I am living, for now, in exile from my land of birth. In a new article at iexpats.com, George Prior explains my situation, “FATCA Critic Fears Arrest by US Authorities“. When George Prior contacted me, I had no idea he would write an article about me nor that he would focus on my fear of returning to the United States. This article appears on Election Day=Revenge Day.

Author Archives: Petros

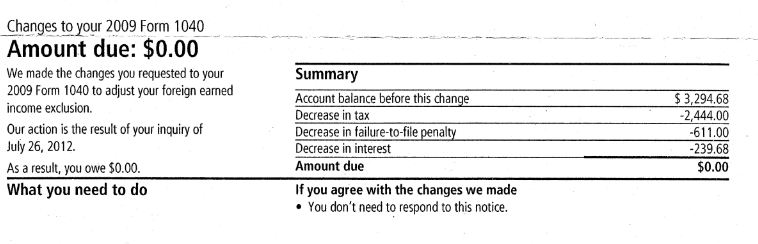

Miscellany: IRS to Peter Dunn, “Never mind.”

As you folks know, the IRS decided that since I didn’t fill the first part of my Form 2555 out correctly, that I must owe them a bunch of taxes. And so they sent me a federal tax bill to my Canadian address, disallowing my Foreign Earned Income Exclusion (FEIE). Today, at last, after several tries at sending them the properly filled out form, the IRS has decided that I don’t owe them anything after all. I’ve only had to deal with this 2009 tax issue for quite awhile now–readers can retrace the multiple threatening letters and bills that I received from the IRS just by clicking the above link and the links in that link, and the links in those links. The IRS has wasted its time with me. I’ve been wasting my time. I owed no tax. Zero zip nada. I am not a rich tax evader but a Canadian taxpayer and I renounced my US citizenship because I hate the hassles, the threats, and the intimidation that comes part and parcel with being an US person.

David Selig says that the IRS is interested in your gold

The next IRS overreach will be closer scrutiny of bartering and precious metals. Lauren Lyster interviews David Selig, who argues that the IRS wants to know what you are doing with your gold in the same way that it has brought your foreign bank accounts under closer scrutiny. Also, expats–are you reporting your bartering with 1099B? David Selig says that you must. Did you trade something worth $100 for something worth $2000? That’s a taxable event, potentially a criminal event if left unreported.

Hat tip: Daily Reckoning

Or watch the video at Youtube.

Jim Jatras responds to Isaac Brock Society on FATCA

This comment by Jim Jatras is too important to let it be lost in our comment stream:

To Tim, Petros et al.at IBS:

The organizers at George Mason Law School inform me that the video of the event will be posted in a few weeks. Yes, it was great to have a chance to offer a few points directly to Prof. Harvey and Jesse Eggert at Treasury. Once the video is up, we can let viewers to decide who might be a flake and who is not.

Bottom line from the event is that it confirmed my sense going in of FATCA’s extreme political vulnerability and ripeness for repeal — if financial institutions (both US and non-US) and foreign governments would stop acting as, in effect, FATCA enablers. Most significant: Prof. Harvey, Mr. Eggert, and pretty much everyone admitted in substance that FATCA as written can’t be enforced. IGAs (intergovernmental agreements) are essential for the US to implement what would otherwise be an unenforceable regime. No one pretended that FATCA could be successfully enforced solely as a unlilateral and direct U.S. imposition. Either Washington will be successful in pressuring or tricking other countries into enforcing FATCA on themselves, or the whole scheme collapses.

Miscellany: Expats are a bunch of ungrateful whiners

From the Wilderness made an insightful summary of the comments at Wall Street Journal article. So I offer them here as a new post. Afterwards, I will provide a video by Doug Casey of Casey Research, a firm that specializes in helping American clients to diversify their portfolio–“diversify” means finding investments in countries outside the USA. Finally, those who believe that the US dollar can survive trillion dollar deficits (such as Andrew Smithers) should have a look-see at petrogold trade between Iran and Turkey.

The comments on the WSJ article are most insightful and made me to reflect a bit about the large gap between the “homelanders” and ex-pats points of view.

Homelander perceptions of ex-pats:

1. Ex-pats are a bunch of ungrateful whiners.

2. As citizens of the greatest nation on earth, ex-pats must pay their “fair share” of taxes.

3. Ex-pats have the right to live and work in the US any time they want.

4. The US will come to the rescue of ex-pats if they are in need.

5. Americans living outside the US are suspicious and must be tax evaders .

6. Don’t let the door hit those “traitors” who renounce their citizenship in the @$$.

Wade Hicks on no-fly list

Wade Hicks, Jr., was on his way to Japan to visit his Navy wife who is stationed there. But during a layover in Hawaii he became stranded as the US federal govenment has put him on a no-fly list. Doug Hagmann writes:

The above events took place on October 14, 2012. The victim in this case is one Wade Hicks, Jr., 34, a U.S. citizen and resident of Gulfport, Mississippi. I personally checked him out and verified his story. With his permission, I conducted a “basic” background check of Mr. Hicks, Jr. He has no criminal record. He is not a “wanted” man. By all normal and visible accounts, Mr. Hicks, Jr. appears to be a law abiding member of society. I did find, however, that he is an outspoken “patriot” and openly critical of the NDAA. He is a former talk-show host of a small, local radio station known for its “patriotic bias.” He is a member of “Patriots for America” and the Mississippi Preparedness Project. He is openly vocal about the erosion of our rights – and it certainly looks like he has been proven correct. Is that now a crime worthy of being denied the ability to travel freely within the United States?

Regarding post-natal alterations of birth certificates of trans people

In light of the United States’ tax jihad against any person born in the United States, even those possessing the dominant nationality of another nation, I would like to explore the possibility that Canada take the lead in making post-natal changes to one’s place of birth. I could perhaps legally change my middle name and have my place of birth re-assigned to Canada, and then I would be able to cross the US border as a native-born Canadian.

The Parable of the Prodigal Uncle

My father once left for Far Away Country and returned to Homeland empty-handed and starving. Since he had squandered his part of grandfather’s fortune on prostitutes and riotous living, he feared that the villagers of Homeland would not accept him. He was grateful however that grandfather received him back warmly, saying, “For this my son was dead, and is alive again. He was lost and is found.” But my uncle, whose name is Sam, seethed.

When I turned eighteen, my father sent me on business to Far Away Country where he still had friends who had now become his business partners. I met the daughter of one of the partners; she was fair and so we wed. I worked for my father-in-law, and we wisely saved our money. I became a citizen of Far Away Country. After many years, we had two sons and two daughters, a house with no mortgage, and investment and retirement accounts. One day, I said, “I shall return to Homeland to see my aged father and to greet the villagers.”

Rand Paul responds on FATCA

Shadow Raider made the following comment:

Rand Paul responded to my email! Clearly this was not an automatic response and he is aware of the issue. Here is his response (my emphasis in bold):

September 26, 2012

Dear Mr. —,

Thank you for taking the time to contact me regarding the Foreign Account Tax Compliance Act (FATCA). I appreciate hearing your thoughts on this issue.

During the 111th Congress, Congress passed and President Obama signed into law, the Hiring Incentives to Restore Employment (HIRE) Act of 2010 (P.L. 111-147). This legislation drastically expanded government involvement in the financial goings-on of Americans who live and work abroad. FATCA, the tax evasion provision in this bill, requires all foreign financial institutions (FFI) to provide a detailed report on American account holders to the Internal Revenue Service (IRS) beginning in 2013, or be subjected to a 30 percent withholding tax on income from U.S. assets. American account holders with more than $50,000 who fail to file a report with the IRS would also be subject to a 30 percent withholding tax. As a newly elected member of the 112th Congress, I did not participate in the debate of this law and would have voted against it if I had been.

Miscellany: QE infinity will destroy Form Nation

Now that “the Bernank” has announced QE III, a.k.a. Unlimited QE (I prefer “QE Infinity”), Marc Faber says that it will destroy world. Zero Hedge estimates that the Federal Reserve’s new money base will increase to 4 trillion from 2.8 trillion (=43%) by the end of 2013–that’s because Bernanke is going to add at least 40 billion to the money base every month, with no limit, no specified target. If you are lucky enough to be in a jurisdiction that doesn’t debase its currency at the same rate, then you better renounce your US citizenship quickly: pretty soon the average home in Vancouver, Calgary or Toronto will be worth two million US dollars, while the Loonie threatens to rise to unforeseeable levels against the Greenback, unless of course Mark Carney debases Canadian currency in this race to the bottom.