cross-posted from citizenshipsolutions

Part A is here

Part B is here

continued from Part B:

5. Why most Americans abroad are like most small business owners in America (and presumably should have similar tax treatment from a U.S. perspective)

It’s simple. The vast majority of Americans abroad who carry on business through Canadian Controlled Private Corporations (and similarly situated Americans living in other countries) are small business people. They are people who are simply trying to make a living. As described in a recent article from American Citizens Abroad:

“Treasury is not truly in touch with the reality of Americans abroad. Foreign corporations owned by Americans abroad exist in abundance. They are an everyday fact of life,” added Serrato.

ACA believes that it is fundamentally wrong for the Treasury Department to write regulations without knowing who is affected, and to what extent, as this goes against the fundamental requirements of the RFA.

The point is that small business people are the same inside the United States and outside the United States. The single most important characteristic is that from an economic perspective the corporation is a structure that is generally created to achieve limited liability or some other local benefit.

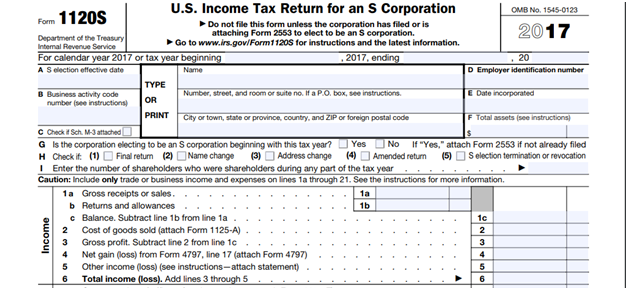

6. How the S-Corp association lobbying in DC has likely resulted in favourable “transition tax” treatment for S-Corps

I tip my hat to the S Corporation America. I have NO DOUBT that their lobbying and organization secured a “transition tax exemption” for S Corporations.

Its what happens when you have a funded full time lobbyist in DC https://t.co/skmITiiSQf

— Monte Silver (@MonteSilver1) November 18, 2018

It is interesting to note that:

1. The individual shareholders of S Corporations were fully aware of the benefits of tax deferral by using the S Corporation as the shareholder of a CFC:

A 2013 analysis of the possible benefits of an S Corporation incorporating a #CFC to defer U.S. taxes by investing or accumulating #offshore: "S Corporations Should Consider Incorporating Foreign Branch Operations in Light of Higher Tax Rates" via @forbes https://t.co/k37IWFA4Cs

— John Richardson – lawyer for "U.S. persons" abroad (@ExpatriationLaw) November 18, 2018

2. In its 2013 submission to the House Ways and Means Committee the S Corp association argued clearly and forcefully that the individual shareholders of S corporations should be exempt from the transition/repatriation tax:

The 2013 @SCorpAssn submission to the @WaysandMeansGOP in which it argues that S Corps should be exempt from the @USTransitionTax bc (1) S Corp do not benefit from #territorialtax like C corps and (2) the repatriation tax will result in double taxation – https://t.co/bJaAdppYVI pic.twitter.com/xvFJGXgc0M

— John Richardson – lawyer for "U.S. persons" abroad (@ExpatriationLaw) November 18, 2018

(The same two arguments for why individual shareholders of S Corporations should have have been exempted from the transition/repatriation tax apply to ALL individuals including individuals living outside the United States.)

The complete S Corp Association submission to the Ways and Means Committee is here:

S_Corporation_Association_WG_Comment_2

7. The argument that – with respect to the “transition tax” that Americans abroad with small businesses should be treated the same way as shareholders of U.S. S-Corps

In the interview with Monte Silver we both agreed with the argument that:

(i) S Corporations are legally corporations but really business entities which are used by individuals who are operating small businesses. (the IRS requirements to qualify as an S Corporation reinforce this.) The S Corporation for practical purposes IS the individual.

(ii) Sec. 965(I) creates a transition tax exemption for S Corporations – and therefore is creating a transition tax exemption for individuals who have decided to create an S Corporation (but remain taxed as individuals).

(iii) If the principle is that individuals should be subject to the transition tax then creating an S Corporation should NOT justify a transition tax exemption for individuals.

(iv) If the principle is that individuals should be exempt from the transition tax then ALL individuals (including Americans abroad) should be exempt from the transition tax even if they are individuals who use an S Corporation.

(v) Individuals in general should be treated the same whether they form an S Corporation or not.

(vi) In conclusion: Since individuals who form S Corporations are exempt from the Sec. 965 transition tax then individuals who live outside of American and have small business corporations should be exempt from the Sec. 965 transition tax.

8. Should Americans abroad who don’t renounce U.S. citizenship consider using U.S. Corps to own and operate their businesses abroad?

Think of it! In order to protect themselves from the U.S. Government Americans abroad might consider (1) creating an S Corporation and then (2) creating a foreign corporation (local to the shareholder) to run his business. Sounds totally crazy! But, it might be worth considering for a simple reason:

Congress does not care about Americans abroad and does not care that it doesn’t care!

Congress does listen to the S Corporation Association of America!

Legislation in America (as Conrad Black once said) is: A pay to play casino.

Practically speaking, what should those Americans Abroad with neither representation nor lobbying do?

Interesting @AARO seminar on the @USTransitionTax and #GILTI discuss some possible options for #Americansabroad dealing with this: https://t.co/dDKeGJWfFN pic.twitter.com/PqGgGaUgCU

— John Richardson – lawyer for "U.S. persons" abroad (@ExpatriationLaw) November 18, 2018

Please find me an accountant who will prepare a return without the Transition Tax!

Most work on the basis of “self reporting.” That is the basis of the system. Maybe just don’t divulge it, and if asked say you are not reporting that.

What are some of the downsides of running your local corp through a US S Corp?

Proposals similar to TCJA’s international provisions have been kicking around Congress for at least a decade before finally finding their way into law.

One such proposal was floated by the Ways and Means Committee in 2011. You can find a discussion draft here: http://waysandmeans.house.gov/UploadedFiles/Discussion_Draft.pdf

In a comment submitted to Ways and Means, the US Chamber of Commerce objected to provisions that gave a 95% exemption to Corporate US Shareholders for dividends received from CFCs, but no such exemption to non-corporate US Shareholders (plus, the proposal would have repealed s959 – which is the provision that allows US-tax-free distribution of earnings and profits previously taxed under subpart F).

https://waysandmeans.house.gov/UploadedFiles/U.S._Chamber_Of_Commerce_1117SRM.pdf – see the bottom of p3 and the top of p4.

Interestingly, the Chamber is interested only in fixing the problem for pass-through entities owning CFCs, not individual US shareholders! I doubt there are many US-resident individual US Shareholders of CFCs. It would be very interesting to know what proportion of forms 5471 filed by individual US Shareholders are filed from a non-US address.