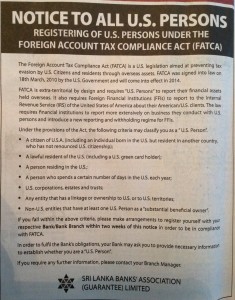

Many thanks to Steve Klaus for providing this visual of what ‘US Persons’ are being asked to do in one country. What happens if they don’t comply with this request? When will full page ads appear in our Canadian or other countries’ newspapers?

NOTICE TO ALL U.S. PERSONS

REGISTERING OF U.S. PERSONS UNDER THE FOREIGN ACCOUNT TAX COMPLIANCE ACT (FATCA)The Foreign Account Tax Compliance Act (FATCA) is a U.S. legislation aimed at preventing tax evasion by U.S. Citizens and residents through overseas assets. FATCA was signed into law on 18th March, 2010 by the U.S. Government and will come into effect in 2014.

FATCA is extra-territorial by design and requires “U.S. Persons” to report their financial assets held overseas. It also requires Foreign Financial Institutions (FFIs) to report to the Internal Revenue Service (IRS) of the Unites States of America about their American/U.S. clients. The law requires financial institutions to report more extensively on business they conduct with U.S. persons and introduce a new reporting and withholding regime for FFIs.

Under the provisions oF the Act, the following criteria may classify you as a “U.S. Person.”

- A citizen of U.S.A. (including an individual born in the U.S. but resident in another country, who has not renounced U.S. citizenship;

- A lawful resident of the U.S. (including a U.S. green card holder);

- A person residing in the U.S.;

- A person who spends a certain number of days in the U.S. each year;

- U.S. corporations estates and trusts;

- Any entity that has a linkage or ownership to U.S. or to U.S. territories;

- Non-U.S. entities that have at least one U.S. Person as a “substantial beneficial owner.”

If you fall within the above criteria, please make arrangements to register yourself with your respective Bank/Bank Branch within two weeks of this notice in order to be in compliance with FATCA.

In order to fulfill the Bank’s obligations, your Bank may ask you to provide necessary information to establish whether you are a “U.S. Person.”

If you require further information, please contact your Branch Manager.

SRI LANKA BANKS’ ASSOCIATION (GUARANTEE) LIMITED

This newspaper notice was placed in a Sri Lankan newspaper last month by the Sri Lanka Banker’s Association, requesting the voluntary ‘registration’ of U.S. Persons with their banks to facilitate the identification of U.S. Persons under FATCA. The voluntary registration was, apparently, not required by the Sri Lanka Central Bank, and Sri Lanka has not (yet) publicly signed an IGA or waived Sri Lankan banking secrecy to allow banks to directly enter into agreements with the IRS.Certainly, the notice for voluntarily registering oneself harkens back to 1939 for some of us, and exemplifies the positive discrimination that FATCA requires. The fact that many of the affected individuals are also Sri Lankan citizens, living in Sri Lanka, and under the protection of their own laws and government, does not factor in at all. Sadly, it also did not factor in to the governments of the U.K, Germany, Mexico and other countries that have signed IGAs either.

Here is a news article that Pacifica found regarding this:

US Citizens in Sri Lanka Asked to Register

“The Sri Lanka Banks Association (Guarantee) Limited today informed all United States citizens living in Sri Lanka to register themselves with their respective banks so as to comply with US legislation termed the Foreign Account Tax Compliance Act (FATCA). …”

…and badger asks:

Has Sri Lanka signed an IGA yet? If not, how can they direct US persons to go register with their Sri Lankan banks now?

The article says; “The Sri Lanka Banks Association (Guarantee) Limited today informed all United States citizens living in Sri Lanka to register themselves with their respective banks so as to comply with US legislation termed the Foreign Account Tax Compliance Act (FATCA)….”

I note that the entity directing US persons to do this is NOT the Sri Lankan government, or the US government, but a corporation – “…The Sri Lanka Banks’ Association (Guarantee) Ltd. is a Company registered under the Companies Act in Sri Lanka….”

On what legal basis can a Sri Lankan company direct ALL US persons or ALL US citizens in Sri Lanka to do anything on behalf of themselves or the US government?

Reminds me of a “Wanted Dead or Alive” poster.

@bubblebustin

I was just about to type the same thing!

I’m guessing that at the same time the “registration” takes place, individuals will be asked to waive whatever rights they have under the applicable Sri Lankan data privacy and data protection laws as is the case in Switzerland. This could happen in other countries that don’t have an IGA or who have an IGA but have not yet passed the “enabling” legislation to allow the banks to effect the data transfer.

Creepy, isn’t it?

We all know how the homelanders would respond if US banks were to do that on the behalf of China, don’t we?

@411 – and steve .

This sounds like 1939 alright – in Europe. It is scary..and you all are aware how people then did not believe that the evil that did come their way would come. But it came and many, many died and others lost everything.

..Writing to my politicians do nothing to help us…I wrote Kevin Schoom this:

I am watching what the parties in Canada will be doing to help and protect the Canadians who have emigrated to Canada from the USA…Most have become citizens, some have not, but have lived here 50 years and paid their taxes to Canada. I came almost 44 years ago…Some of those Canadians are accidental Americans born in America or to American parents who came to Canada and didn’t even live in the USA or work in it.

Please watch the YOU TUBE Video…There is so much reading about this violation the American government is doing but it is said a picture is worth a thousand words. You can understand our predicament better by watching it. it is 39 minutes long but I will tell you it will not seem that long… Please watch it to the end…..

What the USA is doing is a human rights violation!!!!!!! Is the Canadian government going to let this happen?

If you want to talk to me about this …my cell phone is 111-111-1111.

please watch

http://www.youtube.com/watch?feature=player_embedded&v=a04byPzXOA0#!

I Came to Canada August 16, 1969, and was accepted as permanent resident

I became citizen February 19, 1993 and I feel I am ONLY a Canadian citizen and since that date no longer an American.

There are many others like myself that are facing this horrific nightmare of FATCA.

I am watching!!!!

and waiting to see what the Canadian government will be doing. Will it let the Canadian banks report us to the American IRS?

He sent me this reply

“Thank you for your message below. Apologies for the delay in my reply; I was out of the office for a couple of weeks.

At present I do not have any questions for you. I will keep your number on file in case I need more information from you in the future.

Regards,

Kevin Shoom

Senior Chief, International Taxation and Special Projects / Chef principal, Section de la Fiscalité international et projets spéciaux

Business Income Tax Division / Division de l’impôt des entreprises

Department of Finance / Ministère des Finances

Ottawa, Canada K1A 0G5

Kevin.Shoom@fin.gc.ca

Telephone / Téléphone (613) 992-2980 Facsimile / Télécopieur (613) 943-2486 Teletypewriter / Téléimprimeur (613) 995-1455

Government of Canada / Gouvernement du Canada

Thanks, northernstar, for sending that to Kevin Shoom. You apparently caught him in between times of “being away / not available” — now until July 15th. I appreciate Mr. Shoom having answered each of my submissions.

Here is the tweet I made on this a few weeks ago:

Anyone else notice the similarities between the Sri Lanka Banks Association logo and and the infamous Yellow Star?

Deckard1138, I was just going to ask if they would be handing out yellow stars to those who register. Replace “US Persons” with “Jews” or “Americans of Japanese Descent” and it takes us back to a really ugly point of history. And it should remind us that during that time, more people went along with this singling out of target groups for “special treatment” than did not. Whole countries were basically fine with the discrimination and eventually wholesale slaughter that went on in Europe during WWII and few people blinked in the US or Canada when the govts rounded up citizens and put them in detention camps (or forced them to move from the coastlines, confiscating their homes, businesses and other property in the process) just because they had emigrated (or their parents/grandparents had) from Japan. A stark reminder that our neighbors are usually the second in line to throw us under whatever bus, right after our govts do.

In Canada we also have the added problem of our govt being all to willing to find reasons to strip people of citizenship and send them back to wherever, regardless of whether they were born in Canada or not. I am reminded of more than a few conversations I have had with Canadians that showed a clear disdain for the concept of dual citizenship. In the west at least, you are either “all in” Canadian or standing with one foot out the door by keeping a second passport.

And I continue to be trouble by the “US Person” rather than “citizen”. That’s not an accident.

I noticed the star as well.

I showed the notice to my non-US husband. He just shook his head and said “don’t they know they’re screwing their own people?”

Can’t let those ex-pats wander too far from the plantation. Gotta round em up and bring back to the homeland.

http://en.wikipedia.org/wiki/Fugitive_slave

@YogaGirl: Incidentally, the only time I’m aware of that the US ever required reporting of foreign assets prior to FBAR was on those “loyalty questionnaires” for interned Japanese Americans:

http://isaacbrocksociety.ca/2013/02/19/foreign-asset-reporting-before-fbar-and-fatca-loyalty-questionnaires-for-world-war-ii-japanese-american-internees/

Oops, images didn’t appear in my last comment somehow, so I’ll just leave the links: other “Notices” and “Instructions” in similar format from 70 years ago

http://www.baumanrarebooks.com/rare-books/world-war/civilian-exclusion/80190.aspx

http://encyclopedia.densho.org/Civilian_exclusion_orders/

Canada won’t do something quite so obvious but, it will amount to the same outcome. They will have to treat “U.S. persons” differently than anyone else, any other citizen of Canada for banking purposes. Will there follow some other purpose we will be treated differently for? Or some other nationality? Once that door is open it’s open all the way and very hard to close it. Canada has a big problem here since there are so many of us? ARE they going to ask every single customer if they are a “U.S. person” or will they just begin going through every document in our accounts and we’ll get individual phone calls?

All this secrecy from our government here. All this jumping on board by the banks. Do the banks have some assurance from government that they will be protected when they violate Canada’s charter? This all reeks to high heaven.

That notice in Sri Lanka is chilling! “Come forward” “U.S. persons” Is this 2013? If this is the way this will play out then they need to give us an easy path to renounce. Long term expats who are dual just want out now. This is a mess and a half for every country going along with it. U.S. has made a grave mistake and they will never admit it so the very least they can do is make an easy path out and not “punish” those who give up their passport. So disgusting that the “land of the free” is doing something like this. Whose idea was that notice in the paper? The big banks? Did the U.S. know about it? And what if you don’t, “Come forward?” What’s next?!

The Sri Lanka Banks’ Association is a trade association comprised of member banks who join voluntarily: essentially a lobbying group. They have no regulatory authority, are not a governmental agency, and the notice they posted is simply an advertisement expressing their opinion. To my understanding there is no force of law behind it. That it attempts to look like some kind of “official” proclamation is a misleading creative strategy.

Without FATCA IGA legislation entered into the law of their country; it is up to the Sri Lanka banks to attempt to cajole or coerce their individual customers; it is the banks decision to either ignore FATCA or attempt to comply with it.

Truly an ugly situation – and bad for business.

FYI: here excerpt from their published mandate:

“To represent and further the interests of and to support and assist the Licensed Commercial Banks (LCB’s) and Licensed Specialized Banks (LSB’s) in Sri Lanka and banking in Sri Lanka.

To take note of events, statements and expressions of opinion effecting members, to advise them thereon and to represent their interests.”

AtticusinCanada, that open door could be a huge problem b/c apparently Canada is home to immigrants from over 200 different countries of origin and if the govt acquiesces to the US, it can’t really so no to any other country that comes knocking for its duals, can it?

The bad thing for the US – which might turn out to be good for us – is that the more high profile this gets, the more it looks like blatant discrimination at best or really scary Nazi round ’em and tattoo them at worst. Viewpoint depending, of course. I mean, there is a reason that Canada is not conducting any of its negotiations about FATCA (or the enhanced border deal with the US) out in the open where Canadians can see what is going on and voice their concerns to their MP’s. Canadians tend to be a bit lazy about keeping their eyes on sovereignty breaches and encroachment from the south (imo) but they are pretty vocal when they come to light.

Eric, well, you can’t “confiscate” what you don’t know about, right? The method in the madness. Leave it to the US to be thinking about profit while committing racial hate crimes.

Wiki has an entry called “Second-Class Citizen”, which is described as an unofficial but pejorative term. It does not yet mention the discrimination by banks (FFIs) against US Persons abroad, including dual citizens, due to FATCA. If a Brocker has update access to Wiki, it would be a fine idea to edit this entry to include discrimination against USPs, citing a source(s) as appropriate:

https://en.wikipedia.org/wiki/Second-class_citizen

this is from a built-in Fatca ripple. Participating FFI must ensure that any FFI it deals with is also compliant or get the data to identify the ultimate beneficiary of a payment is not a USP. Sri Lankan banks are caught between local regulations and the demands of their correspondent banks that are deemed compliant by virtue of an agreement with the IRS or participation under an IGA. They are hoping that a request for voluntary disclosure will meet the due diligence requirements.

In the event of 30% withholding is the charge to the account of the receiver of the payee? Would it depend under which jurisdiction the contracts were agreed to?

From personal experience with 3 companies

a: a large Canadian Aviation with international customers, all contracts were subject to Canadian law

b: a micro company personnel placement firm. he wrote his own contracts but agreed to the jurisdiction of his customer

c: a small industrial company that received a contract from a Newfoundland Offshore Oil Development Corp. The end user insisted that the purchase agreement be drawn in accordance to the laws of N&L

and that we an our American supplier agree to its terms (as signatories). Nfld Offshore withheld part of the payment for breach of contract. The supplier sued, on the grounds that the equipment was supplied according to specifications. They lost, the equipment was supplied UL certified, the contract required FM(Factory Mutual) certification. It cost them several hundreds of thousands of dollars.

Under FATCA what would happen in a dispute over withholding be Hydro-Quebec and a US power company.

Even more complicated, between Boeing and its international suppliers and customers. Could a disgruntled supplier have a Boeing supplied aircraft arrested to secure payment of withheld funds.

Question: When your bank or credit union presents you with a questionnaire which, if answered honestly could brand you as a US citizen or US person for tax purposes, what will be your response?

a) act totally taken aback and ask why are they asking these questions

b) answer the questions, waive all privacy rights and fill out any IRS form provided

c) refuse to answer any questions until legal advice can be obtained

d) be indignant, refuse to answer and tell them to close your account(s) immediately (in cash, if feasible)

e) refuse to answer and wait for them to close your account(s) eventually

f) answer the questions in the “least untruthful” manner which will avow a non-US status (let Clapper of the NSA be your role model)

What are other possible responses? (I’m hopeless at creating multiple choices.) I’m leaning towards a) followed by d). (I can be a hot head at times.) Anyway I want to think this out ahead of time because I do stupid things when I’m taken off guard. I’m hoping that when it comes to this there will be a definite class action lawsuit in the works and we can inform our banks and credit unions that FATCA is under challenge.

Remember as Brockers we have a heads up on this situation and we should not fall for any tricks which would prematurely and voluntarily provide the banks and credit unions with any information which would attach US indicia to the files they have on us. Never casually reveal anything in a conversation with a bank employee. Do your transaction, talk about nothing more incriminating than the weather, smile, say thank you kindly and be on your way. Be careful! It’s a jungle out there.

Ern – this is a good question as I fully expect that post Jan 1st 2014 banks will have each new customer fill out a form asking questions designed to determine if you are a US Person under FATCA. I have already seen a version of this form from a UK based bank in Sri Lanka. Once thing is certain, the moment you identify yourself as a US Person they will present you with the IRS form and it asks for your Social Security Number. It seems to me that the only way to proceed is either to lie to the bank, leave and not open the account, or capitulate and accept you will be reported to the Empire and have to pay/report. Just my thought…

@Em

I had a recent experience with opening a RRSP account. Prior to going in to sign the paperwork I considered my various options if confronted with a “are you a USP” kind of question. I settled on a combination of a) and c). I would tell them that I don’t think they are allowed to ask me that, ask them to demonstrate that they were allowed to, and then refuse to answer until I could do my own research, possibly involving the Privacy Commissioner. It would not have been the end of the world if I could not open the account. In the end, no such question was asked and the account was opened.

As the world ramps up to the still possible FATCA roll-out in January 2014, there appear to be changes underway to avoid US dollar denominated transactions:

1) Swiss banks are attempting to become major players in trading of the Chinese currency, according to news reports last week. A result of increased trading in renminbi is that transactions will be settled directly between two currencies, without going through the USD or being settled in USD, as I understand it.

2) UBS announced today that it is stopping its US dollar transaction business in Switzerland which involve third-party (correspondent) banks, although it plans to continue to offer this service to its UBS end-customers. It advised that this is a commercial decision. It would seem that this would also reduce their risk of working with potential non-FATCA compliant banks.

I expect that there will be more reports of banks avoiding the USD to reduce potential FATCA risk with its draconian penalties.

Best to close and US dollar accounts, eh?

Innocente, there was a post on Zero Hedge yesterday about the Chinese making a run for world reserve currency status and that several countries are looking to trade directly with them and cutting out the USD middleman. Australia does already.

But, these transactions only make up 12% of the world’s financial transactions sans the USD and as some in the comments pointed out – fairly correctly – the USG maintains its stranglehold on world currency status via its military might (remember that the USG spends as much on maintaining its military as the next 20 countries that follow it combined). From a historical standpoint, world currency status goes to the reigning military superpower and that’s not China … yet anyway … though I have every confidence that even as we debate here, there are countries scheming work arounds of the US, their economy, their financial sector and their dollar. Someday.