Our four ADCS Board members are John Richardson (co-chair and legal counsel), Patricia Moon (Treasurer), Carol Tapanila, and Stephen Kish (Chair).

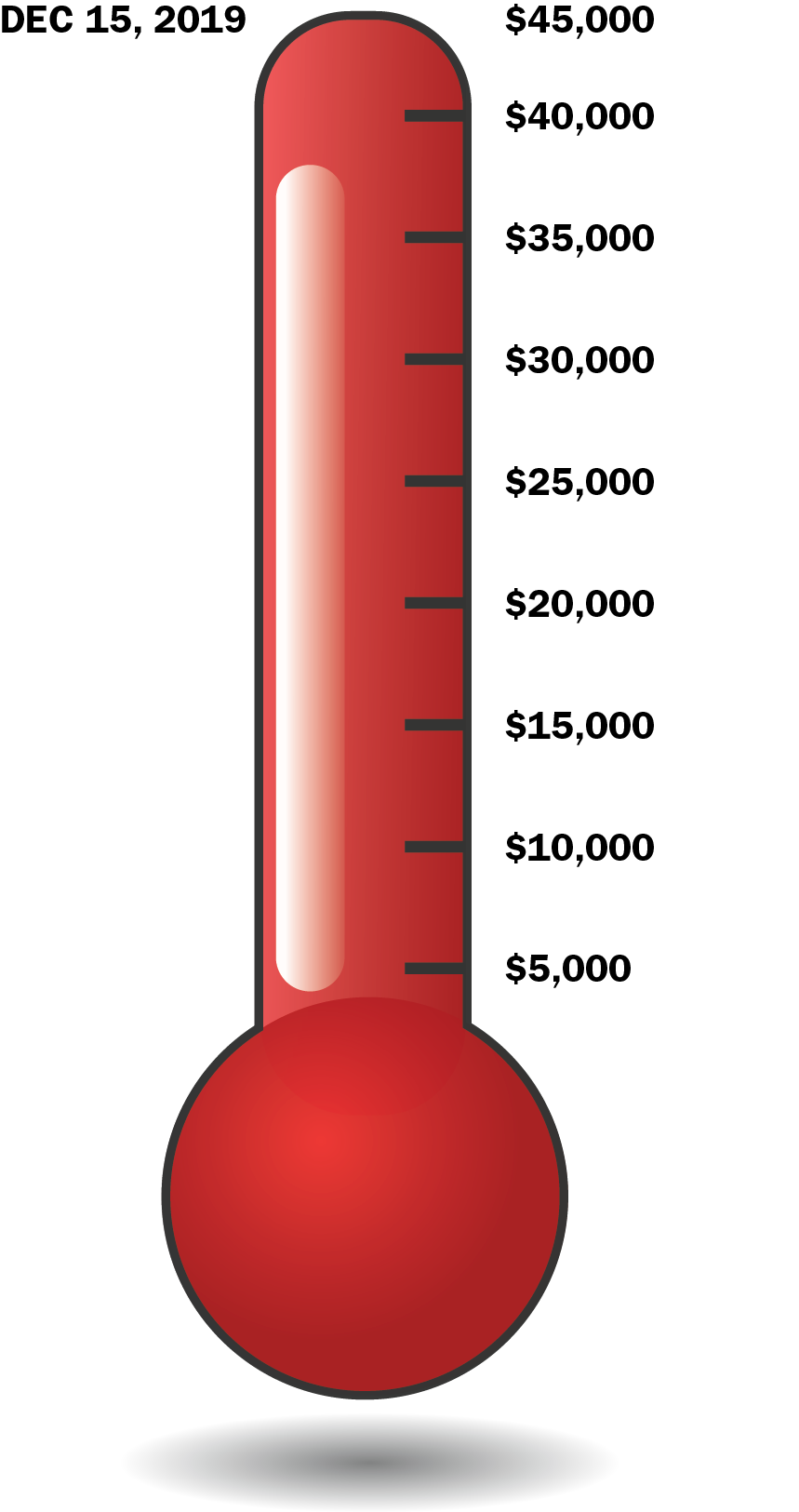

Canadians and International Supporters, we have now received sufficient donations to pay off the $45,000 installment for the legal fees bill for our Canadian FATCA lawsuit appeal. Thank you for your longstanding support.

As Embee says: “This lawsuit may have been overshadowed by these trying times but it’s still important to assert one’s right to justice and plead for common sense to prevail in whatever form US bully boy tactics threaten our well-being”

The FATCA Canada lawsuit began in 2014 and will likely be resolved only in the Supreme Court. Its simple aim is to strike down the FATCA IGA and enabling provisions of Canada’s Income Tax Act in their entirety. Stated differently: We want our nation’s sovereignty back.

A commenter reminded us that we will not receive any support from either Conservative or Liberal Canadian governments: “Harper signed the IGA (Flaherty did clearly point out it’s failings but it went ahead anyway) and Trudeau criticized the agreement and vowed to do something (he did nothing)”. This means that we are on our own.

Please help us to stay the course.

DONATIONS ARE NEEDED TO FUND a lawsuit attacking the constitutionality, regarding autonomy, privacy, and equality rights, of the Canadian FATCA IGA legislation that was imposed by the United States on Canada. We want our sovereignty back.

You can DONATE by cheque and cash in the mail, PayPal and transfers.

CANADIAN FATCA LITIGATION UPDATE May 21, 2020:

LITIGATION STATUS: The Notice of Appeal has been filed. This will be followed by the Appeal Book and the Memorandum of Fact and Law (the arguments). My (SK) personal guess is that the trial itself will take place during the first quarter of 2021.

The Alliance for the Defence of Canadian Sovereignty and Gwen and Kazia have raised $45,000 in this first installment funding round (Thank you for your support!) for the legal expenses of our FATCA IGA lawsuit, now at the Canadian Federal Court of Appeal.

Justice Mactavish said that it is “important” to avoid consequences threatened by the U.S. But we say not at the expense of our Charter rights.Please help end one of the FATCA compliance laws that impact on all of our countries.

CBC says that, for 2018 tax year, information on 900,000 financial records of Canadian residents was turned over by Canada to U.S. IRS because of the Canadian FATCA law. Gwen and Kazia, two Canadian citizens having no meaningful relationship with the U.S., are appealing on your behalf two Federal Court decisions to the Canadian Court of Appeal.

The grounds for appeal will include violations against their autonomy (Charter section 7), privacy (8) and equality (15) as well as arguments that the ruling was improperly based on the finding that the Income Tax Act is primarily regulatory in nature, and that factors such as the relationship between Canada and United States were not properly dealt with. Fleshed out details of appeal grounds will be provided in the Factum, likely mid-year.

Gwen and Kazia ask for your help in paying for the legal costs of the appeal.

If you feel that the FATCA IGA is not good for Canada PLEASE DONATE.

Appellants and the Alliance for the Defence of Canadian Sovereignty thank you for your past support. SEE OUR WEBSITE FOR MORE DETAILS (ADCS-ADSC).

You can SEND DONATIONS by cheque, cash, PayPal (easiest), and transfers.

For more details see: Alliance for the Defence of Canadian Sovereignty

U.S. over reach is bigger than FATCA. Now they are putting financial sanctions on whistle blowers as well. And this whistle blower now lives in Russia. Edward Snowden says, “the government may steal a dollar, but it cannot erase the idea that earned it”. I hope the donations keep coming in so we can at least put a stop to FATCA’s financial extortion in Canada.

https://nationalpost.com/news/all-money-made-from-edward-snowdens-new-book-will-go-to-u-s-government-judge-rules

Been waiting ages it seems for this fund to get below $10000 needed. Thanks to supporter “?” for what appears to be a very generous donation. We don’t need to do this for the royals, Meghan and Harry, (they’ve got all the help they need to manage) but we do need to do this for all of us, the common folk.

“Been waiting ages it seems for this fund to get below $10000 needed. We don’t need to do this for the royals, Meghan and Harry, (they’ve got all the help they need to manage) but we do need to do this for all of us, the common folk.”

Put THAT on the royals FB! & TW!

I see that the funds for the appeal are coming in very slowly. I contributed because I think the appeal is worthwhile and I want to show support for other affected persons. I hope the funds keep coming in and reach the required amount. What the USA demanded and how Canada agreed to it was simply wrong. But who knows how it will play out practically, for those affected?

There has been quite a bit of discussion as to the best option for individuals in Canada, and one theme has been that it is best to do nothing. That the only ones penalized so far are those who have tried to comply with the US demands. Not complying is still an option in Canada, but I think that there are situations that those who give blanket advice to do nothing are not recognizing. One is the sincerity of many people. These people have always tried and sincerely want to continue to be law-abiding. That is a very strong driver to obey laws that they believe apply to them. That kind of behaviour is actually a foundation of order, rather than chaos, in a society and, I think, is to be commended.

A second factor comes from people who are close to the affected person: family members, financial people and business associates. They often, in my experience, have limited understanding of the complexity of the situation and come to simple “oughts,” like “You ought to file” or “You ought to renounce citizenship. It’s simple, just do it and stop exposing us to this.” The pressure from this can be huge.

Some give in to their strong desire to be law-abiding and others to the pressure from other people. So far, I have resisted these pressures but have nonetheless taken steps to reduce risk.

My first reaction when I heard about all these tax form and reporting demands from the US was incredulity, then fear when I realized it was real. As I became informed (with great thanks to Brockers) I became angry. When I heard about what the US was going to attempt to force the Canadian government and the local banks and financial advisors to do, I thought that Canada surely would not agree to it. But the government did! They actually put our own tax collection agency in a conflict of interest situation, requiring them to assist tax collection for a foreign government in addition to, and perhaps before, their own government! And do it at Canada’s expense! Unbelievable but it happened!

But, it seems, the local bank and financial people serving their neighbours were not so eager to go along with this. They did not want to become informers of their friends and clients to a foreign government. I think it’s partly a matter of personal loyalty and partly practical business. Trust is a strong foundation of their business and being a known informer would destroy that trust.

All my life, which is now a long one, I have respected and tried to obey all laws that apply to me. But the irresponsibility (not researching the effects), arrogance (assuming that they can control people in other countries) and stupidity (not realizing the harm they are doing to themselves) of the US lawmakers when they passed the series of laws affecting people with some, often tenuous, connection with the US was incomprehensible to me. I just could not accept spending time and effort gathering information about myself, paying someone to put it together into a report in the format the US wanted and then submitting it so some faceless bureaucrats somewhere in the US could read it, like voyeurs. They were, in effect, treating me like a criminal unless I annually proved my innocence. Those bureaucrats have no right to snoop into my personal life and make judgements about me, and the lawmakers behind them have no right to demand my time, effort, money and information. So I decided I would not play their game. I refuse to provide any information or even communicate with them. If they should ever decide to press the issue, I have protections in place to stop them. If my heirs and those who will be working with my estate can come to believe that those protections are valid, they should have no problems with the US. Nor should I during whatever few years I have left.

Even though I am “doing nothing,” this situation has affected me and my family and caused me to change things I would not have had to otherwise. And it has brought me to the point of despising the country which raised me and which I previously highly respected. Not wishing it any harm, just shaking my head in disgust. And hoping that someday it would “come to its senses” and change its behaviour. I believe that’s the only kind of change that can “make America great again.”

@Wasus Nowcan

What a thoughtful and well-worded comment! So many of your sentiments echo those of my husband (another wasus-nowcan) and myself (an allcan). Thank you for this excellent contribution to the modern day history of Brock and for your donation to ADCS. I too hope this court case will get funded and soon. I cannot and will not engage with the US regime to fight this injustice so I feel I must focus on the Canadian courts and Canadian politicians. I’m forever grateful we have a team of dedicated, talented people who stepped up to represent us and bring this just cause to the attention and consideration of our justice system.

@wasus nowcan

Would like to add to your point of being a law abiding citzen then realizing the insanity. I ”ve had occasion to speak to a canadian accountant.about reporting to the irs . His remarks being that it’s a duty and tbat one risks losing one ‘s US passport and in most cases rarely pay. My answer was essentially that irs tax collection was unenforceable . He remained muted to that response ,possibly not knowing that since he refers any clients with US taint to his US tax attorney. I wonder how many law-abiding Canadians would continue to fill income tax forms and pay additional taxes if the their own tax laws were not enforceable. How many accountants and tax lawyers would still be in business? How many “law-abiding” citzens would continue to fill out tax forms in perpetuity?

What appalls me here is that the canadian tax community considers the irs rules as generic canadian tax law and raises that spectre to the level of a “duty.” or obligation.

By the way , Your actions are higly commendable. You wore two hats at the same time til you realized it blocked your view.

@Wasus….

What a great post! I think you really nailed it regarding the low level Canadian bank employees not willing to become “rats” for the US. Canadians, although generally favorably disposed towards the US (as in love to cross border shop and take a break from winter), are also extremely wary. The US is enough of a bully already; no need to carry the water for them. As awareness of FATCA slowly seeped through the system (not exactly front page news) I think the bank people made the quiet decision to go through the motions but to not press the question of whether or not a customer was a US Person. (I’ve believed right from the beginning that FATCA was doomed to fail because it depended on way too many little cogs all doing the US’ bidding to be a success. But it has certainly caused a lot of collateral damage along the way.)

As for the US ever “coming to its senses” I have little hope. They have totally forgotten their founding principles and have now become a rudderless Titanic on a collision course with some unknown iceberg. As for exactly which iceberg, who knows, but there are plenty of them out there, and chances are the sinking will happen rapidly once it begins. Plus their ignoramus president is unwittingly doing his level best to destroy what little respect, credibility, and sympathy the US still enjoys around the world. I find it hard to imagine that a country that is incapable of providing a decent health care system for its own residents is going to one day miraculously wake up and stop shafting its expats. America isn’t going to become great again; its in serious decline.

@wasus

You make some interesting points.

First, a clarification regarding “requiring them [CRA] to assist tax collection for a foreign government in addition to, and perhaps before, their own government”. The mutual assistance in collection agreement, in the tax treaty, long predates FATCA and the IGA. It also does not apply to anyone who was a Canadian citizen when the US tax debt arose – i.e. duals from a young age are completely protected. In the recent era, we know of precisely one case where the IRS has invoked the treaty to force CRA to collect on its behalf: the unfortunate (and extremely self-destructive) Mr. Dewees, who was not a Canadian citizen.

Second, I’m not sure that local bank employees are sympathetic to duals or even really that aware of the problem. FATCA and CRS are checkboxes on application forms, one part of the KYC/AML rules they need to follow. What I’ve seen thus far is pure bureaucratic indifference: give customer paper; ensure customer checks one of the boxes and signs the paper; move on to the next step. What is interesting, though, is that Canadian banks are so relaxed about this compared to their European counterparts. No asking for proof, no denial of services for those who do identify as US persons.

Regarding the possibly commendable instinct to obey laws – to do what one “ought” to do. I think there is a spectrum there, some folks think first of their obligations to follow any laws that apply to them, others think first of what they can safely get away with. I tend to the latter camp. Certainly my first reaction upon learning about my personal US tax obligation was “bugger that, they’ll never find me” – this was the correct instinct, as it turns out. But whether it’s fear of punishment or a personal need to be “law-abiding” – which one often hears in the appeals from those who’ve entered compliance and regretted it – this is, unfortunately, a factor in many individuals’ decisions to file.

Pressure from others with a financial connection (family members or professional advisors) is a serious issue, particularly when others don’t fully grasp the complexity of the issue, or the impotence of the US government. My elderly parents, for example, simply cannot conceive of lying to a bank about US citizenship, and they have great difficulty accepting that I’ve made a conscious decision to neither renounce US citizenship nor file US tax returns. To me it’s simple – no risk to doing nothing, no gain from doing anything. To them it’s somehow wrong, even if they believe the US has no right to tax me.

Finally, it is certainly true that even doing nothing requires doing something, or at least making certain decisions. I won’t be an executor or have power of attorney for my parents, because they’ve told their lawyer that I am a US citizen. Similarly, I must trust my executor – who has been fully briefed – to never disclose my US citizenship to a member the legal profession, lest someone get the bright idea to bring the estate into compliance.

“What is interesting, though, is that Canadian banks are so relaxed about this compared to their European counterparts.”

Most European banks scan government issued ID to open an account which clearly shows place of birth, that cannot be ignored.

UK banks on the other hand ask you to sign a form which says you are not a tax payer in any other nation, end of issue.

Why some banks have gone overboard and further than anything demanded under FATCA (the Netherlands stands out) remains a mystery, to me at least.

Is this it? Are we at a standstill 18% short of the first, now way overdue, installment? There’s a whole lot of insanity, injustice, corruption and depravity in this world, none of which we can change for the better. The ADCS lawsuit gave us a shot at taking a stand against one glaring wrong and now our resolve seems to be dwindling. That’s a pity. Canada was the first out of the anti-FATCA gate (made me proud) and now it’s falling back (makes me sad). And this is the country with probably the highest number of US expats, although Mexico could be very close. (I don’t think there was much opposition in Mexico and I have no idea why.) What’s next?

Sad it is…

My fight has been my value in the sovereignty of the country I chose to become a citizen of. I learned that Canada’s leaders give lip service to sovereignty.

In the beginning of the ADCS-ADSC litigation, we at Brock and others of us in Canada could have been real leaders in standing up for this country’s sovereignty, ideals and values we thought the Canadian Charter of Rights and Freedoms stood for. Our government leaders failed us, telling us in one way or another that we are merely US citizens who happen to abide in this country, Canada, second class to any other Canadians by virtue of a place of birth that no other Canadians are subject.

Critical thinking seems required to support this Canadian legal action and prevent what may well happen further down the line, perhaps well after my time. Prevention better than reacting later to further US extra-territorial consequences to US CBT.

Sad it is…

as now many of us have chosen changing the narrative of who we accidentally became by a US birthplace or birth to US parent(s) in this (or another) country outside the US. Will that forever be “the answer” as we each determine our own course of action?

Carol Tapanila

EmBee,

No, this is not “it”.

Yes, at the moment, we are at a near-standstill with respect to donations.

But regarding the lawsuit itself, we are not at all at a standstill: Our lawyer Greg Delbigio continues to work hard on our behalf (he provided an update to the Board yesterday) and yes, the lawsuit continues.

What I said in the post is correct: We are at the very early stage in which Mr. Delbigio is deciding what can and what will go into the Appeal Book. This may seem trivial, but it is not, and in our lawsuit rather complicated — and the process involves our side seeking agreements from Canada and the Court on the contents.

The lawsuit in fact is slowly moving forward.

Soon however will come work that results in much more significant expense: the Appeal Book itself (and, for example, the expense of the photocopying charges) and the research necessary to prepare the Memorandum of Fact.

My hope is that as the lawsuit continues, and we show more progress, we will receive more financial support. But yes, if we run out of money to pay the expenses, the lawsuit that we began in 2014 stops.

It really seems so obvious to me that Canadians (and our international supporters who are in the same boat) should passionately resist a loss of Constitutional rights and a nation’s sovereignty — unfairly imposed by a foreign country.

It comes down to 3 choices:

#1 COMPLIANCE — After carefully calculating the cost (basically my entire inheritance from my Canadian parents) I eventually ruled this out. This, however, was my husband’s choice because it carried a relatively low cost (at that time) and made relinquishment go fairly smoothly for him.

#2 RELIANCE (on the Canadian Justice system) — The lawsuit seemed a good thing to gamble on and we both did (at much less cost than my calculated compliance costs and much more cost than my husband’s compliant relinquishment). I have no regrets but it’s disappointing that the lawsuit may not get to the Supreme Court where it would have to end up for final judgment. Still there is honour in trying and I will never cease to appreciate the team which made this choice available.

#3 DEFIANCE — This continues to be what has surprisingly (I’m a law-abiding person at heart) become an easy choice and will, if #2 fails, become my only choice.

@ Stephen Kish

Thanks for your comment (I was typing while you were posting).

“It really seems so obvious to me that Canadians (and our international supporters who are in the same boat) should passionately resist a loss of Constitutional rights and a nation’s sovereignty — unfairly imposed by a foreign country.”

It’s been obvious to me too so let’s hope these dwindles die out and resolve returns.

I’m still regularly running into Canadians with UStaxablestatus due to birthplace and or parentage, and those who have already, or are headed towards acquiring the US taxable burden directly, or inadvertently or peripherally via their own or a family member’s marriage, or moving there with a spouse temporarily for work or study, starting a family in the US while there, or having some other relationship to a UStaxableperson (ex. a family member with US status as an executor, or beneficiary, shared accounts, old accounts left behind in Canada, etc. ). Some know something vague about US extraterritorial CBT, FATCA and FBAR, and some look at me as if have two heads…..have to try and deliver just the briefest of warnings if I can … there are so very many with crossborder families and ties. Some have become aware of and wise to the US extraterritorial morass and resist the advice of Canadian accountants trying to push them (and sometimes Canadian estates and beneficiaries) into the compliance vortex.

If we only had a dollar for each one affected ……..

As Badger says, “have to try and deliver just the briefest of warnings if I can” …way to go!

When I came to Canada in 2004, I was completely oblivious to U.S. extraterritorial tax law. After some talk with other U.S. expats here, it gradually began to dawn on me that trouble might be brewing. Years later with the onslaught of FATCA, the tidal wave of shock arrived on my doorstep.

There are others with U.S. ties still unaware of the traps that have been set for them. Good to give them some warning if we can.

I just managed to make another small donation. The sovereignty issue should wake up others out there and perhaps we’ll get past the standstill in donations. U.S. territorial overreach extends far beyond FATCA. Those of us who have renounced or in some way distanced ourselves from U.S. citizenship taxation are fortunate. But can still be negatively affected by infringement on the sovereignty of nations worldwide by U.S. bullying, which seems to go unchecked.

@PatCanadian

It’s interesting that some of the most vocal and consistent contributors to these causes are no longer U.S. citizens. Yet, even though they are no longer directly affected by FATCA, they continue with their support (financial and otherwise). You and others (presumed renuniciants) deserve special credit and thanks for your support. The problems of FATCA, U.S. citizenship-based taxation, unequal treaties generally, unfair extradition treaties specifically and other USA induced trauma will be solved only with the support of people like you.

Supportive comments (which are very important) are one important aspect of support!

Financial contributions (to the extent they can be made) are also an important source of support!

“Front 3: And most interestingly: Individuals who believe that change will hurt them personally. This includes individuals who are tax compliant and are doing fine under the current system. But, interestingly there are individuals (mostly not compliant with U.S. taxes) who are uncomfortable with the lawsuits because they believe that the FATCA IGAs – as experienced in Canada – result in comfortable conditions for them as individuals. In Canada they believe that the IGA facilitates “hiding in plain sight”. Of course, if they lived in other countries (France, Netherlands, etc.) they would experience the IGAs (in their brutal horror) differently. At best members in this group are not supportive of the FATCA lawsuits. At worst, they are actively opposing those lawsuits.” (by USCA from another thread)

It is disappointing to hear that some people don’t seem to care about being 2nd class citizens, even if nothing is (currently) happening to them in terms of dealing with the Canadian banks.

Not enough Canadian US Persons seem to know or care about the ADCS FATCA lawsuit. It is really galling that some would actively oppose it.

@USCitizenAbroad

Yes, I am a renunciant and stand up to U.S. induced trauma. Thank you for your support and recognition of the wider problem beyond FATCA.

@ Mr. A

There are a number of U.S. persons “hiding in plain site” whom I know personally. They live in Canada as I do. I think that this is more a matter of being afraid and hiding behind current Canadian protections for their own citizens which keeps them private. Not that this is an excuse for not supporting the lawsuit and standing up for their own rights. And as we know, these things can change.

I have created a new page, the “Tax Compliance (or not) Thread” and moved discussion relating to that there.

Today, 87% of the legal fees installment has been donated.

Hoping that the rest of this installment can be paid off soon.

The lawsuit is targeted to the Federal Appeal Court of Canada — a country in which both Conservative and Liberal Governments decided that compliance with a foreign country was more important than the Charter rights of our citizens and the sovereignty of our country.

Please donate.

For those who haven’t yet contributed, but who support this cause in theory;

This latest https://isaacbrocksociety.ca/2020/02/29/dual-citizens-in-canada-will-no-longer-be-able-to-renounce-us-citizenship-in-halifax-and-quebec-city/comment-page-1/#comment-8748031 shows that ‘a stitch in time saves nine’. US overreach and lack of respect for Canadian sovereignty is obvious by its actions on Canadian soil – even in dealing with US and Canadian citizens (ex. https://bc.ctvnews.ca/where-does-it-stop-u-s-border-guards-ordered-to-vet-anyone-who-even-visited-iran-document-suggests-1.4791317 https://www.cbc.ca/news/business/cbp-border-iranian-born-travellers-detain-1.5461097 ) .

This FATCA lawsuit is a way to resist another type of US overreach creeping ever further on autonomous Canadian sovereign ground. And our Canadian federal government has to be sent a message that it can’t continue to disrespect and disregard our Charter of Rights to sell out Canadian human and civil rights on several fronts (ex. https://www.cba.org/CMSPages/GetFile.aspx?guid=c3b7eb96-4912-4be6-865e-6b9aeb17cecd ) just to appease the US emperor.

We’re about to see the 10th anniversary of the creation of the US FATCA legislation https://americanexpatfinance.com/news/item/361-fatca-at-ten-march-18-2020 and we still have yet to see any evidence of that elusive US ‘aspirational’ ‘reciprocity’.

No ‘reciprocity’ is anywhere in sight. Don’t hold your breath.

Note for example that this more recent version of an IGA between Singapore and the US does not promise any more ACTUAL ‘reciprocity’ than the US pretended for its 2014 IGA with Canada.

https://www.iras.gov.sg/irashome/Quick-Links/International-Tax/International-Tax-Compliance-Agreements/

https://www.iras.gov.sg/irashome/News-and-Events/Newsroom/Media-Releases-and-Speeches/Media-Releases/2018/Singapore-and-The-United-States-of-America-Signed-Agreements-for-Exchange-of-Information/

“Agreement between the Government of the Republic of Singapore and the Government of the UnitedStates of America to Improve International Tax Compliance and to Implement FATCA

NOTE This Agreement was signed on 13 November 2018. However, the Agreement is not yet ratified and therefore does not have the force of law.”

……………….

https://www.iras.gov.sg/irashome/uploadedFiles/IRASHome/Quick_Links/International_Tax/Singapore-US%20FATCA%20Model%201A%20IGA.pdf

“Article6 Mutual Commitment to Continue to Enhance the Effectiveness of Information Exchange and Transparency

1.Reciprocity.

The Government of the United States acknowledges the need to achieve equivalent levels of reciprocal automatic information exchange with Singapore.The Government of the United States is committed to further improve transparency and enhance the exchange relationship with Singapore by pursuing the adoption of regulations and advocating and supporting relevant legislation to achieve such equivalent levels of reciprocal automatic information exchange.”…..

Now, compare to the text of the 2014 IGA with Canada;

“Article 6

Mutual Commitment to Continue to Enhance the Effectiveness of Information Exchange and Transparency

1.Reciprocity.

The Government of the United States acknowledges the need to achieve equivalent levels of reciprocal automatic information exchange with Canada. The Government of the United States is committed to further improve transparency and enhance the exchange relationship with Canada by pursuing the adoption of regulations and advocating and supporting relevant legislation to achieve such equivalent levels of reciprocal automatic information exchange.”

Canada got no more ‘reciprocity’ than it already had under the pre-existing terms of the Canada US tax treaty – predating FATCA. AND still doesn’t.

Yet, the amount of data Canada has been sending to the US under FATCA has increased every year;

https://www.cbc.ca/news/politics/fatca-tax-us-canada-1.5353942

Not angry enough to donate yet?

How about this then;

“….”after initially agreeing to multilateral information exchange” with the rest of the world, “the US made a rapid U-turn, and has since refused to provide information to most other jurisdictions – despite continuing to insist, with menaces, on receiving information from others,” the TJN report notes.

This approach, it continues, “leaves the US responsible for what it not so much a crack as a chasm in the international system of efforts to crack down on tax evasion, money laundering and financial crime.”

…..”…..

https://americanexpatfinance.com/news/item/377-u-s-leapfrogs-switz-to-finance-secrecy-index-no-2-spot

See the TJN report on US non-compliance here;

ex.

“…Financial secrecy provided by the US has caused untold harm to the ordinary citizens of foreign countries, whose elites have used the United States as a bolt-hole for looted wealth. Early beginnings: the Federal level The United States has long been a secrecy jurisdiction or tax haven at the Federal US-wide level. The 1921 Revenue Act exempted interest income2 on bank deposits owned by non-US residents, and this was explicitly justified at the time as a measure to attract (tax-evading) foreign capital to the US: a clear statement of tax haven intent. As the US House Ways & Means Committee put it, this “would encourage non-resident alien individuals and foreign corporations to transact financial business through institutions located in the United States”.3″……

https://fsi.taxjustice.net/PDF/UnitedStates.pdf

Now what about a donation to defend Canada against the one-sided US empire’s extraterritorial extortion that is FATCA?

@ badger: re “Not angry enough to donate yet?”

Some dual citizens have been financially drained by their own and their family’s renunciation/renouncement fees, and may also have had big bills for accountants, whether one agrees with that route or not. They did what they had to do, in their estimation.

Posters asking for contributions might consider that some Brockers are in no position to do so presently, no matter how angry.

@Duchesse,

Yes, many, including me, right now are unable to give larger donations managed before.

Each of the smaller donations when possible now and then (like $25 or $10, some in cash donations) add up and help in getting this past the goal line.

As always, all donations are so appreciated.