At the end of September, the IRS released preliminary figures for year 2014 filers of Form 3520-A, “Annual Return of Foreign Trust with a U.S. Grantor”, as part of the “foreign trusts” section of its Statistics of Income series. Many international accountants and tax lawyers take the position that ordinary local tax-compliant savings plans held by U.S. persons in other countries, such as Australian Superannuation, are “foreign grantor trusts” which generate the obligation for their “grantors” to file Form 3520-A as part of a complete compliance diet if the “trust” itself does not file the form.

This early IRS release breaks down “foreign trusts” only by extremely broad income categories — to give you some idea of what Homelanders think we owners of “foreign trusts” are like, the upper bound for the lowest category (aside from the category for trusts with a loss of any size) is US$0 to $100,000. For purposes of this blog post I’ll call this category “small reporting trusts” (though the category is defined in terms of income rather than trust assets). The final release will probably only break that down as far as $0–25,000.

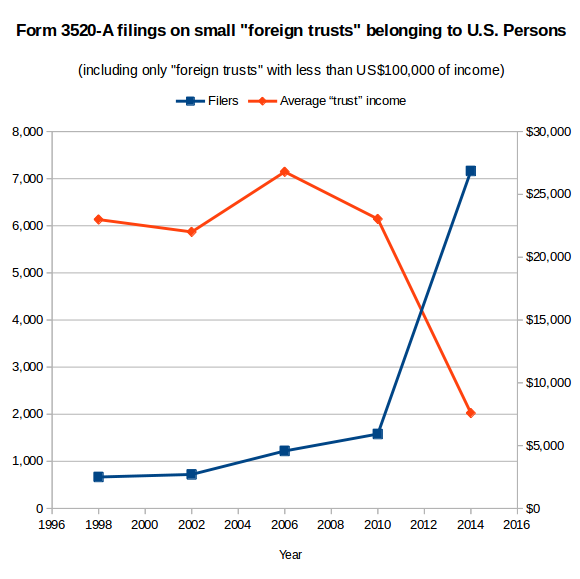

However, we can still see two related trends: many more “foreign trusts” with income under $100k are reporting, and on average they have far less income and less assets than “foreign trusts” which reported in previous years.

|

|||||

|---|---|---|---|---|---|

| 1998 | 2002 | 2006 | 2010 | 2014 | |

| Trusts with $1 to $100,000 of income (“small foreign trusts”) | |||||

| Count | 667 | 772 | 1,220 | 1,580 | 7,163 |

| Average net income | $22,996 | $22,010 | $26,797 | $23,042 | $7,589 |

| Average assets minus liabilities | $910,425 | $2,002,040 | $1,411,437 | $1,389,438 | $389,986 |

| Estimated characteristics of newly-reporting “small foreign trusts” (Assuming that all trusts from previous period continued to report and had same net assets and income) |

|||||

| Count | +105 | +448 | +360 | +5,583 | |

| Average net income | $10,055 | $33,737 | $10,316 | $3,216 | |

| Average assets minus liabilities | $15,240,364 | $555,181 | $1,314,886 | $107,138 | |

Assuming that all the small reporting trusts from 2010 continued to report (not a perfect assumption — note the absurd result for average assets minus liabilities of trusts which began reporting during 1999–2002), that means the additional five thousand-plus small trusts which started reporting during 2011–2014 had an average of only ~US$3,200 of income and US$107k of assets. In fact, for the first time in the history of Form 3520-A, the average small reporting trust in 2014 had less income than an individual’s personal exemption plus standard deduction — i.e. even in those cases where the trust’s income is treated as belonging to its U.S. person “tax owner”, no U.S. tax is actually owed. (Note also that this analysis excludes trusts which had losses, since the IRS statistics lump together minnow “trusts” which had minnow-sized losses and whales with multi-million dollar tax losses which may or may not correspond to economic losses.)

I expect that precisely none of these new “small reporting trusts” are actual Panama Papers-style offshore trusts with a professional trustee taking legal title to some assets and then managing them for beneficiaries according to local trust law — the fees for those would eat up all the income. Rather, their size — about the same as the average U.S. 401(k) plan — strongly suggests that these are normal retirement accounts, not tax-evading drug-dealing money-laundering terrorist-financing instruments.

In simpler terms, after spending tens of millions on offshore compliance crusades, the IRS managed to dig up a bunch of local retirement plans which owe no U.S. tax.