The video is not embeddable; you’ll have to watch it over on NBC’s site. You can also check out Phil’s post on it. The somber-faced newsreader begins by intoning:

00:00/Announcer: While many Americans are struggling to make ends meet, there is a growing trend among some of America’s ultra-wealthy: they are willing to give up their U.S. citizenship, in many cases to save money in taxes.

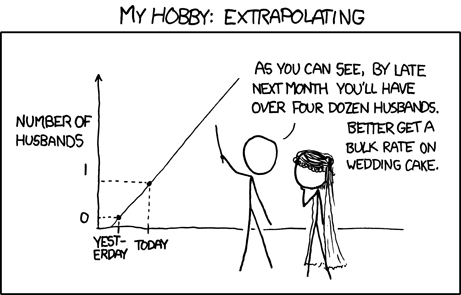

Clearly if two people renouncing citizenship are ultra-wealthy, then all 1,800 must be!

Cartoon by Randall Munroe/xkcd.org; licensed CC-BY-NC 2.5

Unless of course you could be bothered to look at Wikipedia’s list of famous people who renounced/relinquished — which consists primarily of politicians running for office in foreign countries, activists who object to U.S. policy, and other random emigrants. Not to mention the ordinary people who don’t make it into these lists, like Peter Dunn and Genette Eysselinck who have been interviewed by a real and honest journalist about their choice to give up U.S. citizenship.

00:15/Announcer: Our report tonight, from NBC’s Andrea Mitchell.

(Archive footage of Denise Rich and Bill Clinton)

00:20/Rich (archive): We know this saxophone has your name on it

00:24/Mitchell: A songwriter and philanthropist, Denise Rich even got the president of the United States, the First Lady, and Michael Jackson to headline her fundraisers for cancer, honouring her daughter Gabrielle, who died of leukaemia. She supported the Clinton campaign, and just before leaving office, Bill Clinton faced a storm of criticism for pardoning her husband, fugitive financier Marc Rich, who fled prosecutors for tax fraud in 1983.

To Mitchell’s credit, she at least opens her report with a balanced summary of Rich’s life, including mention of her philanthropy and of human tragedy which afflicts the rich and the poor alike. This offers a sharp contrast to how Lynnley Browning covered the same subject. But Mitchell’s report goes downhill from there.

00:49/Rich (archive): Just to be recognised by your peers is so wonderful.

00:52/Mitchell: From politics to the Grammies, Denise always surrounded herself with superstars and the super rich.

00:59/Rich (archive): It’s just a lot of fun, and everyone has a really good time.

01:01/Mitchell: But now, she’s put the 5th Avenue apartment — twenty rooms with view — on the market for $65 million dollars. She’s one of nearly 1,800 people last year who gave up their U.S. citizenship, compared to only 235 four years ago. It’s not only Denise Rich. Facebook co-founder Eduardo Saverin gave up his citizenship before the Facebook IPO. He moved to Singapore.

As usual, the mainstream media either do not understand — or do not care to make it clear — that people emigrate first and then renounce, and that the process moves at the speed of government and not of news reporting. Saverin moved to Singapore in 2009. And after living there for two years, he gave up U.S. citizenship in favour of retaining his existing Brazilian citizenship. He began the process of renunciation in January 2011. He finished it in September 2011. The government declined to mention it until eight months later. The media love to focus on the tax aspects; they make no mention of the other difficulties Saverin would face by retaining his U.S. citizenship if he wanted to invest in local startups and maintain a local bank account.

Certainly you can describe the above sequence of events as “gave up citizenship before the Facebook IPO, and moved to Singapore”. All three of those statements are factually accurate in isolation. Similarly, if a woman you wanted to libel met a good man, took him to her hometown to meet her relatives, got married, and had a son two years later, you could say, with the same logic, that she “got married before her baby was born, and introduced the father to her parents”. We all know what you’re trying to sneakily imply with your wording and your distorted ordering, but of course your careful wording preserves plausible deniability.

01:28/Mitchell: Why the trend? Tax lawyers say, because of an IRS crackdown, and to avoid estate taxes.

01:30/Hodgen: They don’t pay any estate tax when they die, and this is a big concern to them, particularly for preserving family businesses.

What happened to the rest of that quote? Who’s the “them” that Phil Hodgen is referring to? My guess would be that he’s talking about Persian Gulf oil state families where it’s common for brothers to jointly own businesses, the same as he mentioned in “Why People Expatriate” “[F]or those living in countries with no estate tax, the impact is profound. I have many clients in the Middle East. There it is the norm to have very large family-owned businesses. If two brothers own a business and one is a U.S. citizen, upon the citizen’s death an estate tax will be imposed, essentially causing his share of the business to be sold to the non-citizen’s side of the family. In order to preserve the family business, ownership must be removed from U.S. citizens.”

But thanks to the magic of careful editing, anyone quoted on TV can be made to seem like they’re talking about anything at all. No doubt most viewers will have concluded that Mr. Hodgen’s “them” refers to Saverin and Rich, and the editors will have succeeded at leaving the audience with the impression that the only reason to renounce citizenship is to avoid the estate tax.

01:38/Mitchell: In a statement, Rich says she gave up her citizenship in order to be closer to her long-time life partner as well as her family and loved ones in Europe. New York Senator Chuck Schumer, who’s sponsoring a law to penalise people like Rich, sees a tax dodge:

01:49/Schumer: You certainly don’t need to renounce your citizenship to be closer to your family. We all know the reason she’s doing this, and it’s to avoid paying taxes. I find the people who renounce their American citizenship to be despicable.

Indeed, you certainly don’t need to renounce your citizenship to be closer to your non-US family. You and your non-American spouse can treasure the experience of hundreds of thousands of dollars of FBAR fines together. Shared hardship is great for bringing people closer. And think of the benefits to the U.S. Treasury, which can get its hands on all those assets which were earned by non-Americans elsewhere in the world. It’s Patriotic And It’s Their Fair Share!

02:05/Mitchell: Whatever her reason, Denise Rich, whose father escaped the Holocaust and found refuge in the U.S., has now become a citizen of Austria. Andrea Mitchell, NBC News Washington.

Browning’s story implied that Rich had been an Austrian citizen all along (“Rich, who was born in Worcester, Massachusetts, has Austrian citizenship through her deceased father, said Michael Heidt”); however, this apparently was refuted by a statement by Rich’s spokeswoman Judy Smith reprinted in the WSJ’s Washington Wire blog. Rich might have had dual citizenship at birth, but she might have never claimed it, or at the time she became an adult Austrian law might not have permitted dual citizenship. Current Austrian nationality law permits those who were born dual citizens to retain both citizenships indefinitely, but those who naturalise must give up other citizenships.

So either Mitchell or Browning must be wrong about Rich’s Austrian citizenship. Between that and Browning’s false statement that Saverin became a citizen of Singapore, we can see very clearly how this story is progressing: news organisations are sacrificing any semblance of fact checking, clarity, and accuracy in favour of speed and sensationalism. All they have to do is keep the outrage at an orgiastic peak for another couple of weeks, and then the second quarter name-and-shame list will come out and there will be a new Emmanuel Goldstein for everyone to denounce. Anyone wanna take a bet on how long before Schumer hijacks the Senate floor again to demand immediate passage of his “Emigration Punishment by Abusing Taxpayers Residing In Other Territories” Act?

@Tim…

Thanks for that link. Funny you should bring that up. I got a copy of that from Victoria (not sure how she found out about it) and I have had it open in a tab all day to read. However, since it was my wife’s day off we went touring on a beautiful day in the Pacific NW instead. Now, tonight, I am listening to Libor stories and trying to catch up on my reading. I will definitely read it next.

I was wondering if that should get a post all of it’s own, and as you have had a hand in its publication success, it would be good if you had permission to give it wider viewing.

BTW, in the same edition of Tax Notes Int’l, should be Steven Mopsick’s proposal on noisy “make my day” disclosures. I think I understand there is a period before he can publish it separately, but I would expect by next week to see it up here too…

All of this helps get visibility and more intelligent discussion of alternatives to the IRS stupidity, unfortunately the sensationalist at NBC won’t bother to read…

@Em… Just another little podcast out today about questions of our favorite Treasury Secretary on what did he know about LIBOR manipulation back in 2007…

Here it is for your edification: http://www.thetakeaway.org/2012/jul/11/libor-scandal-reaches-united-states/

@tim- it is an excellent presentation. Well reasoned and most practical.

@Em…

Here is one more LIBOR piece I heard yesterday in the car on XM radio, and I have been looking all night for it on the internet as I forgot what program it was. It was an interview with Joe Nocera who I like reading. If you haven’t read his book on the Financial Crisis called “All the Devils are here” I would recommend it…

http://www.wnyc.org/shows/bl/2012/jul/10/joe-nocera-explains-libor/

@ Just Me

Thanks for the links. I’m about to explore them now. Please don’t mistake me for some sort of financial whiz though. I’m not at all whizzy, just an ordinary person with perhaps a bit more curiosity than what’s good for me. I picture you as someone who reads 1000 words a minute and juggles 10 tasks at once so please don’t burn yourself out … we’ll need you for the long haul here. 🙂 Also, I sometimes think you never sleep!

@Em…

I am just an average person with a lot of curiosity too, and spend way too much time on all this just to keep me “Fool Proof” I guess. I tend to listen to a lot of things to see if I can pick up the nuances that might be missed in any one story. The Biggest thing that worries me, is that we have a BIG crumbling of trust in all financial and government institutions after seeing one scandal or another, or one ridiculous government policy after another. Everyone is engineering or manipulating something to their own selfish benefit it seems. Trust is the underlying foundation of Capitalism if it is to work as envisioned by the idealist, but that Trust is taking a beating. It is essential that it survives, as it forms much of the fabric that holds society together. Once it is gone, katie-bar-the-door.

Reuters is running the same story again in a condensed version. Still makes all the same errors as Browning’s original article (Austria “worldwide” taxation, Saverin being a Singaporean citizen, etc.). I left a comment pointing out the errors. It’s pending moderation.

http://www.reuters.com/article/2012/07/10/tagblogsfindlawcom2012-lawandlife-idUS77478219220120710

@Tim and Just Me

While basing FBAR and FATCA reporting on country of residence will help a lot of people who are being unfairly burdened by these requirements, it is, unfortunately, not enough in the global world we are living in. In particular, it is not enough for the increasingly borderless Europe that many dual citizens live in. I will provide 5 examples that show while reporting bank accounts based on country of residence would be a good step to take, large and increasing amounts of dual citizens will still be subject to these destructive positions.

Example 1: My European large multinational employer makes money by contracting a significant part of its workforce to work in other countries. These contracts are usually for only one year, but as part of the salary and expenses are paid in the country of employment, it is necessary to have a bank account there. However, the employee fully intends to return to his or her “home” country after 1 year. These employees are not resident in their home country, but it would be foolish to close out all their home country bank accounts since they intend to return. Thus, while performing a legitimate activity in the country they reside in, they have accounts in a country they are not resident in, which is really their “home” country.

Example 2: Many of these employees who work in foreign countries for a year are required to participate in local retirement schemes. When they leave that country, their contributions are by law sometimes required to be transferred to a private bank account. Two notable examples are Swiss Vested Pension Benefits and Mexican AFORE accounts. While Switzerland will let you liquidate the account if you move abroad, if you move within the EU, you cannot liquidate a portion of the account until you are 65. Switzerland offers some flexibility in that you can keep the money in cash, but Mexico automatically invests the money in funds and there is no possibility to liquidate it before age 65. Thus, a young dual national who thought it would be a great opportunity to live and work in Mexico for a year becomes saddled with a PFIC for most of his or her life in a country he or she does not reside in. This PFIC will likely cost more in accounting fees and US taxes than the account is worth.

Example 3: What about the cross border worker whose employer pays the salary into a local bank account in the country of employment? That same bank also offers accounts in the currency of the country the employee lives in so the employee keeps a large part of their money in an account in the country of employment, not the country of residence, as the exchange rates are better.

Example 4: What about the dual citizen retiree from Sweden who retires to Thailand or Spain, but yet spends the summers in Sweden visiting family and friends. As they have a legacy account in Sweden and do spend some time in the country each year, it would be foolish to close the account as they will have several months of local expenses to pay. These people will be unnecessarily punished and examined for legitimate activity.

Example 5: What about the dual citizen employee who participates in the stock plan of the company he or she works for? One day, the company decides that they can save money by transferring the plan to a bank in a third country. Suddenly, the employee has an account in a country they do not reside in even though they have never stopped residing in their country of employment. .

These are realities, especially for many of us who live in Europe. They illustrate that a same country exception binds the wound, but it does not heal it. Reporting exemptions based on bona fide residence abroad (not related to the country of the bank account), or residence based taxation, or renunciation appear to be the only true answers.

@Eric…

Well, I see I will have to comment on that one too this morning..

Here is another on CBS

5 citizens who left the U.S. to avoid paying tax

Will see if I can comment on that one too.

@Just Me. Thanks. I left a comment (I’m “deo” over there):

Slowly learning to be more succinct and restrict myself to making one point rather than trying to refute all the garbage that gets left in the comments — if I tried that I’d be there all night. Already getting late over here; must be even later down in NZ.

@Eric

I should learn to be succinct, but I can’t help myself! 🙂 I saw yours. I tend to write an entire narrative, which for the “drive by” readers is skimmed or not read, and yours, probably sticks better. On the other hand, I hope to influence journalist that might read more deeply to get a better understanding. You never know.

So, I put up a more lengthy comment just now.

I am in the Seattle/Bellingham region these days, and back in NZ right now, the sun is just getting up.

Here is what I wrote, just to have it somewhere I can find for cut and past later.. LOL

More Chuck Schumer

@Calgary: Well, maybe that will get Prime Minister Harper’s attention about US bullies in a way FATCA doesn’t seem to be doing!

@Blaze, one would hope so, though:

Perhaps this will catch the ire of Canadians on American exceptionalism and we can take advantage of that by fueling the fire with our stories on FATCA and all we talk of here.

@Calgary: I’m sure we all have our own views on Nexen and China–as does Harper. What galls me is that Schumer, et. al. think it is any of their business.

Just leave us alone! They don’t own Alberta’s oil any more than they own those of us unfortunate enough to have been born in US!

@Blaze,

Exactly! They just can not ever keep their nose out of the business of other countries. They are NOT king of the world.

One more reason to support the deal. Lenin was right: When it comes time to hang the capitalists they will gladly sell us the rope.