I am posting this comment of Gary Clueit that appeared on the Robert Wood article couple of days ago. Over the past few months, we have “met” Gary on FB, Twitter etc. Especially the Wednesday Tweet Rally- A group that just keeps on giving!!

by Gary Clueit

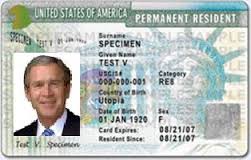

The article provides a good, if brief, overview of the perils and pitfalls of being a green card holder. The reality is somewhat bleaker.

As a long-term green card holder with no way to escape “covered expatriate” status should I decide the leave the US, I must point out a few of the other insidious side effects of being the holder of a residence permit.

If a green card holder were to decide to leave and relinquish his or her green card, here are some the issues they face in a bit more detail:

Determining the $2M net worth threshold does not cover any assets that the person might have had before ever moving to the US or assets received after taking up residence due to bequests from relatives that have never set foot in the US. The net worth amount signed into law in 2004 and was, I believe, related to the estate tax, despite being less than half the amount of the estate tax (which is indexed whereas the expatriation exit tax threshold is not). Anyone who has diligently saved for retirement and owned houses in San Francisco, Seattle or other major cities over the past dozen or so years can quite easily reach the $2M threshold. It does not make you “rich” by any stretch of the imagination. The non-indexed $2M figure simply appears to be a punitive amount designed to punish anyone for daring to want to leave the US.

Even after paying the exit tax on the “deemed sale” of everything you own worldwide, you will have to pay actual capital gains when you do actually sell since no tax treaty provides a credit for a deemed sale of anything. Outright double taxation. For example, if I own a house in Toronto and sell under normal conditions, I will pay capital gains tax on any profit in Canada. When filing my US tax return I will get a credit for the tax paid to Canada resulting in a single tax bite. However, if I own the Toronto property on the day of expatriation, the US taxes me on any paper profit. Since I have not actually sold the property, there is nothing to declare to Canada’s Revenue Agency (CRA) at that time. When I do eventually sell, CRA will then tax the actual profit, but there is no ability to get a credit from the IRS since expatriation is a terminating event.

After departure and payment of the exit tax, every penny of any bequest or gift you make to someone resident in the US (e.g. a child, grandchild or friend, even if they are not US citizens) is then further taxed at a flat 40%. Because this tax is imposed on the recipient, there is no opportunity to offset estate, wealth or inheritance taxes that might be imposed on the estate of the deceased person by another country even when there is a treaty in effect. Here is where it gets really interesting: assume your net worth is $2.5M on the date of expatriation, you pay the exit tax. Let us also assume that your wealth increases to $250M AFTER you leave the US due to hard work and good luck. If your heirs live in the US (again, whether citizens or not) and you leave all that wealth to them, the entire $250M estate will be taxable to them at 40% regardless of the fact that 99% of your wealth at the time of death was created outside the US and after you had ceased to be a resident. By what stretch of any imagination is this fair or equitable on either the expatriate or their US resident heirs?

Most foreign tax treaties contain tie-breaker clauses to prevent double taxation of those living abroad. However, if a green card holder is living overseas (on assignment, for example) and elects to use a tax treaty benefit to avoid double taxation, that in itself is considered an expatriating act.

I will point out that most of the above situations also apply to US citizens who decide to give up their citizenship, as well as to Accidental Americans who are compulsory citizens simply by being born in the US but who may never have lived, been educated in or worked in the country. The fundamental difference between the citizen and green card holder is that a citizen can only lose their citizenship through the proactive step of filing Form DS-4079. This might at least provide some ability to time events to minimize the tax consequences. A green card holder can voluntarily relinquish their card too. However, a green card holder may be denied re-entry into the US simply by staying out of the country for more than 1 year. Even a re-entry permit, applied for before leaving, is only valid for 2 years and is not be renewable. As a result, a 2 year and 1 month overseas assignment for a green card holder can result in refusal to enter upon return. You then have the alien(!) situation where you are not allowed to reside in the US by action of Customs and Border Protection, but are still considered a US resident by the IRS and still subject to FBAR, FATCA, PFIC, CFC filing requirements and taxation on your worldwide assets. Or at least until you explicitly relinquish the green card or the IRS finds out you are no longer living in the US at which point it becomes an involuntary expatriation and immediately invokes the expatriation regime and tax based on the date you were denied entry back into the US. Why is the ability to time any expatriation important? Take the case of your primary residence. If you plan to expatriate, you make sure you sell your house before that event to ensure that up to $250K profit is not taxable. If you are involuntarily expatriated for any reason, there is no tax break because you have not actually sold the house. The paper profit from the deemed sale will be added to your taxable base subject to the exit tax. When you do sell in the future, you may well be subject to tax on that profit from your new country of residence.

Even while a green card holder resides in the US, they are subject to discrimination. Besides never being allowed to vote (not really an issue since presumably one never desired to be a citizen), they are still expected to pay taxes on worldwide income (not really an issue either since almost every OECD country taxes worldwide income now). The real problems arise in estate planning:

US citizen spouses can transfer or gift an unlimited amount between each other. Green card holders have a lifetime $5.45M limit with a maximum transfer of$149,000 annually. If one spouse has a much greater net worth that the other, the ability to balance things out are extremely limited for the green card holder.

Upon death, a citizen can leave an unlimited amount to their spouse free of tax. If your spouse is a green card holder, the maximum is any unused portion of the same $5.45M above. If your spouse is a nonresident alien, the maximum is $60,000 (though only US based assets count in this case). Amounts above these limits are subject to 40% estate tax.

There is also the possibility of double taxation of your estate when you die where both the US and your home country claim your domicile and there is no double taxation treaty.

Green card holders are now also face discrimination by their home countries due to FATCA reporting. I am a UK citizen that has held UK Government (Treasury) bonds as a component of a diversified investment portfolio. These have been invested and reinvested through Nationals Savings and Investments (NS&I) for more than 40 years, long before arriving in the US. I received letters from NS&I dated 28 April, 2014 stating that due to the costs and burdens associated with FATCA compliance, NS&I would no longer deal with US Persons (citizens or residents). As each bonds matures, they will distribute the funds as a bank draft with no possibility of reinvestment. My own government is now denying me the ability to invest in its own sovereign bonds due FATCA. It seems I am a pariah everywhere!

Green card holders are now also face discrimination by their home countries due to FATCA reporting. I am a UK citizen that has held UK Government (Treasury) bonds as a component of a diversified investment portfolio. These have been invested and reinvested through Nationals Savings and Investments (NS&I) for more than 40 years, long before arriving in the US. I received letters from NS&I dated 28 April, 2014 stating that due to the costs and burdens associated with FATCA compliance, NS&I would no longer deal with US Persons (citizens or residents). As each bonds matures, they will distribute the funds as a bank draft with no possibility of reinvestment. My own government is now denying me the ability to invest in its own sovereign bonds due FATCA. It seems I am a pariah everywhere!

The root cause of the problems facing green card holders, Accidental Americans and US citizens who decide to live abroad is Citizen Based Taxation (CBT), introduced at the time of the Civil War. The only other country that practices CBT is Eritrea, and their tax rate on nonresidents is a paltry 2%. Every other country uses either Residence based taxation (RBT) or Territorial Based Taxation (TBT). Green card holders are citizens for tax purposes but cannot vote, hold office, serve on a jury, volunteer to sit on local government boards in certain States (WA requires one to be a registered voter) and are ineligible to receive US government assistance when overseas, even when not in their home country. They can be stripped of their green card and deported for any infraction of the law (it used to be a felony, but apparently a misdemeanor conviction is now grounds too). This is the ultimate in taxation without representation – one of the founding principles behind the creation of the US. A tea party and a war of independence ensued in that apparently forgotten case.

Replacing CBT with RBT or TBT and replacing FATCA with Common Reporting Standard (CRS) would go some way to mitigating the issues faced by any US resident who wishes to live abroad for love or money. Exit taxes are punitive, especially on the non-US assets for foreign nationals. “Covered” expatriate status is especially egregious. If there is to be an exit tax, at least raise it to a level commensurate with the indexed estate tax.

I was recruited to come to the US on an L-1 visa valid for 3 years because I possessed unique skills in my field. I acquired my education and experience overseas at zero cost or burden to the US taxpayer. Before the L-1 expired, the company I was working for decided to apply (and pay) for a green card on my behalf rather than them having to renew a short-term visa on an ongoing basis. I eventually left and started my own company followed by several other companies as well as acquiring others. I have exclusively funded all startups and acquisitions with my own capital and have employed US citizens, provided them with health and retirement benefits and paid all business and personal taxes due on worldwide income despite having the ability to “defer” tax on overseas subsidiary earnings like large corporations do. I have no problem paying taxes – they are the price we pay for living in a civilized society with modern infrastructure. However, should I decide I wish to retire back to my home country, or elsewhere, I find it incredulous that I should continue to be required to pay taxes on my worldwide income when I no longer receive any benefit from the US. I would not even be a burden to Medicare which I have paid for all the time I have been employed in the US. The argument used against citizens who live abroad is that they still receive protection from the US via its diplomatic presence and citizenship offers other (unspecified) benefits. How does this argument, assuming it were true, apply to a green card holder who will receive zero benefits or assistance from the US when living abroad nor has any absolute right of return to the US?

Before I moved to the US, I lived and worked in several countries, including Australia, France and South Africa. Each time I moved, I filed a “final” tax return with the country I have been living in and that was the end of it. No exit taxes or extra paperwork ever. Why is the US different from everyone else in attempting to tax not only its citizens living abroad, but non-citizens too who made the mistake of staying longer than the arbitrary 8 out of the last 15 years (a change made after I was already here that I only found out about when it was too late)?

Attempting to explain any of this to most homelanders usually elicits one of two responses: a) disbelief that anyone could be treated this way, or, more commonly, b) “suck it up, you’re obviously one of those wealthy tax evaders”.

Just like cities that impose enormous hotel accommodation and other tourist taxes and get away with it because it only affects nonresidents who cannot vote, so too does it appear to be the plight on green card holders as well as Accidentals and citizens living abroad (who can vote but that vote is diluted to the point of being irrelevant). The residents of the cities as well as homelanders in general actually approve of unfair taxation of those nonresidents who cannot fight back since it increases their local tax coffers and reduces the amount they have to contribute themselves. The only example that seems to penetrate the consciousness (if not conscience) is to ask how one would feel if relocating from Massachusetts to California and MA continued to require one to continue to file and pay tax on all of one’s income because there is an ongoing benefit from previously being born or having lived in the Great State of MA. Even if MA were to provide credits for some taxes paid in CA, one would need to file multiple returns and likely need the costly assistance of a professional.

Disclaimer: I am not a lawyer nor an accountant and have better things to occupy my time than develop too deep an understanding of all the details, nuances and other gotchas. Unfortunately, I have to spend an inordinate amount on hiring these professionals each year to understand the numerous, complex, “evolving” rules and regulations that apply to my situation. And to ensure that all my tax returns, FBARs and other forms are filed accurately and on time lest I should have to pay usurious penalties that again seem designed to punitively punish anyone for having the temerity of living abroad or operating a foreign (to the US) bank account.

*******

For more on Green Cards please see the following three articles by John Richardson:

Green Card Holders; the Tax Treaty TieBreaker rules and taxation of subpart F and PFIC income

Green Card Holders, the Tax Treaty Tie Breaker and REporting Forms 8938, 8621, and 5471

Green Card Holders, the Tax Treaty Tiebreaker and Eligibility or Streamline Offshore

@ND and others

“Green card holders are now also face discrimination by their home countries due to FATCA reporting. I am a UK citizen that has held UK Government (Treasury) bonds as a component of a diversified investment portfolio. These have been invested and reinvested through Nationals Savings and Investments (NS&I) for more than 40 years, long before arriving in the US. I received letters from NS&I dated 28 April, 2014 stating that due to the costs and burdens associated with FATCA compliance, NS&I would no longer deal with US Persons (citizens or residents). As each bonds matures, they will distribute the funds as a bank draft with no possibility of reinvestment. My own government is now denying me the ability to invest in its own sovereign bonds due FATCA. It seems I am a pariah everywhere!”

Remember my British friend living in Japan whom I wrote about? Same with him.

Attention anyone considering getting a green card – this is the fine print no one tells you about.

This is the work product of chuck Schummer. You would think then if you exited and pay all the taxes etc that you had paid you fair share etc. In fact Chucky attacks people who have actually exited and paid his taxes and followed his procedures. What kind of loathsome creature creates all these barriers and pain points and then criticizes those that actually take this unpleasant route?

As a successful GC holder you have to become a citizen. No other choice really to protect yourself. I could well imagine if you told chucky you became a citizen because of this force he would likely say you performed some unpatriotic etc act.

There’s currently some considerable ignorance kicking around on the topic of surrendering green cards, too.

For example, this and this from just the past week or so. Both state categorically — and incorrectly — that there is no need to file I-407 to surrender a green card.

Of course, this being the US, there is every need to file I-407 and so break the shackles. A green card that has expired for immigration purposes never expires for tax purposes. The ever reliable Virginia La Torre Jeker provides the full and correct story.

A couple of small factual corrections to the article.

“Determining the $2M net worth threshold does not cover any assets that the person might have had before ever moving to the US or assets received after taking up residence due to bequests from relatives that have never set foot in the US.”

I am not quite sure what this is trying to say, but the net worth test does definitely haul in worldwide assets, no matter when and where acquired. Owned a home outside the US for half a century before becoming a green card holder? Yup, that’s included in the net worth test. What you do get, though, is a step-up basis in assets held before taking out the green card for exit tax deemed (unrealised) capital gain. For some that might be helpful. Likely a bit niche, unfortunately.

“After departure and payment of the exit tax, every penny of any bequest or gift you make to someone resident in the US … is then further taxed at a flat 40%.”

You still get the normal annual $14k or so gift tax exemption. After that, the gift is taxable to the recipient at the highest rate of gift or estate tax in effect for the year, so yes, likely 40%. Even though the exit tax law was passed nearly a decade ago now, the IRS still has not provided any mechanism to comply with this part, section 2801, so it’s currently ‘deferred’. Nobody knows what will happen with it in future.

… any bequest or gift you make to someone resident in the US (e.g. a child, grandchild or friend, even if they are not US citizens) …

Also applies to US citizens even if not US residents; in fact, to all ‘US persons’. So if you are a covered ex-green card holder now living outside the US with your children and they were born in the US and haven’t (or cannot) themselves renounce, they suffer this same tax penalty on gifts and bequests. Another part of the reason why the exit tax motivates entire families, not just individuals, to expatriate.

To add to @Watcher’s commentary (directly above):

It is NOT clear that the filing of the 8833 without more (yes I know that it states so on form 8333) results in an expatriation. That said, filing the 8833 is a dangerous thing to do!

This is an outstanding post, thank you Patricia for posting it and Gary for writing it. But one sentence is a little unclear and could be misleading, I think (I’m no expert!!).

Gary writes:

“Upon death, a citizen can leave an unlimited amount to their spouse free of tax. If your spouse is a green card holder, the maximum is any unused portion of the same $5.45M above. If your spouse is a nonresident alien, the maximum is $60,000 (though only US based assets count in this case). Amounts above these limits are subject to 40% estate tax.”

I think the US citizen spouse can leave the full $5.45M to a nonresident alien spouse without estate tax being invoked. The problem is if the non-resident alien spouse dies – they can only leave $60,000 (of US assets) before 40% tax kicks in on the remainder of their estate. Please tell me if I’ve got this wrong!

@Star

This is a helpful chart

http://www.clarkskatoff.com/files/Non%20Citizen%20Estate%20and%20Gift%20Tax%20Chart%202017.pdf

@Heidi

Thank you, that is a VERY chart. Brilliant

I appreciate seeing a post on the plight of Green Card victims such as Gary (and myself). GC victims are the slightly less oppressed branch of the tribe of US Persons: at least we are able to extricate ourselves, have a home country to escape to, and do not transmit our US Personhood taint to others. Yet the exit tax imposed on GC victims is even more painful, with even less justification, than CBT or the exit tax applied to former US citizen-slaves.

On the point of assets accumulated before the “US Person” tattoo/smear is acquired subsequently being taxed on the back-end when you exit: yes, it is true! (It still completely boggles me!). Some of these tax changes date back to 2004 and efforts to “pay for” the war in Iraq with rules brought in under a Republican congress, before the Democrats brought forward the abomination that is FATCA. Demonization of “foreign” assets is a bipartisan tradition.

As Watcher pointed out, you do get to use a step-up basis when accounting for capital gains, but this is complicated. Everything is in USD, so phantom currency gains are a huge risk. Particularly dangerous are the valuation rules for defined-benefit pensions — they appear to be trying to apportion the total value based on years of residence, in effect “moving” a lot of the value from non-US to US, and taxing the “US” gain. For a simple example: person works in Canada for 15 years, and then moves to US and works another 15 years. All assets from the 15 years in the US will be factored into the exit tax, as well as half of any defined-benefit pension from the 15 years in Canada. There is nothing more galling than paying taxes on pension benefits that will not come for literally decades — and may not come at all if your company’s pension gets in to trouble: it is possible to pay $300K in taxes for pension benefits that end up to be zero. The rules around defined-benefit pensions was one of the gotchas in the exit tax for Green Card slaves that just pissed me off!

My story: raised in Canada, started working for Chrysler (Canada) at 21, moved to the US at 39, took an early retirement package and moved home to Canada at 53. Chrysler’s bankruptcy reduced my pension by more than half, so (fortunately?!?!) that saved me on the exit tax because my wife and I were able to skate just under the $2M threshold. I’d been following the tax policy changes since 2001, so I consulted with a lawyer and engaged a tax accountant for a pro-forma expatriation return before handing in my Green Card with glee 6 months after taking my early retirement. I am Canadian, and I am free.

I do wonder about the long-term effect on the US and its ability to attract professionals and entrepreneurs. Bluntly, I knew the rules in 2001 when I moved to the US, and the rules changed on me. If the rules in place by 2011 had been in place in 2001, I never would have accepted the Green Card; heck, I may not have accepted the L1 visa that preceded the GC. When I am talking to younger Canadians or Europeans considering a mid-career move, I tell my tale and encourage them to consider the long-term consequences. I also wonder why any well-informed person who can do arithmetic would ever consider an investor’s EB-5 visa for $500K that qualifies you for a GC, because the only way the EB-5 is ever worth it is if you intend to commit fraud, and fraud is grounds for the GC to be taken away. Might as well burn a $500K pile of cash rather than get an EB-5 — and again, why would any (informed) entrepreneur choose the US?

Unlike Ed, I (Em) did everything wrong (don’t want to talk about it) so I will be “covered” (stupid word) until the day I die. However I haven’t been to the U.S. of Arrogance in 2 decades and will NEVER go there again. How effective those foreign tentacles are at grabbing everything I’ve got (it’s all of Canadian origin) remains to be seen. Anyway, it’s good to read a post addressing the danger of kryptonite (i.e. a U.S. greencard) since this is an area which the media never seems to look at. Heidi’s chart is excellent but there isn’t exactly a category which fits the situation of a greencard holder who long ago returned to his/her homeland and didn’t follow to a T the U.S. exit procedures because he/she didn’t know what they were. Remember there was a time when information was not there at the touch of a computer keyboard.

Fabulous post! Probably the most comprehensive exposee of CBT’s application to green card holders that I’ve seen.

Good article. I agree with most of it but there is a contradiction between something said by Clueit and the chart referenced by @Heidi. Clueit says that even after expatriating, every penny gifted or bequested to someone in the US is taxed at 40%. The chart posted by @Heidi (courtesy of Clark Skatoff law firm) says that gifts or bequests of non-US property from a non resident alien never attract a gift or estate tax.

At least according to the Clark Skatoff chart, if you expatriate and move your property outside the US, you are a non resident alien and can give money to people in the US without being taxed.

Of course Clueit may be referring to gifts of property that remains in the US that is given stateside after the former green card holder expatriates. Those gifts DO seem to be subject to taxation although not “every penny” as there is an exclusion amount.

When you leave the US you need to be very strategic about what order to do things in regarding getting your property, your money, and your person out of the US. Some ways carry significantly more tax burdens than others.

@Dash1729

I think Clueit was referring to a person deemed a ‘covered expat’. Then the 40% would apply to any gifts/estate made by him to US persons. But as Watcher pointed out this rule was enacted 10 yrs ago and there is still is no mechanism to comply on any form.

Watcher: My apologies. It should read “Determining the $2M net worth threshold does not EXCLUDE any assets…” Everything is counted as you point out. Stepped up basis may or may not be worth anything.

Heidi: Thank you for finding that chart. It explains things so much better than my seomwhat confusing words. The thing to remember is that the $5.49M shown in the gift section is the same $5.49M in the estate tax section. They are not separate pools as some I have spoken to appear to think.

Dash1729: If I relinquish, I will be a “covered” expat. Anything I leave to my daughter who lives in the US (Australian citizen) and my grandson (born in the US, therefore a citizen) will attract the 40% tax. The exception is, as was pointed out by someone else, the $15K or so per year that can be gifted to each of them without attracting the tax. There is a workaround: If my daughter and her son were to expatriate too (which they could do without being “covered”) I could leave them everything free and clear. The issue is that she is married to an American who seems extremely unlikely to want to live elsewhere. Non-“covered” expats do not have this problem. They can leave an unlimited amount to a US Person after expatriation. Again, this all applies to both US citizen and green card covered expats.

If you are anywhere close to being a covered expat, then it would be highly desirable to hire a competent professional to steer you through the extremely complex determinations and calculations. This does not come at less than considerable cost, but it likely still money well spent. Attempting to DIY this is not something I would ever contemplate. And that in itself truly galls me!!

@Gary Clueit

Thanks for stopping by. And thanks also for your thorough description of how it feels from the inside to be constantly battered by bad US tax laws, from a perspective that is different from most.

In some ways you and I may be opposite sides of a coin. I worked in the US for a number of years, enough with a green card to trigger the exit tax. Like Ed above, the rules changed on me after I was already past the exit tax thresholds, otherwise I probably would not have gone to the US in the first place, but chosen a different country instead. The sense of betrayal from the way the exit tax law was constructed and passed was, at least for me, acute, visceral, and personally still leaves a very bitter aftertaste.

Where we differ is that when I saw the exit tax law looming, I immediately packed up my stuff and headed back to the UK. Because I got out before the law passed, it doesn’t capture me or my family. The margin turned out to be one month, but it’s a very important one month. I instantly saved over $100k in retirement saving double-tax, and it has of course paid dividends ever since as my retirement savings continue to increase. I am actually ‘covered’ under the pre-exit tax expatriation rules. These are bad enough, but with a tiny bit of planning — mostly avoiding holding US investments directly, so no hardship there whatsoever! — they boil down to annoying and pointless paperwork for a decade after leaving, but no worse.

You have helped to shine a much-needed light on the way this outrageous tax operates against green card holders. Your Forbes article comment should really have been the article itself. It brings the whole thing to life in a way that the article mostly just fails to do.

The law changed in 2004 and 13 years later it remains almost unknown.

Common sense, some version of the Petros Principles, and much perusing of IBS brings to mind a very interesting option when coping with the US tax situation when one is moving to America. Remember your greatest assets: a non-US citizenship with a non-US birthplace. When you are home in Country X, you are a pure Xer. Keep that in mind. Act that way. Always.

– Moving from Country X, keep an address there. Have the mail forwarded to family or friends. With an address in the same country, the bank need not be bothered with FATCA. You’re just the same old Joe Xer, like millions of others to them, end of story. Born in X, raised in X, living in X. Without a funny address or birthplace, FATCA is not applicable.

– In such a situation there is NO reason to start declaring old Country X bank accounts, assets, whatever, to the USA. What’s in Country X, stays in Country X. Selling something in Country X? Goes to Country X bank account, end of story. No reason to feed this data to your tax preparer.

Now obviously if someone is very rich, or a public figure, … or maybe other situations, then you may need to become 100% compliant, and in those cases it may be worth it, or unavoidable (but perhaps impossible). But in lower, middle, and upper-middle class situations (the 99%), it seems quite obvious that the best option is flying under the radar. The key of course is to retain control of the data. If you just plunk all your stuff down on an accountants desk and say “sort it out” you’ve just enrolled in a costly nightmare. Instead, when you get to the US, act as if you had no life before that. No bank accounts (what’s that?), certainly no house, no car, no nothing. Homelanders will not ask: they know how backwards the rest of the world is, and they know why you want to come to America: to live the dream. And don’t tell country X banks anything either.

Keep it simple.

@Clueit

Got it! I didn’t know that. I stand corrected. But I wonder: there is no gift tax in Canada. So couldn’t the covered expat first gift the money to a trusted Canadian intermediary who doesn’t have the US taint? Because there is no Canadian gift tax this wouldn’t be a taxable event. The intermediary would then make the final gift to the intended US destination.

@ Fred (B)

But will that hold after FIs start sharing all this info across borders?

@Watcher. I am in my current situation largely because I was not paying attention, primarily in 2004 when I too had also crossed the threshold of being here too long. None of this applied when I first arrived. The other irony is that the vast majority of all revenues from my companies have always been derived from exports (i.e. non US-sources). So it is foreign corporate customers that are responsible for most of the wealth I have acquired while in the US. And most of my software engineers are immigrants also educated and trained on Canadian, UK, Australian and South Africa’s taxpayer’s dime. The wise ones telecommute from overseas!

@Dash1729 It would have to be a very trusted intermediary! But I am sure it could be arranged. Hmm…..do I smell a business opportunity. For a small fee…….;-) Could also be a way of escaping being “covered’ in the first place!

Japan T: I have an ancient savings account in France, from when I lived with my parents. It’s still open, and they still get the mail. Neither my country of residence nor the US need know about it. But you’re right, it’s harder. What I’ve seen is banks ask you to come in from time to time ostensibly to check current ID (happens in Belgium). Not very invasive. But if your ID says you’re living the US now, well…

Still, this leaves lots of room to plan ahead, close accounts, etc. No need to try to dot every i and cross every t: it’s impossible. My philosophy is I’m honest, I pay my taxes, and yes, I will sabotage efforts to invade my privacy.

@Fred

My account was in the US and had been for over 20 years. Opened it at a young age to put my earnings from my paper route, through my time in the service and the college. It is a small town and the same people working at the bank as when I opened the account.

Although the recent ransomware might stop the headlong rush to digitalize all data on everyone, stored and shared by every entity we deal with, I doubt it cause much more than the briefest of pauses. Need to know or not, it will not be so very long from now that your bank in France and anyone anywhere who wants to learns of your current and past immigration statuses. Regardless of what is currently shared via CRS, more and ever more info will be added till they have eveything on everybody.