It is now 2019, and it’s been eight full years since I was a USA citizen. My date of relinquishment was 28 February 2011, but the IRS thinks erroneously that my date of relinqhishment was 7 April 2011. That means its been over six years since I last filed taxes and the statute of limitations for the IRS challenge my tax returns has expired, at least according to criminal law. However, if the IRS wished to claim that there is fraud on my tax returns and to attack me according to civil law, there is no statute of limitations.

In the case that one of the three exceptions does apply, the IRS has an unlimited amount of time to audit and charge penalties and interest.

Specifically, the IRS’s civil division can pursue taxes, penalties and interest indefinitely, and without any time limitation, if any one of the following three situations has occurred:

1. The Taxpayer Filed a false tax return,

2. The Taxpayer willfully attempted to illegally evade paying taxes, or

3. The Taxpayer Failed to file a tax return.

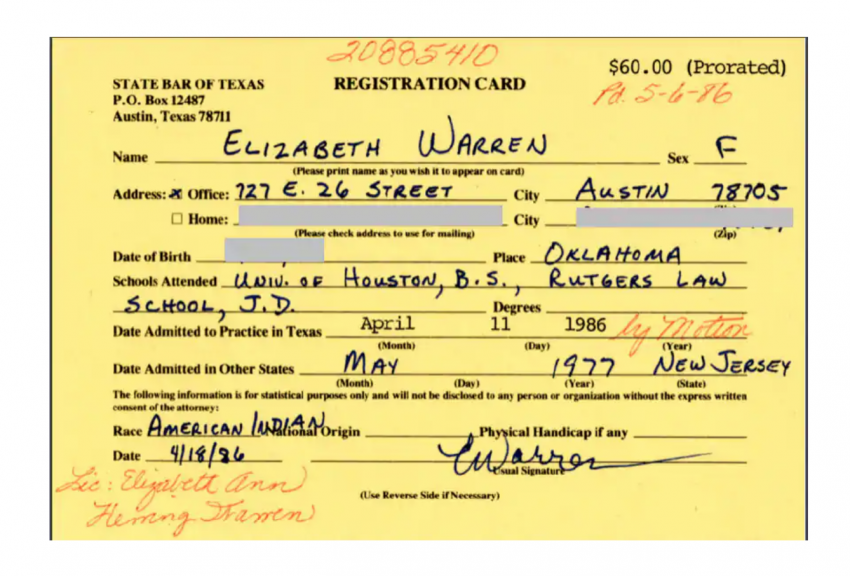

Of course if you are a Democrat candidate for President of the USA, fraud is not really a problem. Consider Elizabeth Warren’s attempt to pass herself off as American Indian minority, which circumstantial evidence shows that it helped to land a well-paying academic post at Harvard Law School. She had no more proof of her minority status than family anecdote and high cheek bones. Academic cheating is a serious enough problem that armed Federal Agents went to the home of Felicity Huffman, hand-cuffed her and took her into custody. So if you use the mail system (mail fraud) to bribe your child into Harvard or Yale, you get roughshod treatment from the FBI, but if you use fraud (and the mail system) to get a position at Harvard, you can become a Democrat candidate for POTUS.

Do former Americans regret renouncing their citizenship of a country where they are constantly threatened with jail time while their politicians get away with fraud? John Richardson says, “They almost all “regret” that U.S. laws have forced them to renounce U.S. citizenship (they wish they could have remained citizens of the country of their birth); but [t]hey NEVER feel that they made the wrong decision.” I think that Mr. Richardson must have spoken with me and a few other Brockers before he wrote that.

With all due respect, Petros, your fixation on Warren is intriguing. I do not support her because I believe she is unsympathetic to the victims of citizenship based taxation and would gladly throw US citizens abroad under the bus. However she is, from a US only standpoint, quite an effective researcher and politician in the field of consumer protection and has contributed to the greater good. It is in my opinion ludicrous to believe she became a Harvard professor only because she claimed to be Native American, or American Indian. She is obviously not an ordinary jurist, and she did go on to be elected US Senator, no small achievement. There are as many reasons as people for choosing to identify as one or many races, ancestries or ethnicities. If one grows up in Oklahoma to family lore of Indian ancestors, why not choose to identify as such, one possible reason being to show solidarity and raise visibility of the group. Warren may be flawed in other ways, but this ancestry issue isn’t very convincing.

This is a tricky post with many near truths, here are the issues:

– True, statute of limitations – it exists within the context of “Innocent Until Proven Guilty” Constitutional protection afforded to US Citizens.

– Once a person applies for a US SSN, they are in the tax system, social security system, and property tax rolls, even when renting and this is collateralize d against the national debt. A “Taxpayer” (Love, no hate this terminology) is running under 1913 Federal Reserve Act / 16th Amendment rules that state “Guilty till proven innocent” ERGO THE CONFLICT! This results in no limit for “Fraud” whether it exists or not, or some agent at the IRS sat on a thumbtack on their chair that morning.

– Solution: I don’t play along with the threat game, send your copy of the tax return(s) Certified, return receipt , copy of CLN or self certified relinquishment, and tell them in no uncertain terms that the filing was accepted by the IRS at the time of filing 7 or so years ago and you consider the matter closed. Many times, they, the IRS, Social Security, are operating with “Transcripts” or Meta Date types of info and do not have retention of the “Tax Filing” the actual “Return” documents So shove it right in their face on their desk, and take no more action.

Perhaps consider filing a complaint with the department of State at an embassy or otherwise directly by mail.

@Petros

Judging by recent press reports stating that the IRS are unable to upload the old paper returns to their data bases, I do not see how they could challenge past renunciants after the 6 yr period especially for those of us who sent in paper tax and fbar returns.

In fact my son in law who works as an accountant for a large US company has dealt with many audits and has confirmed the IRS doesn’t seem to be able to locate data over 4 yrs old and often asks the company to help produce it!

@Heidi: I conclude from your above comment that it’s preferable to send in paper returns. That’s what we’ve always done (yes, hubby and I have been stupidly compliant). We have always used paper returns, partly because we don’t trust electronic security, and partly to make the IRS work harder and thus clog up the system just that tiny bit more. It seems that we may have protected ourselves just a little as well, by doing this.

The IRS not having paper returns on file is interesting. Of course they could still come after you saying you didn’t file. I.e., for the capricious and whimsical this story never has to end.

@Fred, As for Warren, I don’t care what her contributions “to the greater good” might be. That simply irrelevant. Felicity Huffman has obviously contributed to the greater good. Why is one being arrested at her home and charged with bribery (to foist upon the world an academic fraud–her child) and the other, Warren, a candidate for POTUS? What sort of double standard allows this in politics.

And yet another form passes my desk, this time from TD Waterhouse, warning me against “perjury” and fraud, and all the penalties that we could receive if we were caught committing Form Crime. And yet Warren is a form criminal. The proof is the yellow card that she filled out saying that she is an American Indian, reporting it as her minority status. She never belonged to a native national group nor does she qualify. She has now apologized, that she did not understand how that was an affront to real native people. LOL. She didn’t understand, and yet she is a law professor. Do you not remember the IRS telling us that if we had higher academic degrees that we could not claim ignorance (for things like FBAR!!!!).

@Barbara

Yes, paper returns, that’s what our son in law always recommended and of course back in 2012 I was able to send in fbars by paper too. Those I am told are unfiled in box cars in a parking lot somewhere .

@Petros, Re Warren

I have heard my family tales of having various races in our family, yet research has proven otherwise. Perhaps she really believed or wanted it to be such?

Aren’t we all a confusing mixture of good and bad and what about “who will throw the first stone”?

But then I have people I love to hate, Shumer, Levin, Rangle, Obama, to name just a few …..

Politics has always been a language of double standards as Brexit is so aptly proving.

Double standards are innumerable in life, in politics, … I remember French budget minister Jerome Cahuzac railing against tax evasion while maintaining his own fraudulent Swiss bank account. Timothy Geithner had to admit he forgot to pay taxes when he went from the NY Federal Reseve to Treasury Secretary. Those are more appropriate examples of double speak. Warren’s Indian heritage is insignificant in comparison.

On filing or not. One doesn’t have to file under a certain revenue. True, it may be implausible that one earns less than, say, $10000 a year, but wouldn’t it be up to the IRS to prove that I was earning more than the threshold ? “Hey, true, I didn’t file from 1998 to 2014 but I wasn’t obligated to”… would that fly?

Charlie was ‘censured’ for not declaring rent and an offshore account from his villa in the Dominican Republic, at the same time as supporting FATCA reporting of ‘offshore’ accounts of bona fide expat Americans in their resident countries.

https://observer.com/2011/06/charlie-rangel-retreats-from-troublesome-dominican-villa/amp/

@Fred, we should not trivialize “ethnic identity theft”.

@Petros

How ethnic is ethnic and who decides?

I have a Jewish East End London great grandma from my female line . Can I claim Jewish ethnicity? 🙂

The nation/tribe to which you wish to claim identity often decides. Jewish people have their rules, and so does the Cherokee nation. The USA has its rules. Canada has its rules.

A law professor should be able to figure it out.

@Petros

I am not defending Warren but before the advent of ancestry websites and dna testing people often made assumptions/statements based on what their family had told them.

So is there any recorded instance, here or elsewhere, of the IRS attempting to contact a non-compliant US person whose financial life is outside the US, either after renouncing without filing any tax paperwork, or just ever?

To my knowledge, no. Until that happens, the fraud and statute of limitations discussion is basically irrelevant for anyone who doesn’t or didn’t file.

Having settled that point, we may now return to our discussion of Elizabeth Warren’s DNA and Japanese postal money orders. Gripping stuff.

@nononymous, We have to be careful about asserting omniscience on the subject. FATCA’s main purpose is to seek out people who have otherwise escaped the US tax system, and if Obama is to be trusted, “overseas tax cheats” were the main target. But I’ve not talked to everyone who has renounced, nor can I say that no one who has ever renounced and failed to file IRS forms has ever been contacted by the IRS just because I’ve not heard of such a case.

We don’t know of a single case, to date. I would assert that US non-residents without US income/assets are of no interest to the IRS. They were not the original FATCA targets. The IRS will process the returns and cash the cheques of anyone who volunteers to file, but we have no evidence that they attempt to seek out the 85 percent who do not.

We also don’t know how many US persons in Canada are actually being reported under FATCA. An Access to Information Act request for that number plus other data has been submitted.

@nononymous

The IRS have to be pragmatic, they have limited resources, its no use chasing pie in the sky if they have no information and cannot collect from abroad. They rely on threats and fear that someone will file and then if it looks worth their while they will try to sting them. I expect their agents are on commissions or bonuses to spur them on. I wouldn’t rule out some kind of standard letter being sent at some stage but as far as I know no non filer has received anything yet.

If and when the IRS decides to send letters to non-filing US persons identified by FATCA it will be the equivalent of a e-mail blackmail scam, barring any change in their inability to collect. Though likely much more effective than an e-mail scam because a small army of tax advisors will be there to “help” the newly frightened.

@Nononymous, Frightening people is the most effective modus operandi of the IRS.

“The nation/tribe to which you wish to claim identity often decides. Jewish people have their rules, and so does the Cherokee nation. The USA has its rules. Canada has its rules.

A law professor should be able to figure it out.”

Nation. The USA has its rules. The rules change every time the Supreme Court wants them to change. I think I saw a web site somewhere around here that had some threads on this topic, some of them very recently.

A Supreme Court judge should be able to figure it out, even if they figure it out differently from the way they did a few years ago, even if they figure it out differently from each other in a single year.

@Petros

Indeed. That’s why we’re here, and elsewhere – to counter the fear narrative.

Jewish people do not all agree on “Who is a Jew?”. Black people do not all agree on who is black.

I don’t care one way or the other about Elizabeth Warren’s political prospects, but am a bit confused what tribal membership has to do with anything. She claimed Native American heritage, not tribal membership, as far as I know. Would she also not be allowed to claim European heritage just because she is not (I assume) a citizen of any European country?

Seems to me the issue (if there is one) is how much “blood quantum” is needed to claim a heritage, and it sounds like hers may be lower than she thought or hoped or claimed. That is not something that tribal law has any bearing on, is it?

Heidi, You correctly wrote: ” I expect their agents are on commissions or bonuses to spur them on.”

Just after completing my 1st university degree, Bachelors in Professional Accounting from an accredited NY School, permitting the graduate to sit for the CPA exam if they desire, there was an IRS agent that attempted to recruit me. He told me this was the decade of seizures! (Late 1980’s) Further, when levying and seizing real property, boats,cars, and airplanes there was up to a 50% commission on the take!

Personally, this repulsed me since my spirit is one that feels empathy and likes to help others. I went on to another university in another state to complete another field of study.

Stephen Arvay’s anecdote reminded me: When I lived in a certain unnamed Asian metropolis in the 1990s (sorry, don’t want to run the chance of shaming someone), I met a nice young American man at a mainly-expats social event, introduced as a friend of a friend. I saw him a few other times at small music venues where foreign musicians would be brought in to play for mainly expat crowds, such as jazz clubs. Sometimes he’d even sit in to play guitar. He was coy about answering the question, “So, what work do you do?” After running into him several times, we considered ourselves friends, and he told me he was the information officer at the US consulate. Maybe he’d had too much to drink that evening, but he admitted that part of his job was to attend expat social events and eavesdrop on Americans to find any who boasted, or otherwise admitted, of any financial shenanigans, including whether they hadn’t filed US tax forms. In fact, that’s how I learned about CBT. Whether anyone got investigated or audited because of this guy I’ll never know. I don’t hold it against him. It was his job.

Back then at least, consular officers were spies for the IRS. I wonder if it still holds true.

@Barbara

Beware of putting photos on Facebook of yourself on your yacht, private jet or your Caribbean island paradise too. 🙂