At the end of September, the IRS released preliminary figures for year 2014 filers of Form 3520-A, “Annual Return of Foreign Trust with a U.S. Grantor”, as part of the “foreign trusts” section of its Statistics of Income series. Many international accountants and tax lawyers take the position that ordinary local tax-compliant savings plans held by U.S. persons in other countries, such as Australian Superannuation, are “foreign grantor trusts” which generate the obligation for their “grantors” to file Form 3520-A as part of a complete compliance diet if the “trust” itself does not file the form.

This early IRS release breaks down “foreign trusts” only by extremely broad income categories — to give you some idea of what Homelanders think we owners of “foreign trusts” are like, the upper bound for the lowest category (aside from the category for trusts with a loss of any size) is US$0 to $100,000. For purposes of this blog post I’ll call this category “small reporting trusts” (though the category is defined in terms of income rather than trust assets). The final release will probably only break that down as far as $0–25,000.

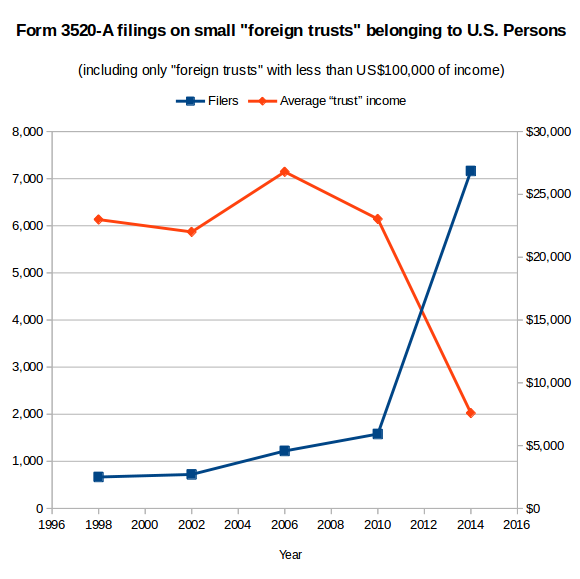

However, we can still see two related trends: many more “foreign trusts” with income under $100k are reporting, and on average they have far less income and less assets than “foreign trusts” which reported in previous years.

|

|||||

|---|---|---|---|---|---|

| 1998 | 2002 | 2006 | 2010 | 2014 | |

| Trusts with $1 to $100,000 of income (“small foreign trusts”) | |||||

| Count | 667 | 772 | 1,220 | 1,580 | 7,163 |

| Average net income | $22,996 | $22,010 | $26,797 | $23,042 | $7,589 |

| Average assets minus liabilities | $910,425 | $2,002,040 | $1,411,437 | $1,389,438 | $389,986 |

| Estimated characteristics of newly-reporting “small foreign trusts” (Assuming that all trusts from previous period continued to report and had same net assets and income) |

|||||

| Count | +105 | +448 | +360 | +5,583 | |

| Average net income | $10,055 | $33,737 | $10,316 | $3,216 | |

| Average assets minus liabilities | $15,240,364 | $555,181 | $1,314,886 | $107,138 | |

Assuming that all the small reporting trusts from 2010 continued to report (not a perfect assumption — note the absurd result for average assets minus liabilities of trusts which began reporting during 1999–2002), that means the additional five thousand-plus small trusts which started reporting during 2011–2014 had an average of only ~US$3,200 of income and US$107k of assets. In fact, for the first time in the history of Form 3520-A, the average small reporting trust in 2014 had less income than an individual’s personal exemption plus standard deduction — i.e. even in those cases where the trust’s income is treated as belonging to its U.S. person “tax owner”, no U.S. tax is actually owed. (Note also that this analysis excludes trusts which had losses, since the IRS statistics lump together minnow “trusts” which had minnow-sized losses and whales with multi-million dollar tax losses which may or may not correspond to economic losses.)

I expect that precisely none of these new “small reporting trusts” are actual Panama Papers-style offshore trusts with a professional trustee taking legal title to some assets and then managing them for beneficiaries according to local trust law — the fees for those would eat up all the income. Rather, their size — about the same as the average U.S. 401(k) plan — strongly suggests that these are normal retirement accounts, not tax-evading drug-dealing money-laundering terrorist-financing instruments.

In simpler terms, after spending tens of millions on offshore compliance crusades, the IRS managed to dig up a bunch of local retirement plans which owe no U.S. tax.

Renunciants probably big portion of new 3520-A filers

Previous IRS efforts to improve the diaspora’s “tax compliance” have generated only mildly-less-dismal results. Between 2008 and 2012 the number of Forms 2555 filed by the diaspora increased by more than a hundred thousand, but the average income reported by each filer fell by an amount that suggested that the average new diaspora filers had pretty much the same income as average Homeland filers. As I stated back when those figures came out:

The average amount of FEIE has always been higher than the earned income on the average U.S. return. Homeland pundits often take this as confirmation of the stereotype of “wealthy expats getting great tax breaks”. However, the more likely explanation is that well-paid folks often have tax advice to match their wages (e.g. thanks to tax assistance provided as part of corporate international assignment packages) through which they learn of their U.S. filing requirements and hence show up in FEIE statistics, while people of more average means — whether expats in less high-flying jobs, or ordinary employees living in the countries they think of as home — don’t show up in FEIE statistics because they don’t know they have to file.

And awareness of Form 3520-A is clearly even lower: the number of Forms 3520-A being filed remains only a small fraction of the number of Forms 2555. (Even this growth seems to have caught the IRS by surprise: as recently as 2013, their Paperwork Reduction Act estimates stated that they expected only about five hundred 3520-As per year.) Does that mean that we should expect to see hundreds of thousands of new filers in the coming years?

The five thousand or so people who filed Form 3520-A on their retirement plans in 2014 are an unusual group: they are the 0.1% of the diaspora who try the hardest to comply fully with the U.S. tax system. How big a group is five thousand people? Well, the FBI added 2,426 more renunciants to NICS in 2014 than they did in 2010 (source: NICS Operation Reports — 2009 p. 19, 2010 p. 18, 2013 section “Active Records in the NICS Index”, and 2014 p. 25) — and recall that NICS doesn’t include relinquishers. I suspect that many of the new Form 3520-A filers were among the uptick in renunciants — and that these new filers only accepted the maximalist-extremist position that their retirement plans were “foreign grantor trusts” because their compliance condor told them it was a prerequisite to getting a CLN and officially exiting from the absurd system in as clean a fashion as humanly possible.

Some Homelanders love to repeat that out of the millions of Americans estimated to live in other countries, only a few thousand names show up each year in the Federal Register‘s list of ex-citizens — as if that’s an excuse for abusing the rest who don’t renounce. Yet comparing the number of Form 3520-A filers to the NICS renunciation figures suggests that something like half of people who try the hardest to comply fully with the U.S. tax system go and give up U.S. citizenship in the end. Either the burden of full compliance drives them to give up citizenship, or they are undertaking the burden only as a step along the way to giving up citizenship.

Executive can fix this problem without waiting for Congress

As far back as 2010, it should have been apparent to the IRS that their Form 3520-A filing requirements were netting them an enormous amount of by-catch. The by-country breakdown — not yet available for 2014 — showed that the largest increase in 3520-A filings between 2006 and 2010 came not any of the traditional trust-forming Commonwealth secrecy jurisdictions like the Cook Islands or Belize, but rather Mexico. There were 509 Form 3520-As filed for Mexican “foreign trusts” in in 2006, and 2,144 in 2010. Most likely, these “trusts” were fideicomisos — structures used by non-Mexican citizens to hold coastal land in Mexico. Since then, the IRS clarified to one tax filer in a Private Letter Ruling that they did not consider his/her fideicomiso to be a trust for U.S. tax purposes. Oh, and Canadian RRSPs are exempt from 3520-A filings too. Two tax jurisdictions solved, 190-something more to go!

In any case, Form 3520-A has a 43-hour record-keeping & form-filling time burden, according to Paperwork Reduction Act estimates. So the IRS wasted thirty thousand more eight-hour workdays of the diaspora’s time with this form in 2014, and if all of us bothered to comply with their incomprehensible and insane requirements, we’d waste millions of workdays every year. As we’ve pointed out before, it doesn’t have to be this way. 26 USC § 6048(d)(4):

The Secretary is authorized to suspend or modify any requirement of this section if the Secretary determines that the United States has no significant tax interest in obtaining the required information.

Trump says he’s going to kill a bunch of time-wasting regulations on Day One of his administration. So, are the Republicans going to keep their big promises to the diaspora?

@Iota, ” I receive a UK Government pension, which is taxed by the UK as both source and residence country. I excluded it altogether when determining my US taxable income.”

Under what section of the Tax Treaty did you take that position by excluding it from the USA?

Do not get me wrong, I like that idea.

@Iota….yesterday I was in a state of bliss…….today?

OK, see the following link and go to the last comment. This person seems to be thinking like I am thinking albeit the US German Treaty. It happens to be Article 19 as well.

http://www.toytowngermany.com/forum/topic/352436-us-military-retirement-income-excemptions-living-overseas/

@George – it’s hideously confusing, I agree, but becomes less so eventually.

1. Government pensions are by default taxable exclusively in the source country (in this case, the US).

2. Article 19(2)(b) makes them taxable exclusively in the residence country provided the person is both a national and a resident of that state. (This is the US conceding its taxing rights.)

3. Article 1(4) removes the concession from USCs, and 1(5)(b) does not restore it.

“Are you saying that HMRC is agreeing to give up its power of residency taxation by following sections of the treaty that are in the savings clause with regards to residence?”

Government pensions are taxable by default exclusively in the source country (the US in this case). The UK in this case doesn’t, by default, have the right to tax the pension. The US agrees (in Article 19(2)) to give up its taxing rights – but not if the recipient is a USC (Article 1.4)

@George – “Under what section of the Tax Treaty did you take that position by excluding it from the USA?

Do not get me wrong, I like that idea.”

Article 19(2)(a). However, taking a treaty position (Form 8833) is waived for pensions, so no need to mention the UK Government pension at all. (And in the event, after excluding certain other items, I was below the filing requirement so did not file anything except the expatriation form.)

@Iota, I hate to use your example of the UK pension that you took.

I found this chart;

http://www.tax-charts.com/charts/894_pension_taxation_uk.pdf

Basically, a UK Government Pension to a US Citizen is taxed by the US. Article 19 does not apply to the benefit of the UK. According to this chart.

Somehow I am going back to this was written by the US and for the US.

@George – “OK, see the following link and go to the last comment. This person seems to be thinking like I am thinking albeit the US German Treaty. It happens to be Article 19 as well.

http://www.toytowngermany.com/forum/topic/352436-us-military-retirement-income-excemptions-living-overseas/”

Yes, this is exactly what I’m saying: the UK doesn’t have the right to tax your US government pension (provided HMRC agrees it’s a government pension). Just like the poster at that link says:

“By the terms of the German-USA income tax treaty (specifically Art. 19, Para. 2 “Government Service”) GERMANY may not tax your US military pension – at least not directly.”

In your case, “By the terms of the UK-US treaty (specifically Art. 19(2)) THE UK may not tax your US government pension.”

I don’t know what the poster means by “not directly”.

@George – “I found this chart;

http://www.tax-charts.com/charts/894_pension_taxation_uk.pdf

Basically, a UK Government Pension to a US Citizen is taxed by the US. Article 19 does not apply to the benefit of the UK. According to this chart.”

Yes, I’m aware of the chart. I disagree, and fortunately IRS Publication 901 agrees with me.

@Iota…..OK so the chart that I found says in your situation Article 19 does not apply. BUT as we have seen on the ISA link above where Phil has flipped and flopped over two years if its a trust!!

All of a sudden I am running into lowish income OAPs some that are accidentals and they are in a panic.

In general terms I would agree that HMRC would follow the FULL terms of the treaty and ignore the savings clause they have a right to based on residence. Over the years I have found HMRC to be decent folks.

Regardless, this is muddy as the Mississippi River and someone could take about any position with full reference to the treaty!!

@Iota, just looked at the publication and printed YOUR page. I know someone who can hang their hat on that peg. You just helped someone greatly with that Pub.

@George – I agree that it’s largely a matter of interpretation. Tax advisor have to be super cautious about these things, because the IRS has them by the short and curlies. IMO, that’s exactly why it’s better (if possible) to figure out how you can interpret the treaty to your advantage (safely) rather than accept a tax advisor’s hyperanxious interpretation.

However, my affairs are simple. For many, I know, the situation is much more complex.

@George -,”Iota, just looked at the publication and printed YOUR page. I know someone who can hang their hat on that peg. You just helped someone greatly with that Pub.”

Excellent!

I was referring to any account they don’t or can’t know about.

I wonder if at one point CBT is going to start costing the US more than it brings in. If low-income people come into compliance they will drown the system in data. Lots of fruitless investigations. Lots of unnecessary correspondence. Not much tax owed. And even people getting tax credits (like me).

@Fred I have been studying the Obama care repeal and replace bill. At first glance it appears expats will qualify to get free private health insurance no matter where you live.

The exchanges meant you had to be resident in the USA but the proposal is a refundable credit and private plans overseas may qualify.

By treaty, Canadian CPP and OAS and US social security are taxed only in the country of residence. An American living in Canada and receiving US social security does not include it on her 1040 and vice versa. Are the UK and Germany different?

US SS and UK SS (UK State Pension) are taxed only by the country of residence, under the US/UK Treaty.

I don’t know how US SS is supposed to be entered on the 1040, if at all, because mine didn’t start until after I had renounced. I excluded my UK State Pension (or would have done if I had filed a 1040.

@ Eric Very good article! I absolutely agree that foreign trust is a very broad and sweeping term that encompasses things that it NEVER should encompass. I had an RESP for my (2) children. A RESP is a Registered Educational Savings Plan in Canada. Basically, you contributed money and the government contributes. If the child DOES NOT use the RESP, the amount contributed by the government goes back to the government and you must roll your contributions into a RRSP ( Registered Retirement Savings Plan). The RESP never had more than $20,000 in it for both children. Yet, I had to claim it has a foreign trust because I might benefit from the RESP if the children did not go to school. The only benefit would have been the tiny amount of interest it had earned. That reporting cost me an extra $500.00 per return ($500.00 x 6). My accountant said to me that I could choose just to report with my tax return, but if I was renouncing, I might want to do the 3520 and 3520A. The whole situation is beyond stupid and I don’t see it changing anytime soon, if ever.

Ann#1. Yours is a perfect example of an accountant interpreting the rules (where the IRS gives no guidance) with an abundance of caution. Better to just leave the RESP out. That’s why they were exempted from the IGA

I was unfortunate to be a UStaxablecitizenserf with a small Canadian TFSA ( registered ‘Tax free Savings Account’) – which of course our Canadian government urged all Canadians to invest in, and was told by US compliance specialists that without a doubt it was a ‘foreign taxable trust’ that required a 3520 and 3520A. I had it for only about a year – with almost no return because interest rates were so low, and the principal was so small. I closed it out in order not to have to continue to report it – and to pay the US lawyer his retainer. It cost me much more to pay someone to do the forms than it made in interest – being only basically a term deposit type GIC). It was very difficult to find people who would complete it for me. Some local accountants who had been doing US returns and some information forms said they no longer would touch a 3520/3520A. Some didn’t know how to complete the forms. Another would do it but only if I signed an unlimited agreement first – without specifying even an estimate of the fee they would charge to do it. The expensive ‘experts’ who did the first form also made a math error – which caused problems down the road with the next reporting.

The Canadian government is fully aware that Canadians with the USP taint are being advised that their TFSAs, RESPs, and RDSPs are ‘taxable foreign trusts’ in US and compliance eyes, and that our tax treaty does nothing to protect them from US taxation and a heavy US reporting and penalty regime (3520 has its own layer of confiscatory penalty for non-filing on top of the FBAR, etc.).

Basically the reporting was in itself a punitive US tax imposed extraterritorially on my Canadian government recommended and registered savings, whether it earned any taxable interest or not, and whether I owed the US tax or not.

So, because I reported it, the IRS will say it ‘found’ my pitiful Canadian government registered TFSA – yet, won’t acknowledge that it gained no US revenue from it, had to spend US government dollars to process my incomprehensible, complex and useless 3520 and 3520A forms and deprived me of the use of a basic simple legitimate, legal, local registered savings option blessed by my home country government and local tax agency as ‘taxfree’ as part of a Canadian social policy initiative to encourage Canadians to save for future security.

Another of the long list of reasons why relinquishing my US citizen birthright was absolutely necessary in order to have an ordinary life in my chosen home country of Canada.

The only happy note? That the US Treasury and IRS had to spend their own resources to process what they demanded of me, got no additional US revenue out of it, and actually came out with less than they had before.

The IRS used the number of ‘foreign trusts’ reported as a measure of ‘risk’ applied to people’s files in OVDI and Streamlined. Knowing full well that some/most of what they were going to get were basic ordinary savings vehicles that generated modest or almost no taxable interest, tightly controlled, created and REGISTERED by and with the local revenue agencies of our actual home country of residence.

I hope that the US Taxpayer Advocate demands for her next report a detailed analysis of the useless wasted US tax dollars and hours that the IRS squandered in processing legal savings REGISTERED with my home government – with an almost zero interest rate – because the US Treasury refuses to exempt Canadian registered TFSAs, RDSPs, RESPs, and other retirement type accounts like the Australian supers from the greedy short sighted and ridiculous US attempts to pretend that those outside the US are all taxevadingmoneylaunderingterrorfundingdruglords.

Why not look at those US homelanders right under their noses, with true offshore investments (Hello Commerce Secretary Pritzker and Pritzker family trust , and Treasury Secretary Lew http://www.forbes.com/sites/janetnovack/2013/05/02/pritzker-family-baggage-tax-saving-offshore-trusts/#6924204da357 and now Trump’s pick Mnuchin for Treasury http://www.reuters.com/article/us-usa-trump-treasury-breakingviews-idUSKBN13P2QD ).

@ DoD My accountant told me that she really didn’t know what to do with them. Yes, they aren’t mentioned in the IGA, but depending on which agent that you got on which day, you received a different answer. She told me that she honestly did not know what to do with them and gave me several scenarios of what I could do with them. I was never pressured. She told that she had clients who did nothing, others included them with their tax return feeling if they were at least mentioned they could not be accused of hiding them and yet others who reported them both with taxes and did 3520 /3520A.

@ Badger My accountant told me that I ABSOLUTELY SHOULD NOT invest in an TFS account until after I renounced. I was glad that I had not opened an account prior to these BS. I DID have a conversation with RBC about whether or not they were advising clients with US taint to avoid RESP, TFS, etc. accounts. I got the standard run around. “We didn’t know they were a problem.” Me, “But you know now, so are you advising clients they could be a problem?” Bank, “Well, we don’t know what each financial advisor is telling clients.”

@Ann#!, glad you were forewarned. Mine had barely been opened – but I only found out afterwards – too late, about the US extraterritorial crusade against those living abroad and our legal, local savings and other accounts as ‘offshore’ including TFSAs. I told my credit union about the problem and they were aghast – though they did say they had wondered why some members had been avoiding opening one.

The US won’t do anything to address the situation unless shamed into it.

I saw that AICPA is trying to do something to make reporting simpler and cease double taxation on our registered accounts;

ex.

“…The American Institute of CPAs (AICPA) requests that the United States Department of the

Treasury (“Treasury”) provide relief to United States (U.S.) and Canadian citizens who have

contributed to and maintain various cross-border deferred and tax-exempt savings accounts, from

double taxation and current inclusion in income of amounts saved in these accounts. We also

request that Treasury work with the Canadian Department of Finance to provide similar relief as

appropriate..”….

https://www.aicpa.org/Advocacy/Tax/DownloadableDocuments/2016-03-04-comments-on-proposed-tax-relief-us-can-equivalent-purpose-def-tax-savings-plans.pdf

NO sign whatsoever of any interest or efforts in that vein from the Canadian feds who are supposedly sworn to serve Canadian’s best interests. Or the CRA who are now the Canadian arm of the IRS. Minister Mme Lebouthillier is a staunch FATCAnatic http://ipolitics.ca/2016/03/17/trudeau-liberals-reverse-position-on-controversial-irs-information-sharing-deal/ , but apparently could give a rat’s ass about our own legal local legitimate Canadian TFSAs, RESPs, and RDSPs and how a foreign country seeks to tax and penalize those belonging to Canadian taxpayers – thus thwarting the very social goals that the federal government espoused when creating them http://www.cra-arc.gc.ca/tfsa/ . The IRS refrained from any comment on this story about the RESP of a baby Canadian http://ipolitics.ca/2016/04/14/baby-girl-drawn-into-cra-irs-information-sharing-controversy/ .

The Canadian governments of the CONS and now the Fibbin Sunny Libs have done nothing to make TFSAs (or RDSPs or RESPs) protected under the terms of the Canada US tax treaty despite being made aware of the significant tax treaty gap, and despite government statements like this one, professing that;

“…..Ensuring that the tax system provides meaningful incentives to save supports a more efficient allocation between current and future consumption. In particular, the accumulation of personal savings allows Canadians to improve their living standards and better align income and consumption when planning for important life events such as retirement. In addition, personal savings can provide individuals with a private safety net in case adverse circumstances such as job loss or illness cause an unexpected drop in income. More generally, savings contribute to economic growth by increasing the funds available for capital investment, which leads to a higher capacity to produce goods and services. ………”

http://www.fin.gc.ca/taxexp-depfisc/2012/taxexp1202-eng.asp

It’s necessary to be able to read between the lines. TFSAs, RESPs, RDSPs were exempt from FATCA reporting for a good reason. Rev can was encouraging us to not include them. RRSPs and RRIFs were covered by a separate agreement. ( you don’t report income until it’s actually received

Comment on Ann#1’s

How very proactive of RBC Royal Bank! I have been saying for what seems like years now that the RDSP, the RESP and the TFSA investments need to come with a clear warning for deemed US Persons to purchase (my latest comment on that: http://isaacbrocksociety.ca/media-and-blog-articles-open-for-comments-part-3-of-3/comment-page-96/#comment-7682257). Seems the banks care more about selling those products than in any way advising or protecting their clients. Do the financial advisors who advise RBC (and other banks) clients, employed by same RBC (or other bank) and do they not communicate with one another?

*We didn’t know they were a problem*!?! is claptrap, ducking responsibility.

My accountant warned me that if I had decided to retain my US citizenship that tightening regulations would mean that she would have likely had to start treating my pension plan and even possibly my investment ISA as foreign trusts. Filing 3520 and 3520a would have been very expensive on top of already very high accounting costs.

The ongoing compliance burden was the main reason I decided to go ahead and renounce back in 2013.