Author Archives: Petros

The FATCA star: a design suggestion

Some folks here, especially Steven J. Mopsick, our beloved former litigator for the IRS who has now turned advocate for fairness and justice for Americans abroad, have really wanted to stop the Isaac Brock Society from going off the deep tangent of drawing analogies between the United States and Nazi Germany. Finally, as an editor and administrator here at Isaac Brock Society, I have to agree: Everybody, please stop it!

That felt good. It is always good when you feel that you are in control and can order people around!

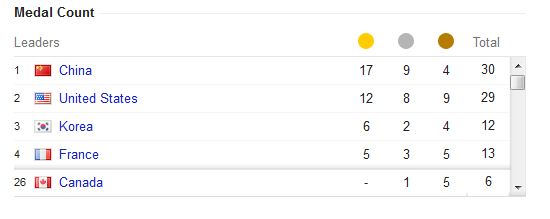

US Olympic Athletes at competitive disadvantage because of citizenship based taxation

Chris Banescu at the American Thinker laments, Win an Olympic Medal, Pay the IRS, and concludes that citizenship-based taxation puts US athletes at a disadvantage, citing American for Tax Reform:

Not only do our Olympic athletes have to pay taxes on their medals and prizes – chances are their competitors on the field will face no such taxation when they get home. Because the U.S. is virtually the only developed nation that taxes “worldwide” income earned overseas by its taxpayers, our Olympic athletes face a competitive disadvantage that has nothing to do with sports.

Monty Pelerin: It’s the numbers, stupid

Monty Pelerin shared some comments and a video which explains why the United States government is going to collapse economically. This is why the new Obama ad, in which President Obama says that he will tax the wealthy to “pay down our debt”, is utter mendacity. This video shows that the United States Federal budget cannot be balanced. It is mathematically not possible without some maturity. Going after US expats around the world will not solve the problem. But we can be sure that as long as the USA cannot get its fiscal house in order, the federal government will continue to demagogue against expats.

It’s the numbers, stupid, by Monty Pelerin

Most people have no idea of the unsustainability of government spending. The path which the government blindly follows ensures a complete and total collapse of the US. What has happened in Greece (and things will get much worse there) is exactly what will occur in the US. A complete and total economic collapse is inevitable.

Shadow Raider is rewriting the United States Internal Revenue Code

The following was submitted in the form of a comment:

I’d like to have some opinions about the bill that I’m writing to replace citizenship with residence-based taxation. Maybe someone could move this to a different page if it gets too long. By the way, I’m about one third of the way through with the relevant sections in the Internal Revenue Code.

1. To define residence, I am using the current substantial presence test with all of its rules and exceptions. This is the definition that is currently used for foreigners without a green card, so I am just applying it to everyone. I am also adding an exception to consider US government or military employees abroad as residents, because their salaries are sourced in the US and they would pay higher taxes if they were considered nonresidents. I am also adding that US citizens and permanent residents who don’t satisfy the substantial presence test may elect to be treated as residents for tax purposes by simply filing the normal resident tax forms (1040). I understand that there are some cases where this may be beneficial, and I don’t want to increase taxes on anyone.

The Dark Side of Anti-“Swiss Bank Account” Politics, by Matt Welch

The Dark Side of Anti-“Swiss Bank Account” Politics

by Matt Welch, at reason.com.

George Clooney to raise money for Obama from rich American masochists in Switzerland

A reader sent me the following link:

Clooney to visit Geneva for Obama fundraiser

Clooney is set to visit the Swiss city for fundraising events on August 27th, according to Charles Adams, an American lawyer and a representative of the Democratic Party.

The movie actor plans to speak at a reception for 150 supporters paying $1,000 each, Adams told the Tribune de Genève newspaper.

The event will be followed by a dinner for 50 people coughing up $20,000 each ($30,000 for couples) for the privilege of breaking bread with Clooney.

ING France’s message to USA: “FATCA? Thanks but no thanks.”

Jet Li: Hero of China

Jet Li is easily the fourth most famous recent renunciant of US citizenship, after Eduardo Saverin, Denise Rich, and Superman. Details regarding his reasons and motives are scarce. But I doubt that anyone should be surprised or dismayed by Li’s choice to expatriate. He must be fabulously wealthy. Does his renunciation make him “despicable“. Did the United States make Jet Li a great actor and martial artist? Does he owe the United States perpetual allegiance?

Jet Li is easily the fourth most famous recent renunciant of US citizenship, after Eduardo Saverin, Denise Rich, and Superman. Details regarding his reasons and motives are scarce. But I doubt that anyone should be surprised or dismayed by Li’s choice to expatriate. He must be fabulously wealthy. Does his renunciation make him “despicable“. Did the United States make Jet Li a great actor and martial artist? Does he owe the United States perpetual allegiance?

Perhaps a little effort to understand is in order.

Last weekend, I watched the film Fearless in the original Mandarin with English subtitles. Jet Li plays the part of Huo Yuanjia, the historical founder of Jinwu Sports Federation. Early in the film, after the Huo Yuanjia wins a match, he celebrates with his friend and financier, Nong Jinsun. They are drinking from tea cups and Huo makes a face and says:

Huo: This tastes terrible.

Nong: It’s coffee. It comes from the West. It’s robust. Our country has grown very weak now. We are living in dangerous times. We need to regain our power and our strength. We have to learn from them, learn from the West. Otherwise, I am afraid our country shall continue its course. Continue reading

Canadian Bankers Association’s Maura Drew-Lytle responds to the Isaac Brock Society

The following response to the Isaac Brock Society appeared in a comment.

I am with the CBA and we have been following your discussion. We certainly understand the concerns that you have with FATCA. However, you seem to be under the impression that Canadian banks are planning to willingly go along with the FATCA requirements and this is certainly not the case. In fact, the Canadian banking industry agrees with your concerns and we have been and will continue to fight to change the extraterritorial reach of FATCA and lessen the impact it will have on Canadian banks and their customers.

We have information on our stance on FATCA on our website:

http://cba.ca/en/research-and-advocacy/47-regulatory-enviornment/598-foreign-account-tax-compliance-act–