OVDP Program

cross-posted from citizenshipsolutions

by John Richardson

IRS announces the end of #OVDP: Fascinating tweets from the “OVDP Historians” who compose the tax compliance community

http://www.citizenshipsolutions.ca/2018/03/17/irs-announces-the-end-of-ovdp-fascinating-reactions-from-the-tax-compliance-community/

#OVDP: Reactions from the “tax compliance community” (and others who tweeted) to the termination of OVDP

(Note: For the purposes of this post I will use the terms “OVDP” and “OVDI” interchangeably. Each term describes a specific example of one of the “OVDP era” programs, as it existed at a specific point in time. A particularly good analysis of the evolution of the “OVDP era” programs is found here – of interest only to those who want to “OVDP Historians“!)

On March 14, 2018 Professor William Byrnes reported that:

The Internal Revenue Service today announced it will begin to ramp down the 2014 Offshore Voluntary Disclosure Program (OVDP) and close the program on Sept. 28, 2018. By alerting taxpayers now, the IRS intends that any U.S. taxpayers with undisclosed foreign financial assets have time to use the OVDP before the program closes.

“Taxpayers have had several years to come into compliance with U.S. tax laws under this program,” said Acting IRS Commissioner David Kautter. “All along, we have been clear that we would close the program at the appropriate time, and we have reached that point. Those who still wish to come forward have time to do so.”

Since the OVDP’s initial launch in 2009, more than 56,000 taxpayers have used one of the programs to comply voluntarily. All told, those taxpayers paid a total of $11.1 billion in back taxes, interest and penalties. The planned end of the current OVDP also reflects advances in third-party reporting and increased awareness of U.S. taxpayers of their offshore tax and reporting obligations.

I have heard it said:

The good thing about bad things is that they come to an end.

The bad thing about good things is that they come to an end.

An memorable moment in American history – what does it suggest about American culture?

“OVDP era” Programs – 2009 to 2018

As the Sun sets on OVDP, so ends one of the most potent weapons in the the U.S. Government’s arsenal in its war against Americans abroad. The “OVDP era” was born in 2009, was nurtured in 2011 as “OVDI”, was reborn “Phoenix Like” in 2012 under the “OVDP” name and has been in existence with “minor tweaks” since. Any serious reflections on the “OVDP era” should lead to the conclusion that that the U.S. Government, the media and the tax compliance community, collectively created an environment that will be seen as a low point in American history. The Government, the media and the “tax compliance community” should reflect on the roles that they played.

Shockingly, the “OVDP era” programs treated “Americans abroad” (who were “tax residents” of other countries”) the same way as they treated “Homeland Americans” who had deliberately used Swiss banks to hide assets from the IRS. The reasoning apparently was:

Homeland tax cheats have bank accounts in Switzerland.

U.S. citizens who live in Switzerland have bank accounts in Switzerland.

Therefore, “U.S. citizens living in Switzerland” are the same as “Homeland tax cheats”.

(This was an example of “Obama Era Logic” at its finest!)

The “OVDP era” programs were a very “sweet deal” for criminals. They destroyed the lives of “Americans abroad” who simply didn’t know about Mr. FBAR. There was even concern that Canadian residents with RRSPs (of all things) would have the value of the RRSPs included in the OVDI Penalty base! Think of it the Homeland criminal treated better under OVDI than a Candian resident with an RRSP!!! What kind of country treats its criminals better than it treats its most innocent and vulnerable citizens? Particularly those who are most anxious to comply with its laws (who you will meet in this post)?

Streamlined compliance – 2012 and continuing

It wasn’t until the Fall of 2012 that the IRS created a “compliance option” that differentiated “Americans abroad” from “Homeland tax cheats”. This program was called “Streamlined Compliance” – which is a program that (in its various iterations) continues today. The initial “Streamlined Program” is described here. For many reasons, the 2012 version of Streamlined was too restrictive. As a result, the conditions to use “Streamlined” were significantly changed in 2014. A post describing the chronology of the “Streamlined Compliance” program is here.

(Of course, most “non-compliant Americans abroad” could have simply solved their compliance issues without the need for a formal program.) A key point is that (see this discussion): Once “Streamlined” became an option, very few Americans abroad would have participated in the “OVDP Era” programs. In other words, those who did NOT act quickly to “come into compliance” fared far better than those who acted quickly.

The experience of Americans abroad in “OVDP era” programs is really the experience of Americans abroad who attempted to come into U.S. tax compliance between the start of OVDP (2009) and the advent of Streamlined (September of 2012).

The OVDP experience from the perspective of ordinary people who were enticed into entering the program

You might begin by watching the video at vimeo.com. As you watch yourself, ask yourself:

- Does this Canadian resident and citizen seem like a U.S. tax evader to you?

- Is this Canadian resident and citizen even a “U.S. citizen” (subject to U.S. taxation)?

How in the world could this person have ended up in the OVDP program?

Those interested in seeing the tragic experience of another Canadian resident (at least this person agreed that she was a U.S. citizen) who made the mistake of entering OVDP 2009 (to resolve minor FBAR problems) should read the account here and here.

NB: Old Brockers/Sandboxers may well remember the above two submissions. Please do not reveal this person’s name in any comments. A previous post prompted a request to avoid this due to its upsetting effect on family members who are ill and the name has been taken off these files. Thanks.

If you can stomach more, consider reading the story of a University of Toronto Professor who attempted to fix his “IRS compliance problems” by entering the 2009 OVDP program, you are invited to read here. (His problem was partly that he was a U.S. citizen who had never become a Canadian citizen. As a result he could not benefit from the section of the Canada U.S. tax treaty that prohibits Canada from collecting U.S. tax debts on Canadian citizens.) Those were only some of the stories from 2009. Unsurprisingly, the administration of the OVDP program was severely criticized by the IRS Taxpayer Advocate.

What all of these “victims” have in common is a desire to be in compliance with U.S. law. Notice also how severely they were punished for attempting compliance through the “OVDP era” programs. But, these are examples from Canada. People from many countries were victimized by their desire to be in in compliance.

One of the most interesting examples is the case of a couple from California. I have previously written about them in my post: “Be careful what you “Fix For” – Mr. Kentera meets Mr. #FBAR in the “Twilight Zone”. The post included:

My initial thoughts …

The facts suggest that Mr. and Mrs. Kentera were people who believed in compliance with the law. The history of their tax filings suggests a conscious effort to comply with the applicable laws. They also (like everybody) were completely at the mercy of their tax advisers. The “offshore account” (which was not opened by them) was disclosed to their tax preparers. The tax preparers failed to advise Mr. and Mrs Kentera to file their FBAR (a requirement that few in 2011 knew about).

This series of events took place during the “2011 IRS Reign of FBAR Terror“. At this time many lawyers and accountants strongly recommended that people (1) correct their mistakes (the nonwillful ones that were the result of not knowing about Mr. FBAR) and (2) correct those mistakes by agreeing to the OVDP/OVDI penalty program (that is/was analagous to a form of “Civil Forfeiture“).

The evidence strongly suggests that Mr. and Mrs. Kentera were ordinary people, trying to do the “right thing”. They were victimized by advice to enter OVDI and then victimized by the IRS because they entered OVDI. (To get a sense of the context of how people were victimized by trying to do the “right thing”, read Phil Hodgen’s April 5, 2011 post here. There were many other posts written during this period. To see how Green Card holders were victimized by the OVDI program see here and here.)

How could the IRS possibly assess this kind of FBAR penalty?

All “armchair quarterbacks” must remember the context in which individual decisions were made. In 2011, there were NO streamlined compliance procedures. There were no delinquent FBAR submission procedures. There were no Delinquent Information Return Procedures.

That said, there was also NO requirement that people enter OVDI!!

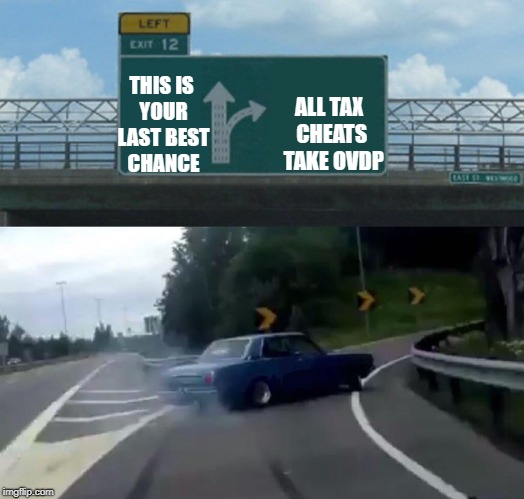

Tragically those who tried the hardest, and acted most quickly, to fix their non-compliance problems were the most harshly treated. (In fact, the history of the IRS assault on Americans abroad has shown that that those who did NOT rush to fix their problems fared much better. You may remember the “This is your last best chance to come into compliance” threats directed to those (including Americans abroad) with

offshorenon-U.S. bank accounts.)To put it simply: The Kentera’s were victims of their desire to be in compliance with the law. It is regrettable that their law abiding sentiments coincided with the 2011 atmosphere of threats from the IRS and fear mongering from the compliance industry.

Suffice it to say that many of the people who entered the “OVDP era” programs were:

– victimized by the convergence of unclear IRS objectives, bad advice from “tax professionals” and (most significantly) their own desire to be in compliance with the laws.

In some cases, those who entered these programs were left in with need for significant emotional counselling.

Significantly, like the 2018 “U.S. Transition Tax”, the “OVDP era” programs were another instance where “identical laws and policies” were “somewhat helpful” to Homeland Americans, but completely destructive to Americans abroad. It’s as though we were back in 17th Century France where it was well known that:

“The law in its majestic equality prohibits both the rich and the poor from sleeping on the park bench.”

It is absolutely essential that the United States STOP defining “tax residents” of other countries as “tax residents of the United States!”

The summer of 2011

Seriously, you wouldn’t believe the atmosphere in 2011. It was truly a summer to remember. Some incredible “first hand” reports of Americans abroad who entered OVDI are here and here. Even for those who had not entered the “OVDP era” programs, the climate of fear, ended the lives of many good people. The problem with the “compliance environment” was that many “tax professionals” were actually discouraging simple compliance and encouraging people to enter the “OVDP era” programs. One of the most tragic stories was that of Brazilian psychiatrist Dr. Marcio Pinheiro. Like many he never knew about various information returns (who did?). He deeply wanted to rectify his “compliance problems”. But, he was afraid that any attempt to rectify his “compliance foot faults” would subject him to life altering penalties. Dr. Pinheiro died in August of 2015. Interestingly his twitter account still exists – frozen in time. A perusal of his tweets reveals the mind of a man very focused on the problems of FBAR, “taxation-based citizenship”, etc. One of his last tweets was:

Makes great sense! https://t.co/Rg1Z3mCWtL

— Marcio V Pinheiro (@marciovp) June 23, 2015

Seriously, the United States appears to be a country where people:

- Are afraid to NOT comply with the law; and

- Are afraid to comply with the law.

These are just two of the reasons why, when it comes to U.S. citizenship, people are inclined to:

I was deeply affected by the story of Marcio Penheiro and I wrote about him here.

Men are not prisoners of fate, but only prisoners of their mind – RIP @Marciovp – @ADCSovereignty https://t.co/2xIWmHOn9w via @ADCSovereignty

— John Richardson – lawyer for "U.S. persons" abroad (@ExpatriationLaw) March 17, 2018

For a nostalgic look at the OVDI “Reign Of Terror” see the post referenced in the following tweet:

Never Forget What Happened in the #OVDI summer of 2011. It's a bit like the @USTransitionTax of 2018! Every seven years, the USG sends a reminder of what happens to Americans who leave the Homeland. https://t.co/10bKtUDhFA

— John Richardson – lawyer for "U.S. persons" abroad (@ExpatriationLaw) March 15, 2018

But, that was 2011. It’s now 2018. Looks like not much as changed in the last seven years!

OVDI 2011: “Your last, best chance to come into compliance”

Is April 15, 2018 "Your last best chance to comply with the @USTransitionTax? I put the following phrase into google: "OVDI Your last best chance to come into compliance" You won't believe what/who turned up! https://t.co/fUe0YrqA0n

— John Richardson – lawyer for "U.S. persons" abroad (@ExpatriationLaw) March 11, 2018

The summer of 2011 was the summer of OVDI. It was a truly terrifying time to be accused of being a U.S. citizen and living outside the United States. For that matter it was a truly terrifying time to be a “Green Card holder” living inside the United States. (Well, at least if you had any bank accounts or financial assets located outside the United States that had not been reported to the IRS.) Yes, it was truly incredible. Green Card holders worried that their failure to report their “home country” bank accounts, could get them deported from the United States, or make them ineligible for U.S. citizenship.

It all started when IRS Commissioner Shulman uttered the phrase – clearly directed at Homeland Americans who were hiding assets from the IRS, that:

“This is your last, best chance to come into compliance!”

The way to come into compliance was OVDI AKA – “The Offshore Voluntary Disclosure Initiative”.

OVDI was a truly amazing invention. In return for non-prosecution (for the crime of living outside the United States in the case of U.S. citizens or for the crime of living inside the United States if you were a Green Card Holder) for nondisclosure of your offshore local bank accounts, you could pay the IRS approximately 25% of your net worth. Interestingly those living outside the United States, who didn’t know they were U.S. citizens, were allowed to pay only 5% of their assets. (One would think that believing that you were not a U.S. citizen would constitute “reasonable cause” for not filing FBARs. But, why let rational thinking, get in the way of a good “wealth confiscation”?)

OVDI and Americans who were “tax residents” of other countries (in other words they lived outside the United States)

Note that for “long term” Americans abroad, most if not all, of their worldwide assets were “foreign” to the United States. Therefore, for an American abroad to enter OVDI, was to agree to turn over 25% of his net worth to the United States! But, in order to get that 25%, one would also have to sell assets to free up capital to pay. In addition, there were VERY expensive compliance fees. My point is that for Americans abroad, participation in OVDI was NOT at the cost of 25% of one’s assets. It was FAR more. Furthermore, lest this basic point be lost:

Americans abroad who entered OVDI were paying the 25% percent penalty on assets that were legitimately acquired in their country of residence! In other words, IN THE COUNTRY WHERE THE PERSON ACTUALLY lived, they assets were “after tax paid” and “properly declared”. #YouCantMakeThisUp!

Bottom line: For Americans abroad, participation in OVDI was a bad bad deal. It could easily result in confiscation of 50% of their net worth!!!

OVDI and Homeland Americans

It was a totally different experience. In fact, relative to the possible penalties it was a reasonably good deal (for a certain type of individual).

First, the “offshore assets” of Homeland Americans (really were foreign to them) were much more likely to be kept out of the United States in order to avoid detection and payment of taxes. (But not in all cases.)

Second, the “offshore assets” of Homeland Americans were not likely to be ALL of their world assets (as was the case with Americans abroad).

Bottom Line: For “Homeland American” tax cheats, OVDI was actually a pretty good deal (considering also that there may have been a legitimate chance of criminal prosecution).

Comparing the OVDP Programs to the 2017 “transition tax”

Q. What do the 2018 “transition tax” and the “OVDP era” programs have in common?

A. They are/were both programs that were a very good deal for Homeland Americans and a very bad deal for “nonresidents” AKA “Americans abroad”.

To see why the 2018 Transition Tax is a good deal for Homeland Americans and a bad deal for Americans abroad see here.

How could the suffering and destruction of lives under “OVDP era” programs have happened at all? It wasn’t just the IRS!

Like the “transition tax” of 2018 (invented by Congress and not directed to Americans abroad), OVDP was a program that (although invented by the IRS and not directed at Americans abroad) was a program marketed by the media and by the tax compliance community. The tax compliance community successfully convinced a large number of Americans abroad (whose only crime was committing personal finance outside the USA) to enter OVDP. The compliance community confused the possibility that OVDP COULD be used to bring people into compliance with whether it was a good idea to use OVDP to do so. Very few people received good professional advice. Very few indeed. But, the media and the tax compliance community were successful in creating a “reign of terror” that caused many Americans abroad to deal with “foot faults” in inappropriate ways. (To be fair: (1) Hindsight is 20 20 and (2) few “tax professionals understood the programs well enough, at the time, to offer competent advice. (Furthermore, no tax adviser in 2009 could have foreseen the “IRS bait and switch tactic” that effectively removed “reasonable cause” from penalty consideration. Interesting discussion of “bait and switch” in the 2009 OVDP program are here and here.)

The cumulative effects of the IRS, the media and the tax compliance industry were overwhelming. The demand to enter OVDP was great! In fact the demand was so great, that it was reported that even people who were NOT U.S. citizens (because they had relinquished years earlier) were advised to enter OVDP. So, what if you were no longer a U.S. citizen? So what if these insane laws applied only to U.S. citizens? This was just too great an opportunity to miss! Why should those who really were U.S. citizens have all the fun?

How could this have happened? How could so many people have “committed financial suicide”?

Interestingly, the IRS was NOT suggesting that ordinary Americans abroad and Green Card holders should enter OVDP. The IRS didn’t say you shouldn’t. But, they didn’t say you should either.

You will find a description of the 2012 OVDP program here. What does the IRS say about this program? Who is aimed at? What was it actually trying to achieve? The FAQs include:

2. What is the objective of this program?

The objective remains the same as the 2009 OVDP and 2011 OVDI – to bring taxpayers that have used undisclosed foreign accounts and undisclosed foreign entities to avoid or evade tax into compliance with United States tax laws.

Admittedly the objective is not entirely clear. It does appear that only those who had used undisclosed foreign accounts or entities to avoid or evade tax would be relevant to the objective of the program. Yet, many people applied to enter OVDP and in fact entered OVDP without knowing what their tax situation actually was. At a bare minimum, it is/was clear that OVDP was NOT for everybody. Taxpayers needed to know whether their situation was consistent with the purpose(s) of OVDP. Clearly many of the people who entered OVDP, were NOT the people for whom the program was intended.

The marketing of OVDP

Is April 15, 2018 "Your last best chance to comply with the @USTransitionTax? I put the following phrase into google: "OVDI Your last best chance to come into compliance" You won't believe what/who turned up! https://t.co/fUe0YrqA0n

— John Richardson – lawyer for "U.S. persons" abroad (@ExpatriationLaw) March 11, 2018

Those who do not learn from history are doomed to repeat it!

It’s 2018. The Tax Cuts and Jobs Act, contained a provision called the “transition tax“. The similarities between the 2018 “transition tax” and the “OVDP era” programs include:

– they are/were both good deals for Homeland Americans and wealth confiscators in the extreme for Americans abroad

– they are/were both heavily marketed by the “tax compliance” community and the media

– they are/were both examples of the total indifference that the United States has for its “nonresident taxpayers”

– they are/were both examples of U.S. confiscation of assets that are located in other countries

– they are/were both examples of U.S. confiscation of assets that other countries have primary taxing rights over

But, most importantly they both are/were examples of why it is absolutely essential that:

The United States imposing “worldwide taxation” on individuals who are “tax residents” of other countries and do NOT live in the United States!

Enough is enough!

@Anthony E. Parent, Esq.

Thank you for your comment.

@Jane

It isn’t even just that the U.S. imposes taxes, it is the extension of the entire tax code that is problematic. Eritrea may charge a few percent, but they don’t force Eritreans living elsewhere to only buy Eritrean mutual funds. How many people don’t owe money to the U.S. but losing 1%-2% of their income on preparation costs or lost opportunities? There is so much dead loss.

“Cook didn’t have withholding.“

‘Correct: the US couldn’t withhold US tax from non-US-source in 1924 any more than it can in 2018.’

“Most of my US withholdings are from US sources. Only one was from a Canadian source. I filed for refunds because the withholdings were overpayments.”

‘Could you clarify? What’s the relevance to Cook v. Tait?’

The US could withhold from a Canadian source in 2002, I think they can withhold from a Canadian source in 2018, and I’m pretty sure I read that they could withhold from a Canadian source in 1924. I’m pretty sure it was in the 1920’s that the US coerced Canadian intermediaries to verify residences of holders of Canadian accounts, so if an account holder moved from Canada to the UK then the Canadian intermediary would start withholding the full amount of US withholding required by US law instead of the reduced amount set by the Canada – US tax treaty.

Of course my situation was somewhat the opposite. When I was a US citizen, Cook v. Tait (and Form 1040 instructions and IRS Tax Tip 307) say I could get refunds of US withholding. The IRS did pay refunds as long as the withholding was reported on anything other than Form 1099, the form that Monica Hernandez embezzled from.

Anyway, Cook v. Tait exists because Cook fell for Tait’s trick, but if Cook didn’t fall for it the US could have confiscated someone else’s withholding in order to get … oh wait, if it were someone else v. Tait then the US wouldn’t want to let the person get their refund. Hmm.

“How many people don’t owe money to the U.S. but losing 1%-2% of their income on preparation costs or lost opportunities?”

Sometimes a person loses more than 100% of their income when they didn’t even owe any US tax.

ND: “The US could withhold from a Canadian source in 2002,”

I’m sorry, I don’t see the connection. Cook didn’t have US tax withheld. He was asked (or “demanded”) to file a tax return, and did so under protest. He was assessed for tax on the sale, and paid the first instalment in order to be able to exercise his right to appeal. He lost. End of story.

It’s all there in the SCOTUS judgment.

Plaxy, let’s figure out what you’re asking.

“Cook didn’t have withholding.“ — Was my statement relevant to Cook v. Tait?

‘Correct: the US couldn’t withhold US tax from non-US-source in 1924 any more than it can in 2018.’ — Was your reply to my statement relevant to Cook v. Tait?

“Most of my US withholdings are from US sources. Only one was from a Canadian source. I filed for refunds because the withholdings were overpayments.” — Was my reply to your reply relevant to Cook v. Tait?

‘Could you clarify? What’s the relevance to Cook v. Tait?’

I disagree with your statement that the US couldn’t withhold from non-US-source income in 1924.

I think we agree that if Cook hadn’t fallen for some Bull then there wouldn’t have been a Cook v. Tait. But I think there could have been a someone-else-v-Tait from someone else trying to get their withholding refunded.

“I think we agree that if Cook hadn’t fallen for some Bull then there wouldn’t have been a Cook v. Tait.”

If Cook hadn’t filed a US tax return there wouldn’t have been a Cook v. Tait. Though we don’t know much about his circumstances – if he was planning to move back to the US, or may have had US assets.

For whatever reason, Cook voluntarily filed his return, and pursued his fruitless quest for justice all the way to the US Supreme Court – resulting in the unenforceable doctrine of CBT and the consequent invention, decades later, of OVDP and the rest of the oppressive and malignant campaign.