The video is not embeddable; you’ll have to watch it over on NBC’s site. You can also check out Phil’s post on it. The somber-faced newsreader begins by intoning:

00:00/Announcer: While many Americans are struggling to make ends meet, there is a growing trend among some of America’s ultra-wealthy: they are willing to give up their U.S. citizenship, in many cases to save money in taxes.

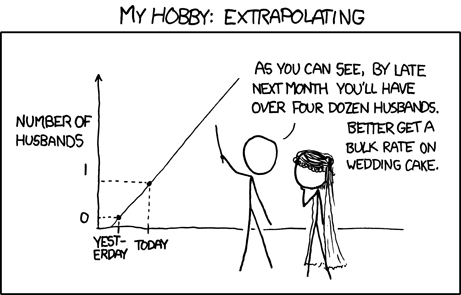

Clearly if two people renouncing citizenship are ultra-wealthy, then all 1,800 must be!

Cartoon by Randall Munroe/xkcd.org; licensed CC-BY-NC 2.5

Unless of course you could be bothered to look at Wikipedia’s list of famous people who renounced/relinquished — which consists primarily of politicians running for office in foreign countries, activists who object to U.S. policy, and other random emigrants. Not to mention the ordinary people who don’t make it into these lists, like Peter Dunn and Genette Eysselinck who have been interviewed by a real and honest journalist about their choice to give up U.S. citizenship.

00:15/Announcer: Our report tonight, from NBC’s Andrea Mitchell.

(Archive footage of Denise Rich and Bill Clinton)

00:20/Rich (archive): We know this saxophone has your name on it

00:24/Mitchell: A songwriter and philanthropist, Denise Rich even got the president of the United States, the First Lady, and Michael Jackson to headline her fundraisers for cancer, honouring her daughter Gabrielle, who died of leukaemia. She supported the Clinton campaign, and just before leaving office, Bill Clinton faced a storm of criticism for pardoning her husband, fugitive financier Marc Rich, who fled prosecutors for tax fraud in 1983.

To Mitchell’s credit, she at least opens her report with a balanced summary of Rich’s life, including mention of her philanthropy and of human tragedy which afflicts the rich and the poor alike. This offers a sharp contrast to how Lynnley Browning covered the same subject. But Mitchell’s report goes downhill from there.

00:49/Rich (archive): Just to be recognised by your peers is so wonderful.

00:52/Mitchell: From politics to the Grammies, Denise always surrounded herself with superstars and the super rich.

00:59/Rich (archive): It’s just a lot of fun, and everyone has a really good time.

01:01/Mitchell: But now, she’s put the 5th Avenue apartment — twenty rooms with view — on the market for $65 million dollars. She’s one of nearly 1,800 people last year who gave up their U.S. citizenship, compared to only 235 four years ago. It’s not only Denise Rich. Facebook co-founder Eduardo Saverin gave up his citizenship before the Facebook IPO. He moved to Singapore.

As usual, the mainstream media either do not understand — or do not care to make it clear — that people emigrate first and then renounce, and that the process moves at the speed of government and not of news reporting. Saverin moved to Singapore in 2009. And after living there for two years, he gave up U.S. citizenship in favour of retaining his existing Brazilian citizenship. He began the process of renunciation in January 2011. He finished it in September 2011. The government declined to mention it until eight months later. The media love to focus on the tax aspects; they make no mention of the other difficulties Saverin would face by retaining his U.S. citizenship if he wanted to invest in local startups and maintain a local bank account.

Certainly you can describe the above sequence of events as “gave up citizenship before the Facebook IPO, and moved to Singapore”. All three of those statements are factually accurate in isolation. Similarly, if a woman you wanted to libel met a good man, took him to her hometown to meet her relatives, got married, and had a son two years later, you could say, with the same logic, that she “got married before her baby was born, and introduced the father to her parents”. We all know what you’re trying to sneakily imply with your wording and your distorted ordering, but of course your careful wording preserves plausible deniability.

01:28/Mitchell: Why the trend? Tax lawyers say, because of an IRS crackdown, and to avoid estate taxes.

01:30/Hodgen: They don’t pay any estate tax when they die, and this is a big concern to them, particularly for preserving family businesses.

What happened to the rest of that quote? Who’s the “them” that Phil Hodgen is referring to? My guess would be that he’s talking about Persian Gulf oil state families where it’s common for brothers to jointly own businesses, the same as he mentioned in “Why People Expatriate” “[F]or those living in countries with no estate tax, the impact is profound. I have many clients in the Middle East. There it is the norm to have very large family-owned businesses. If two brothers own a business and one is a U.S. citizen, upon the citizen’s death an estate tax will be imposed, essentially causing his share of the business to be sold to the non-citizen’s side of the family. In order to preserve the family business, ownership must be removed from U.S. citizens.”

But thanks to the magic of careful editing, anyone quoted on TV can be made to seem like they’re talking about anything at all. No doubt most viewers will have concluded that Mr. Hodgen’s “them” refers to Saverin and Rich, and the editors will have succeeded at leaving the audience with the impression that the only reason to renounce citizenship is to avoid the estate tax.

01:38/Mitchell: In a statement, Rich says she gave up her citizenship in order to be closer to her long-time life partner as well as her family and loved ones in Europe. New York Senator Chuck Schumer, who’s sponsoring a law to penalise people like Rich, sees a tax dodge:

01:49/Schumer: You certainly don’t need to renounce your citizenship to be closer to your family. We all know the reason she’s doing this, and it’s to avoid paying taxes. I find the people who renounce their American citizenship to be despicable.

Indeed, you certainly don’t need to renounce your citizenship to be closer to your non-US family. You and your non-American spouse can treasure the experience of hundreds of thousands of dollars of FBAR fines together. Shared hardship is great for bringing people closer. And think of the benefits to the U.S. Treasury, which can get its hands on all those assets which were earned by non-Americans elsewhere in the world. It’s Patriotic And It’s Their Fair Share!

02:05/Mitchell: Whatever her reason, Denise Rich, whose father escaped the Holocaust and found refuge in the U.S., has now become a citizen of Austria. Andrea Mitchell, NBC News Washington.

Browning’s story implied that Rich had been an Austrian citizen all along (“Rich, who was born in Worcester, Massachusetts, has Austrian citizenship through her deceased father, said Michael Heidt”); however, this apparently was refuted by a statement by Rich’s spokeswoman Judy Smith reprinted in the WSJ’s Washington Wire blog. Rich might have had dual citizenship at birth, but she might have never claimed it, or at the time she became an adult Austrian law might not have permitted dual citizenship. Current Austrian nationality law permits those who were born dual citizens to retain both citizenships indefinitely, but those who naturalise must give up other citizenships.

So either Mitchell or Browning must be wrong about Rich’s Austrian citizenship. Between that and Browning’s false statement that Saverin became a citizen of Singapore, we can see very clearly how this story is progressing: news organisations are sacrificing any semblance of fact checking, clarity, and accuracy in favour of speed and sensationalism. All they have to do is keep the outrage at an orgiastic peak for another couple of weeks, and then the second quarter name-and-shame list will come out and there will be a new Emmanuel Goldstein for everyone to denounce. Anyone wanna take a bet on how long before Schumer hijacks the Senate floor again to demand immediate passage of his “Emigration Punishment by Abusing Taxpayers Residing In Other Territories” Act?

I found out some interesting info. I believe that Petros will appear in the Federal Register this month. Here is what I found out. The Consulate in Toronto makes TWO copies of ones CLN during the second interview. The first once the consulate receives approval from DC electronically is sent to the renounciant/relinquisher by registered mail(In Petros case he has already received it). The second one is sent in diplomatic pouch from Toronto(or any other location)to DC. Once the State Dept in DC has received the second copy they make four copies one for themselves, one for Customs, one for the FBI, and one is send by mail to the IRS in Bensalem, PA. From what I have been led to believe the Federal Register list is made up of all the names on CLN’s received in Bensalem in the last quarter. I suspect Petros while approved in Febuary did not make the DC-Toronto-DC-Bensalem(Philadelphia) journey in the time for last quarter’s release.

@tim- so simply taking the legal step of giving up U.S. citizenship is enough to put you on the FBI’s radar and Customs. Now exactly why would they be interested in people who have not committed a crime?

Such paronia if exhibited by an ordinary person would scream out for medical treatment (LOL).

The FBI probably needs the CLN so they can put the name in the NICS system (background checking system for gun purchasers), to make sure evil traitors don’t get their hands on firearms

http://www.fbi.gov/about-us/cjis/nics/reports/070512_denials.pdf

@eric- they need to be more concerned about the gun toting “honest” Americans in their midst.

@Eric

Interestingly enough “relinquishers” are not effected by the gun purchasing or hazardous material transport restrictions.

@recalcitrantexpat

In general I believe relinquishment is preferable to renunciation. One thing I still haven’t found out is whether the “DS” series of forms are also sent by State to the other agencies.

*More info

ONLY “renounciant” CLN’s are even sent to the FBI. The four categories of “relinquishers” are not sent.

Well, what can you expect of NBC nightly World news that is only 22 minutes plus commercials? A yet, this is all my little ole mother relies on to get a view of the world.

When you know something about a story, then you really realize what crap is served up to America in the way of mainstream news.

https://twitter.com/FATCA_Fallout/status/222918231076257792

What happens to CLNs –

See 7 FAM 1240 Interagency Coordination and Reporting Requirements

at http://www.state.gov/m/a/dir/regs/fam/07fam/c22713.htm

Petros, If your name is published in the Federal Register, would you tell us whether you were considered a ‘covered expatriate’ when you renounced please? I thought only covered expatriates had their name published and want to see if this holds true.

*

I fear that as I’d have to renounce rather than relinquish, it might actually create more problems by putting me on the radar. Don’t like the idea of being watched and accused of being a traitor…I’m genuinely terrified to draw undesirable attention to myself.

*Funny that after knowing about my case the IRS suggested that one way for me to resolve it was by renouncing my citizenship. Written down. It even hurt my feelings as I always been proud to be an American

The Federal Register contains both covered and uncovered expatriates. (I personally know an uncovered renunciant on the list.)

The Federal Register also contains names of Green Card holders who relinquished permanent residence, according to this:

http://renunciationguide.com/Data-On-Renunciants.html

@Wellington, I don’t know if the green card part is new or wrong, but I personally know of six folk who surrendered green cards three or four years ago. Some were definitely covered expatriates. All filed the required IRS paperwork as well as I-407. So far none has appeared in the Federal Register.

@Watcher, yeah from what I understand there are a lot problems with data and the Federal Register is a generally unreliable list of people renouncing. I’ve also heard about full-blooded US citizens renouncing and never showing up in the register! (How nice to have one’s privacy protected by government incompetence.)

What will be Chuck Schumer’s next brainstorm be? Is he going to introduce a bill to guarantee all Americans who renounce will have their name appear on the Federal Register?

Go on Chuck do it – you’ll find the 1800 quite rapidly ramps up to 5000+ traitors (from the Homelanders’ point of view). You’ll also be creating a badge of honours of sorts as well.

No doubts that in the coming years the number of expatriations will skyrocket as US persons realize they basically can have no financial life overseas. I think 5000 is on the lower side of the estimate range.

Or as Chuck might say: Après moi, le déluge.

@Michael, everything I do is documented here at Isaac Brock. I think if my name ever gets on the Federal registry, I’ll find out from the other Brockers. Cheers.

@ Just Me, Neil Postman has a great book, How to watch the TV news, in which he starts, that no one who is not an avid reader of books and journal articles on contemporary news subjects should ever watch the TV news, because you haven’t sufficient knowledge to know what agenda of the TV news is and how it is try to manipulate you. The fact is the manipulation, according to Postman, is clearly quite transparent: the TV news consists of entertaining news segments designed to make you stay and watch the commercials, which is the real programming that they want you to watch. The agenda is: Buy the products that we are selling.

*Senator Schumer does not need to grab the microphone to reintroduce his bill that would penalize persons who renounce their US citizenship for tax purposes. All he has to do is ask the Treasury Department to rule that this Democratic fund-raiser and contributor to the Clinton Library be blacklisted and barred from re-entry in the US for any purpose for the rest of her moral life under the provisions of the Reed Amendment to the 1986 Immigration Act.

Senator Schumer: What’s holding you back?

Now that she is no longer a US citizen it becomes a criminal offense for any politician to accept campaign contributions from her.

@Petros

Thanks for the book tip, but that is one I don’t need to read, as have I known that for years and years. We all believe in the free market and the profit motive, but with that comes a “buyers beware” world full of manipulation and risk. That is just as true about your evening news cast as it is in believing that LIBOR is an honest statement of interbank lending risk and a good untarnished bench mark to tie your loan too. I assume you are following this scandal closely! 🙂

And of course the Federal Register will never count the possibly hundreds of thousands of accidental Americans who ‘unofficially’ renounce a citizenship they never really felt they had -by keeping silent or avoiding the US. Who will hear their voices when they will not speak?

I fear that all of these high profile renunciations will just introduce stricter legislation to screw the innocent individuals like us who are already citizens of another country, and just want to shed the thousand dollar per year cost to an Accountant just to tell the IRS that they do not owe them anything.

You can’t be an avid reader of alternative new sites (as I am) and have any interest in watching TV news. The rare time I do watch it I find myself nattering back at the TV — that’s wrong, that’s slanted, that’s pure propaganda, that’s a blatant infomercial, that’s entertainment not news and so on. Guess that’s why I’ve known for ages about the LIBOR “scandal” (actually a whopping big crime) and nano-second stock trading and how false flag operations work, etc. Speaking of LIBOR, here’s the latest interview I listened to at The Corbett Report which offers a pretty good explanation of what has been going on …

http://www.corbettreport.com/corbett-report-radio-172-liborgate-explained-with-david-smith/

I checked out David Smith’s site hoping to find his views about FATCA but unfortunately he doesn’t seem to have gotten around to it yet, perhaps because he is British-Swiss and it doesn’t affect him directly, although his bio states: “He has worked for major Swiss and US multinationals, global banks, and UHNW businesses.”

@Em..

For a minute there I thought What?!, the Colbert Report did something on Libor?!! Then I checked, and realized you are talking about Cobertt not Colbert! That said, I bet Colbert would have an amusing twist if he took it on. Thanks for that link. I have not listened to him before.

Here was a podcast from Planet Money on this issue too… Shorter,,

The little Lie that Rocked the Banks..

@markpinetree, The IRS actually suggested you could renounce as one way of solving the burden put upon you by them! You should black out your name and share it. That is interesting stuff.

@petros, I know you’ll share if you’re on the list. I appreciate how open you are. What I mean though, is that I’d be curious to hear from you whether you were considered a ‘covered expatriate’ when you did renounce so that it’s easier to understand your situation. But that’s mainly just relevant if your name actually gets on the list b/c I’d always heard only covered expatriates are included. But it seems no one knows about that for sure.

@JustMe

You might want to take a look at this column just published a few days ago in Tax Notes International. I have been in contact with the author for quite some time over the issues discussed here so getting this published I feel was a little bit of personal success on my part getting this published. (I may make a full post about this later)

http://dl.dropbox.com/u/44761778/Christians-FATCA%20Same%20Country%20Exception.pdf

http://taxpol.blogspot.com/2012/07/taming-fatca.html#comment-form