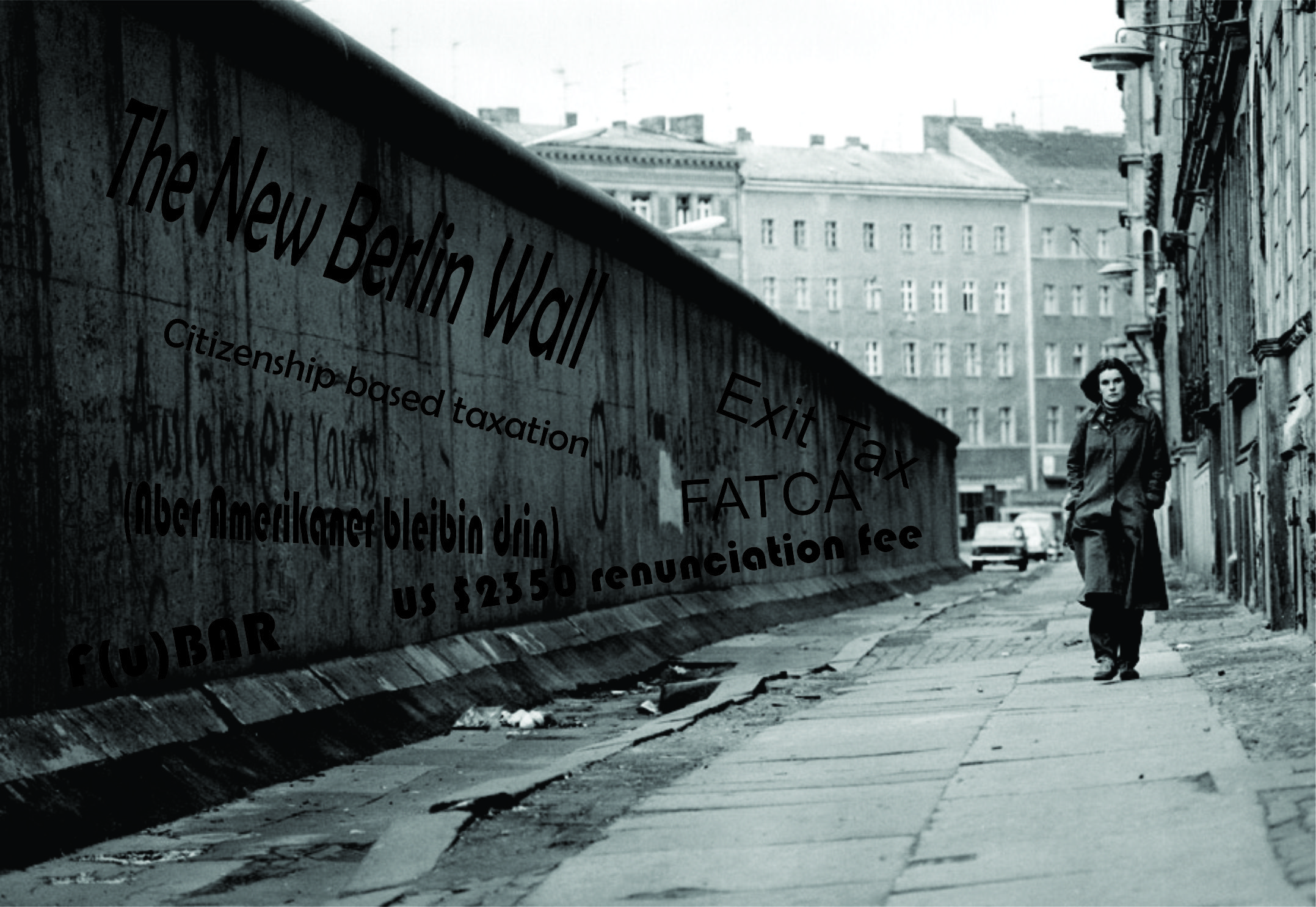

“I think this fence business is designed and may well be used against us and keep us in. In economic turmoil, the people want to leave with their capital and there’s capital controls and there’s people controls. Every time you think about the fence, think about the fences being used against us, keeping us in.” Ron Paul