Many thanks to Steve Klaus for providing this visual of what ‘US Persons’ are being asked to do in one country. What happens if they don’t comply with this request? When will full page ads appear in our Canadian or other countries’ newspapers?

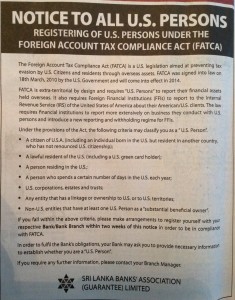

NOTICE TO ALL U.S. PERSONS

REGISTERING OF U.S. PERSONS UNDER THE FOREIGN ACCOUNT TAX COMPLIANCE ACT (FATCA)The Foreign Account Tax Compliance Act (FATCA) is a U.S. legislation aimed at preventing tax evasion by U.S. Citizens and residents through overseas assets. FATCA was signed into law on 18th March, 2010 by the U.S. Government and will come into effect in 2014.

FATCA is extra-territorial by design and requires “U.S. Persons” to report their financial assets held overseas. It also requires Foreign Financial Institutions (FFIs) to report to the Internal Revenue Service (IRS) of the Unites States of America about their American/U.S. clients. The law requires financial institutions to report more extensively on business they conduct with U.S. persons and introduce a new reporting and withholding regime for FFIs.

Under the provisions oF the Act, the following criteria may classify you as a “U.S. Person.”

- A citizen of U.S.A. (including an individual born in the U.S. but resident in another country, who has not renounced U.S. citizenship;

- A lawful resident of the U.S. (including a U.S. green card holder);

- A person residing in the U.S.;

- A person who spends a certain number of days in the U.S. each year;

- U.S. corporations estates and trusts;

- Any entity that has a linkage or ownership to U.S. or to U.S. territories;

- Non-U.S. entities that have at least one U.S. Person as a “substantial beneficial owner.”

If you fall within the above criteria, please make arrangements to register yourself with your respective Bank/Bank Branch within two weeks of this notice in order to be in compliance with FATCA.

In order to fulfill the Bank’s obligations, your Bank may ask you to provide necessary information to establish whether you are a “U.S. Person.”

If you require further information, please contact your Branch Manager.

SRI LANKA BANKS’ ASSOCIATION (GUARANTEE) LIMITED

This newspaper notice was placed in a Sri Lankan newspaper last month by the Sri Lanka Banker’s Association, requesting the voluntary ‘registration’ of U.S. Persons with their banks to facilitate the identification of U.S. Persons under FATCA. The voluntary registration was, apparently, not required by the Sri Lanka Central Bank, and Sri Lanka has not (yet) publicly signed an IGA or waived Sri Lankan banking secrecy to allow banks to directly enter into agreements with the IRS.Certainly, the notice for voluntarily registering oneself harkens back to 1939 for some of us, and exemplifies the positive discrimination that FATCA requires. The fact that many of the affected individuals are also Sri Lankan citizens, living in Sri Lanka, and under the protection of their own laws and government, does not factor in at all. Sadly, it also did not factor in to the governments of the U.K, Germany, Mexico and other countries that have signed IGAs either.

Here is a news article that Pacifica found regarding this:

US Citizens in Sri Lanka Asked to Register

“The Sri Lanka Banks Association (Guarantee) Limited today informed all United States citizens living in Sri Lanka to register themselves with their respective banks so as to comply with US legislation termed the Foreign Account Tax Compliance Act (FATCA). …”

…and badger asks:

Has Sri Lanka signed an IGA yet? If not, how can they direct US persons to go register with their Sri Lankan banks now?

The article says; “The Sri Lanka Banks Association (Guarantee) Limited today informed all United States citizens living in Sri Lanka to register themselves with their respective banks so as to comply with US legislation termed the Foreign Account Tax Compliance Act (FATCA)….”

I note that the entity directing US persons to do this is NOT the Sri Lankan government, or the US government, but a corporation – “…The Sri Lanka Banks’ Association (Guarantee) Ltd. is a Company registered under the Companies Act in Sri Lanka….”

On what legal basis can a Sri Lankan company direct ALL US persons or ALL US citizens in Sri Lanka to do anything on behalf of themselves or the US government?

Pingback: US – Sri Lankans “Asked” to Register with their Banks — What if they don’t do so voluntarily? | The Freedom Watch

@Em

Under current Canadian fedreal and some provincial privacy legislation they are not even allowed to collect that information.

Federally:

4.3.3 An organization shall not, as a condition of the supply of a product or service, require an individual to consent to the collection, use, or disclosure of information beyond that required to fulfil the explicitly specified, and legitimate purposes.

Provincially (BC and maybe others):

7(2) An organization must not, as a condition of supplying a product or service, require an individual to consent to the collection, use or disclosure of personal information beyond what is necessary to provide the product or service.

A longer description is available at http://isaacbrocksociety.ca/2013/03/12/the-best-news-weve-heard-since-this-nightmare-began/comment-page-4/#comment-229349

@ Just a Canadian

“… personal information beyond what is necessary to provide the product or service.”

That sounds good enough for now but after a FATCA IGA is signed won’t the Canadian government have to pass legislation to change the privacy legislation to permit collecting citizenship information? We don’t know what that legislation will look like or when it will take effect. For the moment, financial institutions which are currently gearing up for FATCA (I think the government is keeping them and the CRA informed but obviously not the public) can trick people into revealing their citizenship but they can’t legally force them to do so. That will change when FATCA facilitating legislation is passed. Meanwhile I have printed out the current regulations that you provided (thank you) and will have them on hand in case we need them. All this uncertainty makes it extremely difficult to know what to do with ones bank accounts and when to do it. Timing can be critical so it is maddening how secretive the Canadian government is being about all this.

@ tdott

I like your backup plan of refusing to answer until you have done your own research. It helps too when you are in the position to walk out and leave them thinking they probably won’t get your deposit. Anyway, glad you were not asked any prying questions and it didn’t have to come to that.

I have a friend who is the CFO of an investment house now being registered as a bank here in Sweden. She signed the papers (the husband’s loose lips sink ships) for FATCA compliance, but she said that the banks have no legal authority to gain the information needed. I guess that means that they could send the papers to you, but they couldn’t make you sign them. Then probably couldn’t call you “recalcitrant” either

@Innocente, I added a wiki entry for Americans abroad as second-class citizens:

https://en.wikipedia.org/wiki/Second-class_citizen