From the latest Congressional Budget Office/Joint Committee on Taxation report, “Factors Affecting Revenue Estimates of Tax Compliance Proposals” (via, of course, TaxProf Blog), we get this hilarious table, based on figures from the IRS’ “FY 2016 Budget in Brief”. I present the figures below as they were in the original table: “Cost” and “Revenue” figures are given in millions of U.S. dollars; “ROI” (“return on investment”) is the revenue divided by the cost, and is given as a multiple of the cost rather than a percentage above break-even. Note the two items in red (colour and italics added by me), which have a much lower ROI than the other categories:

| Category | First Year (FY 2016) |

Full Performance (FY 2018) |

||||

|---|---|---|---|---|---|---|

| Cost | Revenue | ROI | Cost | Revenue | ROI | |

| Revenue-Producing Enforcement Initiatives to Implement Enacted Legislation | $166.1 | $256.5 | 1.5 | $160.4 | $658.4 | 4.1 |

| Implement Foreign Account Tax Compliance Act (FATCA) | 71.0 | 67.7 | 1.0 | 66.6 | 155.1 | 2.3 |

| Implement Merchant Card and Basis Matching | 34.3 | 124.2 | 3.6 | 29.0 | 321.6 | 11.1 |

| Address Impact of Affordable Care Act (ACA) Statutory Requirements | 60.8 | 64.6 | 1.1 | 64.8 | 181.7 | 2.8 |

| Cap Adjustment Enforcement Initiatives | $420.6 | $861.4 | 2.0 | $434.6 | $2,798.9 | 6.4 |

| Immediate and Directly Measurable Revenue-Producing Initiatives | $333.1 | $861.4 | 2.6 | $352.8 | $2,798.9 | 7.9 |

| Address International and Offshore Compliance Issues | 40.7 | 49.3 | 1.2 | 43.1 | 159.6 | 3.7 |

| Increase Audit Coverage | 150.7 | 397.5 | 2.6 | 158.5 | 1,266.7 | 8.0 |

| Enhance Collection Coverage | 122.8 | 345.9 | 2.8 | 131.2 | 1,179.7 | 9.0 |

| Improve Audit Coverage of Large Partnerships | 16.2 | 44.5 | 2.7 | 16.9 | 129.1 | 7.6 |

| Prevent Identity Theft and Refund Fraud | 2.7 | 24.2 | 9.0 | 3.1 | 63.8 | 20.6 |

| Strategic Revenue-Producing Initiatives (which do not have immediately measurable ROI, but clear long-term revenue effects) |

$87.5 | $0.0 | 0.0 | $81.8 | $0.0 | 0.0 |

Harassing diaspora 41x as urgent as stopping refund fraud

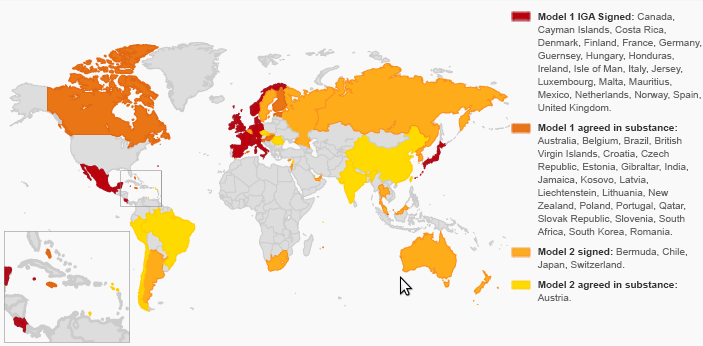

Look in particular at the penultimate line item: the IRS intended to spend only US$2.7 million on preventing identity theft and refund fraud. The IRS already has enormous problems in this area, and with their efforts to rope millions of uninformed new filers into the U.S. tax system, we can expect that similar problems will only increase in the future. Yet the IRS’ 2016 budget allocation for addressing identity theft was not even 3% as large as that for international enforcement (including FATCA implementation), which has a far lower return on investment. And the IRS’ FATCA revenue estimate for 2018 is not even one-fifth of the $850 million/year which FATCA-natics used to claim their pet project would bring in.

The CBO based their report on last year’s Budget in Brief. The most recent Budget in Brief (for FY 2017) is unfortunately not directly comparable to last year’s. In particular, the “Address International and Offshore Compliance Issues” item has disappeared entirely from “Cap Enforcement Adjustment Initiatives”, so we have no idea how much they’re spending on it, nor how little they’ll gain (let alone how much of those gains will be attributable to fines for missing paperwork rather than actual tax owed.)

What is notable: FATCA has become much more expensive. In 2015 the IRS estimated that they would spend only $71 million on FATCA in 2016 and $66 million in 2018, but now they say they’ll spend $127 million in 2017 (+$56 million vs. 2016) and $142 million in 2019 (+$76 million vs. the previous projection for 2018). And these figures only account for what the IRS is spending on FATCA, not the tens of billions it costs banks and individuals to comply with it.

Best, in a crowning touch of hilarity, the IRS moved FATCA to the “Strategic Revenue-Producing Initiatives” category — i.e., the budget category for which they get to handwave about “clear long-term revenue effects” without having to give any concrete figures.