On Wednesday, the U.S. Department of State released one of the last missing parts of the Report of the Visa Office 2015: Table XX, Immigrant and Nonimmigrant Visa Ineligibilities (by Grounds for Refusal Under the Immigration and Nationality Act). Two grounds of ineligibility in particular may be of interest to U.S. emigrants and accidental Americans: § 212(a)(8)(B) “Draft evader” and § 212(a)(10)(E) “Former U.S. citizen who renounced citizenship to avoid taxation”.

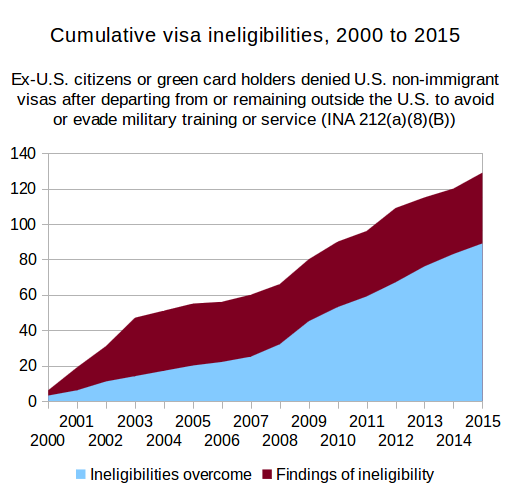

We explored the origins of the draft-related grounds for U.S. visa denial in a post last year. As noted then, since 2004 most people applying for tourist or other non-immigrant visas (though none of those applying for green cards) have been able to overcome the finding that they were ineligible for a visa due to having “departed from or who has remained outside the United States to avoid or evade training or service in the armed forces in time of war or a period declared by the President to be a national emergency”. The denial rate this year is slightly higher: nine people were denied non-immigrant visas, and only six had been able to overcome their ineligibility by the end of the fiscal year in September, either by obtaining a waiver, or by providing evidence that the ineligibility does not actually apply. Zero people were denied immigrant visas on this ground of ineligibility last year. All of those denied non-immigrant visas on this ground were U.S. citizens or green card holders at the time of their departure from the U.S.; § 212(a)(8)(B) states that it does “not apply to an alien who at the time of such departure was a nonimmigrant and who is seeking to reenter the United States as a nonimmigrant.”

With regards to people “determined by the Attorney General to have renounced United States citizenship for the purpose of avoiding taxation by the United States”, the State Department said they did not deny any of them a U.S. visa last year, as they have said every year since 2000. As we discussed recently, the Department of Homeland Security — responsible for making their own determinations of whether non-Americans who show up at U.S. borders (including those with visas, and those who don’t need visas such as citizens of VWP countries) are eligible to enter the country — revealed last November that since 2002, they have only denied two people entry to the U.S. due to the Reed Amendment, because both of them “affirmatively admitted” to government officials that they had renounced U.S. citizenship to avoid taxation.

New retroactive regulations introduced by Treasury to stymie corporate inversions show just how far they’ll go. If past treatment is any indication of future, expatriating citizens too can expect more beatings (until morale improves):

“There remains a lack of consensus as to whether inversions are best addressed through such legislative “sticks” or through the “carrot” of comprehensive tax reform that would include a reduction in the corporate tax rate (generally paid for by taxing accumulated offshore earnings at a preferential rate and either requiring or deeming their repatriation). It is unlikely there will be any action, or even clearer direction, on the legislative front until 2017 or later.”

http://www.mondaq.com/article.asp?articleid=487014&email_access=on