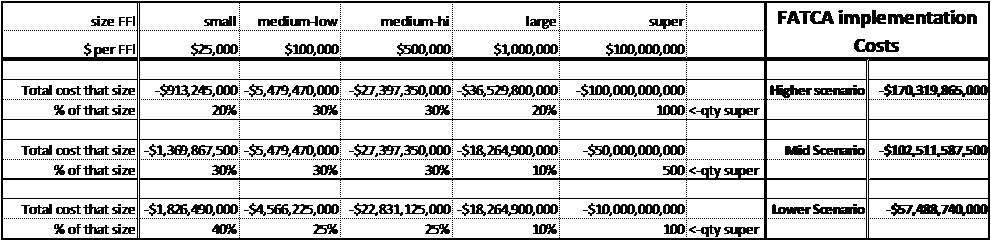

New Zealand’s financial industry invested 100 million NZD, whilst its government invest 20 million NZD to prevent Americans from sending their money to New Zealand to avoid taxation. Also, eligible Kiwis can be identified to pay tax to USA–to help USA tax Kiwis whom USA declares “United States Persons for Tax Purposes“. Such identified Kiwis can be forced to pay U.S. taxes while living in Kiwiland.

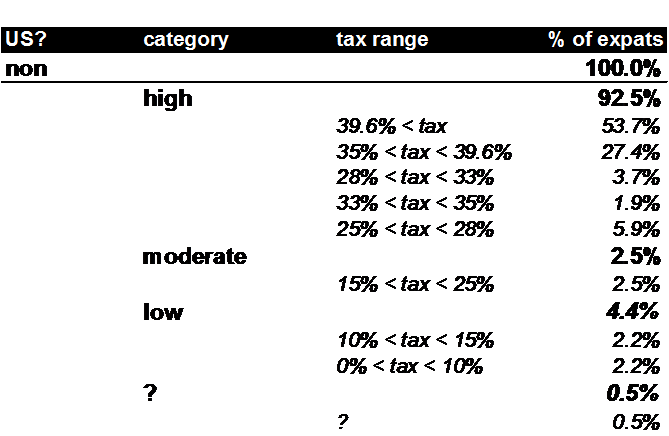

So far, by investigating the highest two US tax categories, we’ve seen that the only 0.274% of the first 81.1% of the expat population’s tax returns yield tax revenue to USA. Now, we investigate expats who may be exposed to USA’s 33% to 35% tax bracket—which comprises 1.9% of the US expat population. If a United States person lives in a country in this range, he could be exposed to USA taxation ranging from 0% all the way up to 6.9% (average 3.45%). These countries are identified to have taxes in this range (with percentages of the US expat population).

Total 1.9%

Colombia 0.7%

Guyana 0.0%

New Zealand 0.8%

Swaziland 0.0%

Venezuela 0.4%

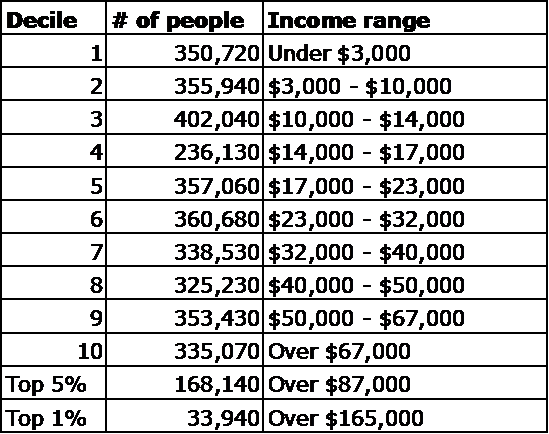

New Zealand is the most significant in this group, and has a top marginal tax rate of 33%. Let’s compare that to America’s tax tables.

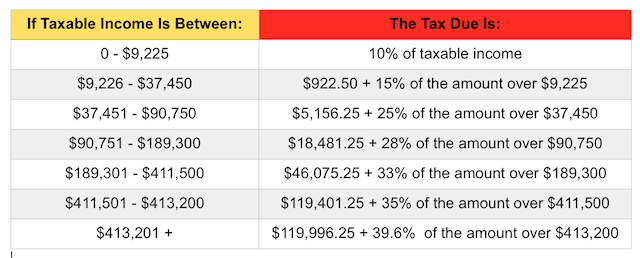

U.S. tax rates for single filers

America has a policy to require its citizens to pay additional tax to U.S.A. if the residence country of a U.S. citizen is not as high as the U.S. tax rate. It has about a $100,000 income exemption. Hence, a US person in New Zealand making 511,501 USD to 513,200 USD per year will be taxed by USA an additional 2% (a very narrow band worth considering insignificant). For any income above $513,201 USD, USA will tax that person 6.9%. This means, that USA can only tax dual citizen Kiwis with incomes over $513,201 (763,000 NZD).

So, how many Kiwis have incomes over 763,000NZD? A: Far less than 1% of the Kiwi population, or less than 1% of the dual-citizen population.

New Zealand has 0.7658% of the US expat population. And therefore, less than 0.07658% of the U.S. expat population can be taxed 6.9% of their marginal income above $513,200. This is beginning to sound ridiculous–Just BEGINNING to sound ridiculous. The story can be no better than U.S. citizens living in Colombia (0.7%), Guyana (0.0%), Swaziland (0.0%), or Venezuela (0.4%). Less than 0.019% of the US expat population can be taxed maximum 6.9% for their incomes above $513,200.

In New Zealand—how many people is this really? Various estimates yield the quantity of U.S. citizens in New Zealand to be between 21,462 Kiwis BORN in USA, to 38,207 to 66,600 Kiwis with known and unknown US citizenship. USA could tax less than 1% of them.

USA could potentially tax less than 666 Kiwis 6.9% of their marginal income above $513,200.

The ridiculousness of America’s extra-territorial taxation glares in New Zealand.

New Zealand has self-paid more than 120 million NZD to help America collect taxes from less than 666 rich dual-citizen Kiwis.