It is now 2019, and it’s been eight full years since I was a USA citizen. My date of relinquishment was 28 February 2011, but the IRS thinks erroneously that my date of relinqhishment was 7 April 2011. That means its been over six years since I last filed taxes and the statute of limitations for the IRS challenge my tax returns has expired, at least according to criminal law. However, if the IRS wished to claim that there is fraud on my tax returns and to attack me according to civil law, there is no statute of limitations.

In the case that one of the three exceptions does apply, the IRS has an unlimited amount of time to audit and charge penalties and interest.

Specifically, the IRS’s civil division can pursue taxes, penalties and interest indefinitely, and without any time limitation, if any one of the following three situations has occurred:

1. The Taxpayer Filed a false tax return,

2. The Taxpayer willfully attempted to illegally evade paying taxes, or

3. The Taxpayer Failed to file a tax return.

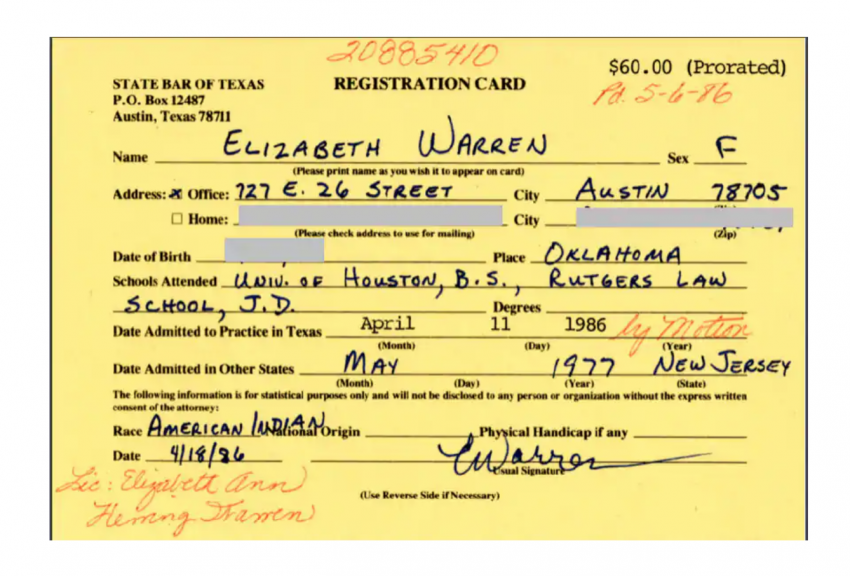

Of course if you are a Democrat candidate for President of the USA, fraud is not really a problem. Consider Elizabeth Warren’s attempt to pass herself off as American Indian minority, which circumstantial evidence shows that it helped to land a well-paying academic post at Harvard Law School. She had no more proof of her minority status than family anecdote and high cheek bones. Academic cheating is a serious enough problem that armed Federal Agents went to the home of Felicity Huffman, hand-cuffed her and took her into custody. So if you use the mail system (mail fraud) to bribe your child into Harvard or Yale, you get roughshod treatment from the FBI, but if you use fraud (and the mail system) to get a position at Harvard, you can become a Democrat candidate for POTUS.

Do former Americans regret renouncing their citizenship of a country where they are constantly threatened with jail time while their politicians get away with fraud? John Richardson says, “They almost all “regret” that U.S. laws have forced them to renounce U.S. citizenship (they wish they could have remained citizens of the country of their birth); but [t]hey NEVER feel that they made the wrong decision.” I think that Mr. Richardson must have spoken with me and a few other Brockers before he wrote that.

Do a search for books written by Otto Skinner on removing yourself from the tax scam. Fraud nullifies all contracts past and present. If the IRS wants to claim fraud they are invalidating their own criminal enforcement. The IRS says many things that are not true and legal, and if you do not reply stating what they say is wrong, it can then be assumed true in the process. Send them a registered letter stating such and keep sending it when they ignore it sighting such again and again until they stop. They’re bullies. Bully them back with the same nonsense.

Anyone who worries about being “constantly threatened with jail time” years after renouncing probably needs to adjust their medications.

I agree with Mr. Richardson’s observation – I don’t regret renouncing but I am sad that I was forced to make that decision.

@Non, Did I say I was worried? The statute of limitations is expired on criminal prosecution. To my knowledge, that threat has passed.

I fail to see what Elizabeth Warren’s belief of having a Native American ancestor in her family tree has to do with IRS, tax fraud and CBT/FATCA !!!

All of us with French Canadian ancestors know that (1) there were intermarriages with Native Americans, and (2) as we are all inter-related there is a high chance of having links to First Nations.

If you have given up your US passport, then you should give up fighting US political games. But please do continue to fight against US imperialism and unfair treatment of Americans abroad.

@Jayne

(1) Warren is not an American Indian; she has never had status as one and she does not qualify; (2) Warren has no legitimate excuse for lying about her status in order to advance her academic career–she is a smart person and a law professor–remember the IRS doesn’t allow people with advanced degrees to claim ignorance of tax law; (3) I tire of the double standard applied by the USA Federal Government. If they are going to demand the letter of the law to normal citizens abroad the least that they can do is get rid of phonies like Elizabeth Warren.

Quit being a party pooper. Republican presidents have also cheated on their taxes. Members of Congress have too.

Or, don’t file US taxes and ignore the whole mess.

@Norman, Who is a party pooper?

@Non, Did you not see that “not filing” (#3) is also on the list of things that the IRS can go after forever?

Which bad thing is most likely to happen to a former US citizen who never filed US taxes?

1. Pursued by IRS.

2. Struck by frozen human waste falling from jet.

Interesting…Last week I had an email from a lady that I had known from church. She came to Canada in her late 20’s after she married a Canadian. So she already had a social security number and work history in the US. She renounced two years ago in Calgary. The IRS is auditing her returns. She said for as far back as they are allowed. She had a bill from them. She spent two hours on hold waiting to speak with someone. She had the return in question in front of her. The agent said that she had claimed her husband. She said she didn’t and that she had the tax turn in front of her. The agent admitted that the IRS had made the mistake. So she asked them to reverse the bill. The agent said no. The lady told me “I blinked twice.” According to my friend the agent said the response time had already expired ( friend had been on holidays when letter came) and she must pay. My friend was very angry, but her husband told her to pay the $600.00 because he was afraid of being stopped at the border when travelling. On a side note, her daughter renounced this year in Calgary. Her daughter is 26 married with a new family. She has never lived in the US. Clearly does not have US ties.They tried to pressure her to change her mind.

@Non, 1. Pursued by the IRS.

I would think that this is particularly true if you have a tendency to cross into the USA. At that point, it is unpredictable what will happen.

If you spend a lot of time in the US, all bets are off. But time will tell.

‘Who is a party pooper?’

I was making a pun. Politicians of all parties have cheated on their taxes.

‘Did you not see that “not filing” (#3) is also on the list of things that the IRS can go after forever?’

Then we return to one of the old flamefests about the difference between what the IRS has power to do and what the IRS cares about. We have observed that the IRS does not appear to care about non-filers who live outside of the US.

@Norman:

It remains to be seen what can happen to non-filers who renounce their US citizenship. This is a worry that has kept some people from declaring themselves to a US Consulate for the purpose of relinquishment and obtaining a CLN–the fear of making themselves known.

At this point the IRS feels overworked and has insufficient resources to go after citizens abroad. But the FATCA gives them the needed information to go after such people. Hence, the reason why FATCA in Canada must be fought in the courts.

“The IRS is auditing her returns.”

I tried to force the IRS to audit my returns, but they refused and courts denied my motions. One might wonder what the IRS is trying to hide, but if one reads TIGTA reports then one will no longer wonder.

“The agent said that she had claimed her husband. She said she didn’t and that she had the tax turn in front of her. The agent admitted that the IRS had made the mistake. So she asked them to reverse the bill. The agent said no.”

Guess why the IRS prohibits people from recording phone calls. Anyway, if the IRS hasn’t issued a Notice of Deficiency then she doesn’t have to pay it yet. If the IRS has issued a Notice of Deficiency then she had better not delay and had better petition US Tax Court. The petition can be mailed, the fee is US$60, and the petition has to reach the court within 150 days from the postmark on the IRS’s envelope that the IRS used for mailing. (Count days, 150 days, not 5 months, not 150 business days, 150 total days.)

Although the petitioner has to specify a place for trial, there might not be a trial. This case sounds so clear cut that the IRS might concede the case during written pleadings.

“her husband told her to pay the $600.00 because he was afraid of being stopped at the border when travelling”

Before that can happen there have to be some worse letters from the IRS. For a US passport to be revoked the IRS would have to allege a debt of at least US$50,000.

“It remains to be seen what can happen to non-filers who renounce their US citizenship.”

No, it’s already known what CAN happen, and it doesn’t matter if the non-filer renounced or kept their US citizenship. What we’ve observed is that the IRS DOESN’T CARE even though they CAN if they wish, if the non-filer lives outside the US. Even in the case reported by Ann#1, the IRS is taking revenge because the victim is a filer not a non-filer.

I’ll start worrying when Canadian banks begin demanding to see birth certificates AND the tax treaty is amended to allow US collection against Canadian citizens. Until then, not a care in the world.

@Diamond,

You cannot know what cannot be known. It is an epistemological question. The future policies of the IRS may be predicted but only with uncertainty. Evidently neither of us is omniscient.

I’d better remove an ambiguity from my previous statement.

The petition can be mailed, the fee is US$60, and the petition has to reach the court within 150 days from the postmark on the IRS’s envelope that the IRS used for mailing the Notice of Deficiency. (The IRS doesn’t mail petitions. Petition kits can be downloaded from ustaxourt.gov)

With regard to the first post, by “No one of consequence,” US courts invariably find anti-IRS “tax resister” arguments along the lines of Otto Skinner’s to be frivolous. Beware of people spreading dangerous nonsense.

With regard to Elizabeth Warren’s American Indian roots, just because she lacks tribal registration is no reason to deny her felt sense of identity. (The NAACP doesn’t get to decide who’s black.) Sure, her Indian ancestry turns out to be very remote, but she would have had no way of knowing that growing up, and anyway race / ethnicity is not well defined. As to whether she used her “minority” status to get affirmative action preferences, the Boston Globe investigated this issue, and exonerated her:

https://www.bostonglobe.com/news/nation/2018/09/01/did-claiming-native-american-heritage-actually-help-elizabeth-warren-get-ahead-but-complicated/wUZZcrKKEOUv5Spnb7IO0K/story.html

The only thing I regret is having a US birthplace, but its the next best thing to having none at all. I’ve long since found excellent ways to fix everything else. One man’s (or government’s) fraud is another’s common sense.

@Nononymous. “Struck by frozen human waste falling from jet.”

Nowadays, I’d worry more about the jets themselves.

@Zla’od, Your naivity is amazing. Warren is a complete and utter fraud. She is a law professor and has no excuse for her claim to be a native American. The funniest part of this whole story is her plagiarized recipe in the Pow Wow cookbook which she claimed was a Cherokee recipe (but was actually by a French chef). There is no integrity.

Warren DOES NOT belong to a native people group, NOR DOES SHE QUALIFY to join one.

“The Cherokee Nation, whose leaders have defended Warren in the past, issued a sharp rebuke: “Sovereign tribal nations set their own legal requirements for citizenship, and while DNA tests can be used to determine lineage, such as paternity to an individual, it is not evidence for tribal affiliation. Using a DNA test to lay claim to any connection to the Cherokee Nation or any tribal nation, even vaguely, is inappropriate and wrong.””

https://www.gq.com/story/elizabeth-warren-dna-tests