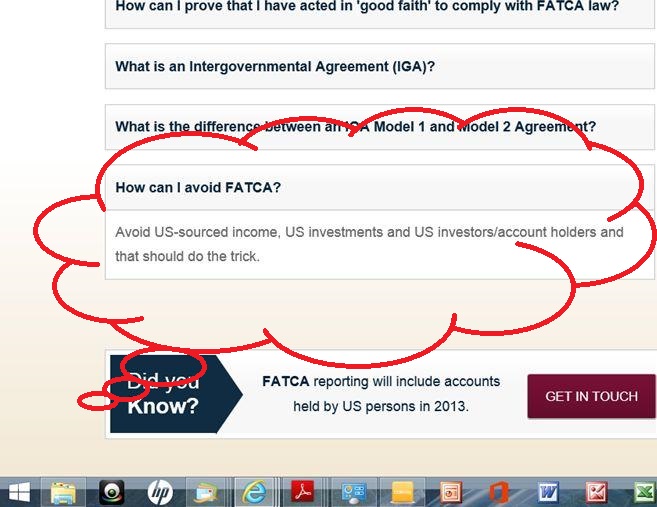

Q: “How can I avoid FATCA?”

A: “Avoid US-sourced income, US investments and US investors/account holders and that should do the trick.”

http://www.ustaxfs.com/fatca/fatca-faqs/

This is just one FATCA compliance consulting house of all of the jillions of FATCA compliance houses .

FATCA is a way to get a bigger chunk of a shrinking pie.

Don’t forget to remind your legislators.

I believe smaller credit unions are not forced to conform to FATCA. That could be one place to “hide” assets. The problem with house sales are, of course, that if your mortgage is with a large lender, it will show up in your account with that lender even if you quickly spirit the money to a small credit union.

I think that the smaller credit unions (with total assets less than $175 million US) are totally exempt from FATCA. Credit unions registered as Local Client Based with reduced reporting requirements are a good option as well. They will only report on non-residents of Canada. So if one is a permanent resident or citizen of Canada, they are exempt.

The above post states “FATCA reporting will include accounts held by US persons in 2013”. I thought FATCA reporting started with new and existing accounts beginning on June 30,2014. Can anyone clarify this?

Uncle Carl’s tips for avoiding FATCA:

http://blogs.angloinfo.com/us-tax/2014/03/17/how-to-avoid-fatca-tips-from-us-senate-subcommittee/

There is no better way to say the USA is CLOSED for business!! In order to avoid their ridiculous Fatca laws, steer clear of investing in the USA….. Look Obama, you are keeping the jobs home!!!

@ NativeCanadian

Maybe it’s just as well that most homelander Americans have never “seen Paree” because now they are about to be kept “down on the farm” and there’s a whole mess of people outside the barbed wire fence who won’t be visiting or buying stock in that farm.

https //www.youtube.com/watch?v=MBj7Fky1K_U (replace the colon)

Even without FATCA Canadian credit unions are a far better deal than any Canadian bank.

Absurd logic by Obama – just like almost everything else he touches. The policy should be to encourage overseas US citizens and permanent residents and other US Persons to invest in the USA – CBT and FATCA have the effect of encouraging such persons to hold NO US assets. Stupidity at its best.

Steve, what you say is true, but the “avoiders” will include a much larger group than just “US tainted” people.

You’re right. CBT and FATCA show an economic intellect as logical as burning your coat to stay warm.

In France, I have accounts in five banks. I have a CLN, am a French citizen, and was born in the US. For Fatca one bank sent me a W8 and an in-house (and bizarre) autocertification form but did not set a deadline to receive them. Another bank set me a W8 and a W9 and set a deadline for the end of February. Neither said what would happen if I did not comply. A third bank sent me a W8 and set a deadline of 2016 and said if I did not comply they would withhold a percentage of U.S. source income. (So far my favorite, since I do not have any U.S. source income.) I have not heard anything yet from the other two banks.

As a matter of principle I do not want to sign a W8 or any American document. Even leaving aside the principle, I shudder when I look at them – “see Instructions,” and then when you see the instructions, you see they are incomprehensible.

I think in France they may have difficulties with those of us who are French citizens with CLNs. We’re being picked up because of our American birthplace, but the French Constitution outlaws discrimination based on national origin. So I think if anyone tried to close our accounts, or took punitive action, because of a refusal to comply with a demand to sign a W8 will be on shaky legal ground.

It should be enough to take the CLN to the banks…at least it was enough for Swiss citizens. I denaturalized but with an American husband (new) I’m back in the crosshairs.

Good luck.

@DLN, After all you’ve been through (acquiring a CLN, etc), if you were going to pick a new one, why did you make it an American? He must have had some really redeeming qualities to make it worth it!

@DLN: I have a civil union with my “wife” — same benefits, without her being FATCA’d!