With FATCA’s 1 July deadline right around the corner, many desperate non-U.S. banks are turning to technology companies purporting to offer “compliance solutions” to help them hunt down all those tax-evading, money-laundering, drug-dealing U.S. Persons abroad who sneakily disguised themselves as ordinary, law-abiding immigrants interested only in paying water bills and buying groceries. How well are these so-called “solutions” likely to perform? Well, attention to detail is crucial in both software development and tax compliance, so let’s take a closer look at the level of attention to detail that one of these compliance firms demonstrates in other areas …

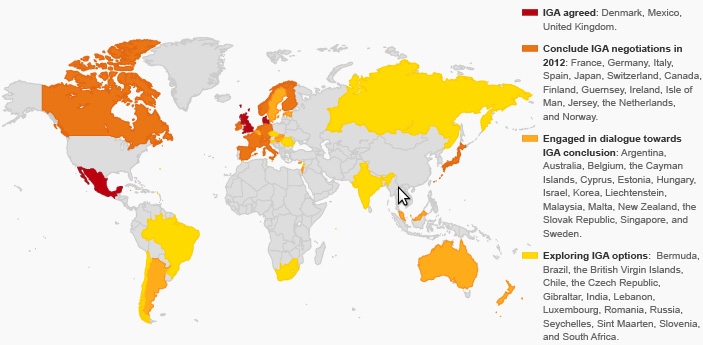

More than a year ago on Twitter, I noted this hilariously awful map of Intergovernmental Agreements posted by Thomson Reuters — apparently they thought that Tasmania declared independence from Australia, Siberia broke away from western Russia, and then Sakhalin & the Kuriles counter-seceded from Siberia, all because of FATCA. From the Internet Archive, if you don’t believe that’s a genuine screenshot: