At the end of September, the IRS released preliminary figures for year 2014 filers of Form 3520-A, “Annual Return of Foreign Trust with a U.S. Grantor”, as part of the “foreign trusts” section of its Statistics of Income series. Many international accountants and tax lawyers take the position that ordinary local tax-compliant savings plans held by U.S. persons in other countries, such as Australian Superannuation, are “foreign grantor trusts” which generate the obligation for their “grantors” to file Form 3520-A as part of a complete compliance diet if the “trust” itself does not file the form.

This early IRS release breaks down “foreign trusts” only by extremely broad income categories — to give you some idea of what Homelanders think we owners of “foreign trusts” are like, the upper bound for the lowest category (aside from the category for trusts with a loss of any size) is US$0 to $100,000. For purposes of this blog post I’ll call this category “small reporting trusts” (though the category is defined in terms of income rather than trust assets). The final release will probably only break that down as far as $0–25,000.

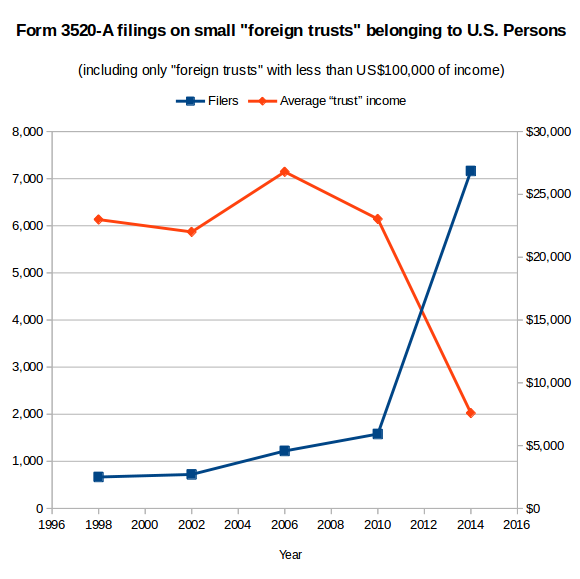

However, we can still see two related trends: many more “foreign trusts” with income under $100k are reporting, and on average they have far less income and less assets than “foreign trusts” which reported in previous years.

|

|||||

|---|---|---|---|---|---|

| 1998 | 2002 | 2006 | 2010 | 2014 | |

| Trusts with $1 to $100,000 of income (“small foreign trusts”) | |||||

| Count | 667 | 772 | 1,220 | 1,580 | 7,163 |

| Average net income | $22,996 | $22,010 | $26,797 | $23,042 | $7,589 |

| Average assets minus liabilities | $910,425 | $2,002,040 | $1,411,437 | $1,389,438 | $389,986 |

| Estimated characteristics of newly-reporting “small foreign trusts” (Assuming that all trusts from previous period continued to report and had same net assets and income) |

|||||

| Count | +105 | +448 | +360 | +5,583 | |

| Average net income | $10,055 | $33,737 | $10,316 | $3,216 | |

| Average assets minus liabilities | $15,240,364 | $555,181 | $1,314,886 | $107,138 | |

Assuming that all the small reporting trusts from 2010 continued to report (not a perfect assumption — note the absurd result for average assets minus liabilities of trusts which began reporting during 1999–2002), that means the additional five thousand-plus small trusts which started reporting during 2011–2014 had an average of only ~US$3,200 of income and US$107k of assets. In fact, for the first time in the history of Form 3520-A, the average small reporting trust in 2014 had less income than an individual’s personal exemption plus standard deduction — i.e. even in those cases where the trust’s income is treated as belonging to its U.S. person “tax owner”, no U.S. tax is actually owed. (Note also that this analysis excludes trusts which had losses, since the IRS statistics lump together minnow “trusts” which had minnow-sized losses and whales with multi-million dollar tax losses which may or may not correspond to economic losses.)

I expect that precisely none of these new “small reporting trusts” are actual Panama Papers-style offshore trusts with a professional trustee taking legal title to some assets and then managing them for beneficiaries according to local trust law — the fees for those would eat up all the income. Rather, their size — about the same as the average U.S. 401(k) plan — strongly suggests that these are normal retirement accounts, not tax-evading drug-dealing money-laundering terrorist-financing instruments.

In simpler terms, after spending tens of millions on offshore compliance crusades, the IRS managed to dig up a bunch of local retirement plans which owe no U.S. tax.

Renunciants probably big portion of new 3520-A filers

Previous IRS efforts to improve the diaspora’s “tax compliance” have generated only mildly-less-dismal results. Between 2008 and 2012 the number of Forms 2555 filed by the diaspora increased by more than a hundred thousand, but the average income reported by each filer fell by an amount that suggested that the average new diaspora filers had pretty much the same income as average Homeland filers. As I stated back when those figures came out:

The average amount of FEIE has always been higher than the earned income on the average U.S. return. Homeland pundits often take this as confirmation of the stereotype of “wealthy expats getting great tax breaks”. However, the more likely explanation is that well-paid folks often have tax advice to match their wages (e.g. thanks to tax assistance provided as part of corporate international assignment packages) through which they learn of their U.S. filing requirements and hence show up in FEIE statistics, while people of more average means — whether expats in less high-flying jobs, or ordinary employees living in the countries they think of as home — don’t show up in FEIE statistics because they don’t know they have to file.

And awareness of Form 3520-A is clearly even lower: the number of Forms 3520-A being filed remains only a small fraction of the number of Forms 2555. (Even this growth seems to have caught the IRS by surprise: as recently as 2013, their Paperwork Reduction Act estimates stated that they expected only about five hundred 3520-As per year.) Does that mean that we should expect to see hundreds of thousands of new filers in the coming years?

The five thousand or so people who filed Form 3520-A on their retirement plans in 2014 are an unusual group: they are the 0.1% of the diaspora who try the hardest to comply fully with the U.S. tax system. How big a group is five thousand people? Well, the FBI added 2,426 more renunciants to NICS in 2014 than they did in 2010 (source: NICS Operation Reports — 2009 p. 19, 2010 p. 18, 2013 section “Active Records in the NICS Index”, and 2014 p. 25) — and recall that NICS doesn’t include relinquishers. I suspect that many of the new Form 3520-A filers were among the uptick in renunciants — and that these new filers only accepted the maximalist-extremist position that their retirement plans were “foreign grantor trusts” because their compliance condor told them it was a prerequisite to getting a CLN and officially exiting from the absurd system in as clean a fashion as humanly possible.

Some Homelanders love to repeat that out of the millions of Americans estimated to live in other countries, only a few thousand names show up each year in the Federal Register‘s list of ex-citizens — as if that’s an excuse for abusing the rest who don’t renounce. Yet comparing the number of Form 3520-A filers to the NICS renunciation figures suggests that something like half of people who try the hardest to comply fully with the U.S. tax system go and give up U.S. citizenship in the end. Either the burden of full compliance drives them to give up citizenship, or they are undertaking the burden only as a step along the way to giving up citizenship.

Executive can fix this problem without waiting for Congress

As far back as 2010, it should have been apparent to the IRS that their Form 3520-A filing requirements were netting them an enormous amount of by-catch. The by-country breakdown — not yet available for 2014 — showed that the largest increase in 3520-A filings between 2006 and 2010 came not any of the traditional trust-forming Commonwealth secrecy jurisdictions like the Cook Islands or Belize, but rather Mexico. There were 509 Form 3520-As filed for Mexican “foreign trusts” in in 2006, and 2,144 in 2010. Most likely, these “trusts” were fideicomisos — structures used by non-Mexican citizens to hold coastal land in Mexico. Since then, the IRS clarified to one tax filer in a Private Letter Ruling that they did not consider his/her fideicomiso to be a trust for U.S. tax purposes. Oh, and Canadian RRSPs are exempt from 3520-A filings too. Two tax jurisdictions solved, 190-something more to go!

In any case, Form 3520-A has a 43-hour record-keeping & form-filling time burden, according to Paperwork Reduction Act estimates. So the IRS wasted thirty thousand more eight-hour workdays of the diaspora’s time with this form in 2014, and if all of us bothered to comply with their incomprehensible and insane requirements, we’d waste millions of workdays every year. As we’ve pointed out before, it doesn’t have to be this way. 26 USC § 6048(d)(4):

The Secretary is authorized to suspend or modify any requirement of this section if the Secretary determines that the United States has no significant tax interest in obtaining the required information.

Trump says he’s going to kill a bunch of time-wasting regulations on Day One of his administration. So, are the Republicans going to keep their big promises to the diaspora?

Even with my PFICs all cleaned up, I would have been facing annual accounting fees of at least £2000, which is over 10% of my yearly wages…and being on a zero hour contract, I couldn’t even count on what I’d be earning….it was just too expensive to maintain my USC.

@Mona Lisa

Your comments confirm that the primary problem is the tax compliance industry. Once people come into U.S. tax compliance by using the services of a “cross border tax professional” they will have to renounce.

@USCAbroad, exactly. It’s such a racket…I’m so relieved to be out.

The compliance industry played a huge part in why I renounced. I owed no tax but spent thousands of UK pounds complying solely to renounce and if i had any doubts, by the time I was through i had no more doubts.

I had Isas that were getting close to the reporting threshold and that would have caused me a nightmare later on. It hadn’t performed very well and you can imagine my relief that this was the case. Imagine being in a situation that makes you happy that an investment under performed.

Accountants I spoke to gave me the impression that they were relishing the question and answers part just waiting gleefully for me to say one wrong thing that they could jump on and do more scaremongering. Not all were like this but the majority. Also being in a situation that you can neither invest in the UK easily as a US citizen and nor can you invest in the US easily if you live abroad as a US citizen.

I was amazed that this has been going on so long and how was it possible that this continues.

and as far as law change, it’s the CBT that has to go full stop. Fatca without the CBT would be aimed at US residents.

@UK Rose

There is such a thing as a “professional tax preparation penalty”.

In almost all cases those who use professional tax preparers will pay more than if they did the returns on their own. It has becoming increasingly clear that the surest and most direct route to renunication is entry into the U.S. tax system.

I remember a conversation I had with an enrolled IRS agent who was doing my final filing. (I am now not sure that foreign agents are lawfully allowed to practice in Switzerland) under Swiss law). We struck up some rapport, she was married to a Swiss and had dual kids who would be likewise affected. I mentioned that I thought it was time the US joined the rest of the world and adopted rbt.

“Hell no” she said, “I am doing very nicely from it”!. There wasn’t an ounce of empathy for any of her fellow Americans.

USCitizenAbroad: fascinating, and of course particularly true for US persons abroad. I personally use the services of a tax preparer but I carefully pre-digest the data for him. He saves me time and gives me a bit of peace of mind as to what forms I need, but I retain full control.

I was happy with the accountant that I used to get compliant and renounce. Yes, she did make money from me using her services, but somebody would have made money from me. I felt that she did understand the issues. She could have very well have been in the same boat as her grandparents were Americans. Her parents were not able to pass US citizenship to her. She gave me several different scenarios for dealing with the RESP, warned me against the TFS and other types of investments. I have never had a lot of money to investment, but we may very well be empty nesters in the very near future with money to invest. She advised me that if I retained the US citizenship, it would be costly. She told me that she had clients renouncing and to make an appointment asap as she believed more would renounce in the future and the wait would become longer. She actually went as far as to say “As soon as you hang up with me, I would contact the consulate to ask for an appointment. Don’t wait.” Everyone here knows my story and knows I was never keeping it and might have been able to relinquish, but chose to exit quickly rather than wait for the State Department to say yes/no to relinquishment. She also told me that I could do the FBARS, mention my employer’s accounts, my husband’s and my children accounts: without giving the SIN numbers; we could find a work around.

Eric: “Trump says he’s going to kill a bunch of time-wasting regulations on Day One of his administration. So, are the Republicans going to keep their big promises to the diaspora?”

I fervently hope that you’ve sent this excellent analysis to the Trump Transition Team and particularly to whoever is poised to become the new Secretary of the Treasury.

@Ann#1, that’s really good that your accountant was willing to find a work-around. Though my preparer was very knowledgable, she seemed to have her own agenda: to ideally retain her clients through charm via her ’boutique’ service. Her clients are generally quite well-off, worth at least seven figures. In the beginning, I don’t believe she realized how much of a comparative minnow I was. In the end, I think she sort of felt badly for me and actually refused to take payment for the final year’s tax return and 8854, which was gracious of her.

Most of her clientele can easily afford her ongoing fees and probably find workarounds that make retaining USC worthwhile for them, but you need to have a certain amount of wealth and income for this to be the case. She works with many in the music industry, etc. I believe she provides an excellent service for them but wouldn’t have been much help to me because I simply didn’t have the assets or income to be able to take advantage of the overall lower US tax rates for really high earners.

Further examples: if you’re wealthy enough, you’re actually better off having a bespoke portfolio in individual stocks rather than mutual funds. PFIC taxation thus hurts the modest middle classes who can’t so easily afford to diversify enough via individual share holdings. I know that many US-compliant investment portfolios such as London & Capital or Maseco aren’t interested in clients with less than £1 million to invest.

And though US income tax is currently much lower at the top end than in the UK, the U.K. nonetheless has a more generous personal allowance of approx £11,000 than the standard deduction of around $6200 and personal exemption of about $4000.

As a part-timer on a zero hours contract, there was always a risk that I would have wound up still owing income tax to the States, especially with my assets in tax-free ISAs and tax-deferred pension plans. Even without an ISA, I would have enjoyed an annual additional £5000 tax free from dividends and £1000 tax free from savings interest…so would have almost certainly been double taxed going forward, or just actually owing tax to the US on what is quite modest income !!

Another example

I just meant to say that I wouldn’t have been able to so easily offset US tax on my passive income via foreign tax credits since all my investment income and interest is currently tax free under the current rules. Form 1116 wouldn’t have been of any help, especially as I am hardly paying any income tax either, being a low earner. But perhaps things will improve with Trump’s new tax plans to lower income tax rates and increase thresholds to I think more like $12,000-15,000 for a married filing separately.

“I wonder if at one point CBT is going to start costing the US more than it brings in.”

I’m pretty sure the amount the US has legally collected from me after renouncing, as a non resident alien from US sourced dividends, exceeds the amount the US legally collected from me during the time I was a US citizen.

(This doesn’t include amounts the US illegally collected by embezzling withholding while I was a US citizen, and penalties imposed for my illegal honesty when I was a US citizen before learning that honesty is illegal on US tax returns.)

“Most of her clientele can easily afford her ongoing fees and probably find workarounds that make retaining USC worthwhile for them, but you need to have a certain amount of wealth and income for this to be the case.”

That’s pretty hard to imagine. The 1% are renouncing as quickly as the rest of us are. Furthermore they’re the ones who get reported in the news, helping homelanders think 100% of us are in the 1%.

@Norman: Indeed. However, in the long run, you and others will collectively “learn”. You have learned that being excessively honest is frowned up, impossible, and indeed sometimes illegal. My point is that they may have burned you but in the long run this “low-hanging fruit” (sorry) will have been picked. This is not sustainable revenue for them. People will have life and investment strategies to work around the US person abroad tax implications, whether they renounce or keep their citizenship. Revenue from USPs abroad will mechanically, I hope, hit a wall.

As to the people with “10-figure” fortunes, it is very likely they are usually better advised than the rest of us and that the many fees they pay are regarded as the cost of doing business. I imagine they have many mechanisms to soften the blow; that kind of money requires professional accounting anyway and although unfortunately I have no first-hand knowledge of this, I can imagine that in some cases US residence might actually be better for someone with a lot of money.

In today’s Fatca world, the only ones retaining US citizenship are the ones that benefit from US citizenship. It’s hard for us to imagine that there are expats benefiting from US citizenship but there are people for example with cross border jobs that need to be able to legally enter and work in the USA. These could been high net worth people or not. I recently met an expat that needed dual citizenship for his job.

and there is the other group of citizens still under the radar trapped into keeping US citizenship and the group that have strong family ties particularly elderly parents that they worry they may not be able to see and help as easily if they have no definite legal right to enter.

For the rest, any sane person would renounce. It’s worth the renunciation fee for freedom. Waiting for law change is pointless. There could be bad law change just as easily as there could be good law change and laws can revert from good to bad at any given time. IEven if there is law change, I could see a situation that in order to take advantage of the new laws, one has to get complaint with tax filing up to that date.

Fighting for law change is good though and I admire all the efforts of this group of people. and as previously stated, i am amazed that these laws have managed to survive for so long.

The AIPCA, AmCham Canada and CPA Canada’s request to exempt these accounts from reporting has apparently gone unheeded, while the FATCA IGA exempts them from FATCA reporting.

Clear as mud what to do.

Or, maybe the compliance industry’s request to both the US and Canadian governments to exempt them from reporting is just a ploy to make us believe that they are actually reportable.

@UK Rose– In Europe, it sounds like people are outed at the banks when they are forced to present a document for ID purpose that shows place of birth. So in Europe, all roads lead to renunciation. In Canada, where it’s possible and easy to hide in plain site, misrepresenting or lying may be your best bet. Many of us here in Canada refuse to play by US rules of engagement. I’m a Canadian– I’ll be damned if I’m going to let a foreign country extort $2,350 USD out of me and force me to travel to set foot in their consulate at great personal time and expense. Refusing to play the game is a Canadian option.

@BC_Doc

Refusing to play the game is a Canadian option.

110% totally agree with you!!!

@Norman. It cost the US thousands to f**k with me. After they sent me the money, I quit filing. I have heard nothing from them, but to this day they are still sending money (the SS which I never would have known I was eligible for if not for their stupid CBT.) Some sweet revenge and a perfect example of the law of unintended consequences.

@BC Doc. Yes, refusing to play is a perfectly viable option. See my reply to Norman above, LOL. And yes, I have lied on occasion. Our own Canadian government necessitated that and I don’t feel the slightest twinge of guilt.

If one can hide safely, then for sure it is an option but it’s always going to be a risk as long as these unjust laws exist. Surveillance is getting more sophisticated all the time For sure I would advise this for accidentals right now because there could be more hope for positive change for them.

and yes In Europe it is not easy to hide once you have been identified. Renouncing becomes the best choice. In my case, I had opportunity to present a case to my bank of why I didn’t have a CLN because I had become a dual citizen years ago (before 2004) and could have claimed to them to have relinquished at that time. One bank sent the Fatca letter. However I had pressure from my non US citizen spouse about fbar fines plus my job has signage authority so best decision for me was to renounce so as not to affect other people with my US taint. it sounds like a disease when you put it like this. one has to be isolation to avoid affecting others.

https://taxpayerrightsconference.com/agenda/

A US taxpayer ‘rights’ conference. FWIW.

Here is the link to the conference papers from 2015 https://taxpayerrightsconference.com/conference-papers/ . Prof. Allison Christians presented a case study of an Accidental American ‘abroad’ to enlighten conference attendees last year about the plight of those ‘abroad’ who the US Treasury continues to threaten and torment http://www.taxanalysts.org/content/understanding-accidental-american-tinas-story .

Those deemed US taxpayers ‘abroad’ actually have any real recourse to those theoretical ‘taxpayer rights’? Where is the concrete evidence that the IRS respects any so-called ‘rights’? They’re still banging on the same drum about legal local savings and banking where we live – outside the US and lying about FATCA ‘reciprocity’. They will never learn another tune. They prefer to threaten the entire world and extort non-US taxpayers into paying for FATCA rather than actually go out and look for their own resident US homelander whales – but, the IRS appears to be happy to continue to torment minnow taxpayers who’re already paying their local taxes in full to their local revenue agency outside the US and waste scarce resources chasing krill who owe no US tax and are already in full compliance where they live, with unremarkable legal local assets.

Guess they don’t want the bother of taking on people with means inside the US who brag about being too smart to pay US taxes http://www.snopes.com/trump-taxes-smart/ . Of course, they don’t bother those in power with offshore accounts and trusts if they’re influential enough – they name them Commerce Secretary or Treasury Secretary instead https://www.bloomberg.com/news/articles/2013-05-20/pritzker-yields-party-role-reversal-on-offshore-trusts . And I can’t see how the newest Treasury Secretary http://time.com/4595902/donald-trump-goldman-sachs/ could possibly be interested in pursuing any of that imaginary ‘reciprocity’ from US banks re FATCA or the OECD CRS.

maz57: and I’m sure nobody is counting and that you’re not alone. Hidden costs of CBT, but only in the sense that, I suppose, coming into compliance made you discover something you have a right to. By the way I know pensioners abroad receiving their SS from the US. They get it on their US account and dutifully file IRS returns every year, with that SS as their only income. Never mind that they have an entire financial life elsewhere and that their country knows nothing about the US and vice versa. Everybody is happy. Smart! (to paraphrase the president-elect). Had Dr Pinetree done this he would have had a much easier time, nobody would’ve ever bothered him.

@UK Rose

Your comment above includes:

Speaking of your “non US citizen spouse”:

Yours is the last generation of U.S. citizens outside the USA who will be able to find a spouse (unless it’s another U.S. person). What is likely to happen is that U.S. citizens will be forced to pay a dowry to find a “non U.S. citizen spouse”. This is to the benefit of the “U.S. citizen” because it may open doors to a second citizenship.

During the early 2000s there were (and still are) marriage agencies seeking U.S. spouses for non-U.S. nationals. It will soon be the reverse There will soon be marriage agencies seeking non-U.S. spouses for U.S. citizens who need a second citizenship. If you google “Russian citizenship through marriage” you will find some discussion of this.

What a reversal of the old order. And to think that it’s all happened during the last eight years – the administration of “Barack Obama.

Think of it:

“A non U.S. spouse! How much would you be willing to pay?”

Perhaps the general program could be called:

“ObamaSpouse”.

“Change you can believe in!”