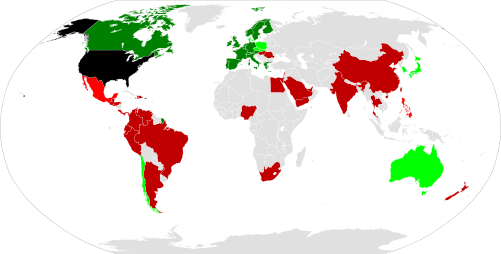

As we’ve discussed previously, U.S. persons who live in countries which do not have totalization agreements with the U.S. face double Social Security taxation if they are self-employed or work for branches (rather than subsidiaries) of U.S. companies. This is because the 26 USC § 901 foreign tax credit applies only to income taxes under Subtitle A, Chapter 1 of the “Internal” Revenue Code, not to SECA or FICA taxes which are imposed by other chapters. Ain’t citizenship-based taxation fun?

On 30 June 2015, the White House announced that Brazil and the United States had signed a Social Security totalization agreement, which in theory would finally end this piece of the double taxation problem that plagued Roger Conklin, markpinetree, and other Isaac Brock Society readers with connections to Brazil:

The United States and Brazil seek to ease the burden on companies in order to facilitate job creation and growth, while enhancing the protection of our workers. To support this effort, the United States and Brazil have signed a Social Security Totalization agreement. This agreement will eliminate dual Social Security contributions, which occur when a worker from one country works in another country. It will also close the gaps in benefit protections for workers who divide their careers between the United States and Brazil. With trade and investment rapidly growing between our two countries, the United States estimates that this agreement will save U.S. and Brazilian companies more than $900 million over the first six years.

Later in the same press release, the White House also “welcome[d] the entry into force of the agreement between the United States and Brazil to implement the Foreign Account Tax Compliance Act”, which suggests that their commitment to “eas[ing] the burden on companies” and “enhancing the protection of our workers” is not very deep, but anyway …

I’d forgotten about this agreement, until a recent retweet by USCitizenAbroad prompted me to look it up, and the Social Security Administration says it is not yet in effect. The Brazilian side appears to be moving to ratify it (even though the President who signed it has been removed from office): the executive branch submitted it to the National Congress in July, and it is now under consideration by various committees in the Chamber of Deputies.

On the U.S. side, the administration must submit the agreement to Congress to start the clock running on Congress’ time limit for voting it down — if Congress don’t do so by the deadline, they’re deemed to have approved it. However, Obama shows no sign of actually submitting the agreement, which has already been left hanging for longer than any other new U.S. totalization agreement. Given what a political hot potato the 2004 agreement with Mexico turned out to be for Bush, the Democrats probably don’t want to bring this one up before the election. So it will be left hanging in Washington until after the next president takes office — assuming that whoever gets elected actually wants to honour the agreement.

The U.S. government can’t even be bothered to tell the public what the agreement says — for that you’ll have to turn to the Brazilian government, which posted the full text on the same day as they signed it.

How much longer is the U.S. government going to make U.S. Persons in Brazil wait?