FATCA and Australia – Part 1 of 2

January 2020: This thread continues at FATCA and Australia – Part 2 of 2.

Let’s Fix the Australia/US Tax Treaty! The Australia/US tax treaty needs urgent revision to prevent double taxation. Get involved at www.FixTheTaxTreaty.org

Posts on The Isaac Brock Society website concerning FATCA and Australia

For articles on other websites, see Media and Blog Articles

For general discussion of FATCA, see FATCA Discussion Thread

For links to some websites and contact info (government, organisations, tax information), see Australia Information Links

25: John Richardson and Karen Alpert Session in Brisbane Australia Oct 25, 2018

August 2018

01: U.S., U.K., Canada, Australia and Netherlands form international tax enforcement group

January 2018

July 2017

March 2017

13: What Lessons Can Be Learned from the Sad Stories of “IRS Compliant” Australians Shaun and Mary?

November 2016

30: “Solving U.S. Citizenship Problems” – Online January 9, 2017 (Australia)

August 2016

25: Let’s Fix the Australia/US Tax Treaty!

May 2016

15: Australia: Dealing with Superannuation

February 2016

19: #Australia funds America’s #FATCA #Ethnic Identification System

September 2012

27: Last Day to make a FATCA submission to the Australian Govt

August 2012

28: Australian Government wants YOU to tell them what to do about FATCA

July 2012

20: Australian Financial Services Council lobbies Washington for FATCA exemption

Sign up for banks using Australian passport.

…but check to see if your Australian passport shows a US place of birth.

My Australian passport only has the town I was born in, not the country. I think for safety reasons the country is not included.

Ellen D.,

Is that the norm for Australia passports?

Calgary

I think so – my kids’ passports only have the suburb where they were born. Unfortunately the one and only town that I was born in is in the US. But there are a lot of Manchesters, Richmonds, Springfields, Rochesters etc in this world

Then, hopefully, not be a problem to show your Australian passport to open an account, showing you are an Australian citizen.

In Canada, a driver’s license is still acceptable as one of the two pieces of identification for basic banking: http://www.cba.ca/en/research-and-advocacy/50-backgrounders-on-banking-issues/83-opening-a-bank-account and a separate page with their statement on FATCA: http://www.cba.ca/en/media-room/65-news-releases/702-canadian-bankers-association-statement-on-fatca-canada-us-intergovernmental-agreement (and pretty much the same separated pages for Canadian banks). One would think that how FATCA can affect some clients would be presented clearly up front, transparent as part of their information on the *Opening a Bank Account* page. It seems sort of a gotcha environment for (US) persons who aren’t aware of FATCA and how they might be impacted. I don’t believe there is either a *warning sticker regarding US Persons and FATCA* attached to Canadian investment accounts the bank would like to *sell* to banking client. Just observations — similar in my mind to never having learned of US citizenship-based taxation in my US schooling.

@Ellen, ” I think for safety reasons the country is not included.”

Some countries thats standard policy.

Some countries you can request country be left out for security, which is a VALID request when you were born in the USA. Being born in Cork, Ireland is not a risk on your French Passport, being born in Dublin, Ohio, USA is a security risk and is a valid reason to leave that information out.

Further some countries will let you use a county name instead of a city name if that is more secure.

@Calgary411

How duplicitous it was of the Conservatives to tout how great it was that they negotiated the exemption from FATCA reporting several Canadian tax-deferred savings plans knowing that they are still taxable by the US. Talk about instilling a false sense of security. Are they recommending US tax evasion as a way for certain Canadians to keep saving for their retirement, knowing full well that when these accounts need to be closed their funds will be transferred to accounts that are in fact reportable under the IGA?

One of many things I have found deeply disturbing about this process is the effect of currency fluctuations. This year it worked in my favour. But in a very different year it could mean paying money to the irs that i don’t have for a gain that wasn’t real or realisable.

Thanks for your comment here and welcome, Kara. You’re right, the how currency fluctuation works is not so readily seen. For example, as the Canadian (or Australian) dollar goes up against the USD as the CAD has been recently doing, it means, among other things, the equivalent $CA for reaching the $US 2,000,000 net worth to be deemed a *covered expatriate* if one chooses renunciation or relinquishment of US citizenship. As well, it affects the equivalent for the US$2,350 fee for that expatriation.

(I’ve removed your last name — let me know if you want it to show on your comment.)

Kara

Yes, the exchange rate has been very difficult to plan around this year. From late January 2016 to late April, the AUD jumped almost 14%! against the USD (it has eased a bit in the past week). For any capital gains realised in 2015, the gain would have been lower due to the falling AUD. But, if the AUD climbs back to the levels seen in 2012 and 2013, then US taxpayers in Australia will have phantom gains.

The US allows companies to choose a functional currency other than USD – why don’t they allow long-term expats to do the same? I suspect it’s because they want to maintain the fiction that expats are “resident” in the US for tax purposes (see John Richardson’s latest post>/a>).

Calgary – the “magic” number in AUD was USD2m=AUD2.91m on 20 Jan 2016 and USD2m=2.56m on 21 April – a swing of AUD350,000! (using the official exchange rate from the Reserve Bank of Australia)

@ Karen

“The US allows companies to choose a functional currency other than USD – why don’t they allow long-term expats to do the same?”

Corporations are really very exceptional and exemptional people, aren’t they. They don’t have to worry about US taxes until they bring their foreign-earned profits back to the homeland and they get to do their calculations in non-US dollars if they choose to. Maybe US citizens living abroad should incorporate and become very special people too. Wait until Japan T reads that …

I have a question for the Australians here who have been active on this issue for a while. Has anyone tried to engage with Civil Liberties Australia on FATCA and/or CBT? A search of their website shows a small number of articles mentioning FATCA, and nothing since March 2015. What other Australian organisations might be interested in addressing the privacy and/or human rights dimensions of FATCA/CRS/CBT?

From Jak Dac:

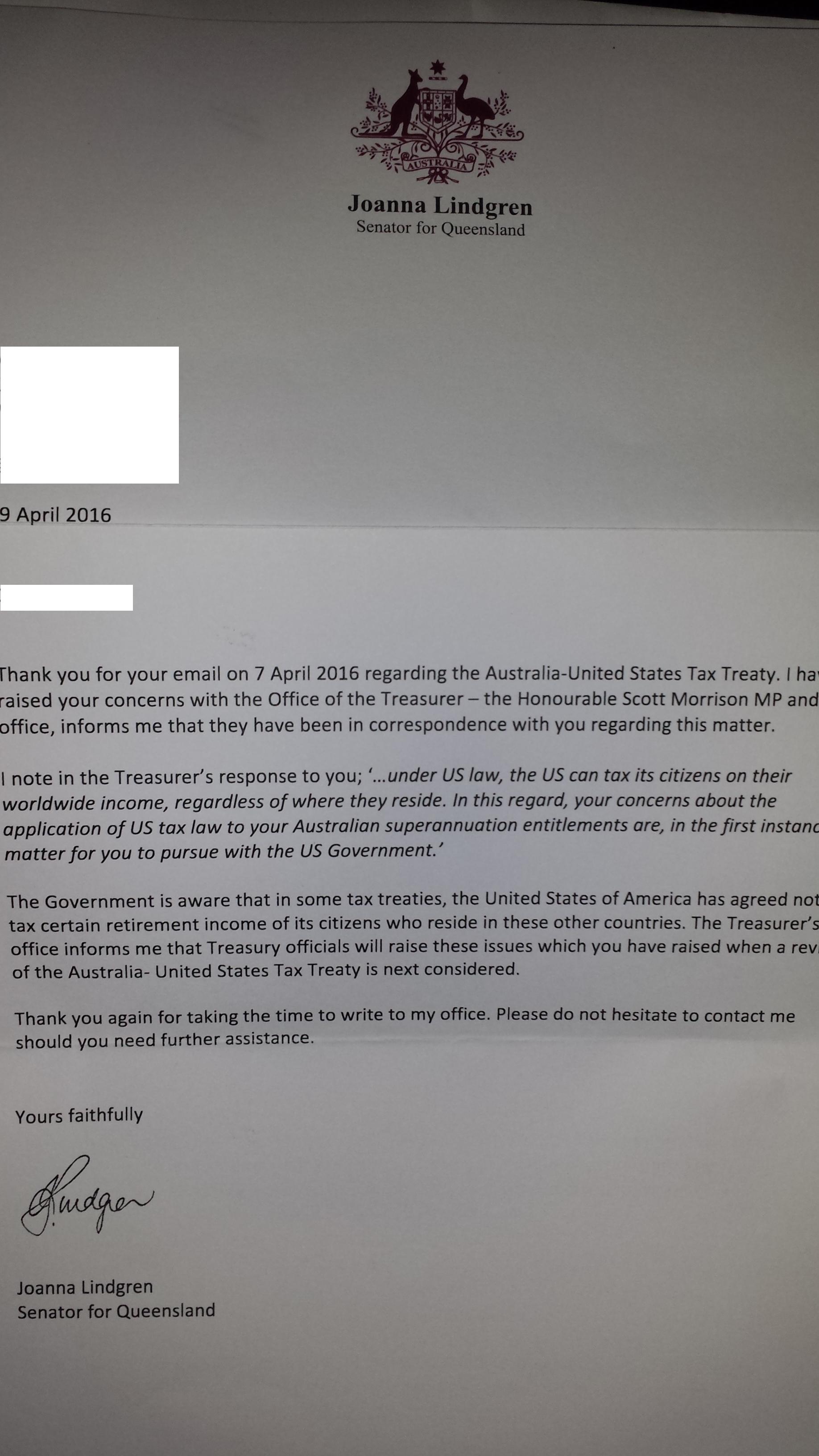

Letter dated 19th of April 2016:

My response (Jak Dac):

Any AU/US citizen may also wish to voice their concern to these parties and hopefully post letters on the FATCA and Australia page.

“Vasta, Ross (MP)” ross.vasta.mp@aph.gov.au

senator.lindgren@aph.gov.au

@Karen I put in a few tweets this way, yet needs to be part of a campaign: @claasn @LibertyVic

That letter from Joanna Lindgren sounds similar to one posted from a Canadian MP. As if, Australian sovereignty and residency is of no consideration. That is basically what the tax treaty says. It needs to be pointed out that the tax treaty does not “prevent” double taxation but guarantees it.

Tweet to: @senatorlindgren>@ScottMorrisonMP

https://twitter.com/JCDoubleTaxed/status/727700704014401536

I believe Joanna Lindgren office has had 2 other queries how about over 100

@JC – besides twitter, have you (or anyone you know) tried to engage with CLA on the issue of FATCA or CBT? Are they worth trying to engage with? I believe they would listen and perhaps even be sympathetic, but I’m not sure whether they have any visibility in mainstream Australia. I don’t see them quoted in relevant news stories (but then, I’m not your average Australian – I read the AFR).

I do have some experience with @cancivlib and e-mail exchange with their (compliancer – wrote a pamphlet on US tax obligations for Canadians) President. The response was from the same script as Treasurer Morrison.

I always thought that there is more critical mass of US persons to get things moving in Canada for precedent setting. Yet they seem really focused on FATCA and not after the tax treaty, which represents an egregious signing away of sovereignty rights and disregard of residents, and IMO violates the Canadian Charter of Rights prohibiting discrimination based on national origin. I believe the perception among Canadian politicians the same as Australian politicians that the tax treaty “prevents double taxation” when we know it guarantees it.

I am not really understanding these civil liberties orgainisations as they are really focused on people who have no representation, poor, have nothing such as say nationals who decide to go fight for ISIS. https://twitter.com/JCDoubleTaxed/status/722315565021274112

For US persons I was thinking pf a message of some tick marks against some points:

v Rights Ignored by Government

v Unfathomable Extraterritorial Compliance and Tax

v Poor, disabled, and disadvantaged among them

v Many of them, 1+ million in Canada

I will respond direct to Senator Lindgren. It may take me a few days. I believe that one should write to MPs/meet with MP’s with expectation of such response – and to counter the expected comebacks in the initial communication.

We will also be writing to Senator Lindgren. We hope to draft something over the weekend.

I agree that it is helpful “to counter the expected comebacks in the initial communication.”

@JC, perhaps also include in your tick marks: high financial barrier to exiting US tax system for good due to the requirement to become US tax compliant and renounce unwanted US citizenship.

http://www.dailytelegraph.com.au/newslocal/south-west/citizenship-of-two-nations-stalls-federal-bid/news-story/89b80782bfa039241466b52b5f680ead

News story outs a dual US /Australian running for office. May or may not know about US extra-territorial taxation, FBAR, FATCA burdens.

Emailed tweeted and Facebooked messaged him already fingers crossed

Comments

Superannuation problem may be fixed (IF we push this issue as much as we can with government and media as this could be done with a signature)

Just went back to the US for that trip we all dread mom was dying got there day before thank God. Mom and dad are gone now seems to have had an effect on me and this issue.

Interesting had a small check put in a US account NOT allowed AUSTRALIA is on a banned country list for people to put in $$ in US account. Australia one of the US biggest allies

This is all CRAZY

Another idea

I see some great suggestions as to what we can do to minimise our US financial exposure would it be possible to have a sub forum for people to quickly check a to do list ??