It is now 2019, and it’s been eight full years since I was a USA citizen. My date of relinquishment was 28 February 2011, but the IRS thinks erroneously that my date of relinqhishment was 7 April 2011. That means its been over six years since I last filed taxes and the statute of limitations for the IRS challenge my tax returns has expired, at least according to criminal law. However, if the IRS wished to claim that there is fraud on my tax returns and to attack me according to civil law, there is no statute of limitations.

In the case that one of the three exceptions does apply, the IRS has an unlimited amount of time to audit and charge penalties and interest.

Specifically, the IRS’s civil division can pursue taxes, penalties and interest indefinitely, and without any time limitation, if any one of the following three situations has occurred:

1. The Taxpayer Filed a false tax return,

2. The Taxpayer willfully attempted to illegally evade paying taxes, or

3. The Taxpayer Failed to file a tax return.

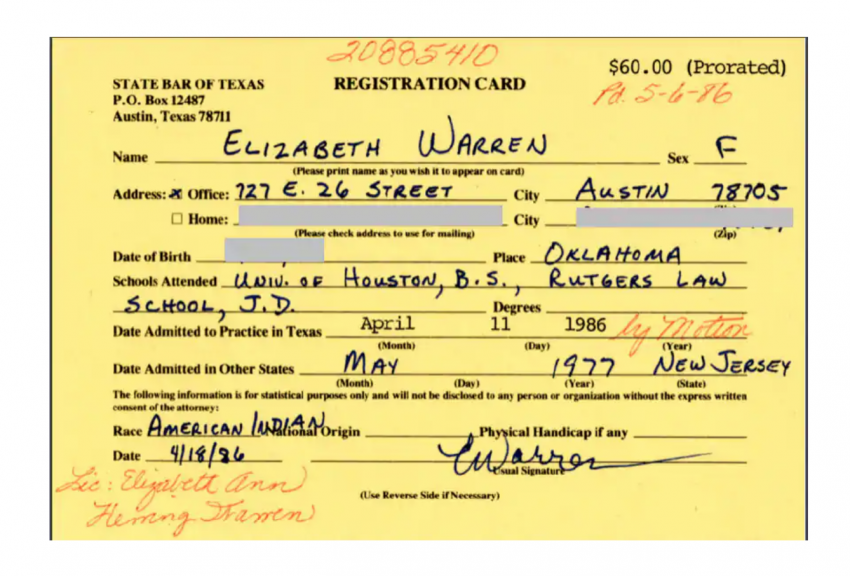

Of course if you are a Democrat candidate for President of the USA, fraud is not really a problem. Consider Elizabeth Warren’s attempt to pass herself off as American Indian minority, which circumstantial evidence shows that it helped to land a well-paying academic post at Harvard Law School. She had no more proof of her minority status than family anecdote and high cheek bones. Academic cheating is a serious enough problem that armed Federal Agents went to the home of Felicity Huffman, hand-cuffed her and took her into custody. So if you use the mail system (mail fraud) to bribe your child into Harvard or Yale, you get roughshod treatment from the FBI, but if you use fraud (and the mail system) to get a position at Harvard, you can become a Democrat candidate for POTUS.

Do former Americans regret renouncing their citizenship of a country where they are constantly threatened with jail time while their politicians get away with fraud? John Richardson says, “They almost all “regret” that U.S. laws have forced them to renounce U.S. citizenship (they wish they could have remained citizens of the country of their birth); but [t]hey NEVER feel that they made the wrong decision.” I think that Mr. Richardson must have spoken with me and a few other Brockers before he wrote that.

stephen arvay says

April 6, 2019 at 11:56 pm

“Just after completing my 1st university degree, Bachelors in Professional Accounting from an accredited NY School, permitting the graduate to sit for the CPA exam if they desire, there was an IRS agent that attempted to recruit me. He told me this was the decade of seizures! (Late 1980′s) Further, when levying and seizing real property, boats,cars, and airplanes there was up to a 50% commission on the take!”

Moderators please move this to the front page.

“Back then at least, consular officers were spies for the IRS. I wonder if it still holds true.”

Back then, the IRS had offices in some US embassies including Tokyo and consulates including Toronto. If you needed help, you could walk in to one of those offices, show them what you couldn’t figure out, and get wrong answers from them. This no longer holds true.

@Foo, Either Warren is an American Indian or she isn’t. She claimed she was but she isn’t. It is not about “blood quantum”. It is about whether you are a member of a tribal group or not. She is not, nor does she qualify.

https://www.tulsaworld.com/opinion/columnists/chuck-hoskin-jr-elizabeth-warren-can-be-a-friend-but/article_8c4b4d62-15be-536d-bb96-f33368a4488b.html

@Norman

I have no idea what moving something to the “front page” means. But it is an unverified story, and so I wouldn’t want to give it more prominence than it has.

Petros — things just aren’t that clear cut. It’s very hard to say what one person is or isn’t in regards of ethnicity. That’s why we tend to leave it up to individuals to decide in what group (if any) they are in. You could have a white person that other white people say isn’t white. That doesn’t mean they are not white. Or partially white. I don’t get to say what you are, and you don’t get to say what I am. This is different from tribal membership, where the tribe can decide. Even then, though, they may not be right. I fail to see Warren’s one-time affirmation that she was “American Indian” is automatically fraudulent or false or misleading. It may be, it may not be.

@Fred, You don’t really understand the academic context.

I asked my wife, who understands better, because she has a husband whose minority status was “wrong minority”, which was worse: bribing your kids into Harvard, or pretending to be a Cherokee to get hired at Harvard Law. She said the latter.

We should expect more of teachers than students. That is a basic pedagogical principle that extends back to at least to Antiquity.

The bribers have been charged with fraud. The fake-Indian professor is running for POTUS.

Also, the claim that an nameless unverified ancestor qualified Elizabeth Warren to make the claim that she was a racial minority is laughable, by the standards of the IRS and the Federal government. Ignorance of FBAR is not excused on the basis of reasonable cause, in some cases, because the government argues that the person was “willfully blind”:

“With respect to the second standard, the government stated that to be “willfully blind,” a person “must subjectively believe that there is a high probability that a fact exists and the [person] must take deliberate actions to avoid learning that fact.” ”

Warren is a scholar and law professor. Clearly she acted in willful blindness as what was required to make the claim that she belonged to the Cherokee nation. She thus took deliberate actions to avoid learning the facts, and therefore, her alleged “reasonable cause” is groundless (by USA Federal Government standards)

“The fake-Indian professor is running for POTUS.”

And a fake real estate magnate IS the president of the US. The US public apparently doesn’t care about fraudulent activity when deciding who to vote for. Those who like Warren like her. Those who like Trump like him. Actual facts don’t seem to matter much anymore.

Slow news day. If it wasn’t raining outside I’d be off doing something useful.

@nononymous

There’s no beer either, but at least the Brexit word hasn’t been mentioned yet…..

@Nononymous

“I would assert that US non-residents without US income/assets are of no interest to the IRS. They were not the original FATCA targets.”

That is debatable. When I first heard about FATCA I initially naively believed that too (comments such as “they’re not after people like you” “collateral damage” “unintended side effects”). However as many complaints and pleas fell on deaf ears in the US gov., it became clear that all US Persons worldwide were indeed the targets of FATCA. The US gov. had decided to get serious about its citizenship taxation law

(the price to be paid for the privilege of being a US citizen).

Petros has shown Obama’s press conference. FATCA co-creator Senator Max Baucus was reportedly incensed about all the lost tax revenue from US citizens across the globe failing to file (in addition to US residents hiding money in offshore accounts). I read about a US gov. bureaucrat saying that the US needed to “broaden its tax base” with its rising deficit and debt levels.

So, after a few years of FATCA reporting, why isn’t the IRS using the FATCA data to pursue non-US resident non-filing US Persons? Likely because, as many have pointed out, they lack the resources and the jurisdictional power to collect from citizens/residents of other countries. But we’re guessing.

And maybe FATCA will turn out to be a toothless tiger for people like you and me who aren’t frightened into filing and have been able to fairly easily escape (so far) the Canadian banks’ lax FATCA enforcement. But Petros is right:

“We have to be careful about asserting omniscience on the subject.”

Even if the IRS can’t carry out the designed goals on a practical level, I wouldn’t be complacent regarding the original intentions of the US politicians who dreamed up FATCA (and distorted FBAR to apply to non-criminal ordinary people).

@Heidi “There’s no beer either…..”

Now you’re talking! If Brock pub figures that out I’ll become a regular (and I promise I won’t cause any trouble). Maybe some of those drones like Amazon is experimenting with?…..and the proceeds could go towards supporting the site.

Barbara – You bet he did and does, and they still do assessments like this (US Consulates/Embassy)! Also, the oldest trick is to get someone to drink a lot of vodka / alcohol, lower their frontal lobe inhibitions and then listen to loose lips that sink ships.

In the modern world, there is a much more direct approach, Facebook / twitter posts, or the trump method, just ask them to find the information if they are listening,……..

Barbara Wrote – “he told me he was the information officer at the US consulate. Maybe he’d had too much to drink that evening, but he admitted that part of his job was to attend expat social events and eavesdrop on Americans to find any who boasted, or otherwise admitted, of any financial shenanigans, including whether they hadn’t filed US tax forms. In fact, that’s how I learned about CBT. Whether anyone got investigated or audited because of this guy I’ll never know. I don’t hold it against him. It was his job.”

@Mr. A. Your comment strikes the right balance in my view.

The answer to why the US doesn’t pursue US persons abroad being the lack of resourcces (money ,personnel,etc )seems a bit too simple . For the US to just ask a foreign country to enforce US tax laws carte blanche on ‘US persons’ who are also its own tax paying citzens is not so easy as that raises questions of sovereignity and jurisdiction. Mind you, one has to exercise caution with a loose cannon roaming the world.

@Petros,

The registration card you linked to says “Race: Native American.” It does not say anything about citizenship. Race and citizenship are two different things.

@Foo Yet with no identifiable ancestor who is native American, how can Elizabeth Warren claim that as her race?

That said, for many natives in North America, the concept of race is foreign–of belonging to a nation is not. In this light, Elizabeth Warren is not a member of a First Nation nor is she qualified to be a member since her genealogy has no identifiable person who belongs to one of the First Nations.

@Petros,

I cannot identify my ancient ancestors by name, but I’m pretty sure what continent they came from. The lack of a paper trail does not erase my background.

I think in Warren’s case, her dominant ancestry is European, not Native American, so I agree that it doesn’t make sense to classify her as the latter. Though the entire concept of “race” is such a slippery one to begin with. Historically it seems to have been one of those things that, if it could be used against you, then a tiny amount counted, while to be used for you, a large fraction was needed.

None of which has anything to do with First Nation citizenship laws, though. At least not any more than Chinese/Nigerian/Swedish citizenship laws have anything to do with whether one has Asian/African/European ancestry.

@Foo, well to give you an idea, I know the name of my mother, my grandparents, and great grandparents on my mothers side, all Korean. That means I am a half Korean, which I suppose qualifies me as to claim that as a race. However, Asians are discriminated against through affirmative action, as overachievers. No advantage in that. And that is probably why Warren talked about high-cheek bones running in her family, and not slanted eyes.

https://images.app.goo.gl/rYZroozoHVoqDhBJ6

Not sure how to categorize here. Accepted as a member of his clan but physical features point to a different lineage. 🙂

@Robert Ross

Re

“for the US to just ask a foreign country to enforce its tax laws on US persons carte blanche”

They can’t, they have legal agreements to collect with only 5 and those countries will not collect if that US person was a resident and citizen of said country at the time the debt was incurred.

All others have no agreements to collect regardless.

https://isaacbrocksociety.ca/2016/11/01/dual-citizens-of-sweden-france-netherlands-denmark-canada-take-note-your-country-will-not-collect-for-the-u-s/

@RR

The point I was trying to make is that they have a lack of resources to make assessments and send out personal threatening letters to non filing US persons if those persons have not supplied them with any information. They could try a standard letter frightening people to file once they have addresses from renunciants but it wouldn’t be worth their while if they cannot collect.

US extra-territorial taxation of individuals is a sword of Damocles. Which is why the matter should be resolved legally. Which is why the legal action against FATCA in Canada is essential.

But since the matter is not resolved legally it all hinges upon application.

Currently, although the situation is dire, most people can continue to live in blissful ignorance, willful ignorance, or with partial compliance. This wishy washy situation may be due to either lack of will and means, or the active (but unsaid) acknowledgement that this whole thing was never aimed as bona fide US persons abroad, or both.

What Brock has brought to the table, in my view, is a percolation of common wisdom that is unavailable elsewhere on the internet. It is this kind of common knowledge that, probably, very rich and connected people have amongst themselves for investment opportunities and social events and schools (although occasionally, as Felicity Huffman discovered, it backfires; but usually, wink to Petros, in academia for instance, it works).

And that common wisdom helps us each reach our own decision with the knowledge that the US is not pursuing, say, accidentals, or even most non-filers abroad. As is repeated here daily, doing nothing is a very viable option (and from an ethical standpoint should be mentioned by tax professionals as a true option).

What I wanted to add is that if the political will shifted and the US had the means and will to “go after” US persons abroad very actively this would make the situation unbearable for many. But this in turn would very probably backfire and the US would be forced to address CBT seriously.