Relinquishers (estimated)

Comparison of the two lines

Let’s look at the data in the graph to evaluate the honesty and accuracy of the administration’s Federal Register data.

Whoa! What do we see? The data in the Federal Register is 8 times lower than what it should be. This is an exponential inaccuracy.

What could be the reason for these Executive “inaccuracies”? A boo-boo? (the proper word for that is incompetence). Round-off errors? (perhaps the figures are meant to be rounded off to the nearest odd 100,000?).

Or is it some other agenda? Is Mythster Robert Stack of the Treasury helping to back up his “and Facts” Sheet? (see refs)

It appears that the quantity of individuals choosing to expatriate has little basis in accuracy. The Federal Register’s expatriation list is known as the “Name and Shame” list, as there is no functional reason for listing the names of persons having renounced their citizenship other than to shame such person. This falls in line with the President’s summer speech where he backhandedly attacked the refugees leaving his FATCA & FBAR dragnet. He was openly flailing the foreign subsidiaries who are trying to achieve corporate refugee status outside the reach of the US’ extra-territorial taxation system., “…But stopping companies from renouncing their citizenship just to get out of paying their fair share of taxes …”. With this one sentence, the president managed to smear an entire group of refugees leaving USA.

(Lest we not forget–a refugee leaving the US is muzzled from speaking about why–that the FATCA and FBAR dragnets are after him. If he shall speak, the refugee is automatically labeled a “covered expatriate” and subjected to an automatic 30% exit tax. And, be reminded that the exit tax from the Wehrmacht was only 25%!).

Altnernative anecdotal data

With no access to factual data, one must turn to anecdotal information in order to attempt to pursue a truth.

For example, in Belgium, a moderately sized country, the embassy has mentioned that they are processing about 5 renunciations per week, and that this is happening at embassies EVERYWHERE. With 190 countries in the world, this would imply 1000 renunciations per week!

In Canada and Switzerland, where awareness of FATCA is very high, most embassies and consulates have waiting periods ranging from 2 to 18 months.

The administration itself has reacted–by locking the doors to people of lesser means. First, the administration raised the renunciation fee from zero to $450. And last month, the renunciation fee was raised to $2350. Compare this to the costs of acquiring a passport–$135. Imagine that–he’s made it so that a renunciation from USA is 17 times more valuable than a passport to USA!

The data shows that the statistics of the administration just do not add up. What is the motive? What is the agenda? With this data available and analyzed, the burden of proof now lies upon the administration to fact up with its “statistics”.

References

Confirming opionion

http://www.nestmann.com/expatriation-statistics/#.VEtv4tEcTIU

ALL RIGHTS RESERVED

ALL RESPECT DESERVED

I don’t know the best way to do this but this is very important work that needs to be brought out to the public. Perhaps Mr. Woods would publish it as part of an article in Forbes? This is seriously important data. Thank you.

I renounced over 2 years ago and have never appeared on the list.

@Notamused, I often wonder whether it is better to be on the list or not. I was detained the first time I flew into the US post renunciation while they ‘verified my copy of my CLN; had my name not already been on the list, I’ll always wonder if they might have refused me entry.

Another concern is whether the IRS could challenge whether a person has fully expatriated for tax purposes if they can’t confirm expatriation without one’s name on the official list!

On the other hand, they could use the list to blackball anyone if they decide to start aggressively enforcing the Reed Act. They could try to argue that the vast bulk of us have expatriated because of tax reasons, even though it’s actually more to do with the expenses and burdens of ongoing compliance, retaining local banking, etc.

Correction, nics data is updated to sept

2014

I renounced over a year ago have a CLN and have sent in all the final forms including 8854 but my name has NOT yet been listed. I know some one who renounced about the same time as me, and their name appeared on the list before they sent the final tax returns and the 8854. It seems inconsistent. I do think this information is relevant for Robert W.

text now updated-changed to sept 2014

Cooking the books to justify bad government policy, even when common sense and morality says otherwise.

How many Freedom of Information requests have been made to the State Department and Treasury to get the real numbers and the answer has always been the same, some BS excuse for why they can’t provide them?

@Banc de la asteroide:

Thank you for your write-up on discrepancies and understatement of expatriation statistics. Although you likely know this, the high number of FBI NICS renunciations in 2012 was due to the State Department clearing up a backlog of 2,900 names, according to Global News’ Patrick Cain:

“The total of 3,128 is lower than the 4,652 people added to an FBI database of ex-citizens. But the 2012 total includes about 2,900 names entered in October, 2012 as the State Department cleared a backlog, FBI spokesperson Stephen G. Fischer Jr. explained in an e-mail. Deducting those names brings 2012’s total down to 1,752, and makes last year’s total the highest since at least 2006. In 2011, 958 names were added.”

http://globalnews.ca/news/1072303/over-3100-americans-renounced-citizenship-last-year-fbi/

@monalisa1776

“I often wonder whether it is better to be on the list or not.”

Me too. I’ve really no idea.

Document that you expatriated by taking the government job. You can even request a CLN back-dated to the date of the expatriating act. Even if you don’t get freed for tax purposes, you do not infect any babies born to you after the expatriating act.

The reason why people are handing in their US passports is that FATCA places an unacceptable burden on dual US / other citizens that other fellow citizens in your home country don’t have to deal with.

We’re suppose to be equal Canadian, EU, and other citizens, but with FATCA the IRS is always that uninvited force always lurking in the background while we continue to pay out income tax, VAT, council tax, National Insurance to our country of residence.

All we want is a level playing field which is impossible to achieve with FATCA.

The US Congress doesn’t care because they spend all their time raising money for the next election. Ex-pats don’t offer much campaign money so we get ignored.

@Don

*The US Congress doesn’t care because they spend all their time raising money for the next election. Ex-pats don’t offer much campaign money so we get ignored*

Not only that…. they figure that expats don’t have votes that will count for them so why bother… also… immigrants in the US have no representation at all for anything so why even bother with them… they have better things to do then listen to the problems… but they forget… some donate even if they themselves can not vote… they influence others in voting… or become citizens in the future… very short sighted by politicians….

Many thanks for the explication and illlustrations @Banc de la asteroide. Very important work in the vein of Eric and others here.

I like to think that the Name ’em and Shame ’em list is evidence of a kind of protest by many who are on it. That is why the US agencies responsible won’t release any data in response to FOI requests, nor explain the discrepancies.

As has been pointed out, the list has no purpose other than punitive – as so many of our contacts with the US government are as expats. And the FBI list due to the Brady Act is just a symptom of US dysfunction – we are no more likely to try to own a gun and abuse it as an expatriate than we would have been as someone with an accidental US birthplace or parentage.

Senators Levin, McCain et al, have such a bloated sense of their importance that they will persist in the myth that only a few misguided individuals have asked to be relieved of the burdens they have wrought upon their fellow citizens and dismiss renounciation as a very minor problem.

It appears that the same number of those who were willing to die to get here, are now committing financial suicide, to get out. I never though I would see the day when anyone who had the good fortune to be an American would want out, but then I never visualized such a poor crop of politician in the executive and legislative branch of government.

We have a fourth branch of government that was established by the ”civil service act” that are 95% socialist, that is, they want government to have 100% control of every aspect of a citizens life. They learned from the Soviets that government cannot even successfully run a whorehouse that sells whiskey.

The IRS confiscated one in NV where they are legal, for back taxes of the old owners who made enough money to owe taxes, and went bankrupt in 6 months. If they didn’t have us in a choke hold it would be funny.

With that as a lesson our socialists want the citizens to manage the realestate and the small businesses and they will just sit by and collect all the profits in taxes, for redistribution to the ”useful idiots” who vote for a living instead of working for a living.

McCarthy made life unbearable for quite a few people in America too in the 50s. He had homeland support too.

One just wonders when is their time up?

Republicans Overseas talks about renouncing citizenship:

https://www.facebook.com/republicansoverseas

RO commenter points out suspected sandbagging of expatriation stats.

http://www.nestmann.com/expatriation-statistics/#.VE02b03u2Ul

It’s evident that our voices mean little to the Democrats by the mere fact that they have no concern whatsoever that those who are trapped into retaining US citizenship would vote against them. We may never know how many people are being held captive because the can’t afford to get out.

@innocente yes I saw that. The administration is using its own data to feed the media with its own intended saga. It is the administrations responsibility to give facts and not to manufacture talking points. I might revise according to that but the administration must attempt to provide truth

Just let’s get this f-in lawsuit to the Suprem Court along with the USA case

And stick a f-in dagger in this thing to give it a permanent limp. How anyone can actually think FATCA is a good thing just disgusts me

@US_Foreign_Person – dilution of votes is a serious problem. That’s why Republican’s Abroad should identify states with close elections (especially the Senate) and have Republican controlled state governments.

Get the Republicans to change their state laws making becoming a resident super easy, registering to vote super easy, and the Republicans would have guaranteed overseas proxy votes to push through their Republican candidates. Of course they must agree to repeal FATCA.

That’s a method worth considering. Yes the Democrats will balk at the idea and probably sue in Federal court, but get a Republican in the Senate first and fight the lawsuits later.

The only thing Democrats care about is protecting FATCA and CBT. And of course they love their FBAR fund raiser.

These are precisely the reasons they have:

1.) been cooking the books to look like only a few expats are renouncing,

2.) have raised the renunciation fee to slow down renunciations and be able to claim that only rich people renounce,

3.) are peddling a possible “same country exemption” gimmick to create the illusion that Democrats care about expats — and of course even more forms and proof of tax compliance will be required.

The Dems need to be swept from the Senate and thrown out of the White House in 2016. If the Republicans turn out to betray us (which they might), then to hell with them as well.

In any event, any congressional votes in favor of supporting FATCA, CBT or FBAR must be considered as votes against expats. The Dems are clearly/blatantly trying to have it both ways and deserve to be thrown out of the Senate and the White House for doing so.

7.6 million expats is a lot of people. And most have extended families living and voting in the US. It is time for us to be noticed.

One thing I wonder is whether many citizens abroad even at this point realize what sort of bind they are in. When I posted something on Facebook about CBT recently, two Canadian friends of my parents said that they didn’t see anything wrong with it because everything tended to come out in the wash on their returns. I know that one of these people is self-employed (this person earns a very meager livelihood and has to work full-time at the age of 75 because they can’t afford to retire), yet this person insists that they have never owed the U.S. money and that U.S. taxes aren’t all that complicated (there seems to be a procedure for not getting double taxed in Canada according to one website, but it is not an obvious procedure). I figured it was best on Facebook not to highlight that they may not have been filing right, since this person has no money to correct anything they might not have filled out correctly. How many people are still clueless?

John Smith –

2) have raised the renunciation fee to slow down renunciations and be able to claim that only rich people renounce,

To refine this. The US has quintupled the renunciation fee in an apparent attempt to slow down the rate of renunciations. Queued renunciants at last report face an eight-month wait in Toronto. Who knows what the wait time is growing to elsewhere? The US may have started to supplement its failed economic disincentive with a consulate chokedown on the flood of renunciants. Murky murky murky.

Possible the recently declared number of hours it takes for someone to renounce be substantiated by the process actually taking that long? That would definitely slow the renunciation mill down.

Renunciation prior to renunciation fee increase takes X hours. State claims renunciation process takes Y hours. State increases the time it takes to renounce to Y hours in order to align itself with it’s own artificial estimates, thereby creating a greater backlog than what existed prior to the fee increase.